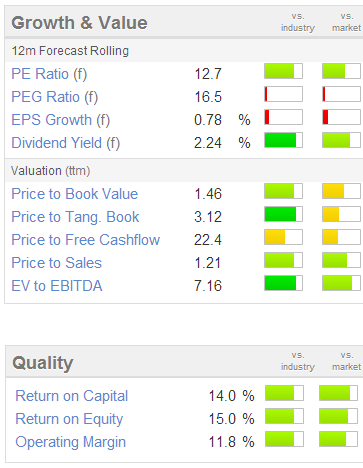

Good morning! Defence contractor Cohort (LON:CHRT) has published its interim results to 31 Oct 2013. This is a company that I liked earlier this year, when it was below 150p, but the price has since re-rated to a level where it's probably fairly valued. Bear in mind that the nature of their work (e.g. supply of communications equipment to the Astute class submarines) is bound to be lumpy, as large contracts come and go. Therefore I would always be wary of the likelihood of a sharp reduction in profits. For that reason it seems to me that the forward PER of 12.7 is probably high enough a rating.

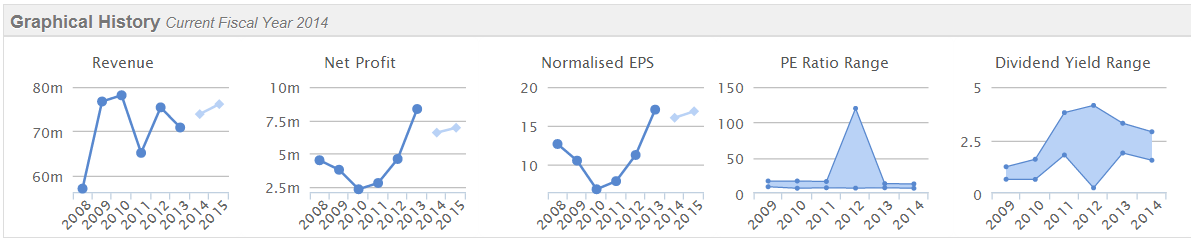

As you can see from the graphical history below, EPS has really shot up in the last two years, so if profits fell back to 2010-2011 levels, then the share price would be much lower than the current price of 214p, which factors in EPS holding up above 15p.

The PER chart has been thrown out of kilter by a spike in 2012. I wonder if they could be adjusted to use a logarithmic scale, which might help soften such spikes? Or perhaps they could be adjusted to allow extreme spikes to go off the page?

Their interim results today are quite soft in profit terms - adjusted operating profit is down 45% to £1.8m (2012: £3.3m), with adjusted EPS down from 6.97p to 3.97p. The phrase "as expected" is used, but I'm not sure whether investors will have been expecting such a sharp fall in profit? So we could see a wobble in share price today if they were not prepared for earnings falling.

However, the outlook is more positive - with order intake up 20% at £35.7m, taking the total order book up to £98.2m, of which £25.5m is deliverable in H2, together with "encouraging" prospects for further order intake in H2. The key part of the outlook statement says;

The second half of this year is already well supported by the October order book and recent contract wins and we expect a much stronger performance than in the first half.

On balance we expect that Cohort will continue to make progress in the current financial year and beyond.

Generally speaking I very much dislike situations where a soft H1 occurs, and assurances are given that H2 will be stronger, as you often find that in reality H2 fails to live up to expectations, and a profit warning follows. Although in this particular case it does sound as if they have firm grounds for optimism for H2.

Stockopedia shows market expectations as being 16.1p adjusted EPS for this year, so that implies over 12.1p needs to be done in H2, against 3.97p in H1 - a tripling of profits from H1 to H2, which seems a tall order to me. It will be interesting to see the broker comments on this, as to how confident they are that H2 profits can indeed be tripled from H1 in order to meet market expectations.

The interim dividend is up 17% to 1.4p, and a total dividend of about 4.2p is expected for the full year in total, and 5p forecast for next year, so a well-covered yield of 2.0%, rising to 2.4%. Not bad if it continues growing. Also noteworthy with Cohort is the strong Balance Sheet - current assets of £34.3m (including cash of £13.6m) represents about 247% of current liabilities of £13.9m, which is a very healthy position. There are negligible long-term creditors too, so that's good.

Therefore the company clearly has plenty of firepower for bolt-on acquisitions, something they allude to in the outlook statement. Net cash works out at about 33p per share, so it's a significant factor in the context of a share price of 214p, and gives investors a considerable degree of protection - the lovely thing about companies with plenty of net cash is that you don't have to worry about bank covenants, or dilution from equity fundraisings, or even the consequences of a period of poor trading. The cash is a safety buffer, and underpins dividend payments too. I think it also indicates a conservative mindset from management - you don't usually find companies which have built up lots of cash doing anything reckless. Also, companies with plenty of net cash won't be going bust, so you never have to worry about a 100% investment loss.

