Good morning! A reminder that it's Mello Beckenham tonight, with some places still available, David tells me. The theme tonight is high yield investments, with various briefings from people familiar with particular niches, e.g. P2P, high yield bonds, shares, etc. More details & booking info here.

Premaitha Health (LON:NIPT)

Patent infringement proceedings - not a company that I'm familiar with - it seems to be a blue sky drug development company. The shares are down 34% today on a worrying announcement about proceedings being issued against the company for alleged patent infringement. I don't like the sound of this, so will be steering even more clear than I normally would for blue sky. My biggest losses are always on the blue sky stocks, and it's better to just avoid them altogether, in my view. The failure rate is absurdly high.

AO World (LON:AO.)

Share price: 180p

No. shares: 421.1m

Market Cap: £758.0m

Director sale - there are two announcements from electrical goods etailer AO World this morning, one being a standard form to disclose that the Chairman, Richard Rose, last week sold 5,583,475 shares in the company at 180p each, banking a whisker over £10m. Lucky him!

However, the company has, in my opinion, made a mistake in issuing a second announcement where they try to put a positive spin on something that is quite obviously very negative, saying;

He only has 723,443 shares left, so the truth is that he sold 88.5% of the shares he held! Doing so after the shares had already dropped a lot, is clearly sending a signal that he thinks there are better places for his money. Trying to put a positive spin on that is ridiculous, and in my view has backfired.

My opinion - I currently have no position in this share, but am considering whether to open a new short on this one, having recently closed my existing short after the big recent plunge. In my view this stock remains significantly over-valued. It's a very low margin box-shifting operation, via a website. There is loads of competition. So why the premium valuation?

Whilst CEO John Roberts is an utterly brilliant PR man, and spins a wonderful story about great customer service, etc., the reality is that applying great customer service (which is expensive) to the sale of very low margin generic products, is a recipe for being extremely busy, but not really making any significant profit!

It looks to me as if another lurch down is on the cards, but you can't be sure of these things - the market is still valuing a lot of web-based businesses in a bizarrely optimistic way at the moment.

Cenkos Securities (LON:CNKS)

Press speculation - quite an interesting announcement today from this broker & corporate financier. It sounds as if they might win a large fundraising mandate from a client, which if successful could lead to out-performing forecasts for 2015. That's how it reads to me anyway - let me know in the comments if I've got the wrong end of the stick! So the key things would be to find out (a) how likely this deal is to happen, and (b) what size the fees for Cenkos would be?

This share looks good value, and is worth a look. Although you do have to be careful that results are very lumpy - they make a lot of money in the good times, as do the staff in bonuses, then revenues can dry up in the bad times.

It has a StockRank of 94, so the Stockopedia computers like it too!

Note that 2014 results were particularly good due to the Cenkos handling the flotation of the AA, and earning bumper fees from that deal.

Brady (LON:BRY)

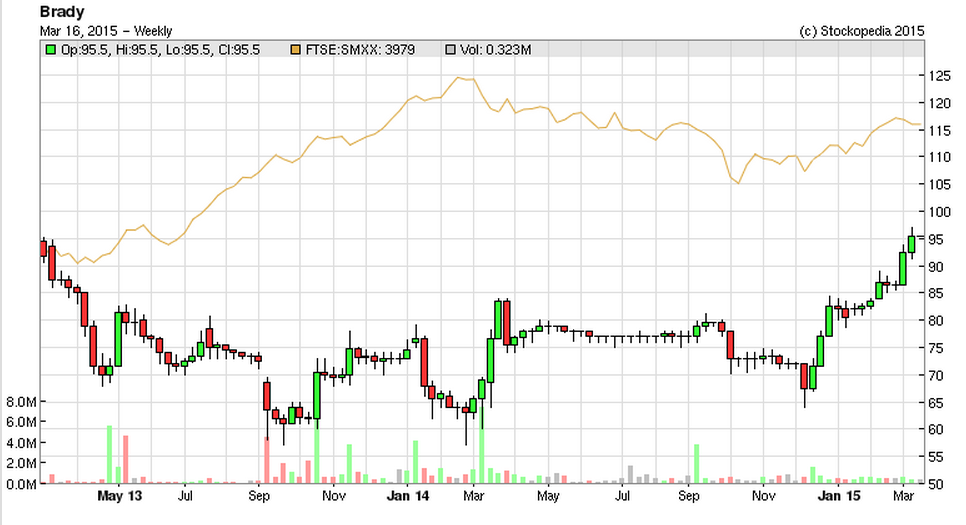

Share price: 95.5p

No. shares: 81.7m

Market Cap: £78.0m

Preliminary results - for calendar 2014. These are the not the easiest figures to interpret, with various performance measures given - EBITDA, statutory profit, adjusted profit, etc. Then each of those has to be considered before & after exceptional items. Then we have to take a view on whether the exceptional and adjusting items really are exceptional, etc. None of which fills me with confidence.

