Good morning! Back to work today after a day off yesterday.

It looks as if the sell-off in the USA has abated, at least for the time being. So maybe we might see some share price recoveries over here? Or maybe investors with cash will sit on their hands for the time being? It will be fascinating to see what happens. Personally I'm starting to see bargains appear, as good news is ignored, and the things I'm focussing on are companies with good dividends and strong Balance Sheets - although that's what I always focus on anyway because the downside is very limited with that type of stock (providing the dividends are sustainable).

NetPlay TV (LON:NPT)

Share price: 7.5p

No. shares: 296.6m

Market Cap: £22.2m

Trading update - this starts off sounding positive, with these positive opening statistics;

21% increase in new depositing players to 18,853 (Q3 2013: 15,566)

22% increase in active depositing players to 35,225 (Q3 2013: 28,890)

High level of marketing spend results in expected full year results to be below market expectations

Cash balances £13.4m at 30 September 2014 equating to 4.5 pence per share.

But hang on a minute! I did a double-take when reading point 3 - surely high marketing spend should deliver positive results, not negative results? After all, they are reporting a 22% increase in customer numbers. We have a problem here.

More is revealed here;

Despite the Group's level of marketing spend, it has not achieved the targeted levels of new customers and net revenue expected from this spend. This situation combined with the current trading environment, and the initiation of POC means that the Board expects current market expectations to be materially lower than forecast.

Oh dear. This suggests that something is structurally wrong with their market - maybe some customers have just run out of money to gamble with? After all, we are in an era of declining living standards for many people as their real disposable incomes are eroded.

Also there is material uncertainty over the introduction of new gaming taxes shortly. I've never believed this company's reassurances on that point, talk of mitigating the impact, etc. In my view it's safer to wait and see how things actually pan out, when there is any doubt over changes in regulations. Also, to my mind by far the biggest "tell" was large Director selling a while ago - if they're getting their own money out, whey should I put mine in?!

On a more positive note, action is being taken to improve marketing, and the company is cash generative and has a very strong Balance Sheet;

Management has conducted a thorough review of its marketing activity and has developed a new strategy designed to deliver improved returns through more cost effective and better targeted marketing spend.

The Company remains highly cash flow generative and is supported by a strong balance sheet with cash or cash equivalents totalling £13.4m at 30 September 2014.

My opinion - So there will come a point where this share is cheap, I'm just not sure we are there yet. Cash is worth 4.5p per share, so that should underpin things, if the company remains profitable once the tax changes have been implemented.

Note that the relatively small (£10k & £20k) Director buys in recent months now look to have been done more for PR reasons, to arrest the share price decline, than on fundamentals.

Jimmy Choo

The luxury shoes brand has been a much anticipated IPO, and I did wonder if it would be pulled, given market conditions, but it seems to be going ahead. No prospectus has been published yet, but today the company announces the pricing of the IPO and some other details. It will be at 140p, which values the company at £545.6m. It's amazing to think that the company only started in 1996.

Unusually, the major shareholder JAB Luxury GmbH will still own about 70.2% of the company post IPO, which seems very high - I wonder if they tried to sell more, but couldn't find enough buyers? There is a one year lock-in, so I would expect a subsequent Placing of more of those shares at some point.

I'll have a run through the figures when the Prospectus is published, but am not expecting to find value here! Most IPOs have been priced too aggressively this year. I was interested to hear the views of a Fund Manager who commented that the pricing of IPOs "doesn't leave anything on the table for the buyer", a good way of describing it. Perhaps a better way of doing things might be for companies to List, and then release tranches of shares to buyers at prices that have been determined by the market?

It amazes me that there still appears to be demand for IPO stocks, as the recent history very much shows that buying these things at launch means you nearly always get a bum deal. After all, why would the existing owner be selling unless he was selling at a favourable price for him?!

Aviation shares

I normally have an aversion to aviation shares (airlines, or support companies), as things so often seem to go wrong. However, this could be an interesting area to look at. Valuations have been hit hard by the Ebola outbreak. However, it seems that the virus is not transmitted through the air, but from contact with bodily fluids if not wearing rubber gloves. Therefore it should be containable, and I saw on the news last night that good quarantining procedures had already worked in Nigeria, where they apparently prevented an outbreak.

Therefore, assuming the virus doesn't mutate into a more readily transmitted form, the impact on air travel should be very little. Combined with sharply falling oil prices, which obviously helps boost the profit of airlines, then this could present a value buying opportunity? Something to consider anyway.

On a human level one obviously hopes that the outbreak is stopped soon, but as investors we have to consider the commercial impact of this type of thing too.

Widening spreads

It's 09:40 now, and I am seeing a widespread recovery in the 90 or so small caps that I monitor in real time.

One thing I've noticed today is that the Market Makers are widening the spreads on most of the smallest companies I look at. So that it's totally uneconomic to try to time the market, trading in & out of these shares. Also I tried to buy one share this morning, with a £13m market cap, and was quoted the full Offer price, and so have incurred an instant loss of over 5% when valuing the position at the Bid price.

