Good morning!

When my clock/radio goes off each morning at 7am, and the iPad starts bleeping with RNSs, it's always entirely random which radio station comes on - this is because my sleepy fumbling to find the snooze button often dislodges the radio tuner. So I've gradually migrated, unintentionally, from Radio 4, through a local commercial station, to Radio 3 for a week or so, and now I think it's on Radio 2.

Anyway, Chris Evans was the chirpy voice who woke me up today. I have to say, Top Gear will never be the same without Clarkson (I can do without his two daft sidekicks though), but if anyone is going to make it work, Chris Evans will. He is annoying, but hilariously funny I think, and spontaneous, and most important of all, a fellow petrol-head.

I am angling for a job as a sidekick to Mr Evans on Top Gear, and have paraded my credentials on Twitter with a nightly competition to "Guess the Communist-era car" from pictures, although unfortunately readers have already discovered they can cheat using Google picture search. Right, onto the markets.

Norcros (LON:NXR)

Share price: 17.9p

No. shares: 597.2m

Market Cap: £106.9m

(at the time of writing, I hold a long position in this share)

Results for y/e 31 Mar 2015 - these are not the simplest of results to interpret, since there are a number of exceptional, and legacy issues. I'm mainly interested in the underlying trading performance of the business, so it's underlying diluted EPS of 2.1p which is the key figure for me. That makes the shares look strikingly cheap on a PER of 8.5. This is flat against last year on an underlying basis (and stripping out the benefit of deferred tax assets recognised last year).

It's also slightly ahead of broker expectations, according to a note from the main broker which has crossed my desk this morning. Forecast for the current year is left unchanged, at EPS of 2.0p, slightly down, so that's a PER of 9.0 for this year - still very cheap.

Balance sheet - overall this looks OK to me. The three key tests I look for are all passed;

- Net tangible assets are positive, at £25.8m.

- The current ratio is healthy, at 1.71.

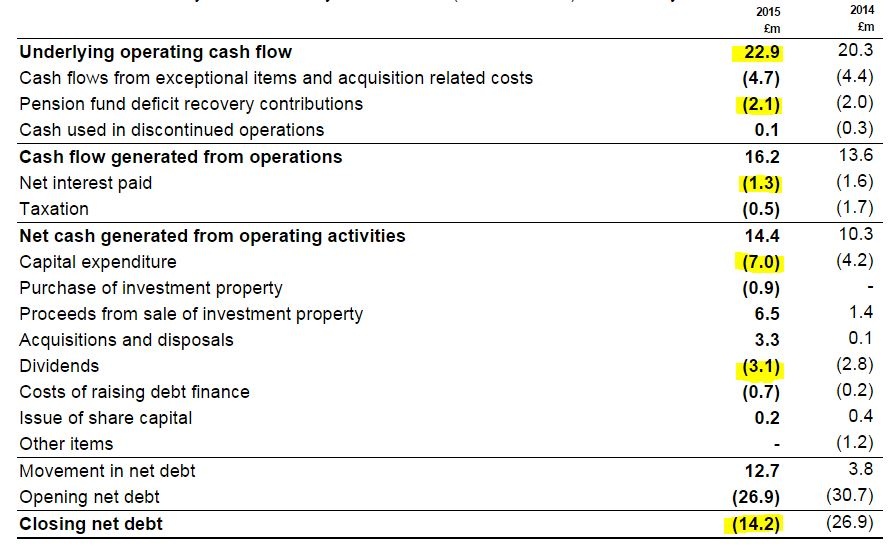

- Net debt is modest, at £14.2m (down from £26.9m, mainly due to proceeds from property disposals).

Note that the company still has significant freehold property, thus giving the balance sheet additional strength.

Pension deficit - this is the only fly in the ointment, but it's not a deal-breaker for me. The pension schemes are large, and as expected the overall deficit has risen from £21.8m last year to £44.3m this year, due to the discount rate falling from 4.3% to 3.3%.

Deficit recovery payments of £2.1m were made in the year, which looks manageable, given the company's strong cash generation.

As we saw with the amazing RNS yesterday from AGA Rangemaster (LON:AGA) saying that they had received a potential takeover approach, a big pension scheme may not be such a large impediment to a takeover bid as I feared. Certainly with US companies now on very rich ratings, I reckon we may see more bids for relatively cheap UK companies.

Dividends - the total payout has risen to 0.56p per share (up 9.8% on prior year), which equates to a yield of 3.1% - worth having, and that's about 3.75 times covered, on underlying earnings. There has been a good progression of divis since they were re-introduced in 2011.

Cashflow - this table is useful, and demonstrates the strongly cash generative nature of the business. The way I look at it, the business generates plenty of cash to finance all requirements - capex, pension deficit, divis, etc.

