Good morning!

Paul is taking a well-deserved holiday for a couple of days, so it falls to me to keep this show on the road.

Stocks on my radar today include Quarto Inc (LON:QRT), Lookers (LON:LOOK) and Epwin (LON:EPWN). I may also discuss yesterday's results from H & T (LON:HAT) (in which I hold a long position).

Best regards

Graham

Quarto Inc (LON:QRT)

- Share price: 122.5p (-21%)

- No. of shares: 20.4 million

- Market cap: £25 million

Termination of Discussions with Potential Bidder

Just over a week ago, this book publisher issued a fairly underwhelming H1 report, offset by the news that an unnamed potential acquirer was sniffing around. Not many details were given, least of all the potential offer price.

Paul thought it was a rather peculiar announcement, and reckoned that the shares would have fallen off much more sharply without the bid interest.

The bid has evaporated for now, leaving the share price to promptly deflate. Commiserations to holders.

The reason given is as follows:

"...these discussions were not progressing to the satisfaction of the Board. It became clear that the regulatory approvals required by the bidder to complete the proposed acquisition were increasingly less likely to be granted on the timeline first indicated. Recognising the importance of delivering a strong finish to the year and after carefully considering the interests of all shareholders, the Board was not prepared to prolong discussions further to avoid distraction to management at such a critical time of year for the business."

That actually sounds like a good justification to me - the distraction cost of actual and potential M&A is underrated, in my view. I don't know what the regulatory approvals for the bidder might have been.

Of course, for those shareholders who were looking forward to getting a bid, it is a disappointment, and some of them have headed for the exits today. That is to be expected.

What of the underlying value of the business? It remains an enigma.

There is a fascinating article by user lavinit which deals with a lot of the nitty-gritty, which I recommend reading for those who have the time. It's at this link.

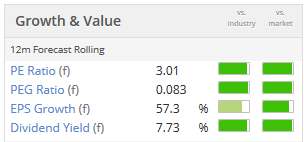

Value metrics remain depressed thanks to the $60 million debt load, last seen, which is clearly spooking investors:

Using an updated EPS forecast of 29p from Paul's July article, the PE ratio is perhaps closer to 4x rather than the 3x depicted above - though at such levels, does the difference even matter?! This must be true binary territory, where it will go to an effective zero through financial failure, or it will produce a big winner.

I've been playing some hold-em poker recently: that's an example of a game where accepting a likely small loss (calling pre-flop with a low pocket pair, maybe?) can be the right play, because if you make three of a kind on the flop (7.5/1 odds), your profitability is excellent. That's the asymmetry concept I've mentioned a lot before!

I'm sorry if that paragraph doesn't make any sense, but the bottom line is that Quarto is now definitely in asymmetric territory. If you can figure out that it won't be diluting or otherwise abandoning existing shareholders due to financial stress, it would be a fantastic buy here. Only for surplus risk capital, though.

Lookers (LON:LOOK)

- Share price: 108.75p (-5%)

- No. of shares: 397 million

- Market cap: £431

This is a large franchise motor dealer representing 32 car manufacturers across the value spectrum, from 100 locations.

Another slight disappointment for existing shareholders with this one today but perhaps it means opportunity for new investors!

I've selected some of the financial highlights below:

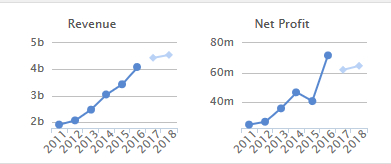

- Revenue increased 5% to £2.46 billion (2016: £2.34 billion) with growth from new and used cars, as well as aftersales

- Operating profit from continuing operations increased 13% to £58.1 million (2016: £51.6 million)

- Profit before tax from continuing operations increased by 14% to £44.6 million (2016: £39.2 million)

- Net debt reduced to £61.9 million (31 December 2016: £74.1 million)

And the interim dividend increases 10%.

Looks has disposed of a car parts subsidiary, and made some acquisitions, which results in the continuing operations distinction.

So the total result including all operations is a bit smaller than last year, but it's not a fair comparison.

Balance sheet management is crucial for this business and at the moment, debt levels look fine versus EBITDA (0.54x net debt/EBITDA multiple). There is also some £168 million in unutilised facilities - plenty of headroom.

The report contains some useful commentary on the car market in general, useful for holders of the other stocks in this space.

The retail new car market is under pressure and Lookers agrees with industry forecasts that it will decline by a few percentage points this year, as it has already done in the first-half.

But Lookers grew its own gross profit in this segment on a like-for-like basis by 7%, and grew used cars gross profit by 13%, too . It also outperformed in commercial vehicles, a segment where general industry conditions aren't so tough at the moment. It's obviously getting the formula right to achieve these apparent market share gains across various segments!

The highest-margin area of the business is aftersales, where revenues made a 4% LfL gain.

Note that all of the above numbers are bigger if you include acquisitions (but LfL is more interesting from a performance point of view).

Perhaps the reason for a few jittery sellers today is this part of the outlook statement:

The excellent performance of the group in the first half of the year builds on what was already a strong comparative for the previous year. However, we have seen a softening in the new car market in recent months. Furthermore, the current political environment, Brexit and weaker exchange rates have created a degree of uncertainty in the UK economy, which is unhelpful and we therefore view the second half of the year with some caution. However, based on the first half performance, the board believes that the results for the year ending 31 December 2017 should be in line with management's current expectations.

It's not a profit warning, it's some type of semi-profit warning: results "should be" in line, but they are cautious. So if results turn out not to have been in line, we will have been warned in advance!