Overall then, I wouldn't be surprised if Cohort shares soften a little after these figures, but the outlook is probably good enough to prevent them falling below say 180p. Although of course it depends on how individual shareholders react, the share price can be volatile as it's not terribly liquid.

We are in a bull market, so shareholders might be prepared to ignore the soft H1, we'll have to see - these things are difficult to predict, as just one large shareholder turning negative can slam a share price down in something as illiquid as this.

Here is Cohort's 12-month chart:

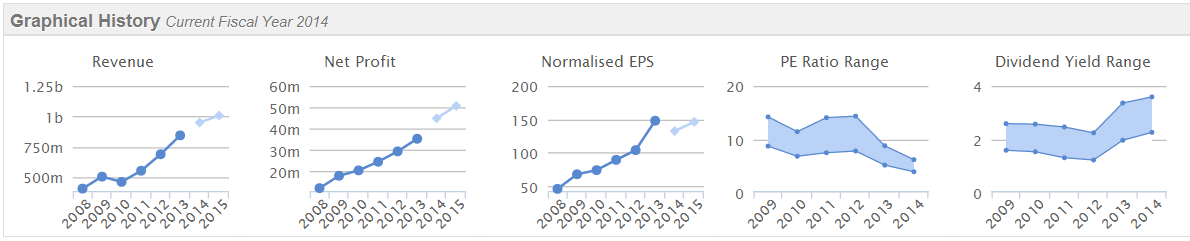

There's an upbeat trading statement from coal distributor Hargreaves Services (LON:HSP). Many investors would ignore a coal miner & distribution business, assuming it's moribund. However, if you look at the historic performance, it's remarkably good, and the rating the shares are on looks very low. It's not often you see a continuous improvement in performance, with a valuation that is going in the opposite direction in terms of PER. Note also the positive trend in dividends - which is set to continue as management have the stated aim of increasing the dividend by 50% in the next three years;

So it's a very interesting situation, worth a closer look I think.

The main problem is Government/EU policy, which is forcing the closure of coal-fired power stations, and leaving a dangerous gap in our national capacity, such that we could even be facing power cuts in future, if the wind doesn't blow enough to get the wind turbines spinning, and the French nuclear power stations are not able to make up for our shortfall via the big cable underneath The Channel.

Meanwhile of course our crazy Govt policy here lumbers industry with excessive power costs to fund green energy, so production closes down here, and we end up importing products instead from China, which is building numerous coal-fired power stations with skant regard for CO2 emissions. The end result - we've just shot ourselves in the foot, by having an energy policy that exports the jobs & the pollution to China, with no net ecological gain when viewed globally.

Similarly, the public are duped into thinking that energy companies are profiteering, even when the most cursory glance at their accounts makes it clear that their profit margins are if anything quite low. The further fact that UK household bills are actually quite low relative to other European countries is also ignored by the "narrative" that the media and politicians seek to impose on a general public that are seemingly incapable of independent thought or research. I really do despair sometimes, when the internet makes it so easy to research the facts, that so few people bother, indeed seem happy to be misled.

So back to Hargreaves Services. Their statement today seems full of positives, which seems surprising considering the backdrop of anti-coal Govt policy.

The key sentence says;

The Group is trading in line with management's expectations and is well placed to deliver a good second half performance.

Stockopedia shows forecast EPS of 132.6p this year, so at about 840p the shares are on a current year PER of just 6.3. Not bad. The dividend yield is forecast at about 3%, and that should grow to over 4% in the next couple of years.

Financially, the group has £95.6m in net debt, but that is offset by assets. In particular there is hidden value here in the property portfolio, which should start to create shareholder value over the next few years.

Their UK cast mines can be switched on & off easily, and have little overheads when they are mothballed, in times of low coal prices. The bulk of Hargreaves's business is not dependent on the coal price, as they receive a fixed margin per tonne of coal.

I attended a fascinating analyst/broker lunch given by the Directors of this company earlier in 2013, and it was a real eye-opener to what a good business they have here - it's primarily a distribution business, but the stock market really hasn't grapsed its true nature. Hence perhaps the very low rating. Also concerns over anti-coal Govt policy must weigh on the price. Overall though, as long term special situation, I think it looks interesting.

Their previous problems with the closure of a deep UK mine, and a fraud in Belgium, appear to have been resolved now, so those should no longer be factors that weigh on the company.

So whilst more research needs to be done on where the UK coal/coke markets are going, on the basis of a cheap valuation & good current trading, it certainly seems worthy of a closer look, in my opinion.

Shares in staffing group Impellam (LON:IPEL) have been on my watchlist for a while, and are down 6% to 345p this morning, in reaction to its pre-close trading update. It sounds a bit messy overall. On the positive side they say that market conditions are improving in their key markets. However, costs are rising due to "investment in headcount". However, profits are expected to rise at their UK and US staffing businesses.

