Good morning!

Unusual market conditions continue. I did a lot of reading over the weekend, and if you're not careful, you can end up frightening yourself into selling everything!

I saw an interesting graph, showing that earnings expectations for US large caps have been steadily trending down in the last quarter, from approx. 5% up, to now slightly down. Combine that with China, a dramatic fall in world trade (the Baltic Dry Index is now at an all-time low apparently), distress in the Junk Bonds market (and possible contagion?), the collapse in oil price, and there are plenty of fundamental reasons to be worried.

Therefore I'm not dismissing this market sell-off as just another dip. I reckon "buy the dip" may not work this time, but who can say? If the US economic data turns positive again, later this year, then markets could well get back on track.

Most of my small caps are UK-centric, and focussed on consumer demand, so that should be relatively safe, for now anyway. Also, historically a low oil price has stimulated the global economy, so this might just be a passing soft patch. That's my general feeling right now, but I'll be watching closely for signs of anything more serious happening.

Mello

Last call for Mello Beckenham tonight. There are 2 very interesting companies presenting, so well worth attending, namely IQE (LON:IQE) and Flowtech Fluidpower (LON:FLO) .

Brady (LON:BRY)

Share price: 58.5p

No. shares: 83.0m

Market cap: £48.6m

(at the time of writing, I hold a long position in this share)

Trading update - for the full year 2015. The background here is that the company said everything was fine on 7 Sep 2015, but then served up a profit warning on 1 Dec 2015, sending the shares down heavily to just 37p. I blasted the company in my report that day.

However, to his credit, the CEO Gavin Lavelle faced the music, and answered investor questions in an interview with me on 21 Dec 2015 in audio form or transcript.

The key thing with a profit warning, is to get the bad news out, and in full. So far anyway, that seems to be the case here, with today's update steadying the ship (i.e. no more bad news);

Highlights:

· Trading in line with market expectations

· Four new contract wins since 17 December

· Cash ahead of market expectations (at £6.5m)

· Cost cutting initiatives that were notified in the 30 November Trading Update have now been completed

That all sounds fine to me.

Valuation - as you can see from the usual Stockopedia graph below, broker forecast EPS has been roughly halved, to about 3p. This begs the question why was the original forecast so aggressive?

With small caps, the broker forecasts are effectively the company's forecasts. So I do think there is an issue here, with over-promising and under-delivery. It needs to be the other way around in future.

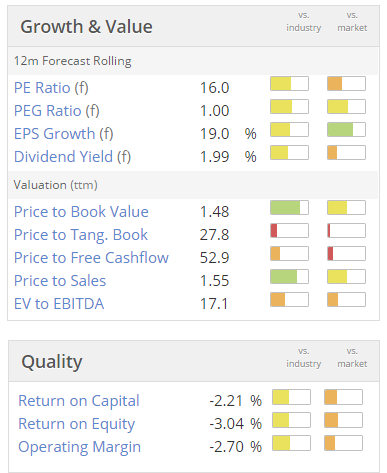

As you can see below, the valuation is not exactly cheap, but these figures are now based on fairly modest earnings expectations, which makes sense given the problems in the sector which Brady serves (software for commodities trading, etc);

It's worth checking the RNS, to see what >3% shareholders are doing, after a profit warning. In this case Kestrel Partners have been hoovering up sellers, and are now over 21% holders, a big vote of confidence in management. Another big holder has been increasing too, called Coltrane. Whilst the only disclosable seller seems to be Investec, who are now down to only 4%, so that's encouraging. Active, large buyers, and a seller that has almost finished, is a good scenario for a rising share price.

Obviously we don't know what the multitude of smaller holders are doing, but given that the share price has been steadily rising, then clearly the buyers are more motivated than the sellers (since by definition the two must balance - every buy in the market has to also have a seller).

Personally, I'm minded to sit tight for the time being. Falling knives can be worth catching, if it's a fundamentally sound business, has no solvency issues (i.e. strong balance sheet), and has supportive major shareholders who are buying in the market, not selling, after the profit warning.

Four recent contract wins also helps reassure that hopefully there isn't likely to be another profit warning any time soon. The big problem with software companies, is the timing of contract wins. This issue comes up time & again, with profit warnings in Q4 due to delays in signing deals. Therefore I'm trying to avoid software companies at that time of year, but selectively buy on the profit warnings, for a recovery over the next 6 months.

It seems strange now, that investors previously assumed that Brady would be immune from the carnage in the resources sector.

Portmeirion (LON:PMP)

Share price: 965p (up 3.5% today)

No. shares: 10.8m

Market cap: £104.2m

(at the time of writing, I hold a long position in this share)

Trading update - as usual, a nice update from this quality company;

Portmeirion, the AIM listed manufacturer and worldwide distributor of high quality homewares, is pleased to confirm that it expects profit before taxation for the year to 31 December 2015 to be slightly ahead of market expectations.

