Good morning! I'm back in the UK now, so am using my normal desktop - so will be able to include graphics again. Hopefully normal service last week wasn't too disrupted by me being on the beautiful island of Paxos. It got me thinking that really I could work anywhere in the world, subject to time differences, so that's food for thought. So I might buy a better laptop, and spend a few more weeks in Paxos, who knows?! A couple of holiday snaps will be at the end of today's report, after the important stuff is out of the way.

Sprue Aegis (LON:SPRP)

Share price: 255p

No. shares: 45.5m

Market Cap: £116m

Sprue Aegis is a smoke & CO2 alarms company. It moved onto AIM on 30 Apr 2014, having stayed on the smaller ISDX market (used to be called Plus markets) for a surprisingly long time. Every now and then you can find a decent company on ISDX, and because very few investors bother looking, there can be under-priced things in there, although you often have to be very patient for anything to happen. A move to AIM is a good catalyst for unlocking the value in such under-priced situations, if management can be persuaded to do so.

Readers here should be familiar with this share, as I've covered it regularly since Jan 2013, when I first flagged it as looking "potentially cheap", and "worthy of more research" in my first ever report exclusively on Stockopedia, on 28 Jan 2013. The shares were only 66p then, so they have almost 4-bagged since then. This is a good example of the opportunities that crop up in small caps quite often, to buy into decent growth companies that are off the radar of most investors.

Shareholders will be pleased with the trading update today, which says;

On 14 July 2014, Sprue, one of Europe's leading home safety products suppliers, released a trading update for the six months ended 30 June 2014. Since that date, the Company's order book has grown considerably, largely driven by a significant increase in smoke detector orders received for the French market. As a result, the Board now expects that the Company's results for the year ending 31 December 2014 will exceed market expectations.

Clearly that is good news, although no indication is given of the scale of the out-performance.

Valuation - Stockopedia shows broker consensus forecast for calendar 2014 at 15.0p, with 20.0p for next year. So given that 15.0p is going to be beaten this year, then who knows, they might be heading for perhaps 17-18p EPS this year? That's a guess on my part - I wouldn't expect a company to report out-performance with over 4 months to go in the year, unless they were pretty confident of comfortably beating estimates. So the 9% move up in share price to 255p today looks a sensible reaction to this statement. That would take the PER to about 14.6 times this year's earnings (using 17.5p as my estimate for 2014 EPS), which is hardly a demanding multiple for a company with net cash, and performing very well. So I suspect there could be more in the tank here, and it wouldn't surprise me to see these shares hit 300p with a bit of patience. Maybe more if the growth can be sustained.

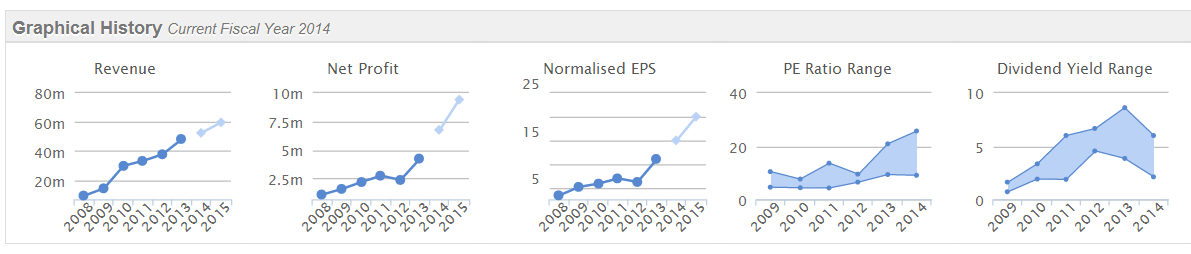

Growth - The growth track record looks good, especially bearing in mind that the 2014 forecasts are going to be exceeded. It is important to find out the drivers of this much improved performance. I'm a bit rusty on this one, as I sold out (too early, as usual) at about 200p a few months ago - clearly I should have held on to my shares, but I banked a profit of over 100%, so can't complain too loudly.

