Good morning! A former favourite of mine, Israeli niche software company (for the broadcast industry) Pilat Media Global (LON:PGB) has announced a recommended takeover bid at 95p per share, from an existing major shareholder (22.7%), Sintec Media. As it's recommended, and because of the large shareholders being in agreement, it's a done deal. It's a good deal too, at a 28.8% premium to last night's closing price.

Readers here will be familiar with this share, as I mentioned it a lot last year, and first flagged it up as "remarkably good value" at 37p on 16 Apr 2013. So a nice success to chalk up there, although personally I sold too early, as usual, but was more than happy to bank a gain of almost 100%, and recycle the money into something else (things which have also gone up since, so there is no net loss from selling early, providing you put the money into something good).

There are quite a lot of trading updates today, so it's going to take me until lunch time to plough through them all, so please keep updating this report in your browser throughout the morning - I publish updates about 30-40 minutes apart typically.

Thorntons (LON:THT) has issued its Q2 trading update, covering the crucial Christmas period. It's looks reasonably good, with LFL retail sales up 3.5%, and the important FMCG division growing sales by an impressive 17.1%. The most important measure of course is profitability, and they confirm that,

Our current outlook for the financial year remains in line with market expectations.

Looking at valuation, broker consensus forecast (which they have just confirmed they are in line with) is for 8.0p EPS this year, so at 142p the shares are on a very warm rating of 17.8. When you take into account a very poor Balance Sheet with considerable net debt, and a pension deficit, this rating is even more unfathomable.

Bulls have bought into the turnaround here, which has been impressive - they have cut back the ailing retail estate, and strongly grown FMCG sales - i.e. selling to supermarkets, etc. - but bulls have also apparently ignored the considerable risk from a very weak Balance Sheet, and problem levels of debt. There is no dividend either, although a small dividend is expected to be restored this year.

Clearly I've been wrong about this share, being too cautious, but taking a gung-ho approach towards weak Balance Sheets is not a fashion that I will be joining, even if the market has been rewarding recklessness on that front in the last couple of years. With a less supportive Bank Manager, this business could easily have gone bust, although that risk has receded now. Bear in mind though that profit is only forecast at £5.7m this year, which is not much considering the size of the debt pile & pension deficit, so they're by no means out of the woods in terms of overall financial position. An equity fundraising is needed, to fix the Balance Sheet, and that would be a sensible course of action now that the company is enjoying a buoyant share price.

There's a positive trading update from car dealership Cambria Automobiles (LON:CAMB). I researched this company a few weeks ago, and was impressed - they are acquiring struggling dealerships at attractive prices, and turning them around under an experienced management team. Today the company reports vehicle sales are up in line with the market, at about 12%. It's remarkable how strong UK car sales are at the moment - maybe a bounce back from deferred purchases during the economic downturn perhaps?

There's very little margin in car sales for the dealers, so the profit is really in creating a relationship with the customer, and then bringing the car back for servicing. The key bit of today's trading update says;

The Board expects the interim results for the six months to 28 February 2014 to be significantly ahead of the prior year and views the outlook for the remainder of the financial year with confidence.

Sounds good, so let's have a look at last year's H1 figures and try to deduce how much profit they are likely to make this year. They reported underlying EPS of 1.04p for H1 last year, and 3.57p for the full year (ended 31 Aug 2013). That implies H2 seasonality to their trading year.

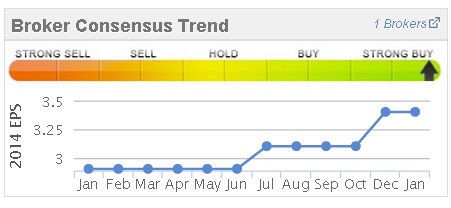

So if H1 is "significantly ahead", and assuming there were no one-off gains in last years figures, and having checked that the number of shares in issue has remained constant (which it has), then that surely implies broker forecast of 3.4p EPS for this year, and 3.65p for next year are too low?

So if H1 is "significantly ahead", and assuming there were no one-off gains in last years figures, and having checked that the number of shares in issue has remained constant (which it has), then that surely implies broker forecast of 3.4p EPS for this year, and 3.65p for next year are too low?

Note from the Stockopedia graphic above left how the trend has been for broker EPS upgrades in the last 12 months, and judging by their trading update, I suspect more upgrades are likely.

I would guess that we're probably looking at over 4p underlying EPS this year (ending 31 Aug 2013), maybe as high as 5p next year? Who knows, I've not seen any detailed figures in the broker notes. It certainly looks interesting anyway. The shares are currently 54p, so the 4-5p EPS range means a PER of between 10.8 to 13.5, which looks fairly good value to me.

The Balance Sheet look pretty solid too. Car dealers tend to have a lot of fixed assets, and a lot of debt. In this case there are fixed assets of £28.9m at the last reported Balance Sheet date of 28 Feb 2013, and of that £25.5m is freehold & long leases, so these are solid, realisable assets, not fixtures & fittings with little resale value. Net debt was only £3.0m at the same date.

Overall then, I think this looks an excellent company - reasonably priced on a forward PER basis, and safe - because it has an excellent Balance Sheet with plenty of assets, and little net debt. The shares have had a terrific run, and the price is probably getting towards fair value in the short term, but I'm considering a small purchase for my long term buy & hold portfolio, as I suspect this share could do well over the next few years of the economic growth cycle. What I particularly like is that the management are clearly shrewd, experienced, and ambitious, but are building up the business on a soundly financed Balance Sheet. When those points come together, you usually see a good long term investment in the making.

