Good morning!

We're seeing a relief rally today, as the latest poll last night showed a small lead for the remain side. The last few days have certainly been a wake-up call to those of us who believe that a leave vote is the best thing for the country in the long run (and I fully appreciate that some readers disagree, it's a matter of opinion). There's no doubt that a leave vote would be chaotic for the markets, and would probably put a big hole in our portfolios for a while anyway.

We had another terrific, and courteous discussion about Brexit in the comments section after yesterday's report. Thanks to everyone who is contributing to the debate, which has been the best I've seen anywhere. Maddox in particular, who works in the City, left us in no doubt that a lack of EU passporting would lead to many job losses in the City, as banks, etc, relocate some operations to within the EU. I've heard the same thing from a friend who is Co. Sec. for an overseas bank which has London as its European HQ.

Some other fascinating snippets I picked up - apparently 80% of Dutch people want the UK to leave the EU. The article suggested this is because they are also disillusioned with the EU, and hence want the UK to open the door to them also leaving. Mind you, I did wonder whether they just think we're a pain in the neck, and want us out for that reason? Germans and Poles have apparently been polled, and strongly want the UK to remain in the EU - although it's pretty obvious why - for self-interest.

Probably the most astonishing intervention, was George Osborne basically blackmailing the electorate to vote remain - saying yesterday that he would impose an emergency budget, increasing income tax by 2%, and other punitive measures, if we vote out. He seriously thinks that he will still be Chancellor after an out vote? It's a diabolical tactic too, which to me indicates appalling judgement, plus malice. So he needs to be kicked out, regardless of the outcome of the vote.

In terms of the markets, it's obviously all about Brexit right now. When the polls & betting odds move towards remain, then shares go up. When they move towards leave, then shares go down. Goodness knows what would happen on an actual Brexit vote? Probably a substantial drop I imagine. That's why it's so vital not to be geared at a time like this. If you're not geared, then you can ride out the volatility. If you're geared, then it's potentially disaster on a big market fall. With the polls too close to call, I wouldn't take the risk of having any significant gearing right now.

On the other hand, a remain vote would almost certainly trigger a substantial rally, because buyers have been on strike for a week or two now. Plus many of us took some money off the table well in advance of the referendum. So there must be plenty of money on the sidelines, ready to come back in (fast) after a remain vote, if that's what we get.

Personally I don't like to trade this type of situation, as with small caps you can't get the liquidity when you want it. So you're trying to sell into no demand when people are nervous, and you're trying to buy when everyone else wants to buy too, after some good news. I tend to just stick with my core small cap positions, and ignore market volatility.

It will be fascinating to see where it will all end.

I think we'll also probably see lots of profit warnings from weaker small companies in the coming weeks, blaming the Brexit vote for a slowdown in business. Good companies will just get on with it, and meet/beat their forecasts. So this sort of thing sorts the wheat from the chaff, in my view.

Walker Greenbank (LON:WGB)

Share price: 188p (down 1% today)

No. shares: 60.2m

Market cap: £113.2m

AGM statement (trading update) - this is the luxury interior furnishings group which was badly affected by floods some time ago. Today's update indicates that production is recovering, and stocks are being gradually re-built;

...it will take some months to return to a full stock holding position in Milton Keynes.

It doesn't specifically say so, but I'm assuming that the decline in sales this year is due to the impact of flooding:

"In the first four-and-a-half months of the current year, total brand sales were down 3.0 per cent in reportable currency, down 4.5 per cent in constant currency, compared with the same period last year. In the UK, brand sales are down 6.7 per cent. Brand sales overseas were up 2.6 per cent in reportable currency, down 1.3 per cent in constant currency.

Further payments are expected from the insurance company, and the cover seems very comprehensive. My main worry though, is what happens if flooding happens again? The insurance company won't keep paying out, if the same thing keeps happening. So I would be interested to know what measures have been taken to protect its vulnerable premises from flooding. Also, have the insurance company hiked the premiums materially, or imposed special conditions? Maybe production could be moved to another site which is not at risk of flooding?

The good news is saved to the end - the overall picture looks fine, presumably helped by more insurance receipts:

"We remain confident of the outlook for the rest of the financial year and current guidance remains unchanged."