I haven't considered 2015 earnings forecasts yet. So if the company delivers say 20-25p EPS next year, then the 255p share price today looks good value - providing that level of profitability is sustainable of course.

Must admit I'm tempted to buy back in, but can't quite bring myself to push the button yet.

Lidco (LON:LID)

Share price: 14.4p

No. shares: 194.17m

Market Cap: £28.0m

This small cap is a maker of cardiac monitoring equipment & associated disposables.

I've just been re-reading my notes here from last time I looked at it, on 29 Apr 2014, where I decided that it looked potentially interesting, but was too expensive at 23.5p per share. Good job too, as it's dropped over 38% since then in just under four months.

Profit warning - It's the top market faller (excluding resource stocks) today, down 16% at the time of writing, to 14.5p. So clearly the trading update today has disappointed, let's have a look at it. The key paragraph says;

LiDCO confirms that it still expects to report further growth in both revenues and profits in the year to 31 January 2015. After a solid first quarter, the Company has recently experienced a level of destocking in the UK along with a lack of sales to its distributor in Japan, and therefore this growth, and the results, will be below previous expectations. The Company also remains on track to be debt free by the year end, as previously anticipated.

Further down it says;

Revenues in the first half are expected to total £3.7m against £4.2m in the comparative period. The fall in revenues has been partly mitigated by improved disposable pricing and tight control in overheads. The Company still expects to show growth in profitability year-on-year.

So overall the company seems to be saying that Q2 was bad, hence H1 will be weak, but they hope to recoup it (and more) in H2. Therefore, there has to now be a heightened risk of another profit warning in H2 - thinking back to Jon Moulton's comment that things are always worse than management at first admit.

I've not kept any stats on this, but it's amazing how often companies do end up issuing an H2 profit warning, after saying a few months earlier that H1 was weak but they expect to recoup it in H2. So I would treat this company with considerable caution now.

Valuation - Given the uncertainties over performance, and the soft H1, I don't consider the £28m market cap to be attractive at all. Historically this company has been loss-making, and only scraped into the black in the most recent reporting year to 31 Jan 2014. So to justify a £28m market cap, there needs to be strong growth & a decisive move into higher profitability. Today's update is too hesitant, so I'd want to apply a much bigger discount for risk here. Growth companies cannot have turnover going backwards, that calls into question the whole basis for it being considered a growth company.

My opinion - The position here is too uncertain, so it's not one I will be taking any interest in, unless there is a much better performance in H2.

Red24 (LON:REDT)

Share price: 13.25p

No. shares: 49.0m

Market Cap: £6.5m

This micro cap is the second largest % faller (non resource sector) today, down 14.5% to 13.25p.

I've only written about it once here, on 11 Jun 2013, where I concluded that at 14p the shares looked reasonably good, but the company was too small, and "my only worry is that a business this small could be overly reliant on a small number of key clients, which is alluded to in the narrative. So that increases risk".

The trading update today confirms that my worry was correct;

In response to an internal review of its business operations, a major customer has notified the Company that it intends to make changes to the products that they offer to some or all of its mainland UK-based customers. Whilst its timing and extent is subject to ongoing discussion, the decision will impact on the Company's financial performance in the current financial year with the loss, depending on the outcome of these discussions, of up to approximately £ 500,000 of revenue and a corresponding loss of contribution to profit before tax of up to approximately £250,000. Looking forward, initiatives are being actively pursued to replace this revenue and the Company will also take other mitigating actions internally. Other areas of the business continue to trade in line with expectations.

