Good morning!

The first two sections of today's report are on growth companies, which are more difficult to value, because the valuation can radically alter, depending on how much growth is achieved. Hence it's easier to get things wrong! Also, investors generally tend to over-value growth, especially in bull markets, when wildly optimistic valuations have been put on many companies which have subsequently turned out to be complete rubbish (I could give examples, but the list is as long as my arm!)

accesso Technology (LON:ACSO)

Share price: 828p (down 4% today)

No. shares: 21.9m

Market cap: £181.3m

(at the time of writing, I hold a long position in this company)

Interim results to 30 Jun 2015 - please note that this company reports in US dollars.

I wouldn't go as far as saying that these figures are irrelevant, but in my view they should not be used to value the company, for two reasons;

Firstly, the seasonality is such that most of the profits are generated in H2. So the H1 figures are mainly just to reassure that things are reasonably on track. Last year the split of adjusted operating profit between H1 and H2 was 15% to 85%. So if you just double the interim profit, then you'll be way short of what the full year profit will come out at.

Secondly, Accesso won a major contract recently with theme park operator Merlin Entertainments (LON:MERL), to provide ticketing systems for all of its sites - over 100 of them, globally. Merlin is the world's 2nd largest theme park operator. This came on top of other contract wins. The nature of these contracts is that they generate long-term, recurring revenues. The Merlin contract will take 3 years to roll-out. Therefore, in my opinion the only logical way to value Accesso now that the Merlin deal is signed, is to base the valuation on 2017 forecasts. Usually I would say that is too aggressive a valuation method, looking two years ahead, but in this case I think it's entirely logical. After all, 2015 and in particular 2016 results, will include up-front setup costs, so are not going to be typical of how the business will perform once the big contract is rolled out.

So for those reasons, the shares are likely to look expensive on a superficial look, over the next two years. However, providing nothing goes wrong, then longer term, I think there is still good potential upside in this share, based on the forecasts for business it has already signed up on long-term contracts. That's very different from basing a valuation on just hope that it will win more business.

As the famous saying goes, when the facts change, then I change my mind. So my report here on 30 Jul 2015 explained why I felt that the Merlin contract news was so significant, a game-changer, such that at 617p the shares were actually looking attractive to me, despite already being up 15% that morning. I was right, and the price has since risen another 34% to the price now of 828p. There's been a bit of profit-taking this morning, which is to be expected after such a strong run. Also I think some investors are bound to baulk at the apparently heady valuation, when set against the modest level of H1 2015 profits, as not everyone will have access to the 2017 forecasts, so won't necessarily understand that the valuation does stack up against likely future earnings on contracts that are already signed.

Here are the key figures from today's interims;

- Turnover up 24% to $32.1m (full year broker forecast is $116.2m)

- Adjusted operating profit up 21.9% to $1.56m

- Note the sharp increase in net debt to $18.8m

- Adjusted EPS is up 2.1% to 4.37p

Valuation - full year forecast EPS for 2015 is currently $0.45, so that's just over 29p per share. That puts the company on a current year forecast PER of just over 28 times - expensive for sure, but the reason is as stated above - that earnings are set to rise due to new contracts kicking in during 2016 & 2017.

2016 forecast EPS rises to $0.54, or 35p, which drops the PER down to 23.7 times, based on a share price of 828p.

I don't have the 2017 EPS forecast to hand, but it's obviously going to be higher still, as the Merlin sites should be live by then.

Current trading - sounds encouraging;

Strong post period-end trading underpins confidence in full year performance

We are pleased with the Group's performance in the first half, delivered by a business well positioned in a market it fully understands. The Board has previously reiterated its guidance for 2015, upgraded its expectations for 2016, and materially upgraded its expectations for 2017. We will continue to work hard to achieve our targets and deliver on the new contract momentum across the business, and we remain confident that we are in a position to do so.

Balance Sheet - looks weak. So personally I would like to see the company strengthen the balance sheet with a small Placing.

Net tangible assets of $56.9m is dominated by intangible assets. Write off the $70.9m intangibles, and NTAV is negative, at -$14.0m.

Whilst the current ratio is strong at 2.2, that is because this measures ignores nearly all the bank debt, which sits in long term creditors, of $22.1m. Overall net debt is $18.8m.

I'm not sure why there is a deferred tax asset of $5.7m, and separately a deferred tax creditor of $8.4m, so it would be good to get some clarity on that.

My opinion - the Merlin deal changed everything for me. Until that point, the valuation of Accesso looked far too high, and largely based on hope of future success. The valuation today still looks high, but it's now underpinned by signed, long-term contracts. So barring some calamity, it should be a fairly sure thing that earnings will be on a strongly rising trajectory.

Also, I like the fact that having won all of Merlin's business, this should be a tremendous catalyst for winning many other clients all over the world - you can't get a much bigger endorsement than the world's 2nd largest attraction operator going all-in with you. In my experience when a landmark contract like that is signed, it tends to be followed by several years' of additional out-performance, as other clients follow their lead, by signing up with Accesso, who now seem to be the clear sector leader.