The biggest faller of the day is specialist retailer Games Workshop (LON:GAW), which is down 24% to 550p on publication of its interim results to 1 Dec 2013. I last reported on this company on their IMS on 18 Apr 2013, concluding that there was little (if any) upside on the then share price (667p).

Their last trading update on 18 Sep 2013 said that Q1 (3m to 1 Sep 2013) was "broadly in line", which of course means slightly below. So today's interim results showing profit a lot below last year, is a bit of a bolt from the blue, hence why the shares have fallen heavily this morning.

The key half year figures look like this:

- Turnover down 10.4% to £60.5m

- Pre-tax profit down 30.6% to £7.7m

- Basic EPS down 30.9% to 17.7p

- Dividend - cancelled (was 18p last year)

- Net cash £9.3m (£15.6m last year)

The reasons given for this poor performance are;

- A continuation of the trend that developed in H2 of 2012/13

- Disruption caused by rapid transition to one-man shops & reduced trading hours.

- Decline in sales through independent stockists.

They then go on to say that these are "short term issues, and expect to see growth return in both channels". However, to my mind points 1 and 3 above are rather concerning, and perhaps point to a structural decline in their markets? (inappropriate comment removed, due to a bunch to Twitter people getting upset by it in May 2017 - over 3 years after this report was published).

So if you think that these issues are short-term, and will be sorted from the "materially lower cost base" that the company is now putting in place, then this could present a buying opportunity?

The Balance Sheet is excellent, with no debt at all, and cash of £9.3m. Current assets are a very healthy 213% of current liabilities, and long-term liabilities are negligible. It has a good track record of profitability in recent years, so has really blotted its copy book with these interims. The immediate outlook doesn't sound great, with the key outlook sentence saying;

Whilst profit will remain under pressure during the implementation of the structural changes mentioned above, the board remains confident in the future growth and profitability of the Group.

Current broker consensus of 49.8p will clearly have to come down quite a bit - I'm guessing that 35-40p is likely to be revised forecast for this year. Personally I wouldn't want to pay more than about 10 times those earnings so am thinking of the 350-400p level as being where I would start to get interested. So at 550p the shares are still too high, in my opinion, especially as the interim dividend has been passed. I'm surprised to see no comment in the narrative or the notes about dividends - surely they should have given some explanation & guidance when passing the dividend?

Overall I think it's best to let the dust settle here, and see what price the shares settle at. I don't see value here just yet.

My Charity Fundraising for Spring 2014

As with many people, new year is my de-tox and get fit interlude, so am limbering up for my next Half Marathon, on Feb 16th. I'm fundraising mainly (75%) for MacMillan cancer support this time, an absolutely wonderful charity I'm sure you agree, and also 25% for a local charity, Sussex Beacon.

Also, I've made this a double challenge, by combining this charity run with abstinance from alcohol for not one, but three months! So far so good, it's been a dry, and boring January to date! So if you would like to sponsor me for charity, my latest fundraising page is here. I appreciate that you were very generous for my last Half Marathon in October, so don't feel obliged to donate again, only if you wish to - or look on it as a fee to ensure Thu morning reports are on time for three months!!

Stanley Gibbons (LON:SGI) issues an in line with expectations trading update today, for the year to 31 Dec 2013. I've never understood why rare stamps are coveted so much, especially in this day and age. They made a decent-sized (£45.3m) acquisition of Noble Investments in Nov 2013, funded by a Placing of £40m, so the increased number of shares in issue will cause dilution, and hence distort EPS comparisons.

The outlook sounds good;

Trading remains strong with high levels of demand both from investors and high net worth collectors looking to secure premium quality collectibles.

The Board looks forward to delivering further growth in 2014 as the business begins to realise the returns from the substantial investments made in recent years.

You would imagine an economic recovery, and buoyant asset prices will be good for such a group.

EPS forecasts for 2014 are 20.4p, so at 360p per share the rating is currently a PER of 17.6, which strikes me as fully priced, so it doesn't interest me.

Value ladieswear chain Bonmarche Holdings (LON:BON) was recently Floated at 200p, and looked fully valued to me on this historic figures. However, like most IPOs, it's gone to a big premium, and is now almost 280p. They report strong Xmas sales today, with store LFL sales up 4.7% for the 13 weeks to 28 Dec 2013, including a very good 6.0% growth in the busiest 5 weeks to 28 Dec 2013. Online growth is a remarkable +60.6%, although I suspect that might be from quite a low base?

I can't find any broker forecasts, so it's impossible to value at the moment, although as mentioned before, it's now looking very expensive on the historic numbers, so is not of any interest to me. That said, retailers do benefit from operational gearing when sales rise, so their next set of figures should look good, hopefully good enough to justify the high valuation.

Historically, a lot of IPOs do well in a bull market for a while, but it can subsequently become apparent that the valuation is too high, once the novelty and the bull trend has worn off. It's a great market for short term traders though - buy IPOs, and then bank the profits after a few days or weeks. It won't carry on forever though, but rich pickings have been had so far.

There's a positive trading update from Tribal (LON:TRB) today. After a strong Q4 they say that adjusted PBT and EPS for calendar 2013 will be better then previous expectations. Net debt has reduced from £9.9m at the start of 2013, to £4.6m at the end.

Their order book is down 23% to £129m, although they say this reflects the maturity of the Ofsted inspection contracts. Their shares are up 7.5% to 206p, which looks to be a PER in the upper middle teens, so probably priced about right. The dividend yield is under 1%, so it doesn't look terribly attractive to me.

That's enough number-crunching for me now, time for lunch.

See you tomorrow as usual, from 8 am.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.