Good morning!

Here's an interesting snippet for you - in the US, between a survey of CFOs found that they believe 20-30% of listed companies "intentionally misrepresent" earnings.

That range sounds very much in the right ballpark to me, based on my work interpreting financial results. Also bear in mind that CFOs are the guys who prepare the numbers, so they know what to look for.

So we all need to be very careful when valuing companies on a multiple of adjusted, pre-exceptional EBITDA! (not that any readers here would be so daft!) Chances are the figures have been manipulated in some way, and hence we will be led towards over-valuing the shares. Therefore it's very much worth checking all those footnotes, and valuing companies on traditional, un-manipulated figures perhaps?

Possible changes to corporation tax - interest deductions

I tend to be so busy scrutinising company results, that sometimes I miss forthcoming important changes to laws, taxes, etc. So I'm particularly grateful when people flag up important issues to ponder. Roger Lawson recently posted an excellent blog on ShareSoc's website, asking "What's spooking the commercial property market?".

In this article he outlined how changes are afoot to possibly restrict the amount of interest charges which companies can deduct against profits when calculating their corporation tax liabilities. Roger says;

According to the FT article, it is possible the Chancellor will not allow interest costs in excess of 30% of EBITDA to be allowed against corporation tax. Potentially this could affect any companies that are highly geared or have large assets which are financed via debt.

I have therefore done a quick review of my portfolio, to make sure there are not any companies that might be affected by it - by comparing the P&L interest charge with 30% of EBITDA. The only share that came close for me, is Enterprise Inns (LON:ETI).

In this case, the highly-geared pubs group last reported EBITDA at £296m (before exceptionals - it will be important to see whether or not the tax proposals allow adjustment for exceptionals?), and the P&L interest charge (before exceptionals again) was £158m. So I make that a 53% proportion - well over the likely 30% maximum - suggesting that ETI is likely to see its corporation tax bill increase significantly. This could well explain why its shares are down 30% YTD.

Overall, this proposal is an excellent idea - the morally bankrupt scourge on society that is Private Equity has been shamelessly abusing the tax system for years, creating convoluted corporate structures, loaded up with debt, in order to eliminate completely (or drastically reduce) UK Corporation Tax liabilities.

Therefore these new proposals should hopefully be creating widespread panic in PE circles, as they see their "tax planning" (i.e. ripping off society by not paying their fair share for public services) on a massive scale, hopefully collapse in ruins. I just hope that the new rules, when brought in, are not diluted through lobbying, and do not contain any fresh loopholes.

I investigated the accounts of Caffe Nero in May 2014, to (try to) get to the bottom of how they managed to avoid paying UK Corporation Tax - basically via a convoluted structure involving Isle of Man & Luxembourg companies, and tons of debt within the group.

One corporate financier commented to me recently that "every potential deal that comes to me now is structured like this" - i.e. using carefully created debt instruments to eliminate tax liabilities, by moving profits to low, or nil tax jurisdictions.

The UK Government's consultation document on this issue is simple to read, and sets out the points very well - here. Unfortunately the deadline for commenting has passed, but it's still worth a read. In particular they summarise the key principle here;

We now have a globally competitive tax system but we expect companies to pay the tax they owe, and to make a fair contribution to restoring stability to the public finances and reducing the deficit.

Overall then, the main target is tax avoidance by PE and similar financial engineers. However, it may also cause problems with highly geared companies such as Enterprise Inns (LON:ETI) mentioned above, and others, e.g. property companies.

When interest rates do eventually rise (when will that be, it seems to be pushed further & further out, as the debt bubble is pumped up more & more?), then more companies are likely to fall foul of the possible 30% rule on tax deductibility of interest payments. Although as the Govt points out, UK companies enjoy a very low corporation tax rate already, plus generous R&D credits, so really nobody can complain too much about interest payments being capped for tax purposes.

Severfield (LON:SFR)

Share price: 60p (up 3.4% today)

No. shares: 297.5m

Market cap: £ 178.5m

Trading update - this looks fine, the company is trading in line with expectations;

The Group's trading performance and financial position for the year continue to be in line with management expectations.

