Good morning!

dotDigital (LON:DOTD)

Share price: 47p (up 5.6% today)

No. shares: 294.1m

Market cap: £138.2m

Trading update - an impressive update today from this provider of email marketing software. This update covers the y/e 30 Jun 2016.

Key points;

Revenue up 26% to £26.9m - the growth is all organic too (i.e. no acquisitions have been made to boost the numbers), so very impressive. Most revenue is monthly recurring, giving a very stable & predictable revenue base.

EBITDA will be "slightly ahead of market expectation". Note that the company capitalises about £1.6m p.a. into intangibles, so EBITDA figures should be treated with care. Also note that EBITDA excludes remuneration in the form of shares, so again that would need to be checked.

Average revenue per client has risen by 29%, from £445 to £575 per month. That's great, but this suggests that the increased revenue has come from squeezing more from existing clients, rather than winning new business? I have queried this point with the company's PR person - will come back with an explanation of this.

Update - I've had a response from the PR person, very helpful. I'm dashing for a train now unfortunately, but am hoping to have a chat with DOTD's FD early next week, just to clarify the mix of growth which is coming from new client wins, and the element related to existing clients spending more.

Cash - the balance sheet is positively groaning with cash, up again to £17.2m. This is the real litmus test of a business - if the cash pile keeps growing, then it's a decent company.

International revenue is still small at £4.9m (18% of total revenues), but is growing fast - up 58% year-on-year. This could drive the stock to a higher rating, if investors become excited about international growth potential.

Brexit comments sound encouraging;

The Board has assessed the impact of the decision from the UK referendum on EU membership, and continues to monitor the effects of the decision. Whilst still in the early stages, the Board's initial view at this time is that it will not have a material adverse impact on dotmailer's ongoing business. This is primarily due to a diverse spread of clients across many sectors and geographies.

Based on experience of the market, the Board also believes that the long term effects of Brexit will be limited as clients and prospects will continue to invest more of their marketing budgets into digital marketing channels which generate high returns on investment. This has also been echoed by independent research carried out by the two leading digital marketing commentators, Econsultancy and the Direct Marketing Association which confirms that 'Email Marketing' is still the most effective marketing channel.

It's becoming increasingly clear that companies which have a diversified spread of business across sectors and geographies, are weathering the current uncertainty the best. In some companies they are even benefiting from weaker sterling, if they have mainly overseas earnings.

My opinion - there are lots of things I like about this company;

- Strong recurring revenues

- Decent revenue growth

- High margins

- Cash generation

- Growing cash pile (now 5.8p per share, or 12.4% of the market cap)

This is reflected in quite a high valuation - after today's rise, the 2016 PER will be in the mid to high 20s. However, that would drop down a fair bit, if you factor in a couple more years of strong earnings growth.

I'd like to be clearer on how much growth is coming from new clients, and how much from increasing charges to existing clients. Today's figures suggest to me that it's more the latter - which is less exciting than winning lots of new business - because it may not be sustainable growth.

It's certainly going back on the watch list though. I'm not inclined to chase the price up, as it's already risen a lot this morning. This is a share I've dipped in & out of in recent years, and am kicking myself for not just tucking some away and forgetting about them. A lot of us probably over-trade our portfolios, and miss some good opportunities by selling things like this through boredom or nervousness, that we should have just held for the long-term.

Brainjuicer (LON:BJU)

Share price: 373p (up 1.4% today)

No. shares: 12.4m

Market cap: £46.3m

Trading update - covering the 6m to 30 Jun 2016 - this company describes itself as an "innovative international market research agency".

Positive figures are given for turnover, and gross profit growth, but normalised profit seems to be flat against H1 last year;

After factoring in our new creative agency, System1, which was launched during H1 and, as anticipated, incurred costs of some £0.3m, BrainJuicer's operating profit increased by some 41% to around £1.7m. After adjusting for exceptional items (share based payments and also the one-off costs in H1 2015 relating to due diligence work and our Head Office move) normalized H1 pre-tax profit will be similar to the £1.7m reported in 2015.

Balance sheet - today the company says;

BrainJuicer's financial position remains strong. At the end of June the Company had a cash balance of £5.2m (December 2015: £6.4m), after returning £2.2m to shareholders during H1 by way of dividends and share buy-backs.

I've checked the last balance sheet, reported as at 31 Dec 2015, and it's really excellent - very strong.

Outlook - sounds reasonably alright at the moment;

The Company generates the majority of its annual profit in the second half of the year, and whilst our revenue visibility is, as ever, limited the Board believes that the Company is in a position to meet market expectations for the full year.

... although I'm worried about the limited revenue visibility. Marketing spending is exactly the sort of thing that is likely to be reduced or eliminated by clients, in uncertain economic times.