The Group expects to report record revenues for the year ended 31 December 2015 of over £68 million, an increase of at least 11% over the previous year. This is the seventh consecutive year in which we have achieved record sales. At a constant US dollar exchange rate our revenue increase would have been at least 8%.

From memory, I think all the growth is organic, so impressive stuff.

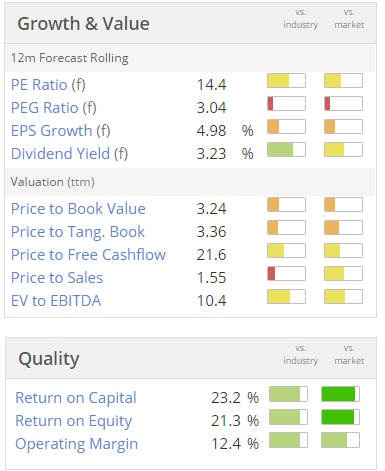

Valuation - looks really good value to me, for a quality business, with steady growth (but I would say that, as I am long of the share!), especially when you consider the balance sheet strength too;

My opinion - I think this is a super company, reasonably-priced. At some point, it's likely to be bid for, probably by a US group, which are actively picking up quality UK companies often on a generous rating of around 20 times earnings.

It remains on my "buy the dips" list. There's possibly further upside from the new kiln coming on stream;

The kiln will be brought into live production from the beginning of February to meet expected demand for UK manufactured product in 2016.

Presumably they wouldn't have invested in a new kiln unless there was sufficient demand to make it worthwhile buying? So possibly we could see stronger growth going forwards? That's speculative upside, but the shares stack up fine on the existing valuation in my view.

Downside risk is mainly that Western economies go into recession, and consumer demand declines. The main markets that PMP supplies are UK, USA, and S.Korea.

Somero Enterprises Inc (LON:SOM)

Share price: 138p (up 1.8% today)

No. shares: 56.1m

Market cap: £77.4m

(at the time of writing, I hold a long position in this share)

Midas Tip & Interview - this US-based, AIM-listed maker of laser-guided concrete floor laying machines was tipped in the Midas column of the Mail on Sunday yesterday. An interesting article, with one glaring flaw - it didn't even mention valuation! How can anyone tip a share, without making any reference to how high or low it is valued?!

Anyway, Somero shares were market up this morning on the back of that tip.

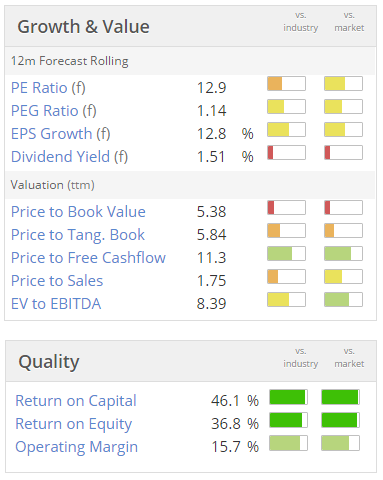

I'm in two minds about this share. On the one hand, it looks strikingly, obviously under-priced, assuming that earnings continue rising. The last, recent trading update confirmed that everything was going well.

However, with the US economy now apparently dipping into recession, and the next biggest market for Somero, China, also having considerable problems, you do wonder what the future holds. Back in 2008-9 demand for Somero's equipment collapsed, so it's a highly cyclical business.

So until things become clearer as to the likely direction of the US & Chinese economies, I'm holding back from buying any more Somero shares. It could drift down as this year goes on, possibly? That said, I'm holding my core long-term position in the shares, as you can never predict what the market will do with certainty (and there could be a takeover bid at any time), but think I'll hold back on buying any more, for now.

CEO interview - I've got the CEO of Somero lined up for my next interview, which will be this Weds, 20 Jan 2016. So as usual, please get your questions in now, using the form on this link (NB. please don't put questions in the comments below this article, as I might miss them).

I can't guarantee to ask every question submitted, especially if they are too obscure, or rambling streams of consciousness (surprisingly common!), but relevant & interesting questions/themes are welcomed, and will be asked.

Universe (LON:UNG)

Share price: 9.23p (up 2.6% today)

No. shares: 231.3m

Market cap: £21.3m

Trading update - for calendar year 2015.

As anticipated in our Interim Report, trading in the second half of the year has been significantly ahead of the first half. The Board currently expects turnover for the year ended 31 December 2015 to be broadly in line with the prior year and that adjusted profit before tax will be in line with market expectations.

Valuation - broker consensus is for 0.72p EPS in 2015, putting this share on a PER of 12.8 times 2015 earnings. That looks about right to me, given that the share is rather illiquid, and long-term performance has been adequate, rather than exciting.

