Good morning!

dotDigital (LON:DOTD)

Today's trading update for the year ended 30 Jun 2014 reads well - the key paragraph says;

The Board is extremely pleased with the Company's performance and now anticipates that full year EBITDA will be slightly ahead of the current market forecast of £4.3m. This performance is a result of continued strong organic growth in the high margin and long-term recurring revenues generated by our core email marketing product, dotMailer.

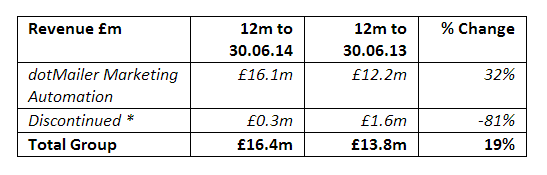

A table shows how total turnover growth of 19% masks the continuing business growing turnover by an impressive 32%. That's fine, as this was a known issue, I recall management talking about winding down a small part of the group, when they presented at a Mello Central investor evening last year.

The bull case is further strengthened by commentary today about strong overseas growth. Revenues are recurring in nature, with over 45% of clients paying retainers by direct debit, and net cash having risen 52% to £9.3m - so the FD should be pretty relaxed.

I've checked the last Balance Sheet at 31 Dec 2013, and it's smashing. Current assets of £10.5m dwarf current liabilities of £2.0m, and long term creditors are negligible. So that's a working capital ratio of 525% the way I look at it, which is one of the highest I've ever seen. Clearly the company should be either giving that cash to shareholders, or spending it on good quality acquisitions, as they really have about £6-7m in surplus cash.

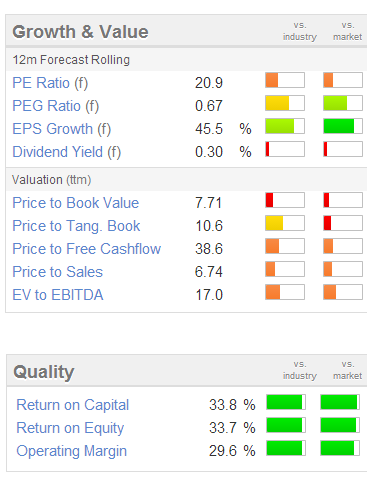

So, it's a good quality, strongly growing small business. My problem is the valuation - it's capitalised at £96.8m at 34.2p per share. Taking off the surplus cash, and you're really paying £90m for the business.

If they made say £4.4m EBITDA, then looking at the last two sets of accounts (the most recent interims and full year figures), it's capitalising about £1.3m p.a. in development spending. In my view development spending is just an ongoing cost for this type of business, so in valuing the company one should write it off. Therefore the cash profit the way I look at it was only £3.1m for y/e 30 Jun 2014. Take off a notional 20% tax, and you come to £2.5m earnings. Therefore the PER (on a cash neutral valuation) is 36 times! That's too high in my opinion. Personally I wouldn't pay a PER of over 20, so a mkt cap of £50m plus £7m for the surplus cash = 20p per share is the level where I'd start to consider these shares. At 34p they're not of any interest to me.

However, for people who are optimistic about the company's future, and are prepared to take a long-term view, paying up front for some future growth, then it might be of interest. It's worth bearing in mind that the increased turnover is also coming with increased overheads. Margins might improve as overseas offices reach critical mass though, perhaps?

Note that the company reported £2.15m operating profit for H1. So EBITDA of £4.4m for the full year, suggests that H2 was probably no better than, or even slightly worse than H1.

A big jump in profitability is forecast for the current year (ending 30 Jun 2015), with normalised EPS set to jump from 1.1p to 1.6p. That would reduce the PER to about 21, which is looking more reasonable, although that forecast would need to be checked for the treatment of development spend.

A big jump in profitability is forecast for the current year (ending 30 Jun 2015), with normalised EPS set to jump from 1.1p to 1.6p. That would reduce the PER to about 21, which is looking more reasonable, although that forecast would need to be checked for the treatment of development spend.

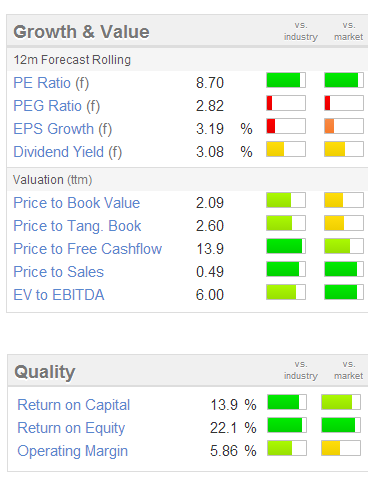

Note that the usual Stockopedia graphics should a high quality business, but pricey on most measures (and the forward PER is based on the big jump in forecast profit. So bottom line in this market, is if you want to buy into a high quality business, you have to dig deep and pay up for it! It also means you have to accept the risk of a big lurch lower in price if the growth is not as rapid as expected.

Mark Slater said in a recent interview that he has a rule of not paying a PER of more than 20, as higher than that there is too much upside priced-in. That seems a very sensible discipline to me, apart from the occasional case where something is so good that you throw the rules out of the window (and often end up regretting it!).

