Good morning!

Today's the day when Scots vote on independence. It will certainly be good to get this uncertainty out of the way. It's scary that the polls are still so close, given the catastrophic consequences of a Yes vote. Two Scottish-based companies in my portfolio have said this week that they consider a Yes vote would be highly damaging, and that they would seriously look at relocating their business to England.

I suspect that the silent majority will prevail. Let's hope so anyway.

Results are coming thick & fast from companies in my portfolio this week, so here we go:

French Connection (LON:FCCN)

Share price: 62.6p

No. shares: 95.9m

Market Cap: £60.0m

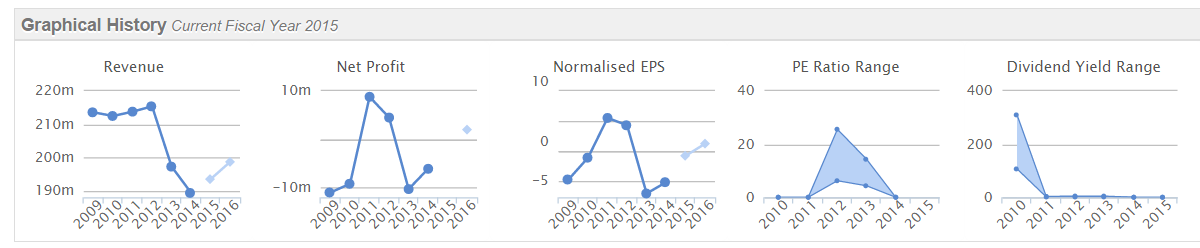

Shares in this fashion retailer/wholesaler are a potential turnaround situation. The company has seen erratic performance in recent years, swinging from losses into profits, then back into losses. There are a number of issues, but to my mind the key issue is down to product (it always is with retailers - if you have the right stock, it sells itself).

FCCN operates at the upper end of the High Street market, so it's high fashion, at relatively high prices. So if they don't get the fashion right, customers won't buy. Note how the turnaround in profitability can be dramatic when they do get the product right - swinging from a £ 10m loss to a £ 10m profit in 2010/11 for example;

I've done very well on this share in the past - catching the big waves up, and selling at (roughly) the right time once it became fully valued.

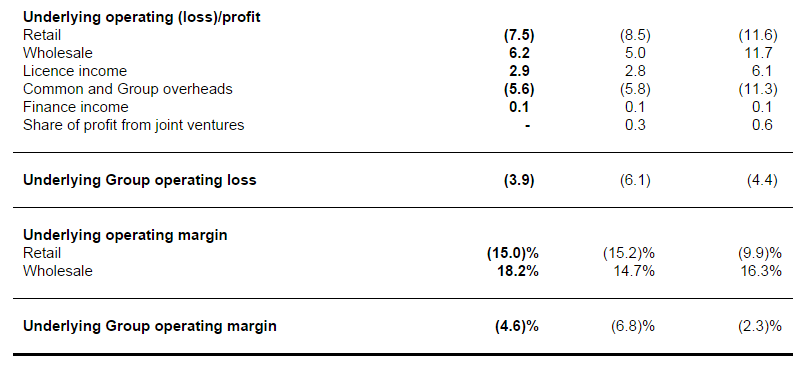

Interim results for the six months ended 31 Jul 2014 are out this morning. These show a reduced loss compared with H1 last year, down from £6.1m loss to £3.9m loss. The company confirms that it is trading in line with market expectations, so it's a bit odd that the share price dropped sharply first thing this morning.

One point to note is that FCCN shares often drop when interim results come out, because some punters don't realise that the company has a strong H2 weighting to its trading (the buoyant Xmas period). I crunched some numbers a while back, and H2 was usually about £6m more profitable than H1, although that gap narrowed last year.

So a loss of £3.9m in H1 suggests that H2 might deliver a profit of £6m better than that, i.e. a profit of about £2.1m, giving an overall loss for the year of about £1.8m.

Problem leases - The other thing to consider with FCCN is that the overall results are split between a hideously loss-making UK/Europe retail division, and nicely profitable other parts of the business. Why does that matter? Because the leases on the problem shops are coming up for expiry over the next few years. Therefore the company should benefit from a strong tailwind over the next three years, as it closes loss-making shops and hands them back to the landlords on expiry of the leases. I think they must have some horrendously heavily loss-making shops, as the figures from the retail division are truly awful - the company should have gone bust years ago, but the cash pile and the profitable other activities have kept it afloat, indeed it is still in rude financial health, with a very strong balance sheet.

Outlook - The company says today;

The wholesale forward order book for Winter 14 is up on last year and the initial Spring 15 orders are strong.

Given the very competitive market place and tougher LFL comparatives in the period, we remain cautious about trading in the second half. As ever we are dependent on the very important Q4 period.

We expect the outturn for the full year to be in line with market expectations.

That's fine in my view. Broker forecast consensus is for a FY loss of £1.6m, so that implies a profit of £2.3m in H2, which ties in almost exactly with my back of the envelope calculations above.

It's a turnaround situation, and you can see from the divisional split from today's results where the problems lie - heavy losses from the retail division, and group overheads that look much too high to me.

So looking forward a couple of years, the retail division should have disposed of the loss-making shops, and be back into profit. If that is combined with some deep cuts in the central overhead, then you could have a business here generating £10m+ profit p.a.. It remains to be seen if management can achieve that.