Dividends - it doesn't pay any divis, which is a big downside for me - I like to get paid to wait for shares to go up.

Outlook - comments today sound upbeat, but rather unspecific;

Significant progress was made in 2015 in developing the product portfolio and securing new customers, leading to a number of roll-outs that are scheduled to start in the coming weeks. We remain encouraged by the Group's continuing development, including its increasing presence in the convenience store sector and the Board remains positive about the outlook for the current financial year.

My opinion - I don't see anything to get excited about here, based on performance in 2015 and before. The bull case seems to be based on hopes for improved performance from recently won contracts. David Stredder mentioned this share in our last chat on 3 Jan 2016.

So I think it might be worth doing some more in depth research on the company, to see if the future prospects do indeed look worth backing, or not.

Note that it has a very high StockRank of 97.

Christie (LON:CTG)

Share price: 128.6p (down 0.3% today)

No, shares: 26.5m

Market cap: £34.1m

Trading update - this is self-explanatory;

Christie Group plc (CTG.L), the leading provider of Professional Business Services and Stock & Inventory Systems & Services to the leisure, retail and care markets, is pleased to confirm that revenue for the year to 31 December 2015 will be in line with market expectations, while operating profits are expected to be marginally stronger than previously indicated.

Whilst the UK retail stocktaking division has continued to experience market disruption and pricing pressure attributable in part to increases in the statutory minimum wage and related costs, this has been more than offset by a strong leading performance across our transactional, advisory and financial businesses and our other stocktaking operations.

Valuation - broker consensus is for 8.2p EPS for 2015, so that's a PER of 15.7, which doesn't strike me as a bargain. I'd be inclined to value this type of business on a PER of about 10, perhaps?

Note that brokers are forecasting a big increase in EPS in 2016, to 12.5p, which would bring the PER down to just over 10, funnily enough. So the crux here is trying to ascertain how likely the company is to achieve the near-50% increase in earnings which brokers are forecasting.

My opinion - although the share price has drifted down somewhat in recent months, I'm struggling to find anything interesting in this share.

International Greetings (LON:IGR)

Share price: 177p (down 4.1% today)

No. shares: 59.3m

Market cap: £105.0m

(at the time of writing, I hold a long position in this share)

Trading update - a Q3 update, covering the "key" Xmas period. The company has a year end of 31 Mar 2016.

The Group is pleased to report that following the strong performance reported over the first six months ending 30 September 2015, trading has continued to be strong during the Christmas period. Results remain in line with expectations with all regions trading profitably. We are therefore confident that the Group is on target to deliver EPS growth for the full financial year ended 31 March 2016 in line with expectations.

There are lots of additional positive comments in today's update, but the bottom line is that it's in line, not ahead, of forecasts.

My opinion - given that the shares have had a good run, and that the valuation looks about right to me, I decided to sell half of my shares this morning. We're currently in very sticky market conditions, so to my mind, it's not a bad idea to take some money off the table if results are only in line, and if the share has had a good run. Lots of other things are rolling over, and plunging fast, for no particular reason, so I'd rather sell some, and then maybe buy back in cheaper at a later date.

Brainjuicer (LON:BJU)

Share price: 347p (up 0.7% today)

No. shares: 12.7m

Market cap: £44.1m

Trading update - I applaud the specific figures given in today's trading update, which suggests good financial controls are in place, as opposed to the general waffle that we're so often served up in trading updates - where they want to presumably keep some wiggle room for audit adjustments.

Here's today's update;

Pre-tax profits for 2015 are expected to be approximately £4.5m (2014: £4.3m) in line with market expectations. Adjusted pre-tax profits, after adding back one-off charges incurred in H1 of £0.3m and share-based payments of £0.2m, are expected to be approximately £5.0m.

BrainJuicer has again proved highly cash generative this year. The Company returned £1.5m to shareholders during 2015 via ordinary dividends and management option share buy backs, and ended 2015 with a cash balance of £6.3m, equivalent to 48 pence per share, compared with £5.3m in 2014. BrainJuicer has no debt.

Valuation - the usual Stockopedia graphics are below. If you adjust out the company's 48p per share net cash, then it actually looks reasonably good value.

My opinion - I quite like this company, and the shares have come down a fair bit in price. So it's going on my watchlist, for a potential future purchase, perhaps.

The problem now of course, is that everyone is starting to worry about a global recession, and whether the E part of the PER will hold up for various companies? A market research company like this would be first in line to face reduced demand, if global economic woes do spread to the UK. Brainjuicer is international too, see the revenue split in the table from 2014 results below;

My eyes nearly popped out when I saw the operating profit figures, but bear in mind this is stated before about £7m in central costs.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.