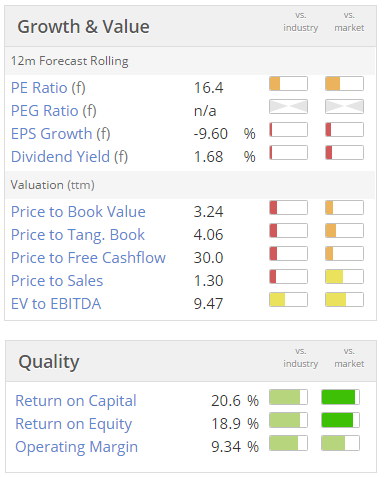

Overall, the valuation doesn't look particularly appealing. I'd say the shares are probably priced about right:

Servelec (LON:SERV)

Share price: 226p (down 33% today)

No. shares: 69.4m

Market cap: £156.8m

Trading update (profit warning) - on checking the archive, I don't seem to have looked at this company before. It calls itself a "UK-based technology and software group". It seems to serve several sectors, including healthcare, social care, nuclear & power.

The group today warns on 2016 performance:

We had anticipated a heavier weighting towards the second half of the financial year than has historically been the case, but it is now clear, given further slippage in contracts, that there is likely to be a shortfall in our expectations for FY16 as a whole.

Whilst Social Care and our Nuclear & Power businesses continue to trade within expectations, market headwinds for our Healthcare, Technologies and Oil & Gas businesses are such that the Board now expect Group operating profits for FY16 to be significantly lower than market expectations and lower than the outturn for FY15.

More details are given as to how each division is trading, which I won't go into now.

In situations like this, I always do 2 things;

1) Find out what the brokers are doing to their forecasts - since they will usually be given a steer by the company. This enables us to re-value the shares, and decide whether they are a potential buying opportunity or not.

2) Check out the last set of accounts, to see whether the balance sheet is strong enough to absorb a period of poor trading. If it's not, then a fundraising could be on the cards, which can trash the share price.

It is usually also sensible to do another thing (preaching to myself here, as this is a mistake I frequently make):

3) Wait. Usually shares take several weeks or months to bottom out. So buying immediately after a profit warning is usually (but not necessarily always) the wrong thing to do.

Broker forecasts - I've found one broker note in my Inbox this morning, which shows EPS forecast for 2016 reduced by 26%, from 21.5p to 15.9p. Therefore on a share price of 226p, the revised PER is 14.2.

Dividends - forecast for 5.8p this year, giving a yield of 2.6% - not very exciting.

Balance sheet - I've just done a quick skim of the 2015 accounts, and it all looks fine. The company is highly profitable, and generates good cashflows. Its balance sheet looks OK, although bear in mind that it has recently spent £20m (from cash & bank debt) on making an acquisition from Tribal (LON:TRB) .

Even after the cash outflow from this acquisition, I reckon Servelec's balance sheet still looks robust. So no solvency issues, and no need to raise fresh equity, in my opinion.

My opinion - this looks a quality company, with a high operating margin, and strong, genuine cashflow (no excessive capitalising of development spend, for example). No funnies in the accounts at all, that I can see.

Therefore it's going on my watch list for a possible future purchase, if the share price continues falling. I'd want a PER of 10, rather than 14, to tempt me in at this time.

Drat, I've almost run out of time. Am shortly heading into the City for a lunch with management of Norcros (LON:NXR) then after that am popping in to see new management of Coms (LON:COMS) and learn more about their interesting turnaround strategy.

So just a few quick comments before I sign off:

Severfield (LON:SFR) - results for y/e 31 Mar 2016 look good to me. 3.67p adjusted EPS seems to be a beat against consensus forecast of 3.4p. The order book is very strong. Underlying operating margin has risen from 4.5% to 5.7%. No balance sheet issues that I can see, other than a £14.6m pension deficit. Might be worth a closer look, possibly?

Castings (LON:CGS) - solid results today, profit up to £19.7m (£17.5m prior year). Fantastic balance sheet with lots of surplus cash. A very nice business, on an undemanding valuation, I reckon.

Many thanks to Gus, who pointed out below, in the readers comments, that there's a special divi:

Dividend

I am pleased to report that the directors recommend an increase in the final dividend to 10.33 pence per share to be paid on 19 August 2016. This, together with an increased interim dividend, gives a total for the year of 13.71 pence per share.

Supplementary dividend

In addition to the final dividend set out above, the board has reviewed the cash position of the group and considered the balance between increasing returns to shareholders whilst retaining flexibility for capital and other investment opportunities.

As a result, the directors are declaring a supplementary dividend of 30 pence per share to be paid on 22 July 2016 to shareholders on the register on 24 June 2016. This dividend, being discretionary and non-recurring, in no way compromises our commitment to invest in market leading technologies to maintain our competitive advantage.

Jimmy Choo (LON:CHOO) - trading in line with expectations. Further deleveraging in 2nd half - good, it needs to reduce debt, which is far too high. Poor balance sheet, with too much debt, so not one I would touch at the moment.

Sorry that's all I have time for today.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.