Good morning!

Ubisense (LON:UBI)

Share price: 29p (up 7.4% today)

No. shares: 55.9m

Market cap: £16.2m

Interim results to 30 Jun 2016 - interesting company, but when is it going to make sustainable profits? The trouble with permanently loss-making companies like this, is that they need refinancing every now and then, to keep the wolves from the door. That usually means dilution for shareholders, and a relentlessly falling share price.

Punters hope that one day there might be some game-changing news that leads to a vertical share price move upwards. That's a hopeless way to invest - as I've learned from experience. Being an optimist can be a huge impediment to investing success, if you repeatedly buy into jam tomorrow stocks. They practically all fail to deliver on what is promised, so risk:reward is just terrible with this type of share.

That said, it is a proper business, generating real turnover. It just never seems to make sustainable profits. So the danger is that management & staff are perhaps just busy fools? After all, customers are usually happy to buy products or services which are being sold at below the overall cost of providing them. That's a nice subsidy.

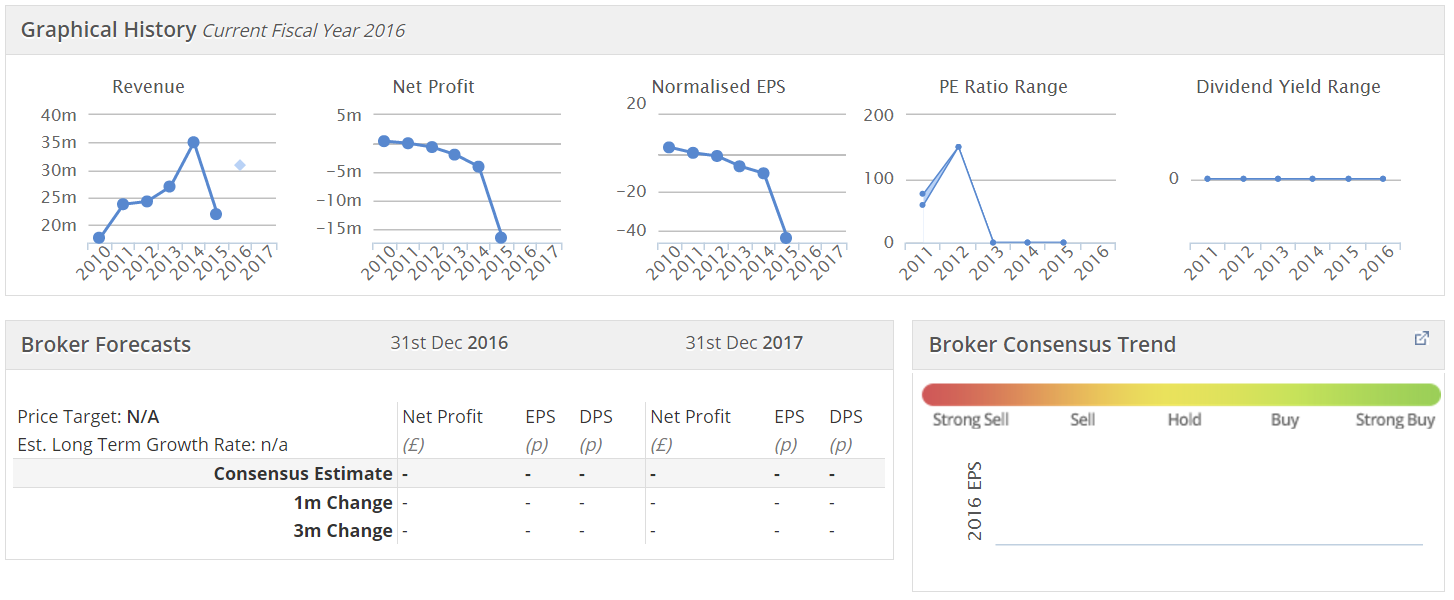

The Stockopedia graphical history doesn't exactly fill me with confidence;

Thomson Reuters doesn't seem to have any broker forecasts, so I've asked my broker to have a dig about to see if he can find any research on the company.

H1 figures out today don't look particularly good. Key points;

- Turnover is up marginally at £10.7m (up 3.1% on H1 2015)

- Adjusted EBITDA -£637k loss. If they can't get this, the most flattering measure of profitability, into the black, then that's a poor show.

- Loss before tax of -£897k looks a dramatic improvement (H1 2015 loss of -£7.5m), however H1 2016 is flattered by a net profit of £1.5m from non-recurring items (mainly a £1.65m forex gain), so the business is still loss-making on an underlying basis.

- Overheads have been reduced in a restructuring - which has reduced losses. Maybe more cost cutting is needed?

- CEO left (probably pushed, given the poor financial record) in May 2016. It is seeking a new CEO, the Chairman is currently in charge. Not good, but if they find a decent new CEO then that could be a catalyst for a share price rise, perhaps?

- Placing in Apr 2016 raised £4.5m net of costs. This explains why the company has £5.0m cash, at the same time as having bank debt of £4.0m. Presumably the cash is earmarked to be burned away through further losses?

- HSBC facility - £4m was drawn down of an £8m facility. Covenant defaults were waived at 31 Dec 2015 & 31 Mar 2016, presumably to give the company time to do the equity raise noted above. This is a big advantage of lending to listed companies - the risk is greatly reduced, as shareholders can usually be tapped for more cash if things get sticky.

Balance sheet - generally OK, although loss-making companies really should not have any bank debt.