Its year end is 31 Mar 2016, so it looks as if the numbers are probably now in the bag for this year.

Valuation - broker consensus is 3.4p EPS this year, putting the shares on a PER of 17.6, which doesn't look a particular bargain.

A 31% increase in EPS to 4.47p is forecast for next year, although given economic uncertainty, personally I'm now very wary of relying on forecasts that predict strong growth in earnings, as it may not happen. In a slowing economy, broker forecasts tend to be too optimistic.

Outlook - having said that, the outlook comments, and increased order book at Severfield do seem to support higher forecast earnings next year;

The UK business continues its good progress in a relatively stable environment and the current order book will enable continued growth in both revenue and margins. The Indian business remains steady despite a mixed economic backdrop. Overall, the group is on track to meet management expectations for the year.

UK-specific outlook comments overall sound positive, although note the caution re timescales slipping;

The UK order book of £246m (1 November 2015: £185m) reflects some significant recent contract awards from our pipeline of opportunities. Operating margin improvement is also continuing in line with management expectations, primarily from the internal efficiency benefits arising from the Group's operational improvement programme.

The market continues to present a good level of opportunities although as indicated in November's interim results, slippage in potential timescales still remains a risk as clients scrutinise forecast overall project costs with caution.

Balance sheet - this was repaired a few years ago, in a refinancing, following several years of losses & problem contracts.

Looking at the last reported balance sheet as at 30 Sep 2015, it looks alright to me. It passes my simple three tests;

1. Positive NTAV? PASS. NTAV is £83.2m, mainly fixed assets, as you would expect for this type of business, being quite capital intensive. I've checked the last Annual Report, and note that the group owned £66.0m in freehold property, so that's a hugely positive factor.

2. Current ratio over 1.2? - PASS. This was 1.32 at the last balance sheet date of 30 Sep 2015. In any case, I would be flexible on this, given the strength provided by freehold property noted above.

3. Net debt + pension deficit reasonable? PASS. There only seems to be £0.7m of interest-bearing debt (finance leases), and no bank debt at 30 Sep 2015, so absolutely fine. Note there is a £14.5m pension deficit, which does not look particularly onerous, although I would check the detail in the Annual Report before buying any shares, just to be on the safe side (that it's not an iceberg type deficit).

Overall then, I'm very happy with the balance sheet.

Dividends - not very good, it's only forecast to pay 1.0p this year, and 1.5p next year, although looking at the history of divis, it looks as if management are still being cautious following the financial difficulties and passing of the dividend a couple of years ago. So it seems to me that there's scope for divis to increase strongly over the next couple of years, especially considering the strong balance sheet now.

My opinion - I quite like it. My main reservation is whether we're getting too late in the cycle to look at investing in companies like this? Sure, it might have another couple of good years ahead of it, but what happens after that? In the next recession, this company is likely to be loss-making, so we need to be careful not to value it too highly on peak earnings.

There's a lot of activity in UK construction & infrastructure at the moment, and the next couple of years look likely to be buoyant too (based on upbeat comments made to me by the CEOs of both Waterman (LON:WTM) and T Clarke (LON:CTO) ). Therefore if the current global macro worries abate, then this share could have reasonable upside possibly?

It's not compelling enough to make me want to buy now, but with a strong balance sheet too (look at the £66m freehold property, with no associated debt - that is 37% of the market cap in owned-outright property), there's very good downside risk protection - this company probably won't need to do another equity fundraising in the next recession.

It's certainly a share which I will add to my watchlist, with a view to possibly buying some on any future plunge in price, maybe?

Trifast (LON:TRI)

Share price: 111.2p (up 1.1% today)

No. shares: 116.7m

Market cap: £129.8m

Trading update - this reads well to me. The key part says;

Overall, we are making good progress against our strategic objectives and we remain optimistic about the Group's prospects. Therefore, we remain confident of meeting our full year expectations for the year ending 31 March 2016.