This share won't appeal to everyone, as some people won't like basing today's valuation on profit forecasts for 2017. In my view however, it's not often you find something with a considerable moat, recurring revenues on long-term contracts, apparently dominating its niche, globally, that you can still value reasonably (on roughly 20 times 2017 forecast earnings).

I don't like the balance sheet, so personally I would happily accept say 5-10% dilution, in return for the company raising c.£9-18m in fresh equity, which would be enough to almost, or completely eliminate net debt.

It's also worth noting (PS: amusing typo corrected!) that ACSO shares were rock solid during the recent mini-panic in the markets. There has been an Institution sitting on the bid for weeks now, hoovering up loose sellers. So it's always nice to be holding a stock which is in demand. I doubt today's dip in price will last long.

Another reason this stock is at a premium price, is because the CEO Tom Burnett is held in such high esteem by investors. He promised ambitious growth, and he's delivering it. More proof, if any were needed, that small cap investing is really all about backing the right management, and to a certain extent being flexible on short-term valuation metrics during the rapid growth phase, as a strongly growing business can rapidly make a high PER look cheap, a year or two down the line, especially if broker forecasts turn out to be too cautious.

Synety (LON:SNTY)

Share price: 90.5p

No. shares: 12.1m

Market cap: £11.0m

(at the time of writing, I own shares in this company)

Interim results to 30 Jun 2015 - there's something for everyone (bulls and bears) in today's results, If you're a traditional value investor, then just ignore this section & move on to the next company, as it won't appeal. The following is a rough summary of the conversations I've been having this morning with friends & colleagues;

Bear: £1.4m turnover, and an operating loss of £2.5m, combined with only £3.0m cash left, means there is no viable business, and it's going to run out of cash in early 2016.

Bull: Ah yes, but turnover is growing rapidly (up 131% vs H1 2014), the company is achieving a high gross profit margin (77%), therefore operational gearing should mean that losses and cash burn will rapidly reduce.

Bear: Haven't we heard this story before though, yet cash burn remains stubbornly high?!

Bull: Hmmm, yes. However, the new NED, Peter Simmons (former CEO of successful SaaS company £DOTD), sparked a re-think on strategy at Synety, and the company is now reporting a strong increase in up-front setup fees, and has reduced overheads, therefore operating expenses are now flat, whilst revenue is rising strongly. There was a blip in Apr-May whilst staff were re-trained, but sales growth, and the pipeline, are now said to be strong. Outlook comments for H2 are upbeat. Cash burn is reducing by £20-30k per month, per the Conf Call with management this morning.

Bear: Mgt have told us before that they have enough cash to reach breakeven, and twice they've needed to raise more cash, at an ever-decreasing share price.

Bull: True. The company has again said today that it has enough cash, but I don't believe that either. They will almost certainly have to raise a little more cash, but hopefully from a position of strength, next year, when on the cusp of breakeven.

Bear: Fair enough, if they can get to that point, then I agree, a small cash raise when almost at breakeven shouldn't be a problem. But I don't particularly trust management, and question their competence.

Bull: They've made mistakes, but have been pretty open about that. Also, how many start-ups go completely smoothly? Mgt have invested heavily in the company, buying about £1m shares in the market in the last few years, so are personally committed. I'm just interested in what happens next, rather than dwelling on things that have gone wrong in the past. The bad news is reflected in the low market cap, whereas the upside could see this re-rate significantly next year (or this).

{click}

Bull: Hello? Hello? Are you still there?

(ends)

OK, I've used a bit of creative licence in the above, but I think it covers the main points. It looks to me as if bulls and bears are fairly evenly matched in the market too. This morning has seen fairly even two-way business. Speaking personally, I'm getting concerned again about the cash position. However, I am also encouraged that the revised business plan now seems to be on track to reach breakeven in mid to late 2016.

More importantly, it's not just die-hard private shareholders like me who believe this company is likely to succeed, recent RNSs have shown that the largest shareholder (Helium Rising Stars fund) has also been buying more, and went above 16% on 28 Aug 2015. The price is more likely to go up than down, if your big shareholders are buyers rather than sellers.

Outlook - upbeat, as you would expect, but there's some firm stuff in here too, e.g. record sales in Jun & Jul;

Whilst the Group's change in strategy did have an impact on new orders received in April and May whilst staff were retrained and internal systems amended, I'm pleased to report that the Group has witnessed a strong recovery, with June and July being the strongest months to date for new sales.

The Group's sales teams on both side of the Atlantic are now building strong pipelines, which is encouraging for the remainder of the year.This work is likely to continue well into the second half, but already our customers are experiencing a more tailored and improved pre-sales, sales and on-boarding journey. Whilst the new strategy is still in its infancy, the Board are pleased with the progress made to date and believe the early indications are encouraging.

The Directors remain confident and excited about the Group's future. The Company has cash and cash equivalents of just over £3m at the end of this reporting period, which the Board believes will, on the current trajectory, be sufficient to reach cash break-even.