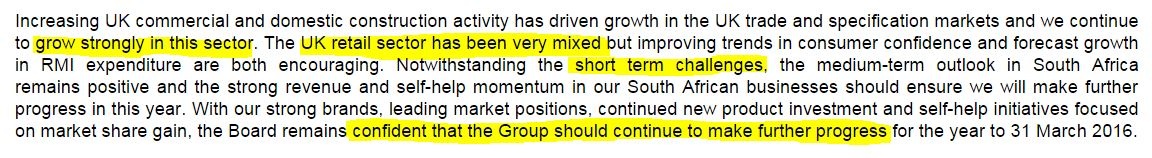

Outlook - the tone of the narrative seems generally positive, although outlook comments seem a bit mixed:

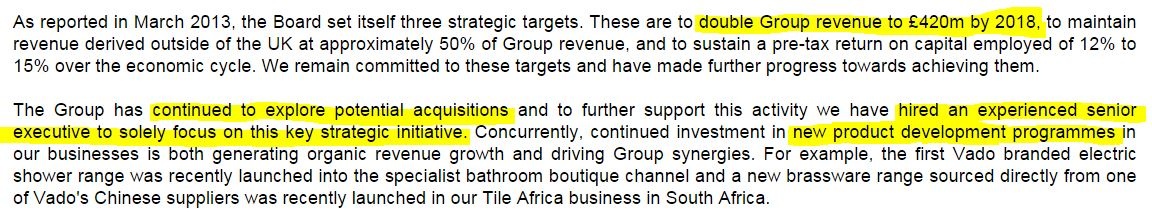

That all sounds consistent with flat broker forecasts for this year, and perhaps explains why the rating is so low - investors perhaps perceive this as a stale, no-growth company? That's actually at odds with the company's stated intention to double in size, and the comments in the "strategy" section sound a bit more exciting:

The company has plenty of firepower for acquisitions, with total bank facilities of £100m, largely unused. Norcros management have demonstrated that they can make good decisions on acquisitions, as the Vado acquisition seems to have gone well - and has offset arguably pedestrian performance from the existing businesses.

My opinion - shareholders in Norcros need the patience of a saint, as the shares have always looked cheap, and there seems to be a permanent seller in the market with an overhang of stock. Whilst this is frustrating, I continue to believe that the shares are fundamentally under-valued, and hence I continue to hold.

The divis are better than interest on money in the bank, and at some point I reckon this share could re-rate to a PER of say 12 (hardly demanding), which gives 34% potential upside on the current share price.

Although I am mindful that there is an opportunity cost to holding a share that doesn't seem to be going anywhere. Although in the past when I have sold out of boring, stagnant value shares, I've ended up bitterly regretting it (e.g. selling out of Dart (LON:DTG) at below a quid, because I'd held for about a year, and it had gone nowhere! It has since gone through the roof of course).

Norcros has performed adequately well, and fixed most of its legacy issues over the past two years, so the share price having gone nowhere overall in two years, seems unjustified to me. So hopefully my patience will eventually be rewarded here, and I have no problem continuing to hold a share that pays out over 3% in (growing) divis, and is on a single digit PER. It seems a pricing anomaly to me, but you may disagree - if so, please comment in the comments - we encourage civilised bull-bear discussions here!

I've just noticed that the Stockopedia computers like Norcros too - it has a very high StockRank of 96, which reinforces my confidence in the shares. In fact I'm finding a high convergence at the moment between my own favourite shares, and high StockRanks, which is great - it's always good when different investing approaches favour a particular share - I've found that this increases the chance of a successful outcome.

Even the chart is now starting to look positive - a "golden cross" pattern (50-day MA moving above the 200-day MA) occurred in late May 2015, and the 15-16p level has proven a strong support level for about 9 months now - which suggests to me that the seller(s) are not interested in selling below that level, and buyers move in at that level.

So risk:reward probably means there's only about 2-3p downside from the current share price, but maybe 6-7p upside (maybe more?). Therefore it's asymmetrical in a favourable way.

Hornby (LON:HRN)

Share price: 93.3p (down 5.9% today)

No. shares: 39.2m + 15.8m = 55.0m after Placing

Market Cap: £36.6m before Placing, £51.3m after Placing

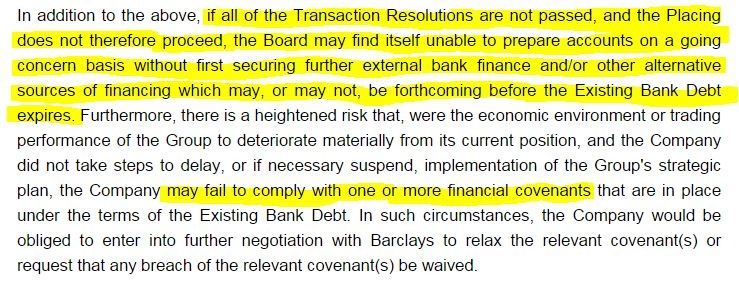

Placing & move to AIM - I'm amazed that the company and its advisers have managed to get this fundraising away at 95p per share (to raise £14m after a whopping £1m in expenses), since it is abundantly clear from today's announcement that the bank have got jittery, and therefore this fundraise has I think been forced on the company, and is close to an emergency fundraise, reading between the lines.