Debtors seem very high, at £8.9m - which is the bulk of H1 turnover of £10.7m. This is a red flag. Excessive debtors suggests that either;

- Revenue recognition is too aggressive, with sales (and hence profits) being booked to the P&L well in advance of cash being paid by customers, and/or

- There might be disputed invoices included within debtors, which require remedial action (hence additional costs) before the customer will pay up.

Generally, debtors should be below half of H1 turnover, which would be below £5.3m in this case. Debtors here are actually £8.9m, so that's at least £4.6m of questionable items within debtors, so a significant red flag in my view.

Outlook - doesn't sound particularly exciting;

The Company separation of the Group's activities into two distinct operating units has enabled the Board to develop clearer strategies for each division. Although we have reduced the Group's cost base, we continue to invest in next-generation platforms and applications that deliver strong ROI to our customers.

Our priority now is to expand the number and size of deployments of Ubisense solutions with major enterprise customers in both divisions. We are also developing our channel partner relationships to extend reach within our vertical markets, expand our delivery capability and enhance margin growth. The Company is on track to deliver full year results in line with the Board's expectations.

Loss-making companies need to talk up their future prospects, in order to get investors excited, and prepared to over-pay for the shares. This all sounds a bit flat.

Also, what's the point in telling us they are in line with expectations, if they don't specify what those expectations actually are?!

My opinion - it seems a bit rudderless. Buying or holding this share is really just a punt, in the hope that a viable business can be created from what has gone before. Therefore it's of no interest to me.

Castings (LON:CGS)

Share price: 439p (down 3.6% today)

No. shares: 43.6m

Market cap: £191.4m

AGM statement (trading update) - this company has a 31 March year end.

Today it says;

We have seen a softening in demand from our main customers since the statement in the Chairman's report in June. Our plan to fill the profit gap created by the ending of a major machining contract remains on course with improvements still expected from 2017/18.

We continue to invest in production techniques and technologies to ensure we remain as market leaders and maintain our competitiveness in a post-Brexit marketplace. The referendum result has given rise to uncertainty and it will take time to gauge the effect this may have on the company.

That doesn't sound too good. It sounds as if the company is experiencing a soft patch. Although as a UK producer, the devaluation of sterling must have been very helpful - I'm surprised the company makes no mention of this today.

No mention is made about performance relative to market expectations, so it's an unhelpful update. I wish there was a formal set of requirements for trading updates - certainly it should be compulsory for companies to guide on how they are performing relative to market expectations.

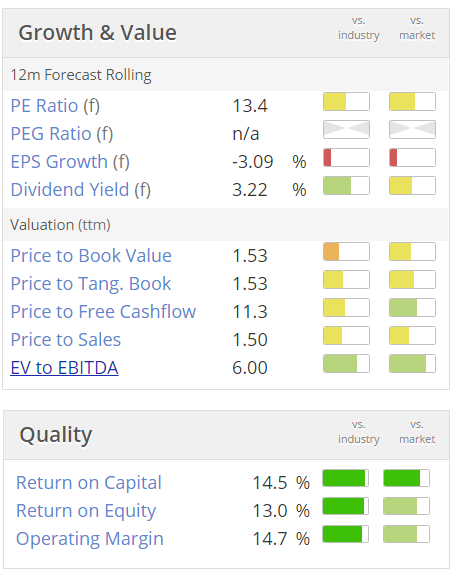

Valuation - here is the usual Stockopedia graphic;

Note the strong quality scores.

Also the forward PER of 13.4 may not look especially cheap at first sight, but bear in mind that you also get a bulletproof balance sheet here. So there are considerable surplus assets thrown in for free.

My opinion - this is a very good company, in my view. Although the outlook sounds rather uncertain for now.

SCISYS (LON:SSY)

Share price: 88.2p (up 5.0% today)

No. shares: 29.0m

Market cap: £25.6m

Trading update - this sounds encouraging;

SCISYS can report that it has maintained the encouraging start to the year reported at the AGM on 9 June. This favourable trading picture is reflected in buoyant cash flows for the period. These transformed a £1.0m net debt position at the start of 2016 into £1.4m net cash at 30 June.

The Group's order book has remained strong, well ahead of the equivalent position in June 2015, and is underpinned by a sizeable pipeline of prospective new business opportunities.

The Board does not expect any adverse consequences as a result of June's EU referendum outcome. Indeed, if the euro-sterling exchange rate stays in a broad range around its current level for the remainder of 2016, the Board envisages that its current full year expectations will be significantly exceeded even after allowing for costs of approximately £0.5m incurred in the first half-year in respect of currency hedging. As in previous years, the Group's full year trading performance is expected to show a bias towards the second half of the year.

Approximately half of the Group's business is conducted in euros. SCISYS mitigates its exposure to exchange rate movements by entering into hedging contracts to convert forecast surplus euros into sterling at fixed forward rates. Such contracts are revalued quarterly on a mark-to-market basis. Following the Brexit referendum vote the value of the pound fell sharply against the euro. This resulted in an adverse revaluation at 30 June of the Company's 2016 and 2017 hedging contracts and will create a £0.5m charge in the income statement for the first half of the year.

The forex hit of £0.5m doesn't matter. More importantly, I like that the company expects to benefit from weaker sterling.

H2 weighting introduces risk, but that sounds like a normal seasonal pattern.

Overall - I like it. The valuation looks about right for now. It's a quality company, with some excellent client relationships, so I reckon there is potential value here. The trouble is, that it's ex-growth, so probably won't ever get a decent rating, unless someone bids for it - which is a distinct possibility, given the latent value of its client relationships.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.