Good morning!

Kingfisher (LON:KGF) today reports a strong performance in the UK, and a poor performance in France;

"We have delivered another solid sales performance in Q2 driven by the UK and Poland. In the UK, the EU referendum result has created uncertainty for the economic outlook, although there has been no clear evidence of an impact on demand so far on our businesses.

In France, widespread industrial action and exceptionally wet weather created a more challenging environment, after a more encouraging Q1. We remain cautious on the short-term outlook.."

Empresaria (LON:EMR)

Share price: 98.8p (up 0.8% today)

No. shares: 49.0m

Market cap: £48.4

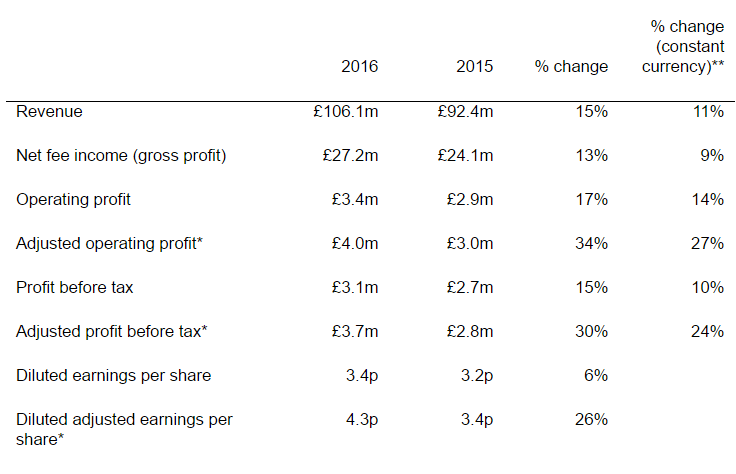

Interim results, 6m to 30 Jun 2016 - this diversified staffing group has put out good half year figures today. Here are the highlights (i.e. the figures that the company wants us to focus on);

Note how the currency effect has reversed - i.e. last year most companies showed stronger growth in local currency, but that was blunted when translated into strong sterling. The opposite is now the case - so overseas earnings are now translating into a better growth percentage when expressed in now weaker sterling.

That's a recurring theme in these reports of late - the sharp deterioration in sterling after Brexit means that companies with overseas earnings are sitting pretty - as those overseas earnings are now worth more when converted into sterling.

I interviewed the CEO & FD of Empresaria recently. Here is the link. There's a lot of useful background information about the group in this audio interview. I was impressed with the company's logical, and effective strategy to diversify across different geographies & sectors.

A fairly big acquisition (£7.5m) was made just after the interim period end, which is important to remember in terms of increased debt.

Balance sheet - net assets of £38.5m reduces down to only £3.5m NTAV, once intangibles of £35.0m are disregrded.

So there's really only a sliver of equity, with the business mainly being supported by bank debt. Net debt was £10.2m at the interim period end. A figure for "average net debt" is also given, of £10.5m. I'm assuming this is the average daily net debt over the 6 months. I wish all companies would report this figure, as average net debt is a far more meaningful figure than a snapshot on one particular day (period end), which can so easily be window-dressed.

Another useful figure which is reported, is net debt as a percentage of debtors. This is very reasonable 28%. So overall, the debt position looks reasonable.

Outlook comments sound positive. The group has greatly benefited from having a wide geographical spread of activites, so has brushed aside any worries about Brexit. This has been reflected in a strong share price in recent weeks;

Empresaria has a clear multi-branded strategy, which is underpinned by investing in our existing brands, to help develop them to build long-term sustainable profit streams. Complementing this we continue to build a diversified and robust group through an Invest and Develop approach, where we evaluate external investment opportunities and strengthen our presence in sectors where we feel we are under-represented. This approach will help us develop leading brands in a group that is diversified and balanced by sector and geography.

We continue to look for suitable external investments to fill in gaps in our sector or geographic coverage with a pipeline of interesting prospects, as well as investing in our existing brands as part of their long-term growth plans. We believe in a balanced growth programme to create a business that is not dependent on one sector or geography for growth.

We see strong growth opportunities across the Group and we remain confident in our ability to deliver increasing profits.

Also, the CEO comments indicate that trading is in line with full year

expectations;...We remain confident in our ability to meet current market expectations.

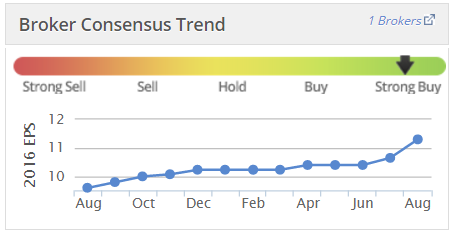

Valuation - note that broker expectations have been steadily increasing this year - obviously a good sign, of a business performing well (plus upgrades relating to acquisitions);

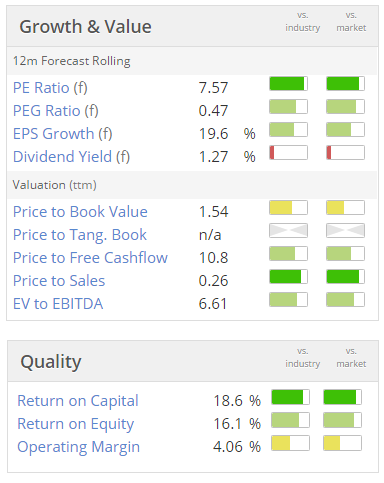

The StockRank of 97 is excellent.

Note that the PER is low, but you have to take into account the debt too. Also, the sector is quite lowly rated at the moment - investors are spoiled for choice for cheap staffing companies at the moment.

A geared balance sheet is reflected in a modest dividend yield - cash is being retained for acquisitions and repaying debt.

My opinion - I like it. This seems a well-managed, successful group, which is growing well through what appear to be sensible acquisitions. The valuation is hardly demanding.

I'm not entirely comfortable with the weakish balance sheet, but whilst debt is so cheap, I suppose it makes sense to use some degree of gearing.

Short & sweet today I'm afraid - there's nothing else of interest to me being reported today.

See you tomorrow!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.