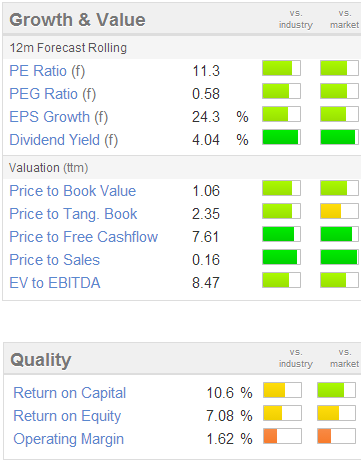

Good morning! It's been a good year generally for shares in recruitment groups, as they have re-rated due to recovering economies in the UK and US. Hydrogen (LON:HYDG) has been on my watchlist for almost a year now, and looks reasonably good value on the Stockopedia traffic light graphics (see below), with a forward PER of 11.3, and an attractive dividend yield of just over 4%.

So let's have a look at Hydrogen's trading update this morning for the year ending 31 Dec 2013. It's a mild profit warning. The reasons given include the cost of an additional 10% sales headcount, foreign exchange losses from the recent strength of sterling, and fee income "marginally lower than projected" in Nov & Dec.

So let's have a look at Hydrogen's trading update this morning for the year ending 31 Dec 2013. It's a mild profit warning. The reasons given include the cost of an additional 10% sales headcount, foreign exchange losses from the recent strength of sterling, and fee income "marginally lower than projected" in Nov & Dec.

Helpfully, they quantify the profit shortfall (always a good idea, as the market hates uncertainty), expecting H2 profit before tax to be £0.3m lower than H1. So looking back at the H1 results, they made £1.3m profit before tax, so that implies a full year result of £2.3m.

Basic EPS was 4.26p in H1 (H1 2012: 6.13p), so adjusting that by 1.0/1.3 gives us about 3.3p EPS in H2, or just under 7.6p for the full year. That's about 10% below the broker consensus of 8.42p shown on Stockopedia, so it's a moderate profit miss, not really anything to get terribly excited about. It's likely to take about 10-15% off the share price today, I would imagine.

The outlook statement sounds upbeat for 2014, but seems to contradict the rest of the statement, saying;

Activity levels across the Group in the lead-up to the year-end remain strong. The Board remains confident in its strategy to grow the business, and believes that the investments made in 2013 leave it well placed to benefit from market opportunities in 2014.

I don't quite understand how they can say that activity levels remain strong, when they have just reported softer than expected Nov & Dec trading? Surely those statements are contradictory?

The UK economy is already recovering, so really Hydrogen should really be reporting profits rising, not falling, so that puts me off somewhat. It perhaps suggests that they might be struggling with competitive pressures. After all, there is little to separate one employment agency from another. In my experience as a client, it tends to all be down to personal relationships with individual recruitment consultants - you keep using the consultant that does the best job for you as a client. And you stop taking the calls from recruitment consultants that just fire random people and CVs at you. It takes time to build those relationships, so I'd want to be investing in a recruiter that is already showing decent growth, not one that is promising better things for 2014 whilst struggling in 2013.

Checking back in the archive here, I last reported on Elektron Technology (LON:EKT) on 27 Jun, and concluded that, "this one needs to be approached with caution I think". The shares were 14p then, and they've since halved to about 6.5p, so it was a good move to steer clear.

There have been problems with restructuring, and some comments from their trading update on 1 Feb 2013 have stuck in my mind, particularly these bits (which sound extremely worrying to me);

Following the foundation of its Technology Centre in Cambridge in mid 2011, Elektron has made its first significant new product launches for many years. This development is much needed, as the Group's legacy product portfolio is mature in its life cycle, naturally leading to a reduction in demand for some products. In Connectivity, for example, over 75% of the core range is now more than 30 years old and the portfolio in Instrumentation, Monitoring and Control is also in need of renewal.

So really the shares seem to be just a punt on them being able to come up with new products, and move back into profit. That doesn't strike me as an attractive proposition at all, unless you have got under the bonnet properly, and concluded that a turnaround will happen.

Today's statement covers Q3, and says that trading has improved, with them moving into an (unspecified) operating profit in Q3 before exceptionals. However, it was still loss-making in Q3 after non-recurring and finance costs.

They also report that net debt will be higher at the year end than at the interim period end, when it was £5.8m, so that's a very concerning position to be in - i.e. the Bank will be calling the shots, and may be supportive for now, but it's far too high risk a situation for me to consider investing here. There seems little upside, and a lot of risk, precisely the opposite of what I look for, so it's not for me. However I wish the company well with its turnaround plan. There must be a high risk of an equity fundraising being needed to prop things up? That could get messy if there is limited appetite from investors, so why take the risk?

Looking at the biggest movers of the day, there's a 36% fall to 6.75p in the shares of Nasstar (LON:NASA), which seems to have been caused partly by poor results for the six months to 30 Sep 2013, but probably more by a large Placing at 5p per share, in order to fund the reverse takeover of Denara Holdings Ltd (i.e. a smaller company buying a larger company).

I can't see a viable business in the results announced today from Nasstar, but the company they are acquiring is profitable, so I'll take a look at the combined entity once it has produced full year results. Although generally speaking I tend to steer clear of anything that promotes itself as being to do with the Cloud, as that seems to automatically trigger an excessive valuation, as it's a trendy area at the moment. In my experience, today's fashionable investments are tomorrow's heavy losses, so one has to be very careful not to get carried away in a bull market.

Advanced Medical Solutions (LON:AMS) issues an in line trading update. Stockopedia shows broker consensus at 5.45p EPS, so that puts these shares (currently 105p) on a fairly warm PER of 19.3 times. The company confirms it will be debt free by the end of 2013, having repaid a term loan.

The £220m market cap looks high for a business that is expected to deliver turnover of £57.7m in 2013, and make £11.3m profit - although note that's a very high profit margin of almost 20%, hence the high valuation.

The dividend yield is poor, at only 0.6%, and it looks as if a lot of the growth has come from an acquisition - the number of shares in issue jumped considerably in 2012, as did turnover & profit. Therefore I wonder if the PER is not a bit stretched now, it certainly is on a PEG basis - since earnings growth is about 8.5% for 2013, and forecast at only 4.8% for 2014. I'd want much stronger growth than that to pay a PER of almost 20. So it's not for me, but I don't know anything about the business, so investors might believe that it will exceed forecasts in 2014 and beyond perhaps?

It's getting so difficult to find reasonably priced companies these days, I certainly wouldn't buy this market as a whole. The only things that interest me are overlooked bargains, and there are still some of those around, although much fewer than last year.

Shares in Iofina (LON:IOF) have been on a rollercoaster ride this year. It's not one I cover, as it's concerned with the exploration and production of iodine. The problem here is that the valuation hinges on expectations of future profits, so if something goes wrong, then the share price can really tank. As you can see from the twelve month chart below, it's been all over the place this year, and has tanked to just above 100p this morning on a disappointing update. I really think it's best to avoid speculative situations like this, or at the very least I tend to top-slice on the way up & run the rest for free;

That's all folks, see you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.