Good morning!

Investing is a team sport

An early report today, as it's my periodic trip to Reading for an investor lunch today. I've been meeting the same small group of investors for lunch every 1-2 months now for the last 14 years, and there are always some interesting insights shared.

In my view, building a network of like-minded individuals, and nurturing contact with investors that you know are honest, successful, and trustworthy, is really important, as well as being enjoyable on a social level. Investing can be a lonely pursuit, and some bulletin boards contain so many unpleasant & downright malicious characters, that in the main, communicating with such trolls online is both dispiriting and a waste of time. Emails, or face-to-face contact with hand-picked good eggs is much more pleasant, and worthwhile.

Newbie investors often ask me for ideas on how to develop their investing skills, and first on my list is to build your own network of successful investors that you can share ideas with, discuss companies & sectors of interest, etc..

We've got one of the most civilised bulletin boards here on Stockopedia too, with some terrific contributors, so thank you to everyone who posts useful follow-up points each day after my articles. More of this please!

Of particular note yesterday was a follow-up comment from "ganthorpe", with regard to my positive noises about the freehold property owned by Severfield.

I know Severfield Rowan well but not a holder currently. I would not put too much reliance on the property aspect as two major units are in rural North Yorkshire (Dalton and Sherburn) with very large specialised buildings and probably difficult to easily be used for other activities or to get planning permission for housing on any volume.. - See more at: http://www.stockopedia.com/content/small-cap-value...

I've not verified this info, but have no reason to doubt it. It's an important point, that freehold property may or may not actually have a resale value of what it's in the books at. Anyway, an excellent contribution, so thank you to ganthorpe, and everyone else who contributes to our teamwork here.

600 (LON:SIXH)

Share price: 9.5p (down 27.6% today)

No. shares: 92.4m

Market cap: £8.8m

Profit warning - bad news for shareholders here, with the key bit saying;

...As a consequence of the above factors the Group's results are expected to be below current market estimates.

Here's the funny thing though. Machine tools is known to be a sector that is under pressure at the moment, so why has this announcement come as a surprise to the market? It must have done, because the share price is down 27.6% today, when really anyone with even half a finger on the pulse should have already anticipated that trading would be difficult.

The forward PER of 3.8 also suggests very strongly that the market had already factored in that existing forecasts were far too optimistic. So I do think that perhaps the knee-jerk 30% share price fall on a predictable profit warning might, very selectively, be providing some interesting buying opportunities for a recovery? That depends whether you think the sector is likely to recover quickly or not.

Carson Block (of Muddy Waters short-selling fame) was on CNBC last night, and he made a similar observation - that European equity markets seemed to often fail to price in really very obvious shortcomings, or risks. The market acted surprised when obvious news was announced. This provides opportunities for short sellers of course. His explanation is that many European investors simply don't do detailed research on stocks they hold, so can easily miss the obvious.

Outlook - the company is taking self-help measures, by cutting costs;

With general economic and in particular manufacturing forecasts being weak, customers are leaving purchasing decisions until the last minute and consequently order books overall are at a little over one month and visibility of future trading is difficult to predict and subject to monthly fluctuations.

Both of our Divisions have taken steps to reduce overheads and improve factory efficiencies from which we will see annual saving of approximately £1m going forward. In addition, the benefits from the integration of the TYKMA and Electrox laser businesses are now producing improved margins.

The sales and marketing initiatives in both Divisions are gradually showing signs of success despite the poor market conditions. However, these improvements and the restructuring benefits are unlikely to offset the effects of the volume decline from the market weakness in the machine tool industry.

Visibility of orders, let alone profits, now seems almost non-existent. That's a big worry. Could things get worse still? Sounds like they could, to me.

Balance sheet - I would have considered taking this idea further if the balance sheet had been rock solid. However, it looks rather bizarre. There is a gigantic pension surplus of £35.4m in fixed assets, but the narrative to the interim results refers to an actuarial funding deficit. So this is a crucial issue that needs to be understood properly before any investment could be made here.

Net debt of £12.1m looks too high to me, as at 26 Sep 2015.

My opinion - the company is operating in a sector that is struggling globally at the moment, and the outlook sounds weak. This, combined with a very strange balance sheet, means that I can only file this in the "too difficult" tray, and the potential risks have probably scared me off doing any more work on it. Why get involved in a potential can of worms, when there are other, much simpler, and more appealing investment ideas out there?

Utilitywise (LON:UTW)

Share price: 174.7p (up 1.6% today)

No. shares: 77.7m

Market cap: £135.7m

Trading update - various statistics are given, but the key paragraph sounds reassuring;

"As a result of the significant investment that we are making in the business, we are pleased to be making real progress with a number of our strategic initiatives and expect to report both revenue and profits for the full year in line with management expectations."

That's good, but the big issue with Utilitywise is cash generation (or rather, lack of). On this front, I think today's announcement falls short of what I would need to gain enough reassurance to consider making a fresh investment here.

"The rate of new customer acquisition has increased compared to extensions and renewals in line with management expectations. We also continue to make progress in aligning supplier commercial terms to improve cash conversion.

That sounds positive, but net debt is showing a worsening trend (which might be due to acquisitions possibly, I don't have time to check the detail today);

Net debt at 31 January 2016 was £10.4m (net cash of £1.6m at 31 January 2015, net debt of £6.7m at 31 July 2015), in line with management expectations

My opinion - I remain on the fence with this share, but have probably shifted slightly more towards a negative view. A highly profitable business like this should be highly cash generative, but it's not.

