Good morning!

Crawshaw (LON:CRAW)

Share price: 53.5p

No. shares: 79.6m

Market Cap: £42.6m

CEO appointment - this looks a very impressive announcement. Crawshaw's, a small chain of butchers & fast food, raised the money to do a stores roll-out earlier this year, but the only problem was that they didn't have a CEO to actually do the roll-out!

Anyway, that looks to have been fixed today with a very impressive-looking appointment - of Noel Collett. I don't know him, but his credentials look ideal - having been COO for Lidl's UK business for the last 12 years, during which time Lidl did a store roll-out from 200 to 600 stores. So this appointment really looks quite a coup for Crawshaws. I wonder what sort of package he has been offered to persuade him to take this role?

My opinion - the valuation of Crawshaws looks crazy, if you only base it on the historic, and indeed the next two years' forecasts. However, bulls counter that by pointing out that the company has thrashed forecasts in the last year, and that the company already has cash on hand to roughly double the size of the business.

Therefore, if the store roll-out is successful, and gathers pace, it should become self-funding, and in 5-10 years' time this could be a business that is 10-20 times its current size perhaps. At which point the market cap would probably also be multiples of the current valuation.

So you either buy into the roll-out, and don't mind paying a toppy price for it up-front, or you don't! So far, the bulls have been proven spectacularly correct. Personally I'll be watching from the sidelines, and will see how things progress over the next year or two. Retail roll-outs are far from straightforward.

incadea (LON:INCA)

I've never quite seen the value in this car dealership software company. The shares have traded sideways for the last two years, with the odd blip up & down.

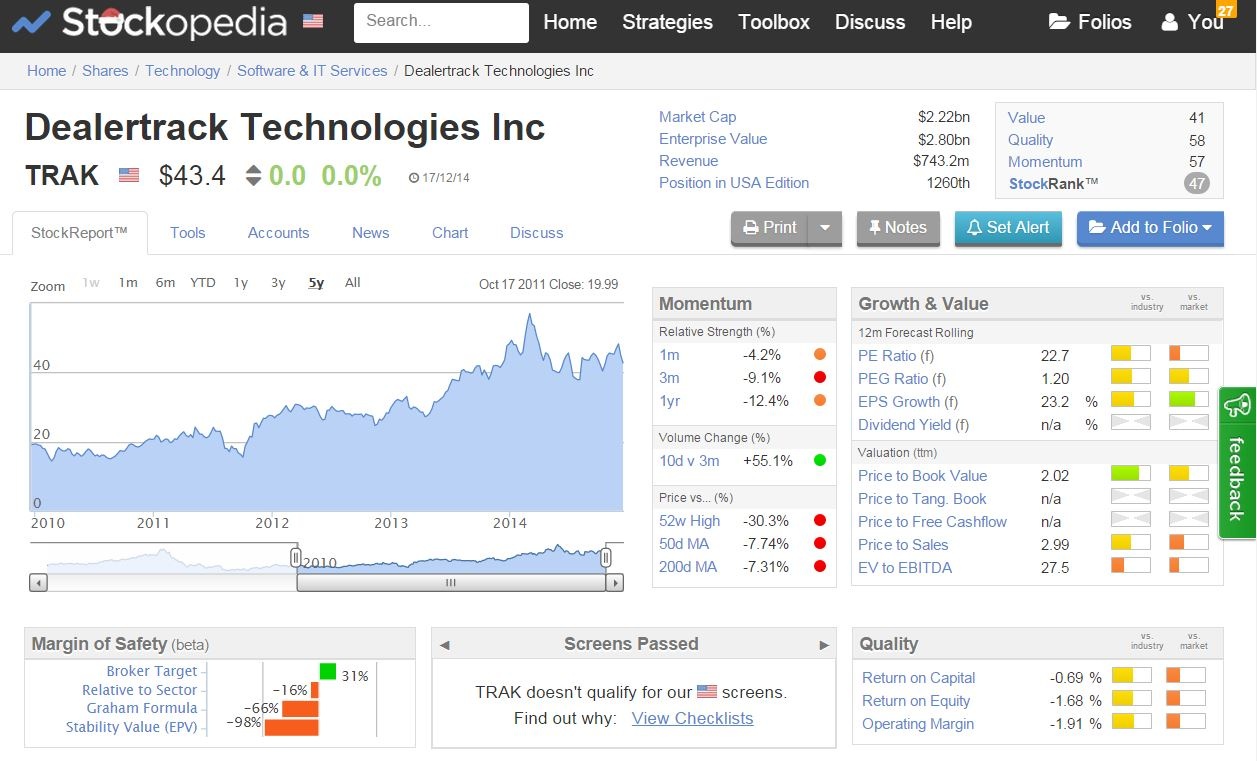

Clearly there must have been more to Incadea than the market realised, as there's a 190p recommended cash offer announced today, from a US outfit called Dealertrack Tech. Inc.. This is a US Listed (NASDAQ: TRAK) company with a $2.2bn market cap.