It's interesting that Trifast sees the UK softening;

Whilst the UK industrial market has shown signs of some softening as we expected when we reported last November, our markets in both mainland Europe and Asia remain strong.

Other points mentioned today;

- Acquisitions are trading well

- "Sales enquiries remain brisk through our TR portal"

- "Our order pipeline remains encouraging"

- "...in negotiations with a number of multi- national OEM customers to extend the plants we service and to widen the product ranges we currently supply"

- "...continue to explore new geographic areas to broaden our reach and search for suitable acquisitions"

Outlook - overall sounds fairly upbeat to me;

Although global sentiment and the Brexit/EU debate might be influencing the current climate, and consequently impinging on economic confidence, from Trifast's own perspective, Group trading has not been unduly affected, however we remain diligent and far from complacent as we look forward.

Overall, we are making good progress against our strategic objectives and we remain optimistic about the Group's prospects. Therefore, we remain confident of meeting our full year expectations for the year ending 31 March 2016.

My opinion - the shares look reasonably-priced, and today's outlook sounds as if the business is pretty solid, and doing alright.

The balance sheet looks alright, with a bit of debt, but not excessive. There's a 2.4% dividend yield, but it's well covered (almost 4 times).

Overall, it gets a tentative thumbs up from me. Looks a good business, at a reasonable valuation. Although as with many things at the moment, macro worries are the main question mark over how we value it.

Hargreaves Services (LON:HSP)

Share price: 198p (down 16.8% today)

No. shares: 31.9m

Market cap: £63.2m

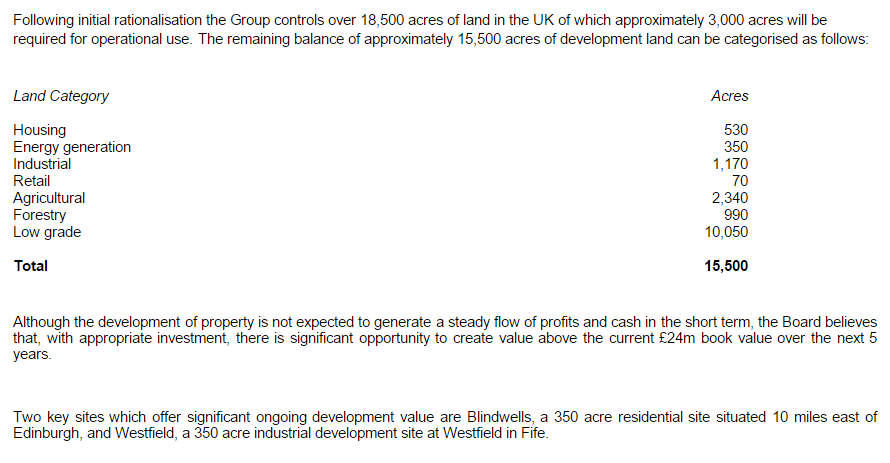

Interim results - this is very much a special situation, as the core business (coal distribution) is effectively in wind-down, as coal is largely being phased out in the UK as a too-dirty source of energy.

Therefore, it's now impossible to value the company on a PER basis - good job too, as profits has collapsed. Continuing revenue dropped 50.2% to £174.8m in the 6 months to 30 Nov 2015. Underlying operating profit dropped 81.3% to £4.1m. So we can largely ignore the legacy coal business, and just hope it doesn't make too large losses in the future.

The shares are now about 3 elements;

1) remaining activities, after coal has largely disappeared

2) value on the (strong) balance sheet as working capital turns into cash

3) property development assets - HSP owns a substantial amount of land, and there is medium to longer term development upside on this;

Set against this, the downside risk is of unexpected losses from closing down its legacy operations, and any other liabilities that might come out of the woodwork - I suppose the nightmare scenario would be some kind of legislation or legal action to slap punitive damages onto Hargreaves, for environmental damage caused by the burning of coal.

My opinion - it's just a question of crunching the numbers, for all the various moving parts. My back of the envelope figures suggest that there might be some quite good (maybe 50-100%?) long term upside on the current valuation.

