Good morning!

As I'm sure most of us have, I've been following the crisis in Russia with great interest. It looks as if a full-blown currency crisis is now happening, with the Ruble crashing against other currencies, despite a huge hike in interest rates to 17%. Surely capital controls are now inevitable, to stop bank runs & capital flight?

It's unpleasant for the Russian people, but I can't help feeling a degree of schadenfreude towards Putin - who overplayed his hand, and has lost. Mind you, it does mean there's a much higher risk of some military crisis occurring - after all, when backed into a corner, Soviet-era dictators can be unpredictable - what better way to drive up the price of oil again, than to trigger some sort of military action in an oil-producing area? Or he could turn off the gas supplies to Europe, and then demand negotiations/help?

So these could be dangerous times. I'm looking at oil services companies, and like the look of some of them at these depressed levels. Plexus Holdings (LON:POS) and Pressure Technologies (LON:PRES) are on my do-more-research list over Xmas, both being companies that I have previously liked, but got too expensive. Now they look more sensibly priced again. Although who knows what the impact on earnings will be, from this much lower oil price?

Xaar (LON:XAR)

Share price: 299p (up 13% today)

No. shares: 76.5m

Market Cap: £228.7m

This was one of my worst stock ideas for 2014. I jumped in too early, only to be clobbered by two more profit warnings. With Chinese demand for its tile printheads in sharp decline, I did wonder if it had another profit warning in it.

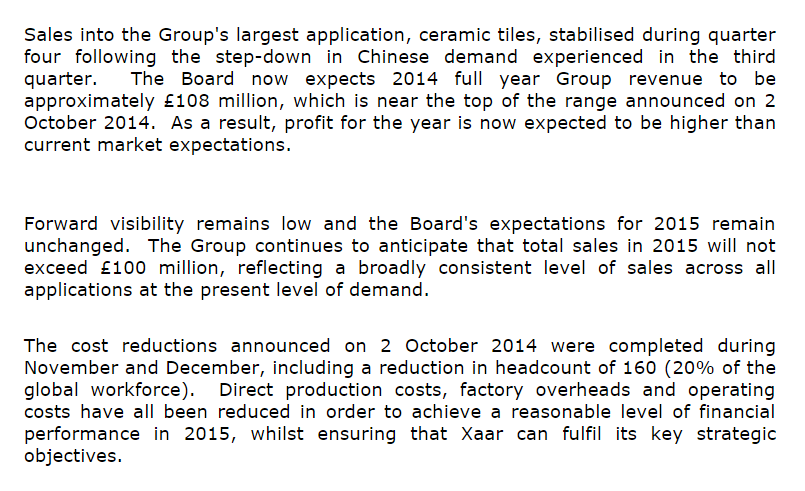

However, the trading update today is a little better than feared. So it seems that things are stabilising at any rate. Here are the main points (I am having to copy them here as pictures at the moment, as the software is playing up, and won't let me copy paste the text & highlight bits, as I used to);

My opinion - having got this one badly wrong in 2014, I'm reluctant to revisit it. However, the new printheads for printing onto any shape (e.g. glass bottles) being launched in 2015 look potentially very exciting. So it's a share I'll be watching closely in 2015 for signs of new sectors adopting the company's next generation print heads. The heavy reliance on Chinese ceramic tile printers makes these shares high risk - very vulnerable to a further slowdown in the Chinese economy.

NWF (LON:NWF)

Share price: 124p

No. shares: 48.3m

Market Cap: £59.9m

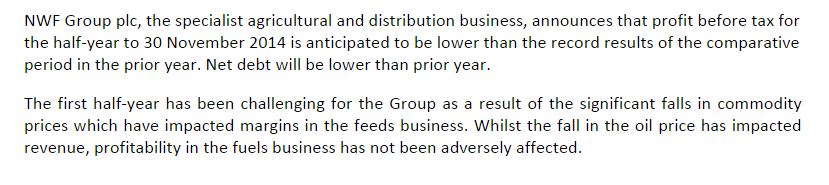

Trading update - there's a mild profit warning today from this agricultural products distributor.

More detail is also given on individual division performance.

