Good morning! It was the monthly investor evening called "Mello" last night, in Beckenham, and I have to say what a pleasant evening it was. I really do strongly recommend that people based in the South East try to get along to these evenings, as it's such a pleasant crowd of regulars, who are very welcoming to newcomers. Last night I did the first presentation, then it was the turn of NetPlay TV (LON:NPT), who gave us a very thorough briefing on their recent strong results.

My main issue with Netplay, and the reason I sold my shares after just a couple of days of holding them, was that a friend alerted me to the significant negative impact on their earnings which is likely to happen when the UK Govt changes the tax regime for online betting companies. I felt this was somewhat glossed over in the presentation last night, and has the potential in my view to harm the share price once investors latch onto the impact of the tax changes. Some of that impact can be mitigated, and the company explained their strategies for that, but it's still a nasty headwind, and for that reason I won't be revisiting this one until I'm clearer on how the earnings figures are likely to look from 2015 onwards.

That said, Netplay are cushioned by a very strong Balance Sheet, with lots of net cash, and arguably the low current valuation (once you strip out cash) already factors in some reduction in earnings in the future. Sorry to sound negative, and thank you to the Directors for giving up their time to explain the company to investors. It's always very interesting to meet Directors and hear them explain the business in their own words.

Turning to this morning's announcements, Porvair (LON:PRV) has issued a positive IMS, covering the nine months to 31 Aug 2013. They say that revenue in constant currency was up 13%, and that profit before tax is now expected to be ahead of expectations. Excellent stuff, although they needed to be doing well, to justify a valuation that had really become very stretched. I couldn't fathom why the market took it as high as 200p back in the spring, but much to my amazement it didn't stop at 200p, but then roared up to a peak of 300p in Jun 2013! That was clearly too high, and they have since fallen back to 232p.

This is why I don't like momentum-based investing strategies - as momentum tends to feed on itself, and detaches the share price from reality, which causes a messy situation when eventually momentum traders all rush for the exit at once (as happened several times here - e.g. see the intra-day spikes down on the candlestick chart below at the end of Jul, early Aug 2013)

The bulls are firmly back in charge this morning though, with Porvair shares up nearly 10% to about 252p.

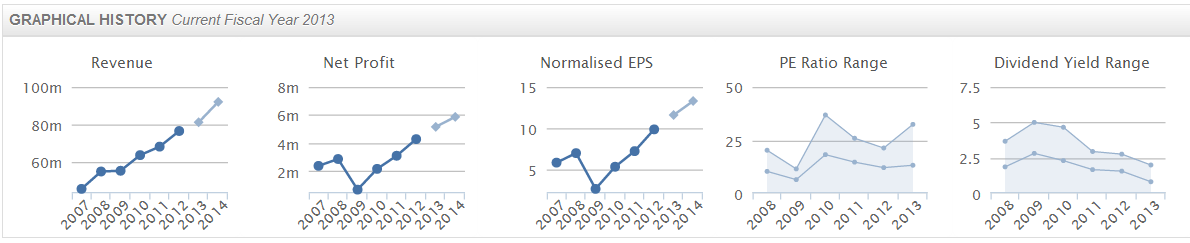

Looking at earnings forecasts, broker consensus for the current year ending 30 Nov 2013 is for 11.6p (up from 10.6p last year). So at a guess, maybe they are heading for 12-13p this year? That puts the shares on a PER in the range 19.4 to 21, so still a pretty lofty rating for a company that's delivering good, but not spectacular growth:

So, much though I like the company, the price is just too high for me - I cannot see how the shares represent good risk/reward at this price, unless you are very confident about the company's ability to continue outperforming, and are happy to pay up-front for the next couple of years' growth. So it's not for me at this price. I would revisit if they warned on profits & the price fell to sub-150p, but otherwise it's too expensive.

Next, I see that shares in Bond International Software (LON:BDI) have risen 4p to a mid-price of 78.5p this morning. The bid/offer spread here is usually ridiculous, and that has deterred me from buying the shares several times in the past. Companies and their NOMADs really do need to tackle this issue of ridiculously wide spreads as a matter of urgency - after all, what's the point in having a Listing, if you're not going to create a reasonably liquid market in the shares?

Bond is a software provider for recruitment & HR. Today it has published interim results to 30 Jun 2013. The headline figures look reasonable. Turnover is down 2.4% to £17.0m for the six months, but a £658k reduction in administrative costs means that operating profit (before the amortisation of goodwill) is actually up 35% to £1,344k.

I like the clear presentation on the face of the P&L, which shows separately the impact of goodwill amortisation & the amortisation of development costs - it's much better when companies clearly set out the information investors need to make an informed judgment on the accounts, so I like this approach. Although it does seem to me that presentation of accounts are getting more & more creative, to a point where some sort of new accounting standards are needed to better standardise reporting of figures.

EPS figures are particularly difficult to interpret these days, as so many items can be excluded from adjusted EPS that you end up with a figure that hugely flatters performance, and hence can lead to you overpaying for the shares. That was certainly my view with BDI shares in the past. Also it doesn't help that something seems to have gone wrong with the formating of their results RNS this morning, in that the Balance Sheet figures don't line up with the titles.

So I'll ignore EPS, and instead look at the total value of the business. At this morning's higher price of 82.5p (it's now up 8p on the day!) and with 36.6m shares in issue, that's a market cap of £30.2m.