On the negative side, profits are expected to fall at their medical staffing business, Medacs, which overall will tip the group into, "a small year on year decrease in operating profits". Although the outlook "is promising".

The bit that concerns me is the news of two onerous contracts at their Carlisle Support Services business, which require a hefty provision of £13m for ongoing losses, which will be taken as an exceptional item. That's a material loss, and worries me, because its cause seems to have simply been management mistakes, and lack of financial control. So for me that rules out investing in this share altogether. If mistakes of this scale can be made, then what else might go wrong? This type of business needs very tight financial control, which doesn't seem to be the case here perhaps?

Also, checking back the archive here, I didn't like the presentation of the results back in July, which seemed to gloss over a deterioration in underlying performance in H1 against the comparable period last year. So all in all, I think the low PER is probably justified for the time being - this group looks too accident-prone.

I first reported on Australian eye & face movement software company Seeing Machines (LON:SEE) on 10 Oct (when the shares were about 5p), after attending a Mello Central investor evening at FinnCap. It's a bit more speculative than my normal type of thing, but every now and then you stumble across something that looks really exciting, is easy to understand, and in a bull market could be a profitable investment as more investors discover the share and also get excited about the potential.

I don't touch anything blue sky these days, having been burned so badly in the past on numerous story stocks that almost all end up failing in the long run. So hyped up aggressive valuations on companies that are little more than start-ups, are nearly always best declined, as it's like searching for a needle in a haystack.

However, SEE looked interesting to me more as a GARP share (growth at reasonable price), since they are the established market leader in software which tracks eye and face movements of a vehicle driver, and sounds an alert if they start to fall asleep. Their system works very well, and has an exclusive sales deal with Caterpillar, the world's largest manufacturer of heavy vehicles for the mining sector.

The excitement surrounding SEE is that the same, commercially proven technology can now be rolled out to the global truck & coach markets, before eventually finding its way into cars too. So the company recently announced plans to raise £15m in a Placing at 5p. You would have expected that to act as a drag on the share price, but it hasn't at all. The price has soared, and it's now 9p Bid, 9.25p Offer. That means people who took stock in the 5p Placing are not sellers, even for an 80% instant gain. Or at least that, if they are sellers, buyers have taken up all the slack.

Bear in mind that the Placing was over-subscribed, so perhaps that has led to follow-on buying from people who were scaled back in the Placing? There is still the hurdle of an EGM vote to clear before the Placing completes, but with everyone having done so well on it (both existing, and new shareholders), then I'd be surprised if the vote is not carried.

The reason I'm mentioning it today, is that the latest news is of the first Caterpillar dealership signing up to the Caterpillar-Seeing Machines alliance agreement. The beauty of this sales strategy is that SEE is handing over the job to Caterpillar dealers, with another 20 in the process of signing up. So SEE does not need to build up a salesforce itself, the job will be done by Caterpillar, for a profit share arrangement.

Consider also the significance of Caterpillar agreeing exclusivity with SEE, what does that tell us? That they have tried about 30 competing technologies, and are so satisfied with SEE that they are prepared to go exclusively with them. You couldn't wish for a better validation of the technology in my opinion.

The applications don't stop at trucks & coaches, or cars. It also has application in consumer electronics, and the company has certainly excited investor interest in how user-facing cameras will become input devices - i.e. you will only have to look at an item on a menu to select it. Or advertisers will be able to track what you are looking at, and determine how effective their ads are. The possibilities are really exciting. Clearly there will be plenty of other companies active in the same space, so let's not get too over-excited, but SEE are clearly the current market leader with the Caterpillar deal. That justifies a premium market cap in my opinion. The valuation is already getting pretty warm, but this is a rare occasion where I'm going to suspend my normal valuation rules for the time being, and just let it run.

STOP PRESS!

An announcement has just been issued by Vianet (LON:VNET) giving an update on the Government's proposed Statutory Code.

It doesn't really say a lot, just that the Government needs more time to consider the evidence. The tone of Vianet's announcements on this issue seem to be improving in my opinion, and that was certainly the impression I got too at a recent meeting with the Directors of Vianet. So whilst they're not counting their chickens yet, it seems highly unlikely that the Government will ban the use of beer flow monitoring.

It's worth noting also that this Government review has been counter-productive so far, in that it has actually triggered an acceleration in the rate of Pub closures, and a reduction in investment - precisely the opposite effect of what was intended (as is so often the case with Government meddling).

Vianet conclude today's update by saying;

Whilst it is a very unwelcome distraction, the Board is optimistic that the reasoned, evidence-based strength of the Group's argument will result in a fair outcome.

That's it for today, so see you from 8 a.m. tomorrow, as usual.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in SEE and VNET.

A small caps fund with which Paul is associated also has a long position in SEE).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.