GYM (LON:GYM)

Share price: 173p (-6.5%)

No. shares: 128.2m

Market cap: £222m

(I have a long position in GYM.)

It was helpfully pointed out in the comments last night (by rhomboid1) that two private equity backers of The Gym intended to sell down the rest of their stakes.

It's a large placing for 30.5% of the company and has now been completed at 175p, about a 5% discount to yesterday's closing price.

Unsurprisingly, the share price has dropped today to around (just below) the placing price.

One of the technical hazards when investing in recent IPOs is that an overhang of stock can continue for some time.

Of course, if you think the shares are good value, this can be the basis of your opportunity to keep buying.

The problem is that insiders and private equity backers tend to know the most about the companies they are selling to the public markets, and so it's difficult for public market investors to come off on the right side of the deal.

Anyway, I think the overhang has been cleared now as far as The Gym is concerned.

Though I personally run a very concentrated portfolio when it comes to my biggest holdings, I am very cautious with growth stocks and recent IPOs. So The Gym currently represents only about 1% of my portfolio. But as time passes and as the investment thesis develops, I hope it will prove worthy of adding to.

SThree (LON:STHR)

Share price: 307.5p (-2.5%)

No. shares: 129.6m

Market cap: £399m

SThree reports a flat performance in Q1 at constant currencies, or up 12% in GBP terms.

This is a global STEM recruitment group with its heaviest weighting in Continental Europe (nearly half of gross profits).

I last reported on it in January, at the results for the year to November 2016. Those results showed gross profit increasing by just 2% against 2015.

The lack of overall growth makes it fairly uninteresting in some ways, but I think it's still pretty easy to defend investing here.

The international/sector diversification it enjoys means that it's flexible to allocate resources where there are the best opportunities, making it less risky than some other players in the recruitment sector.

This helps to explain why it current enjoys a 14x PE ratio (versus the likes of Harvey Nash (LON:HVN) at 8x).

It's currently going through a transformation away from the Permanent hiring segment. Permanent sales staff have been reduced by 18% year-on-year as it increases the percentage contribution from Contract recruitment (now 70% of total gross profits). Contract runners are up by 9% against Q1 2016.

So hopefully the business a whole will return to growth, as soon as the Permanent segment has stopped shrinking!

Outlook

The outlook statement is as you might expect:

'Looking ahead, political and macro-economic uncertainty remains at heightened levels in a number of our key regions. Against this background, we are managing the business prudently and continue to invest in our highest performing teams. Our focus on Contract, the continued strength of our performance in Continental Europe, our greater momentum in the USA and firm control of our cost base, leave us well positioned for the future.'

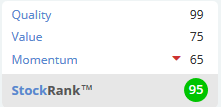

In terms of the investment metrics: Momentum is sliding but Quality and Value remain impressive, so the StockRank remains a formidable 95 (down from 98 in January!).

Ilika (LON:IKA)

Share price: 43p (-11%)

No. shares: 78.4m

Market cap: £34m

This innovative materials business issues a trading update ahead of the end of the current financial year.

Taking a quick look at prior accounts, it doesn't appear to have had a profitable year yet, and the H1 loss announced for the period to October 2016 was unchanged year-on-year.

The order book is now £1.8 million, which is a record high for the company but still seems too low against the market cap.

Today's update includes a warning in relation to hoped-for licensing revenues:

While levels of interest are encouraging, predicting the timing of when these licenses will generate revenue remains a significant forecasting challenge for the Company. Given our proximity to the end of Ilika's current financial year and the duration of negotiations with OEM potential licensees, it seems increasingly likely that revenue from licensing may first have an impact in 2017/18.

For me, this stock remains firmly in the "blue-sky" category - there is merely hope that new income streams will be created by the company's IP, and that these can justify the current market cap.

It raised £5.8 million earlier this year, lost £2 million in H1, and finished that period with a £5.7 million cash balance.

So at least it should not need to raise any new funds from investors in the short-term.

News is quiet today, so I think I'll leave it there!

Have a great weekend.

Regards,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.