Brexit - note that BJU has a good geographic spread of business, which is key at the moment, to insulate companies from worries over the UK economy;

The decline in the value of sterling versus the US Dollar, the Euro and other leading currencies following the referendum on the UK's membership of the EU benefits the Company's non-UK profits reported in sterling. The results of our overseas businesses are translated into sterling using monthly average exchange rates. Beyond this, it is too early to say what the impact of the UK's exit from the EU on the market research budgets of our clients is likely to be.

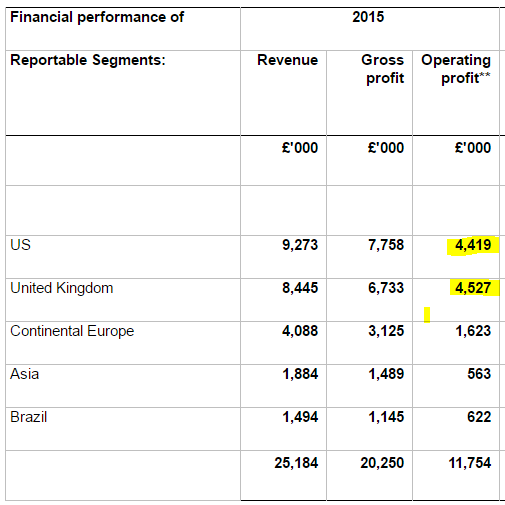

My opinion - I'm not going near any marketing/PR type businesses at the moment, even if they do have a good geographic spread of business. Looking at the 2015 results, BJU makes most of its profit from 2 big markets, USA and UK. So there has to be some downside risk, from the UK market.

Therefore, despite the apparently cheapish valuation of a fwd PER of 12.8, I wouldn't want to place any reliance on those profits being made, given the uncertain UK outlook.

EDIT: Mind you, looking at the table above, the company is achieving a remarkably high operating profit margin. That suggests to me there could be something interesting here - clearly a service that clients value, or they wouldn't be prepared to pay a price which contains such a high profit element.

So it's a stock which I might revisit at some point in the future, when the macro picture is more settled.

Stanley Gibbons (LON:SGI)

Share price: 9.5p (down 7.7% today)

No. shares: 178.9m

Market cap: £17.0m

Corporate Update, Board Changes and Audit Update - there's a lot of information in today's update. Checking back through my previous notes here, I had a brutally negative view on SGI when it released details of a 10p fundraising on 14 Mar 2016. It was a mystery to me why the share price at the time was 22p, after the fundraising announcement, when nearly 3/4s of the enlarged share capital would have just been issued for 10p. It's funny how obvious anomalies like that can persist for some time.

Key points;

Cost cutting is going well - already exceeded £5m annualised cost savings target, with further savings identified.

Sounds like they are abandoning the offshore status, and moving to UK.

CEO & FD positions are being made redundant, due to the move to UK (sounds like a good excuse to ditch management, to me!)

Old Chairman & a NED are also leaving. A recent Board addition, Harry Wilson, is becoming Executive Chairman. So a major clear-out of the Board is happening basically.

New strategy is to focus on predictable revenue streams, rather than large, lumpy sales. Sounds sensible.

Revised ecommerce strategy, and at lower cost (good idea, as most people seem to agree that their existing online efforts have been dismal).

New auditors want a more conservative revenue recognition policy on investment plans operated by the company. This will be done via a prior year adjustment, reducing historic profits, and hence having a corresponding balance sheet hit - increased liabilities, and reduced stock valuations. No quantum is given, but it's described as "material".

Further balance sheet write-downs are likely for intangible assets. Note that none of these adjustments have any current cash impact.

My opinion - I think I can see a big shiny kitchen sink appearing on the horizon!

So no doubt the balance sheet is going to be heavily written-down, and that's a good thing overall. The discount to NAV struck me as largely an illusion - I don't believe the stock is actually worth what it's in the books at.

In my view, philately is just a horrible area to invest in. When we were kids, almost all of us had a stamp collection. These days, kids would I think look puzzled and then laugh, at the idea they should collect stamps. What's the point?!

As a fellow commentator aptly put in an email exchange with me this morning;

Penny Blacks …or Pokemon? No choice !

Now I know that top end collectors are different to kids, but over time it might dawn on some of the older collectors, that's it's all a bit pointless. Small scraps of paper are of some minor interest, as a curiosity, but I think the whole idea that the rare ones are worth vast amounts of money, is fundamentally flawed. So I expect to see a long term, gradual fall in prices for curiosities like old stamps.

Whilst SGI is indeed a major (the major?) specialist in this area, a case can be argued that philately is all a bit silly, and a relic from the past. That's just my opinion, you might disagree, and think that philately is still an exciting alternative asset class. If the latter is indeed your view, then at some point SGI might become a good turnaround stock. After all, it has been refinanced, and seems to be making some progress.

I'd definitely want to see the next balance sheet first, before making a decision, post the imminent kitchen-sinking. It could make a nice speculative trade at some point, who knows?

That's all from me today & for this week.

I hope you have a pleasant, and peaceful weekend.

Regards, Paul.

(usual disclaimers apply - these reports are just my personal opinions only)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.