Good morning!

An interesting Budget yesterday from George Osborne. I won't cover that here, as there are any number of other places where summaries and analysis can be found.

SkyePharma (LON:SKP)

Share price: 427p (up 3.3% today)

No. shares: 104.8m

Market cap: £447.5m

(at the time of writing, I hold a long position in this share)

Results y/e 31 Dec 2015 - sparkling results were published yesterday for this, "expert oral and inhalation drug development company". Pharmaceuticals is a sector I normally avoid, unless the figures are easy to understand, which they are in this case - SKP has ticked the right boxes to be considered a good GARP (growth at reasonable price) share for some time. It's one that I've written about here 10 times before.

Pre-exceptional EPS rose from 17.5p in 2014, to 25.1p in 2015. Even after recent rises, the shares don't look particularly expensive to me, at a PER of 17.0 times, although there are lots of moving parts with this company's accounts - e.g. milestone payments, etc. So it really needs more in-depth analysis which is beyond my pay grade in this sector.

I've always thought SKP would, sooner or later, make a bid target, and that's what's happened:

Recommended merger - also announced yesterday. The boards of Vectura (LON:VEC) and SKP have reached agreement on an all-share merger, whereby SKP shareholders will receive 2.7977 Vectura shares for each SKP share. There is also a partial cash alternative.

Personally I'm not at all happy about this. I don't want Vectura shares! I want to keep my SKP shares. So it will be interesting to see how the shareholder vote goes.

With any luck, this not particularly good merger deal might smoke out a proper bid (at a decent premium) for SKP.

EDIT: A further point that I forgot to include before, is that all-share mergers can be problematic. The trouble is that often there is part of the acquired company's shareholder base that doesn't want shares in the acquirer. So they sell in the market. That can cause a terrific overhang of shares, which can last a very long time.

I noticed this happen when Matchtech (LON:MTEC) bought Networkers Intl in Apr 2015, and the share price has never recovered - even when MTEC puts out good news, any rise is almost instantly snuffed out by sellers - probably former Networkers shareholders.

Let's hope the same thing doesn't happen with the SKP/VEC deal. Although I am told by a contact of mine who's knowledgeable in the sector, that Vectura is a very good company. Although it's also on a very high rating - much higher than SKP.

I'm tempted to sell my SKP shares in the market before this deal goes through. It's only a small position anyway, so would remove a worry getting rid of them, banking a profit is always nice anyway.

Cello (LON:CLL)

Share price: 96p

No. shares: 85.3m

Market cap: £81.9m

Results y/e 31 Dec 2015 - I last looked at this marketing group this time last year, and flagged up in this report how the company makes enormous adjustments to move from relatively modest statutory profit, to adjusted profit approximately 2-3 times the size!

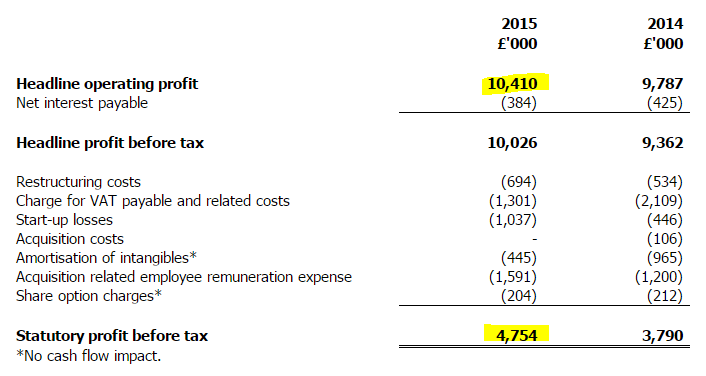

Well they've done it again! For the third year running now, a whole load of adjustments are made, to inflate profit by a material amount;

So I think the adjustments are so highly material, and repeat every year, that the adjusted figures completely lack credibility in my view. Therefore, I think it would be a mistake to value this share based on its adjusted EPS figures.

Basic EPS is only 3.54p, and even if you move that up to about 4p, to allow for reversing the amortisation charge, that still puts this share on a PER of 24 times - i.e. very expensive.