My opinion - as mentioned above, I'm not convinced that the company does has enough cash to reach breakeven, but it's probably not going to be that far away in reality, so it's a worry rather than a grave concern.

I reckon it is likely to receive more Institutional support next time, if the current good news continues - evidence for that is that Helium are buying in the open market. Therefore if the company came to them and asked them to support a small Placing, one imagines they would be receptive to that possibly?

The problem with Synety's last fundraise (which had to be done at a then massive discount, at 90p) was that it was being done at a time of weakness, when targets had been missed, and previous assurances about cash reserves being adequate, had proved wrong. Also it was clear that, at the time, the company was still a very long way from breakeven. I believe the next fundraise will be very close to breakeven, and therefore should be well supported. Famous last words!

Overall, with a StockRank of just 1, the Stockopedia computers absolutely hate it, as it's a classic jam tomorrow stock that has disappointed several times already. I completely understand where they are coming from, and normally, if I wanted to play it safe, then I would agree. However, in this particular case, it seems to me that the company is building the groundwork for what could be quite an exciting growth stock in a couple of years' time. Not everyone agrees with that, by any means - which is fine, it's what makes a market.

The cash position looks a bit touch & go, but the growth potential seems to be coming through quite well now, and there's plenty of positive stuff in today's narrative to reinforce my belief that Synety will reach breakeven & move into profit late next year. They've stopped increasing overheads now too, which is crucial to reaching breakeven, as it was an ever-increasing target in the past.

Anyway, this one is obviously high risk, but potentially high reward. Best avoided if you are of a nervous disposition!

Hydrogen (LON:HYDG)

Share price: 41p (down 23% today)

No. shares: 23.9m

Market cap: £9.8m

Interim results to 30 Jun 2015 - the company mentioned in its last update in Mar 2015 that the outlook was uncertain, due to exposure to the oil & gas sector. However, today's interim results show that actually the bottom has fallen out of their performance, with Net Fee Income down 30% for H1.

Given such a large drop in NFI, the operating loss of £62k actually looks quite a reasonable achievement. The loss could have been a lot worse, but the company has deeply cut staff, with headcount down sharply from 285 to 214. Certainly painful for the people involved.

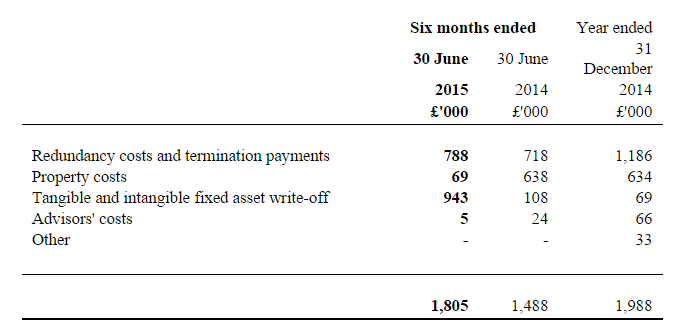

Down-sizing a business comes with exceptional costs though, so as you can see from the table below, these are fairly hefty - not just this year, but last year too;

Balance Sheet - so is it likely to go bust then? I would say not, as the balance sheet is actually in quite good shape. One of the positive things about down-sizing a business like this, is that debtors turn into cash. This is strikingly the case here, with H1 showing a positive operating cashflow of £7.7m, which was used to eliminate group net debt completely - the group held net cash of £116k at the end of H1.

Net assets are £22.6m, take off intangibles, and NTAV is £8.0m. That's not far short of the market cap of £9.8m, which should give some support to the share price around this level, providing losses don't worsen.

Outlook - having established that it's not likely to go bust, will it recover any time soon? This is what the company says today;

With the business having been through a period of major change, there are still a number of uncertainties surrounding the business moving back into growth in the short-term. Our review has already identified a number of growth opportunities and we are confident that by focusing on our practices key propositions we will shortly be in a position to move forward.

That's a tricky one to interpret! It sounds to me as if there might be some more bad news to come out, but that there are also some signs of hope for growth. Difficult to judge overall what this might mean.

Dividends - as if often the case, a very high forecast divi yield is actually a sign of trouble ahead. In this case Stockopedia shows fc yield of 8.68%. Sure enough, the interim divi has been passed today, however, the door is left ajar to a possible final divi. The balance sheet strength makes the company more likely than not to reintroduce divis in future, I reckon.

My opinion - it's possibly too soon to look for a turnaround situation here, as it sounds as if there might be more bad news before any good news.

I like the balance sheet, but am worried that further restructuring could throw up other liabilities. It's difficult to know what sort of profits the group might make in future.

Overall, I don't really have any idea how to value this share at the moment. It's tempting to buy a few for a recovery, but this share is hideously illiquid, which then means you're locked in once you've bought.

If it can get back to the level of profits achieved in say 2010-2012, then the shares would end up looking cheap. However, how much of that originated from the oil & gas sector, which is now on its knees?

At some point, this share is probably going to be a really good bargain, I just don't know when unfortunately, and would you want to buy into this trend?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.