Good afternoon,

It's a quiet start to the week following the long weekend, but I'll add a few snippets below for those releases which might be of interest.

I hope you all had a relaxing break!

Cheers,

Graham

UPDATE: The FTSE is lower by 2% and the pound is up 1.4% against the dollar, after Theresa May called a snap general election for 8 June.

So in the short-term, we can look forward to a lot more uncertainty and plenty of hand-wringing over the immediate effects this will have on business confidence and of course on the consumer.

Looking to the slightly longer-term, however, it should result in an increased majority for the Conservatives. With potentially a 200-seat lead, and with no election due until long after Brexit negotiations should have completed, perhaps we'll get a little bit more macro-political stability than we expected (which is not saying much, of course).

I try to focus much more on the prospects for individual companies than I do on the economy as a whole, but I would certainly welcome GBP strength and the knock-on effect this would have on British retailers and importers. The forthcoming election should clear a path forward for a new government to settle the terms of Brexit and deliver the certainty which the currency markets crave.

Begbies Traynor (LON:BEG)

Share price: 48.5p (-3%)

No. shares: 106.7m

Market cap: £52m

The long-standing threat that insolvencies might return to normal rates sounds closer than ever, according to the headline from this latest quarterly alert

Apparently, the level of "significant" financial distress is up by 26% on average, when one looks at what Begbies describes as "key supply industries" - namely, Industrial Transportation & Logistics, Wholesale, and Food & Beverage Manufacturing.

However, that does sound like a fairly limited set of industries, compared to the size of the business sector as whole.

It's true that the impact of the new National Living Wage hasn't been measured yet, and that there is some considerable uncertainty over these industries' future access to European labour.

But I don't think this report will be enough to sway too many minds on the subject of future insolvency rates. For me, I continue to suspect that it's primarily a question of interest rates and bank policies.

Ashmore (LON:ASHM)

Share price: 355.5p (-2.2%)

No. shares: 712.7m

Market cap: £2,534m

Ashmore returns to net inflows for the first time in several years.

Here is a table I've prepared showing the evolution of AuM over the past few years, and including today's numbers:

|

Period |

Starting AuM |

Inflows/(Outflows) |

Performance |

Ending AuM |

|

Q1 2015 |

75.0 |

(0.3) |

(3.4) |

71.3 |

|

Q2 2015 |

71.3 |

(4.8) |

(2.8) |

63.7 |

|

Q3 2015 |

63.7 |

(2.0) |

(0.6) |

61.1 |

|

Q4 2015 |

61.1 |

(3.0) |

0.8 |

58.9 |

|

Q1 2016 |

58.9 |

(4.0) |

(3.8) |

51.1 |

|

Q2 2016 |

51.1 |

(1.7) |

0.0 |

49.4 |

|

Q3 2016 |

49.4 |

(1.1) |

3.0 |

51.3 |

|

Q4 2016 |

51.3 |

(0.7) |

2.0 |

52.6 |

|

Q1 2017 |

52.6 |

0.0 |

2.0 |

54.6 |

|

Q2 2017 |

54.6 |

(0.7) |

(1.7) |

52.2 |

|

Q3 2017 |

52.2 |

1.4 |

2.3 |

55.9 |

Performance was obviously disappointing at the start of this period, but now that it has been quite strong overall for a year or so, the return of asset allocators has materialised.

CEO comment:

"Ashmore delivered the anticipated return to net inflows this quarter, generated from a diverse range of existing and new clients, and the Group's investment processes are continuing to deliver strong performance over one, three and five years. The outperformance of Emerging Markets reflects accelerating economic growth and attractive absolute and relative valuations across Emerging Markets equity and fixed income markets. This increases the pressure on investors to address their underweight allocations."

My opinion

I still like the positioning and potential of Ashmore to deliver income for investors over the long-term. Financially secure and potentially near the start of a strong fundamental trend, it remains firmly on the watchlist.

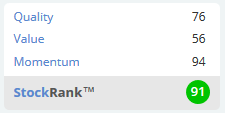

The Stockranks like it too. Since I covered it in January, the Quality and Momentum scores have improved (Value unchanged).

Distil (LON:DIS)

Share price: 2.9p (+2.7%)

No. shares: 499.8m

Market cap: £14.5m

Listing in Major UK Supermarket Chain / Trading Update

These shares have doubled since I covered them three months ago.

There hasn't been any update on trading since then, but the market is beginning to price in a lot more growth, which appears to be justified based on the latest news.

RedLeg Spiced Rum and Blackwoods Vintage Dry Gin will be listed in another national supermarket chain from May 2017, whileQ4 revenues were up by 23% (volumes by 25%) (this growth boosted by the late Easter promotional period).

Outlook comments remain bullish:

The company anticipates full year performance to be slightly ahead of the most recently updated market expectations* and we look forward to reporting our audited full year results in June 2017.

Also:

"Premium spirits continue to outperform the overall spirits market and we expect this trend to continue for the foreseeable future. Our brands remain well positioned within their respective categories."

The RNS helpfully provides a link to the company website where there is a commissioned research note from January - this estimates breakeven in FY 2017 adjusted PBT, rising to £0.1 million in FY 2018 and £0.3 million in FY 2019.

The basis for the 2018 and 2019 estimates is that revenue grows 25% in 2018 and 20% in 2019. These estimates don't seem stretched based on the company's current momentum, and of course it's encouraging that it looks set to beat breakeven this year.

My opinion

Prior to the January update, 2017 revenues were only expected to come in at £1.5 million, but they are instead set to come in around £1.65 million.

So the business has built up a good head of steam. Still an awfully long way to reach its full potential, of course. It looks like one of the more interesting micro-caps with growth potential to me.

That's all for today from me. Looks like we'll have plenty more macro/political news to chew over for the next while!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.