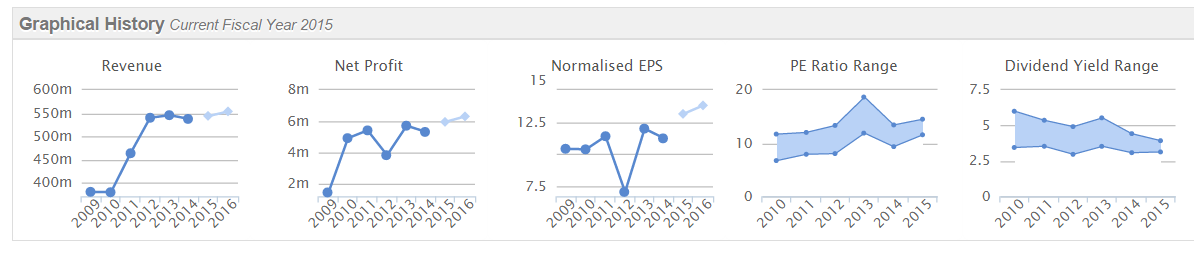

As you can see from the Stockopedia graphical history, it looks to be a mature business, which ekes out a tiny (c.1%) profit margin;

Checking back my previous notes, it does have a pension deficit, which would need checking.

Dividends are reasonable - the forecast yield is about 4.2%, and I note that the company has been a steady divi payer, with it typically rising about 5% p.a..

Valuation - broker consensus is currently for 13.2p EPS this year (ending 31 May 2015). Today's statement makes no mention of performance versus expectations, but since H1 profit is now expected to be below last year's H1, then I assume full year EPS might be likely to come in nearer to the 11.2p achieved last year? Maybe a bit less even?

My opinion - this looks like a boring, ex-growth business which makes wafer-thin profit margins. The PER is probably somewhere around 11-12 current year's earnings. That doesn't strike me as a bargain, especially when you take into account the net debt, and the pension deficit. I would say a PER of 6-8 would be a more sensible valuation, which steers me towards a share price of about half to three quarters of where it is currently.

Tribal (LON:TRB)

Share price: 145p

No. shares: 94.8m

Market Cap: £137.5m

Apparently I've been describing this company incorrectly in the past. I am told that it's mainly a software company, in the educational sector.

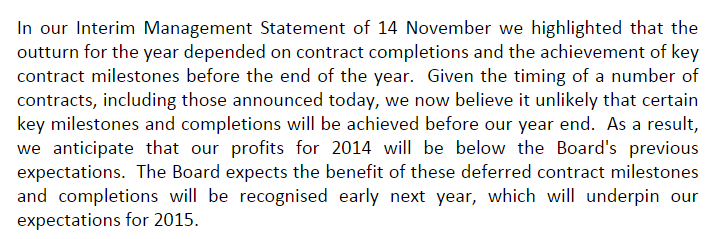

Profit warning - the company blames not being able to close contracts in time for the year end for a profit shortfall this (calendar) year, but annoyingly doesn't quantify how bad a miss it actually is;

So we're having to guess how bad the profit miss is. A miss is a miss, so I don't particularly buy all this timing of contracts stuff, that's what companies always say when they've had a disappointing year.

Interestingly enough, in my report here on 2 Jun 2014 I specifically warned readers that it looked like Tribal was at high risk of an H2 profit warning, and here it is today! The telltale sign is always that contract deferrals are expected to be recouped in H2, after a soft H1, but very often that doesn't happen.

Valuation - broker consensus was for 13.2p EPS this year, so finger in air, I would guess that they might deliver similar to 2012 & 2013, which was 11.7p EPS each year. So at 145p per share currently that puts it on a PER of about 12.4, which looks about right to me.

Given that the company has struggled a bit in 2014, I wouldn't personally place any reliance on things getting better in 2015, delayed contracts or not.

Dividends - are very small, at only about a 1% yield, so that puts me off.

Contract wins - announced today look like window-dressing to soften the blow of the profit warning, if I'm being cynical. The "significant" Australian contract win is A$19m over 5 years. So that's £9.5m over 5 years, or just under £2m p.a. That doesn't sound material to me, in the context of group turnover of about £132m p.a.. Maybe there is a larger profit element recognised up-front, for licences or similar, I don't know.

My opinion - it doesn't look particularly cheap really. I would start to get interested at about 100p per share, but with soft trading news, and a declining trend in the share price, and a poor dividend, I can't see anything to get excited about.

Tribal has a dreadful Balance Sheet too, with heavily negative net tangible assets. So overall, it's not for me.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.