It looks like they should make about £3m in operating profit before goodwill amortisation for the full year, then take off say £150k in net finance charges, less say 20% tax, and I make that earnings for 2013 of say £2.28m, or about 6.2p per share. So at the current price of 82.5p the PER looks to be about 13.3, which is probably about right.

Stockopedia shows broker consensus at 5.67p for 2013, and 6.45p for 2014, so it looks as if they have been calculated on a similar basis to the way I did it - i.e. having factored in the amortisation of development spending (which is a real cash cost, so should be included), but excluding goodwill amortisation (which is not a real cash cost, but just a book entry relating to previous acquisitions).

The Outlook statement sounds good - as you would expect, recruitment in key markets like the UK & USA is picking up, so recruitment companies will be looking to upgrade their software. So I think this is likely to be a reasonably good time to invest in companies like Bond. The valuation here & bid/offer spread are not attractive enough for me to invest though. There is a reasonable dividend yield too, with 2p forecast for this year, giving a yield of 2.4%, which is good considering that it's growing quite rapidly.

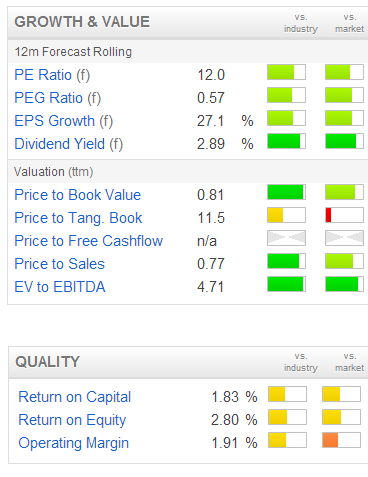

As you can see on the right, the Stockopedia growth & value graphic has plenty of green (=good), although this was based on last night's share price, so it will have deteriorated a bit today with the strong rise in share price.

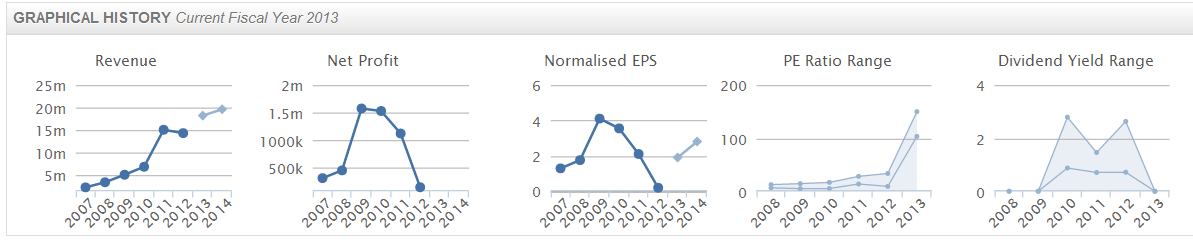

NATURE (LON:NGR) might be worth a look. It's an environmental company that deals with polluted water. As you can see from the graphical history below, their track record has been a bit erratic, but interim results to 30 Jun 2013 published today look pretty good.

Turnover has risen 36% against the equivalent period in 2012, to £11.0m. Profit (before extraordinary item) rose 35% to £1,358k. They indicate that a final dividend is likely to be reinstated if current year performance continues on track.

The outlook statement is rather waffly, but elsewhere these sentences stand out (my bolding added):

"The first half has seen a very satisfactory progression in the consolidation and growth of our infrastructure accompanied by a steady increase in revenues and profitability which shows every sign of continuing."

We are pleased to announce the results for the half-year to 30 June 2013, which have exceeded our expectations and reflect our confidence that a number of new contracts in the Oil and Gas division would be awarded in 2013.

The Balance Sheet looks pretty solid, and has an unusual double entry for insurance claims in both debtors and creditors. There is net cash of £2.8m, so that looks fine.

So on valuation, it has a market cap of about £31m at the current share price of 39.5p. So if H2 is similar to H1, then they should make an underlying profit of about £2.7m, less a bit for tax, so underlying earnings after tax of say around £2.1m to £2.2m, which puts it on a PER of about 14-15. Doesn't strike me as cheap, given the lumpy track record.

So I suppose it would be a bet on a continuing improvement in performance. Stockopedia shows EPS rising to 2.8p for 2014, so that would bring in a PER of about 14.1, again not really of interest to me for a small business with volatile earnings in the past.

And finally, I've had a first, and probably last look at Bango (LON:BGO). It's some sort of mobile phone platform. Their interim figures to 30 Jun 2013, issued today, look really poor. Turnover is down on the equivalent prior period, at £4.5m, and they made an operating loss of £1.8m, worse than the £1.3m loss in H1 of 2012.

It's got £7.2m cash in the Bank, but as they are burning cash, then you wonder how long that will last. Looking at the market cap, I'm absolutely staggered to see it is valued at about £74m! What an absolutely crazy valuation, surely that can't be right? I've checked on another site, and they also have the market cap at £74m. Phew!

The valuation all seems to hinge on hopes of future profits, and I see they have signed deals with Amazon, Microsoft, MasterCard, and Facebook. That's all great, but until the profits are in the bag, and sustainable, I'm just not interested. Story stocks on wacky valuations almost always turn out to be investment disasters, with the odd one a huge success. I don't go near this kind of thing any more, having made too many losses in the past on hyped-up story stocks that don't usually deliver.

That's it for today, see you at the usual time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.