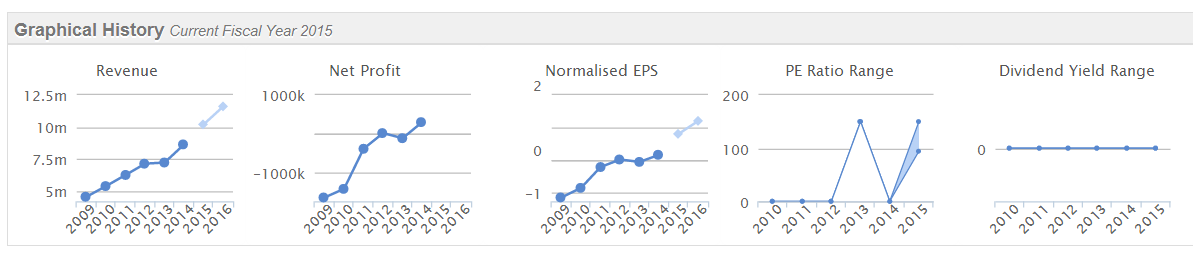

Profit warning - This is quite a big knock. You can see from the charts below that the company typically has made a profit of £600-800k in each of the last five years;

So if we assume that the current year might have been about £700k, then a £250k reduction in profit means nearly 36% reduction. As this announcement is being made nearly half way through the current year (ending 31 Mar 2015), I wonder if the impact will be even greater on next year's figures - i.e. a £500k profit reduction next year? If so, that would take the company close to breakeven next year.

The company says that H1 results will be in line with last year, due to a large contract. So that rings alarm bells too - is it repeatable?

My opinion - On the plus side, this company does have a good Balance Sheet, and has paid reasonable divis in recent years. However, it looks far too speculative to me in terms of profitability. This is the problem with tiny companies - they so often depend on a very small number of key customers, contracts, and staff. So they should be valued accordingly - cheaply - a PER of no more than 5-6 should be the norm for tiny companies like this. People are over-paying if they go much above that in many cases.

Lifeline Scientific Inc (LON:LSI)

Share price: 167p

No. shares: 19.45m

Market Cap: £32.5m

Another new company for me to look at! This one is an Chicago, USA based company, listed on AIM, which makes equipment & consumables for dealing with human transplant organs.

Trading Update - covering the six months to 30 Jun 2014 is issued today. Revenues rose over 11% to $15.1m (note US dollar reporting), due to "solid trading".

While investment continued per plan in geographic expansion and new product development, total sales of proprietary higher margin consumables grew 32% to US$8.5m compared to last year (H1 2013: US$6.5m). The growth in consumables sales is expected to result in operating breakeven at the half year stage compared to a loss of US$1.4m in the same period last year.

Valuation - This is a tricky one. One mustn't obsess too much about the current year's results, it's the long term future that really matters, but that is so difficult to judge. In this case forecasts for this calendar year are for just above breakeven, so the PER is meaningless, at 84.8, so we just have to decide whether a market cap of £32.5m is reasonable for a company that might become profitable in future?

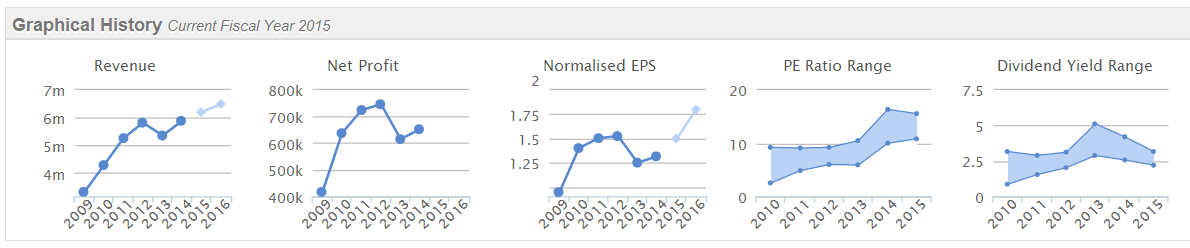

I don't know enough about the company to make a judgement on that. Although I note that its Stockopedia page shows a strong trend from heavy losses into decent profits by 2010, but then a fall back to breakeven by 2012, which seems to be continuing. So perhaps the company is investing in product development & marketing efforts, which might pay off later? It might be worth looking into, but for me a company that is trading at breakeven doesn't look very interesting. Especially as surely its markets can't be that big?

