Good morning! Two articles on economics caught my eye this morning, and this reinforces my view that the UK economy is now recovering, and hence portfolios should be positioned accordingly (i.e. more in reasonably priced cyclical & growth stocks, rather than defensives).

So share price upside is now most likely to be found at companies which manage to exceed broker earnings forecasts, as their operational gearing kicks in from growing sales in a recovering economy.

The Telegraph highlight a surge in UK business confidence to a level not seen since Jan 2008. Begbies Traynor (LON:BEG) also issue their interesting quarterly "Red Flag" report for Q2, entitled the "UK recovery accelerates", which is always worth a read.

Amino Technologies (LON:AMO) is an interesting company, whose shares delivered a roughly 75% gain for my portfolio over about six months (I banked the profit & moved on a few months ago). I last reported on it here, when they issued a positive trading update on 6 Jun 2013. Amino is a Cambridge-based maker of internet TV set-top boxes. I imagine this is a potentially good growth area, as faster broadband is rolled out globally. Their two largest markets are the USA and the Netherlands, and they supply globally to other markets too.

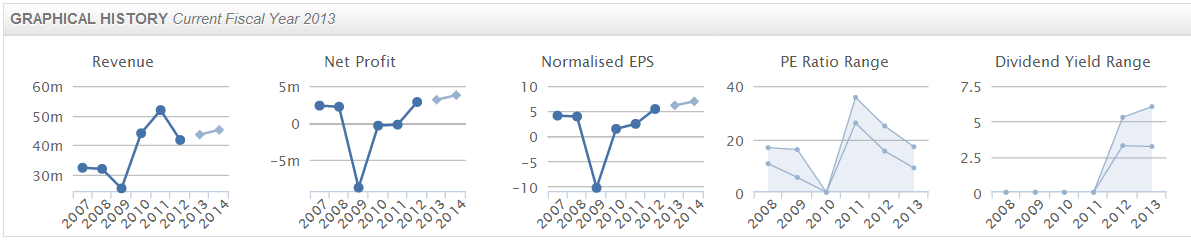

I find Stockopedia's graphical history an excellent way to instantly glean lots of information about any company, and reproduce the graphs for Amino below:

These five charts tell me that;

- Growth has been uneven, and most recently seems to have gone almost ex-growth.

- As with most companies, there was a plunge in profitability at the time of the financial crisis in 2008 onwards, but profits have now returned to £3-4m p.a..

- Normalised EPS seems to have levelled off around 5-7p

- The shares have been getting cheaper on a PER basis in the last three years.

- Dividends were resumed in 2012, and it now has a good yield.

Amino's interim results today look to be as expected. The most striking thing from the P&L is the strong improvement in gross margins, up a whopping 10.8 points to 46.2%. That's very impressive, but had been previously flagged (I recall a friend mentioning that gross margins were rising strongly after he attended the last analyst presentation).

Operating profit has shot up from near breakeven last interim period (£0.2m) to £2.6m for H1 of this year, although this is flattered by an exceptional £1.65m refund of duties (which itself is partially offset by £0.7m of restructuring costs). Is it me, or do many companies seem to be permanently restructuring? Makes you wonder whether those costs really should be classed as exceptional? It just seems a rather overly convenient place to dump costs, where they are not taken into account in the valuation. That's a more general point, not specific to Amino.

The crucial outlook statement is fine, with them confirming that results for the full year (ending 31 Dec 2013) will be in line with expectations. Jolly good.

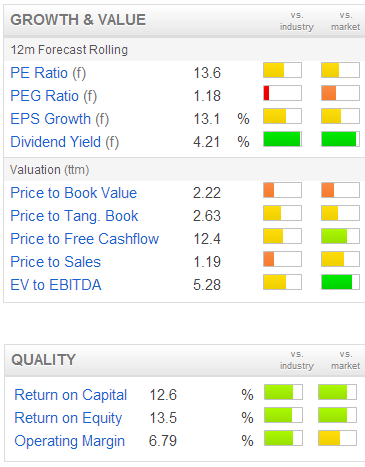

On a PER basis, Amino doesn't look cheap any more, as you can see from the Stockopedia valuation table (which works on a traffic light colour-coding - i.e. green is best, amber is middling, and red is worst).

Note the dividend yield is good, at 4.2%, and the company is committed to a 15% annual increase in its dividend, so that appeals.

Whilst the PER may not look anything special, bear in mind that Amino has a remarkably strong Balance Sheet, with net cash of £18.2m, which is a considerable amount given that their market cap is £49.8m, so almost 37% of the share price is actually net cash!