I find the cashflow statement often is the best source of reliable info with software companies, and in this case it looks as if Brady does generate reasonably good cashflow. That is backed up with a sensible dividend too.

Turnover rose 5.7% against prior year, to £31.0m, of which about half is described as recurring. Adjusted EPS rose considerably, from 2.78p in 2013, to 5.31p in 2014. Although note that the share price is 95.5p, so the PER is 18 times, a fairly full valuation for a company showing little growth, I suggest.

Balance sheet - this looks alright. Net assets of £34.4m drops down to a NTAV of only £3.4m, when I deduct goodwill, and other intangible assets. As with many software companies, Brady benefits from charging customers in advance, so it had a useful cash pile of £9.6m at 31 Dec 2014, with no debt. Note there is however a small pension deficit of £1.9m.

Dividends - Brady has a good track record since 2009, with a compound increase of 7.2% in the annual divi. The forecast yield is fairly modest at 2.0%.

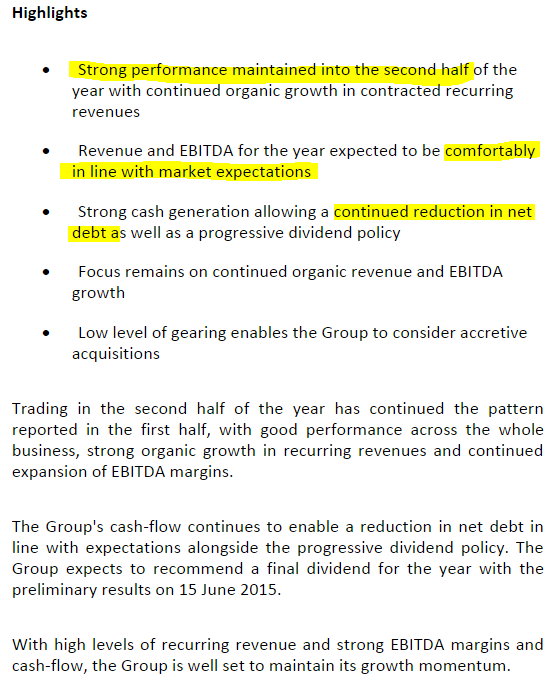

Outlook - the Directorspeak sounds pretty solid;

My opinion - I don't have a strong view either way on this company. It looks a good quality company, and was twitching away on my radar when it dropped to the 70p area. However, now they've had a good run up to 95p, they look fully valued for the time being perhaps? It depends how well growth continues.

I note that the improvement in performance in 2014 seems to have been driven by increased licensing revenues. The trouble is, that may not be repeatable. Personally I prefer software companies to move to a SaaS model, and have all their fixed costs covered by recurring revenues. Brady doesn't seem to be quite there yet, so results could continue to be volatile perhaps?

Tribal (LON:TRB)

Final results for 2014 don't look very interesting. Turnover & profit are down a bit on 2013, and adjusted EPS seems to have come in slightly below broker consensus, at 11.3p. So at 175p the rating looks a little warm, at a PER of 15.5.

The balance sheet is weak - with net tangible asset value (NTAV) negative, at -£46.4m. The current ratio is very weak, at 0.59. I was starting to think this looks bad, but note 14 shows very healthy cash generation, of £19.7m (net cash from operating activities), with a similar figure of £18.6m in 2013. Although of that, £5.2m was development spend that was capitalised.

Given the cash generative nature of the business, then the weak balance sheet is probably alright, providing nothing goes wrong with trading. On balance though, it's not for me.

Redcentric (LON:RCN)

Share price: 143.75p

No. shares: 144.7m

Market Cap: £208.0m

Trading update - this all sounds pretty positive;

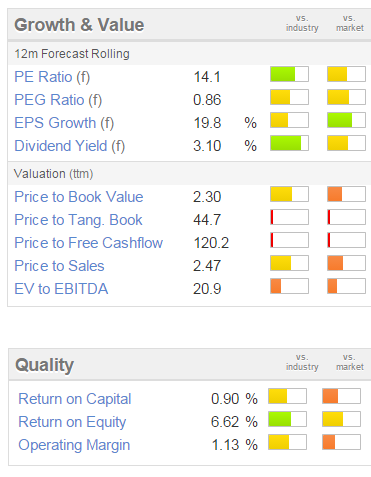

Valuation - it looks priced about right, judging from the usual Stockopedia graphics;

That's it for today. See you in the morning.

Regards, Paul.

(of the companies mentioned today. Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.