Good morning!

Edit: This report is now covering Idox (LON:IDOX), Mincon (LON:MCON) and Allied Minds (LON:ALM).

Best regards,

Graham

Idox (LON:IDOX)

- Share price: 62.375p

- No. of shares: 405.2 million

- Market cap: £253 million

IDOX provides software & related services, mostly to the public sector. I covered it last in December (link).

There hasn't been any share price progress so far this year, and the dividend yield is slim, but it has been a successful holding for long-term investors.

It's attempting to grow organically and via acquisitions. The last IDOX acquisition I covered seemed to be at an aggressive valuation (EV/EBITDA 35x), which brings us to today's.

It's a £5 million deal for "a supplier of electoral back office software and services to UK local authorities".

IDOX already has an elections business unit, so this sounds like a good fit.

The valuation is also far more modest than last time: 4.5x EBITDA on a debt-free and cash-free basis, with senior management staying on for at least two years.

My opinion

I'm getting more comfortable with IDOX as a potential investment.

Public sector clients can be sticky with their software systems - there is a lot of hassle, risk and uncertainty to change, so they can stick around for many more years than might otherwise have been expected.

There does seem to be a good rationale for putting all these public sector services in the same group. At a group level, IDOX should have a very strong understanding of its clients and of each particular service type (e.g. electoral services).

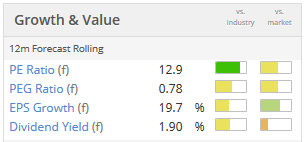

All the metrics are fairly average at the moment but let's keep it on the watchlist:

Mincon (LON:MCON)

- Share price: 98p (+9%)

- No. of shares: 210.5 million

- Market cap: £206 million (€226 million)

I commended this producer of hard rock drilling tools for playing down its success in Q1.

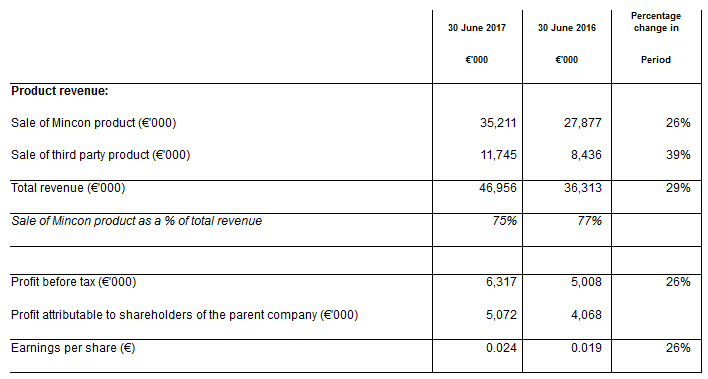

But now the half-year report is out, and the success has continued:

It's an Irish company, hence the €uro reporting style.

Even better, the above performance was achieved with a currency headwind (i.e. it was artificially depressed):

The underlying momentum is greater than this, since we had to absorb an FX charge of €0.5 million as the rand and dollar weakened. We will continue to seek longer term solutions that mitigate these movements.

Mincon also reminds us that its growth is "very substantially" organic.

It's refreshing to see growth that isn't manufactured by large acquisitions, and to see results which aren't complicated by reams of adjusted items.

Prospects for the next phase appear strong:

We have three very substantial projects moving into their sales and marketing phases, with the extended range of large hammers and bits, the new hammer range, and the rapid build-up of our Mincon Nordic subsidiary.

We have driven good growth in our current product ranges, and we have the new products, the new factories and the investment of the last couple of years to come on stream. We have a very strong balance sheet, adequate cash resources and an ambitious, experienced team in a sector that continues to improve.

Industries served by Mincon include many different types of drilling: foundations, exploration, mining, quarrying, etc.

The company has net cash of €32 million and no balance sheet concerns, and talks about the need to drive improvements in its return on capital employed. Stockopedia stats suggest that it has only been earning around 9% ROC.

The outlook statement is again calming:

We had sales of c. €40 million in H2 last year, and while the growth in this reported half year has been strong, we will need to keep growing to add significantly to that run rate. Having said that we have three good investment projects coming to fruition in the remainder of 2017 and 2018 and believe a reasonable strike rate will deliver meaningful growth and profitability from these for the Group.

My opinion

The only detractor for me is the weak return on capital/ return on equity rates.

I'm not sure what can be done about that though, besides perhaps stretching its balance sheet a bit via special dividends and/or borrowings.

The organic growth is excellent, however, as is the clean reporting style.

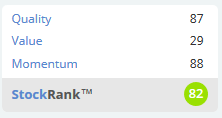

So I'm glad to see it has a strong StockRank too:

Allied Minds (LON:ALM)

- Share price: 160.9p (unch.)

- No. of shares: 237.5 million

- Market cap: £382 million ($492 million)

I've been bearish on this Boston-headquartered venture capital outfit since before it fell within our remit at the SCVR. The share price has been as high as 700p (£1.5 billion market cap!)

Its subsidiaries are very much in the early-stage category, typically developing intellectual property at spin-offs from American universities.

It has never made any money. The premise has been that the profits would eventually flow, as successful subsidiaries progressed toward commercialisation.

The rate of cash burn and losses has always looked unsustainable to me, and cannot continue for all that much longer without fresh financing:

- Net cash and investments* at 30 June 2017: $177.0 million (FY16: $226.1m), of which $113.3 million held at parent level (FY16: $136.7m)

- Revenue: $2.0 million (HY16: $1.3m)

- Loss for the period: $58.2 million (HY16: $52.2m), of which $44.6 million attributable to Allied Minds (HY16: $41.2m)

Seven subsidiaries were closed during the period.

ALM produces for investors a number which is its own best estimate of the value of its stakes in the companies it has invested in. They call this the Group Subsidiary Ownership Adjusted Value (GSOAV).

GSOAV was previously at $536 million. It was easy to call it as a short when the company's own subjective estimates of what its investments were worth, plus its cash pile, added up to something much less than the market cap.

With those seven subsidiaries having been written down to zero, the GSOAV is now $416 million.

We can then add on the $113 million in parent-level cash to get an estimate of group value: $526 million.

The actual market cap is about $490 million. It's reassuring that investors are no longer applying a premium to the company's own estimate of what it's worth!

Meanwhile, annualised losses in the region of $80 - $100 million continue to pile up. Accumulated losses are now $330 million.

One or two of the subsidiaries sound promising and its deep-pocketed investors are likely to continue funding it, but it's still extraordinarily speculative. One to avoid, in my view.

That's all for today. Let's hope Paul sends us a postcard.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.