Management don't seem to be very decisive about what to do with the cash. They really should either give it back in a special dividend, or make a good quality acquisition. Whilst it provides a very nice safety buffer for investors, when it's this material to the valuation, you really do need to know what management intend doing with it.

Overall, the shares look interesting, but I don't know enough about the future outlook to be confident enough to buy back in. It looks like the sort of business where sales could be potentially lumpy if large contracts fall away for any reason.

Another thing to watch out for in Amino's accounts is that they capitalise some development costs. So the amortisation charge in the P&L is not goodwill amortisation (which is a non-cash book entry), but is amortisation of real cash spending on development. The amortisation charge is almost equal to the amount capitalised in the six month period, so as long as you include one or the other in your calculations of profits, then it's fine.

The problem is if you look at EBITDA, you are ignoring development spending altogether, both current and historic, which means that it's a completely false measure of performance, inflating profits. In my view therefore, for this reason investors should reject multiples of EBITDA as an invalid way to value any company that is capitalising development spend.

Thorntons (LON:THT) has issued its Q4 and full year trading update today. Q4 is (by far) their quietest quarter of the year, as the business is heavily dependent on Xmas and Easter chocolate buying. It is also striking how they have successfully rebalanced the business away from retail, and towards commercial sales, such that commercial is now 46% of total sales. That is basically what has saved the business, which probably would have gone bust otherwise, so hats off to management for pulling off this turnaround.

I'm not quite sure why the shares are down 5% today to 92p, since the Q4 sales growth figures are actually better than Q3. They reiterate the statement of 2 July that they expect profit before tax, impairment, and onerous lease charges for year ended 29 June 2013 to be ahead of £4.6m market expectations.

A few comments. Firstly, that's a low margin of only 2% on sales of £221m, so really this is still a fairly fragile business. It also has a weak Balance Sheet - with only £10m of tangible net assets. Although I note from the 2012 Annual Report that fixed assets (which are usually worthless for retailers) includes £25.8m of long leasehold & freehold property, stated at cost.

It would be interesting to find out what those properties are, and what their current market value is. This could perhaps explain why the Bank is happy to extend Thorntons an unsecured facility of £57.5m until Oct 2015. That strikes me as a very large bank facility, given the business being only marginally profitable, hence why I suspect there could be upside on the property book values, as otherwise it would be pretty bizarre for any Bank to offer such a large, unsecured facility against only £5m-ish profits.

There's also a pension deficit of £30.9m, and note 12 to the last set of accounts details how the cash deficit contribution is set to rise from £2.2m to £2.75m, and that further payments would be due under various conditions such as paying dividends over £1.5m.

With potential lease liabilities as well, altogether this still looks a pretty messy situation, and is one where I think the share price has got well ahead of itself, on euphoria about the trading turnaround, and momentum traders just taking the stock higher & higher.

There's a lot of that about at the moment, and in my view these type of situations are just accidents waiting to happen. Thorntons looks very high risk to me, on any rational assessment of the Balance Sheet, but that depends on how much the properties are worth.

Another company which has turned itself around recently, is Finsbury Food (LON:FIF). They announce a pre-close trading statement today. The first sentence rather amusingly says that "profit expectations ... are significantly ahead of expectations", which reminds me of a looped formula in a spreadsheet! I know what they meant though.

The initial excitement subsides a bit when you read later down the statement that part of the reason for out-performance is that the completion of their sale of the "Free From" subsidiary occurred two months later than planned, which meant that it's profits contributed to the group for longer than expected. That's clearly a one-off gain, so not something that should affect the price of the shares other than marginally.

The £21m achieved from selling Free From, and a £3.8m equity Placing, means that the Balance Sheet has indeed been transformed, with net debt down from £34m a year ago to £10m now. Pretty impressive stuff, which now make these shares investable to me, whereas they were far too high risk before.

Finsbury Food shares have more than doubled in the last year, and they now look priced about right to me, based on a forward PER of about 10, remaining net debt being just under a quarter of the market cap, and a rather stingy dividend yield of only 1.4%. It's entirely possible that momentum could take the shares higher, but it doesn't look terribly exciting to me - it's a low margin business, and there's a lid on how much margin any food company can make - if they get too profitable, the supermarkets squeeze out any excess. They also tend to be capital intensive, so need a lot of ongoing capex. It's not for me, but well done to people who saw the opportunity & have more than doubled their money in the last year.

That's it for today, many thanks for reading, and as always comments are welcomed in the comments section below - the more interactive the better, so please feel free to discuss/agree/disagree!

See you tomorrow from 8 a.m. as usual.

Regards, Paul.

(of the companies mentioned today, Paul has a very small long position in BEG, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.