Good morning! The FTSE 100 futures are indicating a flat open, at 6,580, so nothing to worry about there. Of course, small caps continue to outperform massively, with the FTSE Small Cap Index (FTSE:SMC) recently hitting a new all-time high. My preferred index for small caps excludes investment trusts, and is getting close to its 2007 highs. Although one should remember that Indices are not adjusted for inflation, or earnings growth, so they should rise over time - hence comparing a 2007 peak with a similar peak today is not really comparing apples with apples.

For the FTSE Small Cap Index XIT (FTSE:SMXX), Stockopedia calculates the trailing PER as 17.8, and the forward PER 13.8, neither of which look cheap. The trailing dividend yield is 2.4%, and forward yield is 2.7%. So in my opinion that leaves little room for disappointment. From this point on, we're unlikely to get a rising tide that lifts all boats - it will now be all about good stock-picking - i.e. avoiding companies that are going to disappoint on earnings, and not over-paying for good companies that are beating earnings expectations.

I'm also increasingly looking to top-slice successful positions, and hold some cash back so that I can pounce on some bargains when we inevitably have a correction. Things just feel too buoyant for my liking right now.

Norcros (LON:NXR) announces that it has sublet one of their legacy surplus leases, in Swindon. I looked at this issue, amongst others, in a short, independent research note on this company a little while ago. This is probably worth another halfpenny on the share price, I reckon. It's a £4m cash saving, so that's 3.6% of their market cap, multiply by 18.5p share price = 0.66p, OK so a halfpenny on the price is about right, maybe slightly more. This really means that their legacy problem leases are effectively dealt with to any material extent. Their pension deficit should be dropping nicely now too, with bond yields rising, as we're seeing elsewhere. I remain a bull of this stock, and calculate it should be priced at 25-35p, in my opinion. The lowly valuation is bizarre, but it's gradually re-rating, it just does so slowly, such that you don't really notice, but it's actually gained over 50% in the last year, so has been a very successful investment so far.

Another share in my portfolio that has done well this year is Cohort (LON:CHRT), the cash-rich defence contractor. They make highly specialised things like communications systems for the Astute submarines, and support for the RAF. They issue an AGM & Q1 trading update this morning (it has an unusual 30 April year-end, so they are actually half way through their Q2 by now).

It's difficult to know how the market will react to this, as there is good and bad news. On the positive side, they say that the order book has grown from £96m to £102m since the last year-end, and that this improves revenue visibility for the current year.

However, on the negative side, they say that;

the pattern of deliveries and anticipated orders means that we expect performance to be more biased to the second half than in recent years.

So like it or not, that makes the possibility of an H2 profit warning greater than it was. Although a certain amount of lumpiness is just par for the course with this type of business, that has little recurring revenue.

Despite a buoyant share price, the forward PER is still reasonable, at 12.0, with a forecast dividend yield of 2.1%. Note that the dividend is very well covered, at over 4 times, so their capacity to pay dividends is very considerable (which is more important than the actual amount paid in the long run).

Net cash has fallen to "in excess of £11.5m" due to various factors, but that should rise back up into the mid to high teens as the year progresses, in my opinion. Cash is material to the valuation, which is £80.9m at 197p per share, and they are seeking acquisitions, so that should further grow earnings, and hence reduce the PER once suitable acquisitions have been completed.

The shares have had a great run, so I've decided to sell up for the time being.

The takeover bid for Fiberweb (LON:FWEB) finally came through last night, about 3 minutes before the deadline, and is at 102p, plus the 1.2p interim dividend. I think this is an opportunistic takeover bid, at a low price, so personally won't be selling for the moment, just in case a higher competing bid comes along.

Although just over 35% irrevocable acceptances have been received by the company from Institutional shareholders (who are often happy to grab a takeover bid, as it enables them to exit a large position in one go, at a fixed price), it was kindly pointed out to me by "bearbully80" that these undertakings can fall away if a higher competing bid is received by the company. So let's hope this galvanises competitors into launching a higher priced takeover bid, and a better result might be had by sitting tight, who knows?