Balance sheet - quite weak, and dominated by intangibles. NTAV is negative, at -£2.9m

Outlook - sounds confident;

The Group began 2016 with a robust level of secured forward bookings. It has also seen encouraging levels of new business wins so far this year. At this relatively early stage of the year, the Board is confident that expectations for 2016 will be met.

Dividends - not bad. The forward yield is just over 3%.

My opinion - you have to be so careful with the accounts of marketing/PR groups, because it's basically their job to create a misleadingly positive impression, for clients. So the same mentality goes into the preparation of accounts.

These figures are a bit of a joke - 3 years on the trot putting through enormous adjustments to profits, has blown their credibility as far as I'm concerned.

It's not a bad business, but the reported accounts greatly overstate the true level of profitability, in my view. The market is not questioning the adjustments, and is hence over-pricing the shares I think.

Quarto Inc (LON:QRT)

Share price: 252p (down 5.8% today)

No. shares: 19.7m

Market cap: £49.6m

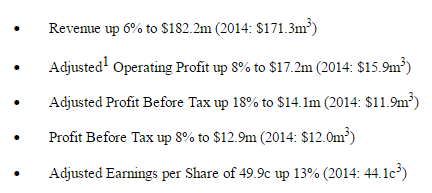

Results, y/e 31 Dec 2015 - the P&L figures look pretty good;

I've had a look at the adjustments to EPS, in note 6, and they look reasonable (and relatively small), unlike the last company I looked at above.

Valuation - so taking 49.9c, converting into sterling (at £1 = $1.439) arrives at EPS of 34.7p. With the share price at 252p, that gives a PER of 7.3 - very cheap on the face of it.

Why is the PER so low then? I think it's partly because of investor scepticism about book publishing. Although it seems remarkably robust to date, technology is advancing so fast, that who knows, in a few years there might be much bigger/better iPad-type devices which drive further declines in book publishing. I don't know, but this has to be a factor holding back shares like this.

The PER is also low because of Quarto's balance sheet issues - it's got far too much debt basically, so let's take a look at that next.

Balance sheet - I still don't like it, but things are improving. Net debt has reduced by 10% to $59.5m. Although gross debt seems alarmingly high, at $84.6m, but is partially offset by $25.1m in cash. I don't see the logic for simultaneously having a large cash balance, when you're paying interest on debt at the same time. Surely the logical thing to do would be to repay some of the debt, using that $25.1m cash pile?

I also very much dislike the $59.4m of capitalised "pre-production costs" within fixed assets. This gives rise to a greatly inflated EBITDA figure, which is best ignored in my view. I'd be much happier if pre-production costs were written off as incurred.

Dividends - total divis for the year are up 6% to 14.5c, or 9.5p. That yields 3.8%, although I'm not keen on companies with lots of debt being generous with dividends.

Outlook - second-half weighting emphasis might have spooked some investors today possibly?

The Group is well-positioned to deliver continued earnings growth in 2016. We expect this to manifest itself in the second half of the year; the increase in second half weighting experienced in 2014 and 2015 is in line with continuing global retail trends. Visibility gained through our forward order books and the recurring revenues of our business model gives us confidence in our ability to continue the momentum of the last three years as we execute our business plan.

Quarto remains a cash generative business and we are committed to reducing our net debt, including by resolutely examining the strengths and weaknesses of our portfolio with a clear focus on our working capital. Continued reduction in net debt will further enhance our options to build on the strong platform that has been created in the last three years and prior. As we further develop our business to take advantage of growth areas and the acquisition opportunities that are presented to us, thereby increasing the Group's earnings, we will progress the Company's dividend in the second half of the year, as we have done in 2014 and 2015.

My opinion - I'm warming to it a bit, or perhaps am less averse to it. Some interesting snippets in the narrative today, indicating that non-core businesses could be disposed of. That might sort out the excessive debt, and gives them flexibility if the bank ever did get the jitters.

I'm hopefully having a telecon with Marcus Leaver, the CEO, next week, so will report back on anything interesting.

It seems to me that Quarto is trying to balance up several conflicting forces - they need to reduce debt, but also need to spend money on acquisitions, to boost declining sales of older titles. They're also under pressure from shareholders to pay increasing divis. It's a delicate balancing act.

I've run out of time for today now, as have to jump on a train back to Hove.

See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.