We've discussed the aggressive revenue recognition here numerous times before.

With Neil Woodford having strongly supported the share price (by buying the dips aggressively), I wonder what the share price would have fallen to without his support (which reassures other investors too of course). Probably sub-100p at a guess. So I think the price has held up more due to this backing from a star fund manager, rather than on fundamentals. That's not a solid enough reason to buy the shares for me.

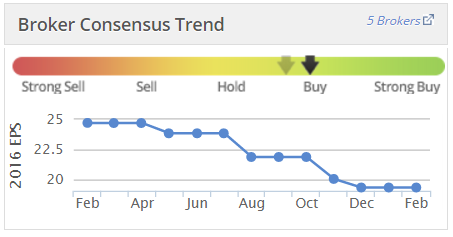

I see broker forecasts have been trending down over the last year two:

For me, cash is king with this company. If it can start to show proper cash generation, then I'll have a fresh look at it, but for now, it's not for me. There are still too many question marks over the company & its accounts. Again, why get involved when you don't have to?

Synety (LON:SNTY)

Share price: 68.5p

No. shares: 13.5m

Market cap: 9.2m

(at the time of writing, I hold a long position in this share)

New loan facility - I last reported on this cloud-based telephony/CRM integration company about a month ago, so it's worth reviewing this report to set the context. The overall trading performance was OK - triple digit Y-on-Y revenue growth, cash burn reducing, and an overall result for 2015 which was "slightly ahead of expectations".

The big issue was that the £1.58m cash balance at 31 Dec 2015 was almost certainly not enough to get the company to cashflow breakeven. My sums suggested to me that the cash would run out in the autumn of this year. Not good - since the last fundraising was botched, and had to be done at a huge discount. So nobody would want to hold the shares if another equity fundraising is imminent, and it might also be done at a huge discount.

Having said that, the biggest shareholder (Helium Rising Stars) has been buying in the market, and went over 18% on 22 Jan 2016. There's a certain amount of guesswork involved here, but to my mind, if Helium anticipated putting more money in, via another discounted placing, then surely they wouldn't be buying in the market now, at a much higher price?

And/or it suggests that if another equity fundraising is needed, then Helium might be minded to cornerstone it. Whichever way you look at it, Helium buying in the open market now, is a positive signal.

New loan - back to today's news. Synety has announced a new £900k facility with Barclays, with £500k to be drawn down on 1 Mar 2016. The balance of £400k can be drawn at any time up to 1 Sep 2016.

Interest charges are quite high, as you would expect, as it's higher risk lending, at base rate + 8.7%, so 9.2%. So the quarterly interest bill on the first tranche of £500k will be c.£11.5k.

My opinion - the rationale for this loan looks entirely sensible to me. We can all see that Synety will need to do another equity fundraising at some point. Taking out this loan has pushed it from (my estimate) late 2016 into (say) mid to late 2017.

This means that, to a certain extent, shareholders can stop panicking about cash. It also means that when cash is needed, the company will be that much nearer to breakeven, or possibly have even reached it. The investing case then is transformed - instead of raising cash from weakness, the company can show that it has already created significant, sticky, recurring revenues, and wants more money for expansion, rather than continued heavy losses. Therefore the next (and hopefully final) fundraising should be done at a higher price, and hence less dilution for existing holders, in 2017, rather than 2016, thanks to the new £900k loan giving more flexibility.

I think there could be a decent outcome here, although I know it's far too speculative for most readers of this report. Personally I'm heavily underwater on this share from the early days, but actually bought most of my position at 90p in the last Placing/Open Offer. So the shares currently being 24% down on that is unwelcome, but certainly not a disaster. I have other shares in my portfolio that are down a lot more than that!

The market cap here is peanuts, and in my view, there's a reasonable chance of a positive swing in investor confidence, if newsflow is positive later this year. The cash requirement should now have been pushed out into 2017, so that's a positive thing. Overall then, taking out this loan facility seems a sensible move. Also, it's sufficiently small, that when repayment falls due in 2018, the company could if necessary tap existing shareholders for the money, so I don't see it adding any significant risk to the investment, rather the opposite, it's helpful.

A few quick comments before I dash off;

Pressure Technologies (LON:PRES) - today's update says that the company sees no significant pickup in the oil & gas market in 2016. The following comments make me nervous, and suggest that there is a distinct possibility of more bad news to come later this year?

In the short-term the Group is dependent on the timing of receipt of large orders in Cylinders and Alternative Energy to meet market expectations and the third quarter of the financial year will be critical to this, with profits heavily skewed to the second-half. Cash requirements for the Group remain well-controlled and we have comfortably complied with banking covenants.

The Board remains confident in the medium to long-term prospects for the Group despite the difficult market conditions created by the low oil price.

Overall then, I'd say there's a heightened risk of another profit warning later this year, so for that reason I'm steering clear.

Tribal (LON:TRB) - has found a new, and experienced-sounding CEO. News of the underwritten rights issue should be forthcoming with results in Mar 2016, from memory. This is an interesting potential turnaround in my view (it's one I hold a long position in).

MTI Wireless Edge (LON:MWE) - results look superficially good, but there are quite a few red flags here. Israeli & AIM is the main one. But also, note that debtors is out-sized - that's the biggest red flag for potentially over-stated revenues (and hence profits). So personally I would not rely on these figures.

Right, gotta dash! Have a good day, and see you tomorrow.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.