I've assumed that working capital turns into cash without any major problems, and that intangibles are worthless, and that fixed assets might have a realisable value of half book value. Plus a bit of potential upside from property.

Therefore, it's worth a look, if you're a special situations investor. It doesn't excite me, because there's an opportunity cost with tying up money for (say) 5 years, in the hope of getting an uncertain 50-100% return. I'd rather be recycling money into shares that can make a decent gain much more quickly.

As you can see from the 2 year chart below, people who thought there was hidden value in the shares so far, have not been well rewarded.

Note that management has quite a big stake, so interests are well aligned for them to extract value from the group. So it could be an interesting one long-term, but my instincts tell me to stay away for the time being. I'd want to see a stonking bargain, to justify tying up money for several years, and with material uncertainty over the outcome.

Tracsis (LON:TRCS)

Share price: 465p (down 5.6% today)

No. shares: 27.3m

Market cap: £126.9m

Trading update - covering the 6 months to 31 Jan 2016.

The key part looks good to me;

Given a good start to the financial year, the Board is confident the Group is well placed to deliver full year results in line with market expectations and remains vigilant to changing market conditions.

Perhaps the last five words might have spooked some investors, possibly explaining the 5.6% fall in share price today?

Net cash was £8.0m at 31 Jan 2016, still very healthy, even after acquisitions have been paid for.

A few other points are noted, including that group seasonality has changed, since the recently acquired businesses are highly geared to H2 trading (this will be the outdoor parking marshals business, I presume). I don't think there is anything at all to be concerned about there.

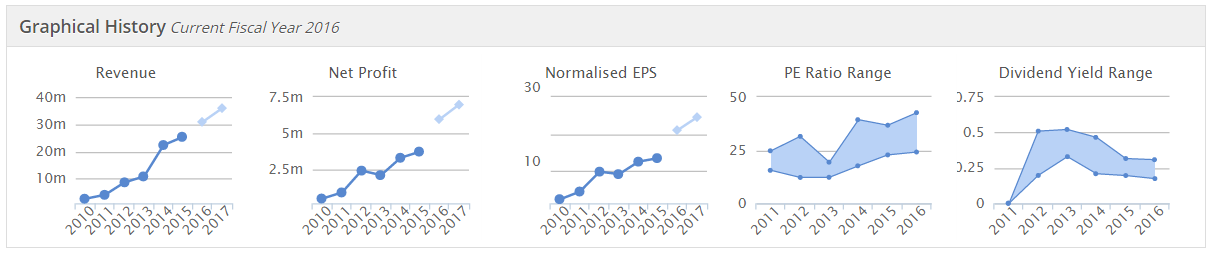

My opinion - Tracsis management has executed faultlessly in recent years, and it's clearly a mostly good quality group of businesses. The market has rewarded that performance with a fairly rich rating.

Overall I'd say the shares look priced about right to me - not cheap, but based on performance to date, and management quality, and the cash pile, the premium valuation seems justified.

EPS forecast is for 21.1p this year, and 24.6p next year, giving a PER of 22.0 and 18.9 respectively. There's no scope for anything to go wrong at that kind of rating mind you. On the other hand, TRCS shares have always looked a bit expensive, but the company has grown into the valuation, with a very nice progression in profits over recent years:

Filtronic (LON:FTC)

Share price: 5.5p (down 6.4% today)

No. shares: 216.9m

Market cap: £11.9m

Interim results to 30 Nov 2015 - these are terrible numbers. Revenue is down 38% to only £4.5m in H1. The operating loss (before exceptionals & amortisation) was £4.1m. To my mind that just is not a viable business. Shareholders very kindly refinanced it with £5.0m fresh cash in Nov 2015, but perhaps it might have been wiser to let it go under?

My opinion - the shares are now just a complete punt on new products/orders, combined with cost cutting, being enough to turn the company around from the hopeless position reported in these interim numbers.

I can't see any reason to take the risk here. It went on my Bargepole List in Mar 2015 at 13.8p per share, and has already lost 60% in value since then. I'd say there's quite a high risk that it will lose the other 40% too, in the coming year.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.