Just having a quick look at Dealertrack's figures, it seems on a fairly warm rating, so I suppose that means the company would itself be happy to pay a high rating for companies that it acquires, and they would still be earnings enhancing.

I wonder if that will become a theme for 2015? i.e. richly valued US companies buying up UK companies at what seem like inflated prices to us. Worth pondering anyway.

I've just (been) upgraded to the USA edition of Stockopedia, and have to say that it's great being able to check US stocks in the same interface that I'm used to. So here's a screenshot of the top bit of the StockReport for $TRAK - as you can see the shares don't pay a divi, and are on a fwd PER of 22.7, which is a little warm for my tastes;

I'm going to have fun rummaging through the stock screens, to see if I can find some bargains on the US markets. Or maybe some stuff to short?

Goodwin (LON:GDWN)

Share price: 2566p

No. shares: 7.2m

Market Cap: £184.8m

Interim results for the six months to 31 Oct 2014 are published today, and look good - basic EPS is up 7.8% to 141.5p. However, the problem is that this engineering company is heavily focussed on the oil & gas industry - which is obviously in turmoil due to the recent plunge in oil price.

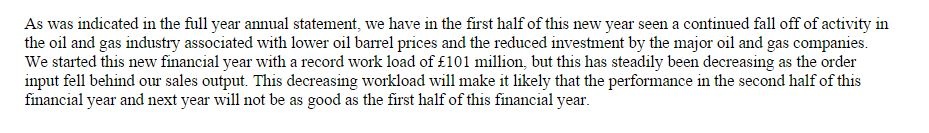

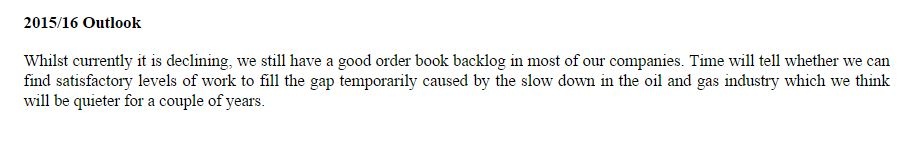

Outlook - the company today says;

Also this;

Balance Sheet - Goodwin has an excellent balance sheet, so it's not going to go bust. That's the most important thing to look at right now, for any oil services company, in my opinion.

My opinion - there's so much uncertainty with regard to the oil price, that valuing this company now would really just be guesswork. So shareholders need to decide whether to hunker down, and weather whatever storms the next couple of years throws at them, or whether to bite the bullet and sell up now, maybe to revisit once the outlook becomes clearer?

It all depends on what the oil price does. If you think it's going to rebound rapidly back up to $100+ then there could be some wonderful buying opportunities out there at the moment, to buy quality companies cheaply, perhaps?

On the other hand, it's obvious from recent events that nobody has the slightest clue what oil prices will be in future - all forecasts & assumptions are meaningless - practically all the experts have been wrong-footed by recent events, so why bother forecasting the oil price at all?! This is the reason I loathe the natural resources sector - it's so volatile, and one day you can wake up to find that the company you've invested in isn't viable any more, because some tinpot dictator somewhere has decided to turn on the taps full tilt at his oil refinery!

I'll watch from a safe distance. You'd have to be very brave to try to call the bottom on this chart!

Crossrider (LON:CROS)

Share price: 113p

No. shares: 148.5m

Market Cap: £167.8m

This seems to be some kind of digital advertising company, which listed on 30 Sep 2014.

Trading update - firstly I've got to show you how the company describes itself, it's hilarious! Ive counted 6 buzzwords in just one sentence! Is that a new record?

Anyway, trading seems to be going well, with an "ahead of market expectations" announcement today;

My opinion - I don't trust EBITDA as a performance measure, as companies often inflate it by capitalising lots of payroll costs. So I'll wait to see what the full numbers look like when they are published in the spring.

I note from the first day of dealings RNS that this company raised £45.9m in fresh cash at its IPO, which is obviously much better than raising money to buy out former shareholders.

There are lots of these companies around, and I'm not sure it's a sector I particularly want to get involved with, as everything changes so fast - a profitable company this year might be passe next year. So how do you value them, and pick the winners?

I've got to take a break now, for lunch, and as I've been roped into becoming treasurer of a local share club, so it's my first month producing the reports, so need to get that out of the way. I'll aim to circle back here later and add some comments about Ideagen and Rex Bionics.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.