It's a high yielding share, but just paying the Bid/Offer spread will consume my first year's dividend!

So if you're trying to time the market, then it really only makes sense to trade the more liquid shares, where the spread is narrow. It's pointless trying to be clever and trade in & out of micro caps, as you can't get the liquidity to buy or sell in any size, and the spreads are too wide to make it economic to do so.

Also, I think it's always best to buy on a red day, and sell on a blue day, but that means you might miss a big move upwards when other buyers force the price up rapidly. If you didn't move first thing this morning, then you've already missed a decent bounce in many stocks.

Hedge Fund selling

Somebody just made a very good point on Twitter, that some of the panic selling this week in the USA has been driven by Hedge Funds that were hit hard by the Shire takeover deal falling through. Apparently that put deal arbitrage Hedge Funds onto massive margin calls, which had to be met by liquidating their positions in other stocks, and thus triggering further margin calls, and snowballing into a selling frenzy of leveraged market participants.

The market then has to overshoot on the downside before value investors see enough value to come into the market buying. That all rings true to me.

So overall I think this was a necessary correction, with a capitulation phase 1-2 days ago, as leveraged forced sellers were chewed up & spat out by the market. So I'll stick my neck out here, and say that my instinct is that we're probably over the worst now, and I suspect that (providing there is no more serious bad news) that the market might well stabilise or recover from current levels. Hence I'm a buyer now.

Spectra Systems (LON:SPSY)

Share price: 19.25p

No. shares: 45.3m

Market Cap: £8.7m

These shares have been heavily whacked this morning, so clearly the market doesn't like their update. I've looked at this company before, but not in any great depth. It's a rather odd little company, based in America, which makes equipment to handle, and chemically clean bank notes, so they can be re-used.

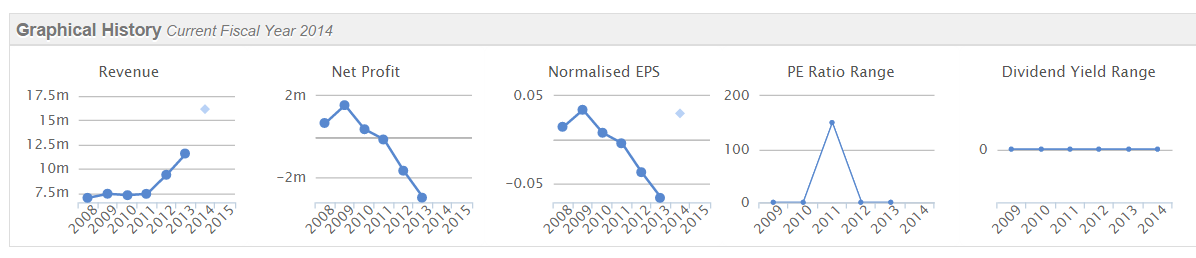

Its historical performance really shows the opposite of what you want;

However, the bull case rests on the company's own cash pile being close to its market cap. Although it's not clear to me that the operating business is worth anything.

Having said that, the last set of interim results look quite good, with a big increase in turnover, and a move into profit. Although the company does not seem able to produce sustainable profit, probably due to the lumpy nature of contracts.

Update - the company says today that a trial with a Mexican bank has fallen through;

Based on this test, the Banco de Mexico stated that: "specifically for the Mexican banknote mix and design, the cleaning process does not meet the central bank's needs at this time and we will consider a second trial of the cleansing technology for the new series of Mexican banknotes, to be issued in 2019".

Although it's not all bad news;

Over the past month, a second Asian central bank has initiated a test program and another third major Asian central bank has requested a detailed estimate of the ongoing operating costs based around the capacity of the commercial AerisTM system being built by Cool Clean Technologies.

The Board continues to be optimistic about the commercialization of the AerisTM banknote cleaning technology and its potential impact on the group's performance over the next few years.

Therefore, if you share the Board's optimism, this might be a good buying opportunity?

My opinion - I'm neutral on this share, because I don't really understand what competitive advantages (if any) the company has, hence have no idea what the future might hold for it. Also I have an aversion to small companies from overseas which list on the UK stock market. Although American companies are usually reasonably alright.

It's worth bearing in mind that companies which never pay dividends arguably exist purely for the benefit of their Directors and employees, who are the only financial beneficiaries from the company's existence.

Although it does seem a rather savage drop in price this morning - down 30% on the day. If you like the company, then it might be a chance to buy in at a bargain price perhaps?

Haynes Publishing (LON:HYNS)

DIY car manuals publisher Haynes has today published its Q1 trading statement covering Jun-Aug 2014 inclusive. It looks pretty awful to me;

As a result of these tighter inventory controls, overall Group revenue ended the first quarter 18% down against the prior period

The company blames currency translation, and de-stocking by customers, but 18% down seems to me far more serious than that. Hence I wouldn't be at all surprised for them to issue a profit warning in a few months' time. There is no mention of profitability in today's statement, which seems odd.

That's me done for today & the week. Apologies again for there being no report yesterday.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.