Good morning! UK Investor Show tomorrow, so I'm starting to get into a flap about what to say in the two sessions that I've been asked to speak at. So will have to do some more preparation this afternoon.

As an aside, a friend sent me a book called "The little book of behavioural investing", by James Montier. If you haven't read it, you should! It's full of insights about the psychology of investing, and the subtitle is "How not to be your own worst enemy". Also, it's an easy & entertaining read, so is highly recommended.

I've just come off the phone with David Stredder, who ran through the companies which are attending his latest "Mello Workshop" event, being held in Peterborough next week, on Thu & Fri, 23-24 April 2015. Tickets are almost sold out. David's events are unique, in that they are organised by an experienced & successful investor, for investors, rather than having a commercial focus.

The list of workshops is fantastic. I know a lot of the speakers, who are experienced & successful investors in mine & David's network, rather than salesmen trying to sell you something. So I am certain this event, which is concentrated on investor education, will be a great success.

Stadium (LON:SDM)

Share price: 121.5p

No. shares: 31.1m

Market Cap: £37.8m

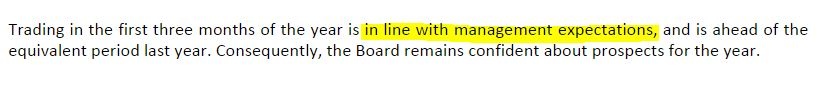

Trading update - this is reassuring;

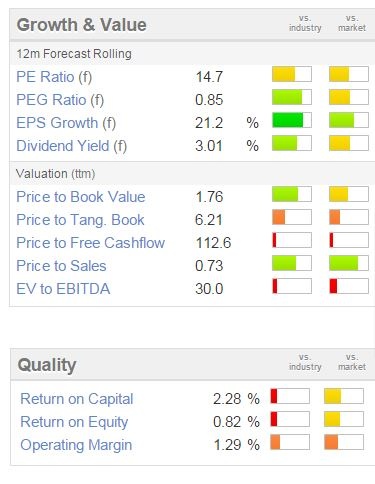

Valuation - broker consensus is for 9.3p EPS this year, so that puts the shares on a PER of 13.1 times this year's forecast earnings, which sounds about right.

I flagged up this share as looking on a "very reasonable" valuation here on 8 Jul 2014, when the shares were only 67p, so they've nearly doubled since then. However, I also flagged the problem of this company's pension deficit, so that's something to watch out for when you're doing the research on this company.

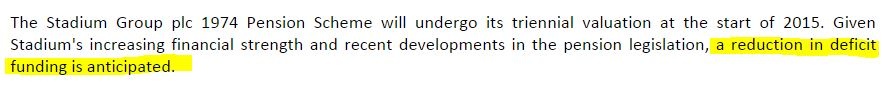

A big pension deficit tends to use up cash that could otherwise pay divis, and that looks like the case here, where the forecast divi yield is only 2.2%. Last time I checked, Stadium's pension deficit required annual cash deficit recovery payments from the company of £866k, which is about a quarter of its forecast profits for this year, so it's quite a big issue.

Although this comment from the most recent results announcement is encouraging on this issue;

My opinion - taking everything into account, I'd say it looks fully valued for now, but it's been a good performer in the last year, so well done to anyone who has held over that period.

There was a funny blip down in Mar 2015, which seems to have coincided with the last results statement, so maybe someone panicked over something? I can't see why, as looking through the 2014 results, they look good to me.

My only reservation is that the balance sheet is somewhat weak now - net assets of £10.2m becomes negative £3.2m once goodwill and other intangibles are deducted. That's the problem when you grow through acquisition, funded by debt.

Whilst there was a nice £6.2m year end cash position, which offset most of the gross debt of £10.3m, I find it safest to assume that the year end cash balance for most companies is optimised, and probably not typical of an average cash balance throughout the year. On that assumption, the overall debt position here looks a tad stretched to me.

Acal (LON:ACL)

Share price: 271p

No. shares: 63.0m

Market Cap: £170.7m

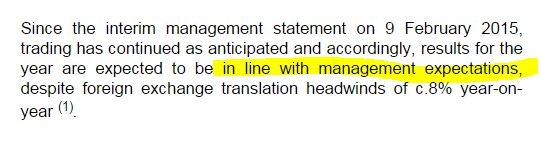

Trading update - for the year ended 31 Mar 2015. This is a very clear, well written update, in my opinion. The key part says;

Additional detail is given - sales for the year were up 28% on a reported basis, and 36% at constant exchange rates, so a very large currency impact there. However, the growth almost all came from acquisitions - organic growth was only 3%. H2 sales growth was stronger than H1, so an improving trend within the year.

Outlook - nothing on this really, other than a bland statement saying "we remain focussed on delivering further organic growth and value enhancing acquisitions".

The EPS growth looks good, but that's coming mainly from acquisitions, so it shouldn't really be priced as a growth company, in my opinion.

Balance Sheet - the last reported one, dated 30 Sep 2014 looks OK. Although note there is a small pension deficit of £7.0m, and gross debt is quite considerable, at £30.2m, although more than half offset by cash of £16.2m on the balance sheet date (but not necessarily for the rest of the year!)

My opinion - I don't see value here at all, if anything the valuation looks a bit toppy to me. There again, perhaps bulls like the prospects for the company - after all, the share price is all about the future, not the past.

I think a key issue to consider is how much business is likely to be affected by the big exchange rate movements lately - depending on where Acal does business, will it be hurt by the Euro's devaluation, or benefit from it? Are they able to increase profit margins, which are very thin at the moment? If so, there could be potential upside there maybe?

I can't see enough upside to make me want to dig any deeper unfortunately.

Other than that, I can't see anything else of interest today.

See some of you tomorrow at the Investor Show.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.