Craneware (LON:CRW)

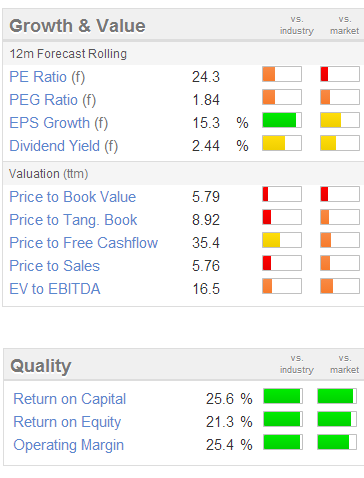

Continuing the theme of high quality, but expensive software companies. Craneware supplies invoicing systems to the US healthcare sector. It has a market cap of about £143m at 521p per share.

A trading update for the year to 30 Jun 2014 today sounds strong - notably total contracts signed which have risen 80% on last year to $70m. Although this revenue is fed into the P&L gradually. So reported revenue is only up marginally to about $42.6m (previous year $41.5m.

They quote the dreaded adjusted EBITDA measure, which is meaningless in my view, but seems to be becoming the norm. This is expected to be about $13m (slightly up from prior year of $12.4m).

The stockopedia graphics again show high quality scores, but a rich valuation. Although the 2.44% dividend yield isn't bad considering the PER is so high. I would have expected to see a yield below 1% for this type of company.

Vianet (LON:VNET)

There's a Q1 update (Apr-Jun) from Vianet today. It sounds reassuring. The core beer flow monitoring business seems to have stabilised;

The first quarter of the current year has started largely as anticipated with trading in the pub sector remaining flat ahead of the implementation of the Statutory Code, which was announced by the Government in early June.

On their other businesses, the company says;

The Group's other business areas have made good progress. In Vending Solutions, our coffee vending telemetry systems have continued to make further gains and Vianet Fuel Solutions is trading profitably.

I met with management again a little while ago, and it was good to hear that they are finally making some decent progress with the vending business. The generous divi has been maintained, and that is likely to remain the case in my opinion.

The uncertainty over the Statutory Code has now been removed, and for a 7% divi yield this share is reasonably attractive I think. Personally I've moved on, and no longer hold these shares, as I think there are more interesting growth opportunities elsewhere. That said, the company is probably in better shape now than it has been for a couple of years.

Taking into account divis received in the almost two years I held Vianet shares, my overall loss was only about 12%. So not one of my better share ideas, but not a disaster either. I wish all investments that go wrong only incurred a loss of 12%!

NetPlay TV (LON:NPT)

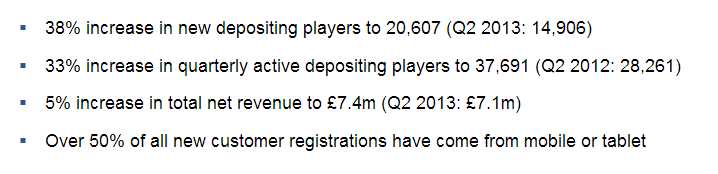

This online gaming company has issued its Q2 KPIs (Apr- Jun incl.):

Note that the increase in revenue was only 5%, which seems odd considering that the number of active players has risen 33%, suggesting quite a big reduction in the average spent per person. There will be continual churn in customer numbers inevitably, as people run out of money to continue playing. So this type of business has to constantly recruit new customers through advertising, it's one of the reasons I don't really like investing in online gaming companies. They tend to be a bit of a flash in the pan in my view.

As regards the new taxation regime expected from Dec 2014 onwards, the company says;

As announced at the Group's final results, there are a number of efficiencies that the Group can take advantage of to mitigate against the 'Point of Consumption' (POC) tax proposed to be introduced in December 2014. During the quarter, the Company has begun preparing itself accordingly; this involves consolidation of certain locations and other cost base efficiencies.

That suggests to me there will be exceptional restructuring costs in both this year & next year's accounts.

It's all too uncertain for me, and with the shares falling 6% today to roughly their 12 month lows, I'm minded to sit this one out & wait to see the full financial impact on the new tax regime in 2015. There must be a fairly high risk of more bad news.

There were some small Director buys in May-July at 15-17p, but I'm not putting any reliance on those, as the amounts are not material. Whereas the Director selling at 17-18p in the last 18 months ran into several £millions. It usually pays to follow the money, so big Director selling in the run up to taxation changes is obviously a big flashing warning sign.

API (LON:API)

This foils business is damaged goods, as it was put up for sale in a long process that saw no interest. So a bit like an antique that failed to attract bids at auction, the shares are likely to attract little interest. This is made considerably worse by the fact that the large shareholders are known to want out. So there's really an overhang of most of the shares in issue.

Today's trading update says:

The Board's expectations for the current financial year remain consistent with what was indicated when full year results were announced on June 4th 2014.

Laminates and Foils Europe are trading well and Holographics is on track to at least hold the breakeven performance established in the final quarter of last year. Foils Americas has continued to experience reduced demand from the metallic pigment sector, exacerbated by destocking of the supply chain. Volumes are expected to start to recover in the second half and action has already been taken to re-align operating costs.

Overall, the Board continues to expect progression in results compared to last financial year.

That sounds reasonable.

The share price is down 3.5p to 68.5p today, for a roughly £53m market cap.

It looks reasonable value, but seeing as apparently nobody wants it, then I can't see any reason to buy the shares. If the divi yield was say 6-7%, then it would get interesting, but we're nowhere near that level at the moment.

I shall sign off for the day, and see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.