Good morning! It's quiet for results & trading updates today, and judging by low volumes so far today, it looks as if a lot of people have taken the day off. So there could be buying (or selling) opportunities - because on quiet days important news from companies reporting can be overlooked.

Begbies Traynor (LON:BEG)

It's always worth having a read of this insolvency practitioner's quarterly updates about companies in financial distress. Surprisingly, today's report for Q2 shows a big increase in SMEs that are in financial distress, up 60,000 to 237,000 compared with the same time last year.

The report also indicates that even a 1% rise in interest rates would push a lot of zombie companies to the wall, and that many such companies tend to (just about) survive Recessions, but then go bust in a recovery, as they stretch their working capital to breaking point when trying to grow sales.

As a nation, at some point we're going to have to bite the bullet, and have a big clear-out of insolvent companies, which arguably is necessary for a sustainable recovery - as it frees up resources for more efficient, growing companies. Begbies describes the UK as having a "twin track economy", with large caps doing well, and many SMEs struggling and overtrading, due to lack of bank finance.

Of course more corporate insolvencies is bullish for Begbies.

The short report is here.

Essenden (LON:ESS)

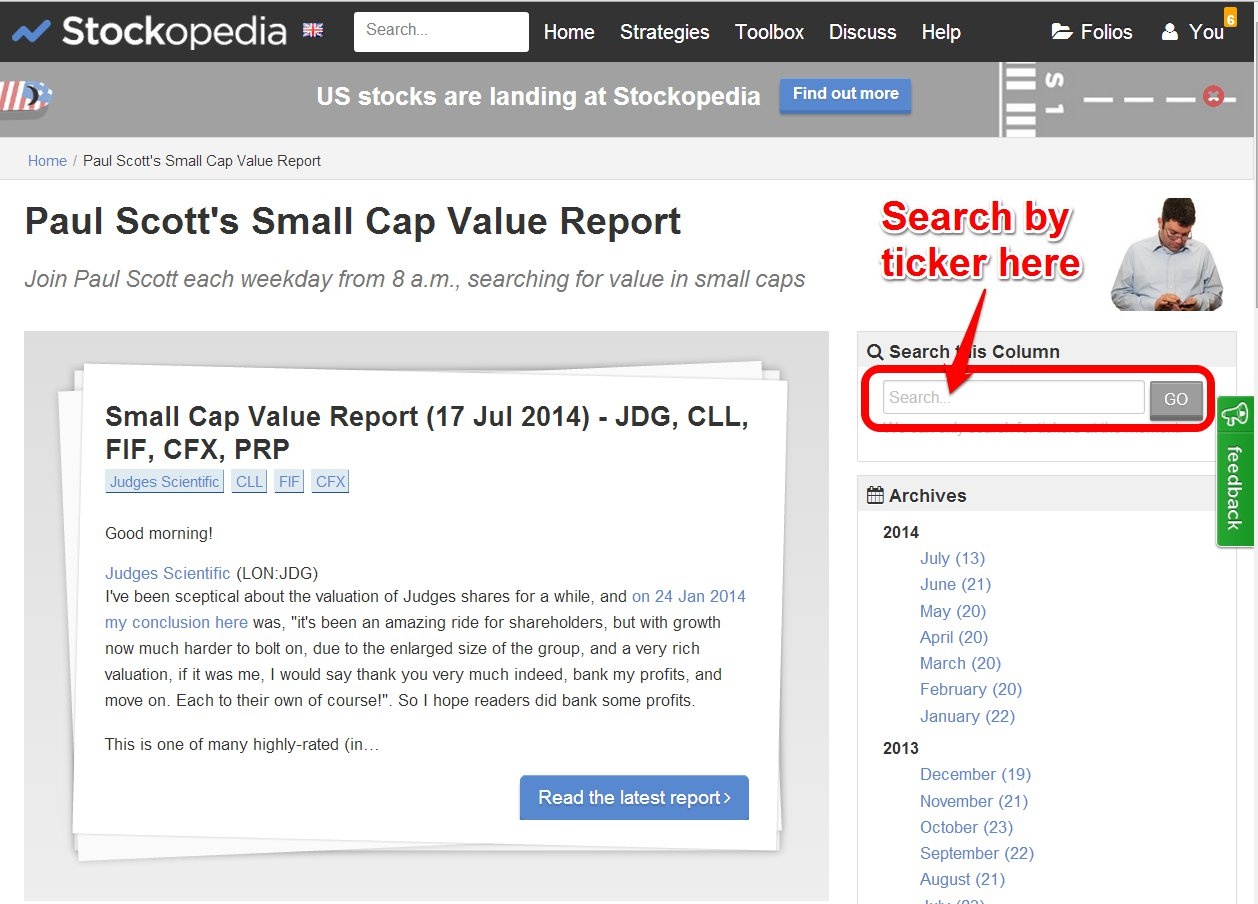

Essenden operates 29 ten-pin bowling centres. It's had a chequered past, but sorted out its balance sheet a little while ago with a debt for equity sawp - I've written about it in great detail here before, if you search the archive using this page (or click on link on screen shot on the right).

We've got nearly 2 years' articles on the site now, so that's loads of background info & strident opinions on many (most?) small caps outside the resources, financial, and overseas sectors.

Back to Essenden, the company's H1 trading update sounds jolly good to me. LFL sales were up 6.1% in the 26 weeks to 29 Jun 2014. That's excellent in an economy where there is no real wages growth. So anything above 2%-ish (inflation) means they are out-performing. They mention that this has been achieved despite the headwind of the World Cup, and it looks like current trading is fantastic, as the 28 weeks figure to 13 Jul 2014 is up 7.1%. To jump from 6.1% to 7.1% YTD in 2 weeks implies a big jump in sales in the last 2 weeks.

I've just knocked up a simple spreadsheet to estimate it, and ignoring seasonality the 6.1% to 7.1% YTD sales growth implies 20% LFL sales growth in the last fortnight. Not bad!

On profitability the company reports "significant growth" in H1 EBITDA. A new contract for amusement machines is expected to drive "significant improvements in sales and margin from quarter 4 2014 and into the future". The CEO concludes the trading update by saying;

"The Like for Like of 7.1% is further evidence of strong momentum. The foundations are now firmly set. There is more potential for future growth."

