Happy Friday!

Great news for holders of GBP as EURGBP has fallen by 1.1% over the last 24 hours.

The FTSE had to compensate for this, and it also fell by 1.1%. All because of a few non-committal hints from the central bankers about what they might do, depending on the data.

Paul added more sections to yesterday's report in the evening, so it now includes Franchise Brands (LON:FRAN) and Haynes Publishing (LON:HYNS) along with four other stocks.

Finally, there is a Mello Beckenham on Monday at which Image Scan Holdings (LON:IGE) will be presenting (in which Paul holds a long position!)

Cheers,

Graham

GYM (LON:GYM)

- Share price: 201.75p (pre-open)

- No. of shares: 128 million

- Market cap: £259 million

Acquisition of 18 gyms from Lifestyle fitness

An interesting boost to growth for this low-cost gym operator, as it buys out 18 sites from a competitor (albeit a competitor which doesn't strictly meet the definition of a low-cost gym).

Gym has been opening 15-20 sites per year organically, so this is a nice doubling of the organic growth rate. The acquisition is expected to be "significantly earnings enhancing by 2019".

Revenue has been growing at a decent clip here: up 19% according to the most recent interims, with H1 PBT increasing 75.5% to £6 million.

I'm impressed with the business model and the prospects, and find myself tempted to dabble in these shares again.

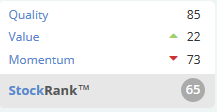

Stocko acknowledges the Quality and the Momentum: two out of three ain't bad!

Purplebricks (LON:PURP)

- Share price: 389.75p (pre-open)

- No. of shares: 272 million

- Market cap: £1,060 million

Another growth story, although not one that I'm a fan of. This real estate agency is one I'd like to short, if I was still in the business of shorting!

It's launching in the US later today, in Los Angeles. The plan is to spread through California and then other target states.

LA is apparently a place of extraordinarily high commission income for realtors. There are both selling agents and buying agents for LA property transactions, raking in the fees, and Purplebricks is going to muscle its way in:

Purplebricks will charge sellers a flat fee of US$3,200 to list their property. Sellers will also be responsible for paying a buyer fee on closing. By way of example, using the average LA house price of $560,000, Purplebricks could save sellers as much as $16,400, based on a seller's commission of 6 per cent and assuming a Purplebricks' buyers commission of 2.5 per cent. There will also be an option for sellers to defer payment of the listing fee.

The planned marketing efforts are highlighted too, as you'd expect.

50 local real estate experts (LREEs) will have been recruited, for LA, within a few weeks.

That doesn't seem very many to me, but it reminds me why I was initially sceptical of this plan. £50 million was raised in March, and yet it struck me that a lot more money than that would be needed to create a large business in the US and in particular to blitz the US media with efforts to raise the brand value over there.

I remain deeply sceptical of this valuation but it will be fascinating to see how it plays out.

Character (LON:CCT)

- Share price: 487.5p (-6%)

- No. of shares: 20.9 million

- Market cap: £102 million

A bit of a strange announcement this one, as the toy designer and distributor announces that it is getting rid of its FD.

It sounds as if bridges have been rather dramatically burned, as there are no thanks offered for service. The reason given for the decision is that the senior executive team lost confidence in him. And that's that.

That it might reflect personal rather than professional matters is supported as follows:

This Board change does not reflect any circumstances relating to the trading of the Group or its finance

Well that being so, I'd be inclined to think that this news is of little relevance to the investment case, either for holders or prospective buyers.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.