Outlook - the company makes generally bullish noises;

"We are pleased to see that the first half of 2014 has built on the growth that we saw throughout 2013. The significant increase in sales of higher margin single use consumables reflects growth in both the number of LifePort Kidney Transporter placements and usage. With France coming on board in a meaningful way, steady progress in North America, and positive developments in Brazil and China, we anticipate continued solid demand for our products and services in the remainder of 2014."

The bit I have bolded above sounds interesting - generally it's a good thing to look for companies which are building a recurring stream of high margin revenue from consumables.

My opinion - Don't know! However, it's in the system now, so at least I've got some notes here to refer to when the next set of results come out, due on 30 Sep 2014.

Generally I wonder why a US company would list on AIM in the UK, when they have such liquid markets in the USA? I wouldn't normally regard a US company as inherently suspicious, because their standards of corporate governance seem good. Although I'd want to dig into why the company has Listed in the UK, and not in the USA.

DQ Entertainment (LON:DQE)

Share price: 6.85p

No. shares: 56.26m

Market Cap: £3.9m

This Indian cartoons company is on my bargepole list - shares that in my opinion are too risky and/or over-valued to even consider investing in.

The wheels came off a long time ago, and it's now just skidding along on its belly, in my view. Previously it reported profits, but couldn't collect in any cash, so Debtors just ballooned to comedic levels. Now they've not even managed to report a profit (despite the fact that customers don't feel like paying anyway!). So Q1 results today show a lurch into losses.

No Balance Sheet is shown, but it will be similar to previous ones, in that the numbers are too silly for the company to be even vaguely considered investable, in my view.

A De-Listing, and 100% loss for shareholders can't be long now. The story sounds nice, of licensing of Jungle Book IP, but it doesn't translate into cashflow, and it doesn't look as if that is likely to happen, judging from the numbers. It's been a disaster for shareholders, although it's been on the UK market for nearly 7 years, surprisingly. I think that's long enough to make it work, if it was going to work.

On that bombshell I shall sign off, and see you back here from 8am tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

Holiday snaps

Whoops, I forgot the holiday snaps, thanks for the reminder Neville!

So here are a few snaps from my holiday last week on the beautiful Greek island of Paxos;

This was my office for the week, on the downstairs verandah of our villa.

And this was the view each morning of the sunrise!

Here's another shot of our villa & pool. That's mainland Greece & Albania in the far distance, under the clouds;

Here's a panoramic iPhone photo of the village of Loggos, which was my favourite place on the island;

Another shot of Loggos. Next to the boats are two bars, so you can bay hop, then moor your boat at a bar or restaurant, cool eh! Our boat wasn't quite this grand though lol!

This no parking sign on a local's gate amused me!

Another shot of Loggos;

Note how green the island is - it's lush vegetation almost everywhere, due to having so many olive groves, which catch the rainfall.

(Stony) beach near our villa. Typical of many dotted around the coast;

At a taverna eating "freshly caught" swordfish. We cynically commented to each other that the swordfish was probably bought in frozen. Proved wrong, when the owners two sons walked in carrying 2 more fresh swordfish they had just caught!

Here's me skippering our little hired boat, best way to see the island;

These caves were pretty awesome seen from our boat! You can actually go inside by boat, by my passengers (family) were too nervous to get that close!

This contraption (an elderly hydrofoil) is how you reach Paxos from Corfu (takes about an hour);

Click here to see my video of the scenic village port of Loggos, and the local bus somehow weaving its way through the narrow harbourside road.

So overall, a lovely & unspoiled island - there are no high rise buildings, and only a few boutique hotels. Well worth a visit, but make sure you take powerful anti-mosquito treatments, as they bit us to shreds!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.