Good morning!

What an awful day yesterday! First all the problems with LAKE, which caused me a nasty financial loss first thing (but I'm pretty confident that's money I'll get back in due course). Then my article here corrupted, with the formatting going haywire. So a reverse midas touch day. Never mind.

DX (Group) (LON:DX.)

Share price: 20p (down 11.1% today)

No. shares: 200.5m

Market cap: £40.1m

Planning application refused - this logistics company is committed to a very expensive new sorting hub in the Midlands. As its finances have deteriorated, external (therefore more expensive) funding was arranged.

Today it announces that the local authority rejected its planning application last night. The company is now considering its options.

In my view, this might be a blessing in disguise. My view on this share has hardened recently. I think that the core, most profitable business, the DX Exchange could now be in terminal decline. With a fixed cost base, it has big operational gearing. Customers are increasingly emailing documents, instead of using couriers. I don't see any reason why that trend would stop, let alone reverse. That leaves DX Exchange high & dry potentially.

Other business is low margin, and highly competitive. So this is likely, over time, to become just another struggling, and possibly even loss-making courier/parcels company. As such, the shares have little to no attraction in my view. Taking on a hugely expensive new depot seemed like overkill anyway, so hopefully the company might now drop its plans to do so.

Good money can be made from catching falling knives, providing you only pick companies with a good business model, sound finances, which have encountered temporary & fixable problems. I initially (wrongly) thought that DX Group fell into that category. However, I have revised that view, and now believe that this company is in structural, possibly terminal decline.

Also, when you look at its balance sheet, the deferred income is likely to unwind as the DX Exchange declines (because customers pay cash for an up-front subscription). Therefore, I think there is an increasing likelihood of a cash crunch here in the next few years.

HML Holdings (LON:HMLH)

Share price: 32.3p (up 2.5% today)

No. shares: 38.9m

Market cap: £12.6m

Acquisition & trading update - another small acquisition has been made. This is the group's strategy, of rolling up small property management firms. It's a good strategy I think, in that they can usually be bought quite cheaply, then bolted on to HMLH's existing IT system, and deals with insurance companies, etc.

Revenue is annuity-like, with low client churn. So quite a nice business model on the face of it. My main concern is that the largest profit generator is kickbacks on arranging insurance for clients. I think that's potentially vulnerable to action by Govt, regulators, etc.

Back to today's update. It's a reassuring, in line update:

The board confirms that trading for the period ending 31 March 2016 was in line with market expectations and looks forward to releasing results in relation to this period in late June 2016.

Valuation - Stockopedia shows consensus of 3.26p EPS for y/e 31 Mar 2016. So the shares look reasonably-priced at 32.3p, giving a historic PER of 10.

The PER is 9, if you base it on forecast earnings of 3.5p for the new year.

That seems a modest rating, for a nice little growth share.

Dividends - the yield is only 1.14%, but this is because cash is being used to make acquisitions. That's fine, as the track record on acquisitions seems good.

My opinion - the price has come down quite a lot in the last year, and it's looking reasonably good value now, in my view.

I liked the management when we met them at Mello some time ago - not flashy at all, just seemingly safe hands, and with a good strategy to gradually grow the business.

Lack of liquidity can be a problem when you get down to this sort of market cap, so for that reason I probably won't be buying any myself, but it is tempting at this price I must admit.

I've heard that the Govt is looking at reforming the law on insurance. So it's an important issue to consider. Investors therefore need to check out whether the commissions received by property managers like HMLH might be under any threat from new legislation.

Patisserie Holdings (LON:CAKE)

Share price: 351p (up 3.9% today)

No. shares: 100.0m

Market cap: £351m

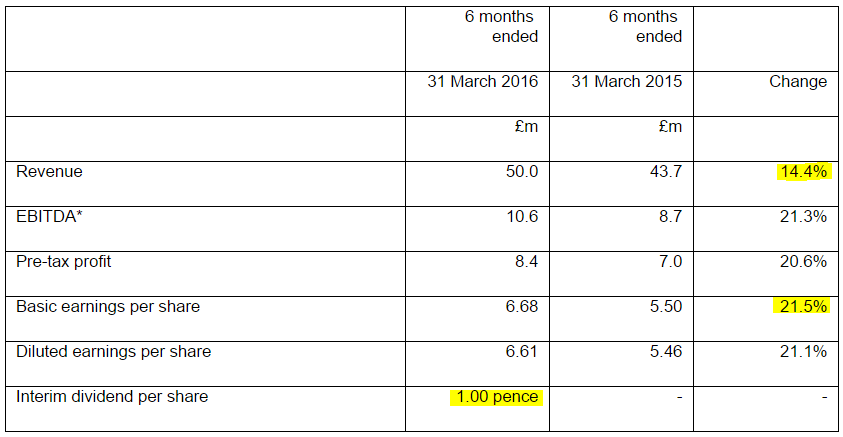

Interim results, 6m to 31 Mar 2016 - these are absolutely superb results. I'm very tempted to buy some shares in this successful retail roll-out, despite the rating being very expensive.

Here are the highlights:

Note that profit is rising faster than turnover.

Also note the 1p divi. The lovely thing about this business, is that it's self-financing the roll-out of new sites, and still has cash left over to pay divis.

There's no doubt this is a very popular format, you can tell that from the high operating profit margin. So I reckon there could be potential for maybe 3-5 times the current number of stores perhaps?

Outlook - sounds good:

These results represent another strong performance from the Group. We continue to control costs tightly, make efficiencies in our supply chain and with the quality of the new site openings in the first half of the year, the developed pipeline and continued solid trading from our premium offerings I am confident of achieving the Board's expectations for the full year.

Valuation - forecasts are for 13.3p EPS this year, and 15.3p next year.

That gives a PER of 26.4 this year, and 22.9 next year. Yikes, that's a rich rating, but in this case I think it is justified.

There are very few good retail roll-outs. This one is probably the best right now - it's already highly profitable, generating a lot of cash, and paying divis.

Other ones I like are Crawshaw (LON:CRAW) which is still quite early stage, hence looks crazily expensive right now, but won't look expensive in 2 years't time. Then there's DP Poland (LON:DPP) which in my view is a complete crock - rolling out a format that doesn't make any profit is just plain daft. Although it is generating very strong LFL growth (but needs to!).

Then you have organic growth from Boohoo.Com (LON:BOO) which of course can expand faster, as it doesn't need physical stores, and can expand internationally too, from a UK base.

My favourite roll outs are BOO, CRAW, and CAKE. The only one I don't hold any shares in right now is CAKE, so perhaps I need to grit my teeth and just pay up?

We're in a market which is obsessed with growth, and will pay a high multiple for it. CAKE has a terrific format, and after results like today's, it's difficult to justify not owning any shares in it. Sometimes we just have to pay up for quality & growth.

Note that only half of CAKE's cashflow was needed to finance its expansion (i.e. capex). So the company is now in that lovely sweet spot where it self-finances further expansion. There's a lot of competition in this space though, but CAKE seems to have cracked it, with an up-market brand image.

Smashing figures, I really like this company.

Churchill China (LON:CHH)

A reassuring update today:

"I am pleased to report that 2016 has started well with good progress against our objectives. We continue to achieve growth in sales from a combination of our new product ranges and from replacement business on our extensive installed product base. As a result we continue to anticipate that we will meet our target performance levels for the year as a whole."

My opinion - another nice company. The share price has had a good year, rising decently, and looks fully valued now. The fwd PER is about 18.5, although that is matched by a similar percentage earnings growth, so a PEG of 1 looks about right.

Got to dash, as I have an investor lunch to attend.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.