My opinion

This seems like a pretty good business to me.

It has achieved excellent growth over the last number of years and has not diluted shareholders to do it (looks like the last time shareholders got diluted was in 2009).

Quality metrics are pretty good except for the operating margin, which highlights how hard it is to generate good op margins in this business even when your gross margins are attractive.

So perhaps the market is right to be sceptical in awarding it a lowly PE ratio of just 7.5x.

Personally, I'd prefer to treat this more of an income stock rather than expecting it to achieve a great deal of capital growth, despite the company's ambitions. The dividend yield is currently just 3.4% and yet the Board could increase this if it wanted to - and it does plan to reduce dividend cover, over time.

Based on the target dividend cover (3.5x-4.0x) and using last year's EPS, the dividend yield should be moving towards 5%. Seems reasonable.

Epwin (LON:EPWN)

- Share price: 78.375p (-18%)

- No. of shares: 143 million

- Market cap: £112 million

Half year trading update and notice of results

Another bad news story I'm afraid.

Epwin is a building products manufacturer (windows, doors, decking, etc). It has been covered regularly on these pages since floating in 2014.

Shares in its sister company, Entu, are now almost worthless.

Mr. Scott covered Epwin in May, when an in-line trading update informed us that the first four months of the year were as expected. Being a "low-tech and cyclical" business, he wasn't too excited about the low PE ratio.

I also covered it in April (all available in the archives).

It turns out that besides arguably being low-tech and cyclical, the company also has a concentrated customer base. That's quite a few negative characteristics for a single company to have:

Since the AGM the Group has noted changing circumstances within its customer base affecting two of its customers, each accounting for around 5% of the Group's revenue. One has significant funding issues and is undertaking a strategic review, whilst the other has sold its plastic distribution business which is principally supplied by Epwin, to a competitor of the Group. The implications, if any, of these matters remain unclear at this stage.

The position of the first customer, assuming it is Entu, is already known by shareholders. But the second one is new.

So maybe 10% in total of Epwin's revenue is threatened.

I wonder how concentrated is the other 90% of revenue?

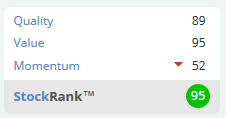

This doesn't pass my quality filters so it's not something I'd invest in personally, but of course there is a price for everything. Maybe this could be in value town now:

Note that Stockopedia's Quality Rank is a quantitative measure. This often coincides with things like product differentiation and competitive advantage, but not always.

I'd be a bit cautious given where we might be in the housing cycle, too, so for a variety of reasons this is not attractive to me.

H & T (LON:HAT)

- Share price: 289.25p

- No. of shares: 37.2 million

- Market cap: £108 million

I continue to hold a long position in this pawnbroking group.

Please note that I am currently selling shares from my portfolio, for personal reasons. I have sold some H & T (LON:HAT) shares and might sell all of the rest.

These results were fantastic, bringing together the company's exciting growth opportunities, consistent execution, and the macro tailwind of POG (price of gold).

"We have made a strong start, in this our 120th anniversary year, with a 62% increase in profit before tax to £6m driven by revenue increases in all key segments. The results reflect a series of initiatives beginning to bear fruit and a favourable gold price.

One of the things I love about the H&T's evolution in recent years has been its switch to jewellery retailing as the face of many of its multi-purpose outlets.

This has given it the flexibility to change emphasis from buying items to selling items in certain areas, and of course it can always change the focus back again in future.

Financial products are doing fine: pawn pledge book is up 11% to £43 million compared to a year ago, primarily reflecting POG and also some fresh routes to market.

And the personal loan book is up 87% to £12 million, cementing this as a key element of the product portfolio.

Net debt makes a material increase at last - that's what I've wanted to see, as the company finally sees more lending opportunities open up (money has to go out the door with the customer first, before it comes back with interest).

Competition is said to have weakened on the high street.

That's not a great surprise, as the similar Ramsdens Holdings (LON:RFX) has also been reporting very strongly.

But remember that H & T (LON:HAT) is about three times the size of Ramsdens Holdings (LON:RFX), holding the undisputed number one spot in pawnbroking.

There are real advantages to scale, not the least of which is the ability to average financial regulatory compliance costs over a much larger revenue base.

H1 PBT (profit before tax) increases to £6 million from £3.7 million, heralding a potential return to the scale of returns seen in 2009-2012.

The mix will be a lot different now, and arguably of improved quality with the addition of personal loans and other financial products,

Personal Loans - this might be the most controversial driver of improved returns, due to the risk of further regulatory action on short-term credit.

H&T informs us that only 70.6% of its recent personal loans fell under the definition of high-cost short-term credit. It has been extending the length of these loans where possible, and reducing their APR. That makes great economic sense, when possible, as it means much lower fixed costs per pound of interest.

Outlook - trading is in line with expectations and management remains confident.

My opinion - should be fairly clear at this point!

The major negative feature is that it is effectively a mini-bank, so you can dislike it for the same reasons that banks tend to be ugly investments: cyclical, weak returns on total assets, and it's not obvious to see how it can ever achieve consistent long-term growth in a mature and often saturated market.

But what's special about H&T is that it's the market leader, it's innovating extremely well, enjoys stable management, and has been managed to withstand the various macro cycles to which it's exposed.

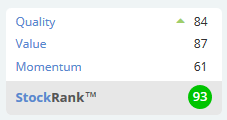

So I agree with the StockRank:

That's it from me today, thanks for tuning in!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.