Trouble is, there aren't any broker estimates out there, so it's difficult to value. Note also that the shares are tightly held, with two individuals controlling over 50%, which some investors may not like. There have not been dividends historically, although I hope to see the company return to the dividend list soon. Interim results are due in late Sep, so it will be easier to value then. Until then, I'm happy to continue holding.

Volex (LON:VLX)

I've been highly sceptical about the turnaround plan at Volex so far, as it's been little more than hot air, with no tangible proof - in my opinion. That seems to be changing, as a positive AGM statement today indicates improved trading;

It is pleasing to confirm that the trading recovery that was reported at the time of the Group's preliminary results announcement on 12 June 2014 has continued. Results for the first quarter of the year were ahead of our expectations in terms of both revenues and profitability. The successful fund raising and renewal of banking facilities announced alongside the preliminary results has meant that the Group can move forward with delivering the Volex Transformation Plan at an accelerated pace and thereby ensuring that a return to growth can be ensured in a sustainable manner.

No figures, or indication of scale of the improvement are mentioned, but at least they are reporting profit being ahead of expectations. Given the company's track record for PR flannel, it would probably be better to reserve judgement until hard numbers have been analysed in the next set of results.

However, Volex has sounder finances after the recent fundraising, which I analysed in detail on Placing Watch (a not-for-profit website to track fundraisings & push for private investor interests). Also the idea has been widely accepted that Volex might be able to return to previous higher operating margins (although I'm still sceptical on that point), and the chart seems to perhaps indicate a bottoming out, that I've taken a small long position in the shares today at 82p. It's not a conviction buy, more of a punt really. Although I note that the PER is looking reasonable now, if forecasts are met for this year. that's a big "if" though!

As usual please be sure to DYOR.

Findel (LON:FDL)

There's an IMS today (its AGM day) from Findel, covering the 15 weeks to 17 Jul 2014. It gives a fair bit of detail, but the upshot is this (which I might need to read several times to understand, as the first bit & the last bit seem to be contradictory);

The Group has seen strong year-on-year profit growth from the continued strong performance of Express Gifts and the improved control of margins and costs. Although changing trends and timing effects have impacted sales in this relatively quiet period we anticipate that these will recover leaving our overall expectations for profit and margin for the full year unchanged.

I've highlighted the crux part. No change to expectations for profit is all that matters.

It's not a company I would ever invest in, due to my dislike for their business model of offering extended credit and correspondingly horrible balance sheet.

That's it for today & this week. Enjoy the weekend & see you back here on Monday morning!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in BEG, ESS, VLX, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.