Balance Sheet/Valuation - The shares are an each way bet, with upside from a trading turnaround, and support from the bulletproof balance sheet.Net tangible assets are £52.1m, so that's just over 54p per share, and most of that is liquid assets, not shop fittings. So those net assets nicely support the share price currently in the low to mid 60p's.

The PER is useless at valuing the company, as it is still loss-making. Although if you assume it can eventually recover to £ 10m profits, less 20% tax, that's £8m earnings, put that on a PER of say 20, and that gives a £160m valuation, or 167p per share, just under 3 times the current share price. That's the potential upside in my view. There are no guarantees that will happen of course, it's just an upside scenario that is possible.

My opinion - With patience (say 2-3 years), I think investors could be rewarded well here, as problem shop leases expire, thus allowing group profitability to recover. The founder, Stephen Marks, still holds 41.8% of the shares, which in my view is probably a positive thing - it blocks any opportunistic takeover bid (unless it's from him!), and you can't get more motivated than an original founder trying to turn around a struggling business, in my experience.

I think the eventual exit will be a trade sale, as the founder is now in his late 60's. This is an internationally recognised & aspirational brand (primarily for ladieswear, especially dresses), so in my view it could be attractive to a trade buyer at some stage.

Today's interims show a modest recovery is underway, and with only a small forecast loss for the full year, the company is in much better shape than it was this time last year, or the year before that - when at one point the losses were sufficiently bad to only give the company 2-3 years to turn itself around.

The company still has £19.4m net cash in the bank (down about £3m from the same point last year), and that will rise to about £30m by the year end, which is about half the market cap! So the downside looks decently supported, with the upside potential thrown in for very little. I think that is an interesting & positive risk:reward situation.

FW Thorpe (LON:TFW) - Results from this lighting manufacturer look good. I really like this company, and have been waiting for a chance to buy in at a bargain price, but the market has not given me an opportunity.

EPS for the year ended 30 Jun 2014 rose 7.4% to 8.7p. So that means the shares (at 138p) are on a PER of 15.9 times, which looks about the right price to me.

Note that the company has a fantastic balance sheet, with £33.5m in cash & short term investments. I make that about 29p per share, or 21% of the market cap! Trouble is, if the company just sits on it as a comfort blanket, then it doesn't really have any value to shareholders. They are doing a 1.5p special dividend though I note, which is positive.

I'll keep this on my watch list. My only concern is what they say about maintaining a large number of product lines, suggesting that some may be mature lines, in decline perhaps?

Sinclair IS Pharma (LON:SPH) - I've had a quick look at results today, for the year ended 30 Jun 2014, but the company seems to have taken on a huge amount of debt, at a high interest rate (LIBOR + 8%) to finance an acquisition. That's completely put me off, so won't be taking that one any further. "Gear today, gone tomorrow", as the saying goes.

Trifast (LON:TRI) - more good news from this fastenings group, with a trading update saying;

Group trading remains encouraging and in line with management expectations as the TR business units benefit from existing and new opportunities arising across our key sectors particularly, automotive, electronics/telecoms and domestic appliances.

In my view, as mentioned here previously, the share price had got ahead of itself spiking up to 125p. I think it's fairly priced for now around the 100p level, and the shares have come back down to reality, being about 106p at present.

I might have another look at this company when time permits, as it's executed an impressive turnaround in the last few years, although I don't really understand how fastenings can generate good returns given that it must be highly competitive internationally?

WANdisco (LON:WAND) - interim results today look absolutely appalling. No doubt bulls on the stock will now tell me how stupid I am for not understanding the business model. What I don't understand is why anyone would finance losses of $18m on $5m turnover - that's just for six months as well!

Continuing to rack up losses like that mean the remaining cash pile will be gone by Xmas. I was astonished to note that HSBC extended the company a $10m credit facility. So maybe there is a credible plan to move into profit?

The shares look a total punt to me, and the only question on my mind is whether to open a short position on it or not?

Essenden (LON:ESS) - this 10-pin bowling operator has fixed its balance sheet, with a debt for equity swap, and is now trading profitably - interim results are out today. I'll go through the results in more detail later, but I am wondering why profits have only risen modestly, given that LFL sales are up strongly. Current trading seems to be very good.

Pittards (LON:PTD) - another share in my portfolio. I've had a quick skim of the interim figures to 30 Jun 2014, and they're not as bad as I feared, especially when you strip out the forex adjustments. There is a tad too much debt, but that seems to be financing the large stock position, so at least it's asset backed from the Bank's point of view. The company is still profitable, and the main reason I bought some shares a while back was hoping that the Non-Exec from a luxury goods maker could tell them how it's done! The shares have performed badly of late, so I was expecting dire results, but actually they're not as bad as I had feared.

Swallowfield (LON:SWL) - has moved into profit, so might be worth a look? Full year results for the 12 months to 30 Jun 2014 are out today.

Monitise (LON:MONI) - another story stock generating huge losses has run into trouble today. Why on earth do people overpay so badly for this type of company? VISA is reassessing its investment in the company, so the shares are tanking. My only regret is closing my short position too early.

As you might have gathered, I'm rushing to finish, as am in a meeting all afternoon.

See you tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in FCCN, ESS and PTD, and no short positions.

A fund management company to which Paul provides research ideas also has a long position in FCCN)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.