Normally in that type of situation the share price tanks, and the placing happens at a massive discount. This one has been done at a small discount (of only 4.2%) to an already buoyant share price, so in my view shareholders should consider themselves lucky that they've been bailed out by the investors participating in the placing. This is probably because 55% of the placing shares are being taken up by existing major shareholders (New Pistoia, and Phoenix) - so they will have been keen to preserve the value of their existing shareholdings no doubt.

Today's announcement makes it clear that things could have got ugly without this deal:

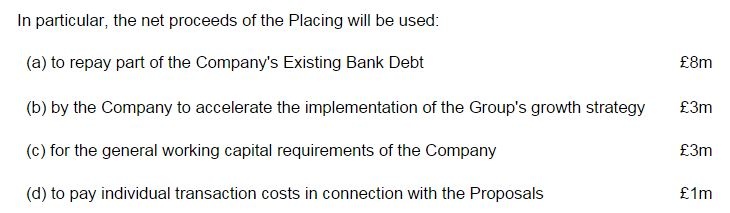

So there's no doubt the company has sailed close to the wind. The funds are mainly being used to get the bank off the hook:

I think the move from a full listing, to AIM, makes complete sense - AIM is cheaper, less onerous, and more flexible than a full listing, and better suited to a small company like this, so this is a sensible move in my view.

Some institutions may become forced sellers, if their mandate only allows them to hold fully listed shares, but on the flipside, AIM will attract new investors to the shares, seeking IHT relief, etc.

Results for y/e 31 Mar 2015 - the company had previously announced on 1 May 2015 that it had moved back into profit, after three years of losses, so this should be seen as a turnaround situation.

Revenue was up 13% to £58.1m, and underlying profit of £1.6m is reported (up from a £1.1m loss last time).

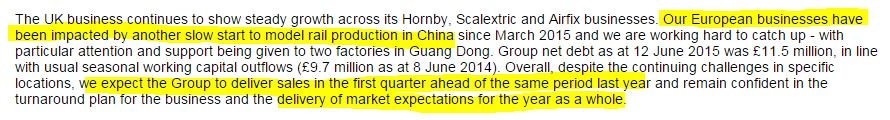

Outlook - various details are given about ongoing turnaround actions. Current trading doesn't exactly sound brilliant, and clearly the supply chain problems are not fixed yet:

My opinion - this shows the dangers of investing in under-performing companies that have too much debt. When the bank goes jittery, the company is forced to raise fresh equity on whatever terms it can get. In this case Hornby has been very lucky to have such supportive major shareholders, who clearly believe in the turnaround plan, and are prepared to back it with substantial new funds.

It's great that Hornby has survived, and should now be financially strongish, so a nice piece of many of our childhoods (not just Hornby, but its other classic brands such as Scalextric, Airfix, and Corgi) survives into the future.

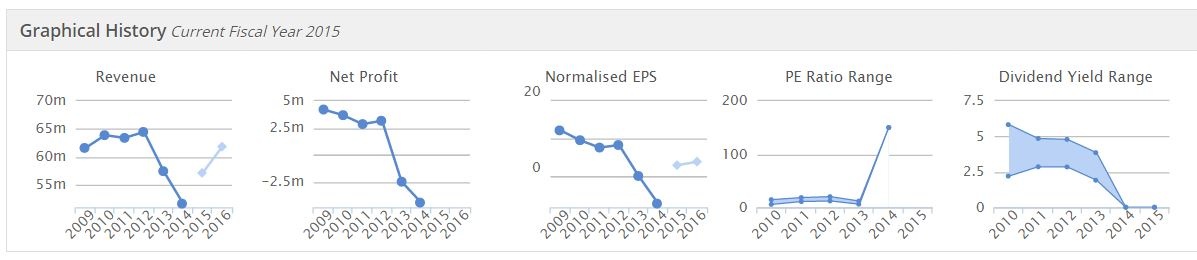

I'm not sure the shares represent value at 93p, which will now equate to a £51m market cap after the dilution from new shares. That seems an awful lot, for a company that has only just struggled to get back into the black. Although in the past, the company has been decently profitable, before they ran into seemingly catastrophic supply chain problems, as you can see from the Stockopedia graphics below. So the stock market has already priced-in a considerable further improvement in profitability.

Given where the company is at the moment, I suggest that a share price of about half the current level would represent a sensible level of risk:reward, so it's not of any interest to me.

Sorry, I ran out of time again, so recorded some brief thoughts on today's video, which covers:

MS International (LON:MSI) , Spaceandpeople (LON:SAL) , Tristel (LON:TSTL) , OMG (LON:OMG) , Plus500 (LON:PLUS) , HML Holdings (LON:HMLH) , Dillistone (LON:DSG) , £FDL

Regards, Paul.

(of the companies mentioned today, Paul has long positions in NXR, MSI, SAL, and has a short position in PLUS. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.