In takeover situations, I always think in terms of what would happen if the bid approach fails? In this case, it's now a proper bid, not a potential bid, so it should go ahead. I've checked out the bidder, and they are Venture Capital backed, so the financing of it should be fairly straightforward, i.e. little chance of them withdrawing from the bid. Finally, I would be happy to hold the shares for the long term, even if the bid does fail, as they are not expensive even with the bid premium in the price. Therefore on the basis of those tests, I will sit tight here. If a bid approach was at a very warm price, then I would sell in the market before the bid finalises, but that's not the case here.

One of the top risers today, up 21% to 113p is RM (LON:RM.), the educational supplies & services group. This is due to a positive-sounding IMS covering 1 Jun to 17 Sep. They have a 30 Nov year-end, so the period being reported on today is Q3 of their year. The key part says (my bolding added for emphasis):

Trading in the third quarter (Q3) of RM's 2013 financial year has continued to progress satisfactorily. Good operational performance over recent months on managed services contracts (including Building Schools for the Future) within the Education Technology division provides support for a significantly stronger second half than was anticipated at the time of the announcement of the half year results.

Can't argue with that! Also they go on to say:

Net cash at 31 August 2013 increased to £38.3m, compared with £13.2m a year earlier.

This is all good stuff, although as I pointed out in my report of 8 July here, the cash really belongs to customers, since it's up-front payments from customers mainly, if you work through their Balance Sheet (which is not strong overall - just £5m in net tangible assets!).

Anyway, what do I know, the share price has shot up, so it doesn't really matter what I think, because the market is running with the positive trading news. Good luck to holders, I don't like the Balance Sheet here, nor the erratic nature of their profitability, so it's not for me.

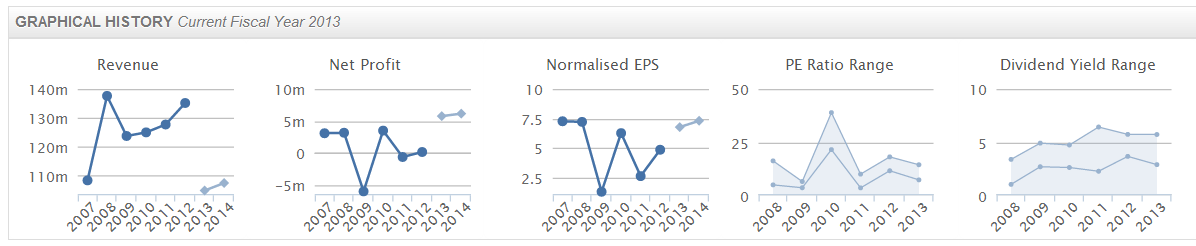

Cello (LON:CLL) is such a difficult one. I've ummed and ahhed over it for the last year, meanwhile the shares have been steadily rising (but hasn't everything, after all we're in a bull market). On the positive side, it's a marketing company, which should be exposed to the improving economy, so a good place to position oneself as an investor right now. Also, they have paid a nicely rising dividend - as you can see from the fifth chart below, there has been a good dividend yield over the last 5 years, and growing (despite the share price also rising):

The PER looks reasonable, shown as 9.37 on Stockopedia, which is now reinforced by an up-to-date outlook statement today, which says:

The robust trading that the Group has experienced in the first half of the year has continued over the summer period. The Board remains confident that full year expectations will be met.

Regulars here will know that I place a great deal of emphasis on having a bang up-to-date positive trading statement when buying into anything, even if it means paying a bit more. It de-risks things at least in the short term.

However, on the negative side, I'm not really impressed with their interim figures published today. The figures show turnover up usefully to £71.5m, but operating profit is only £2,053k, and after finance costs & taxation, earnings drops out at just £1,056k for the six months. That's not a lot really for a group with a market cap of just under £54m (at the current price of 66p).

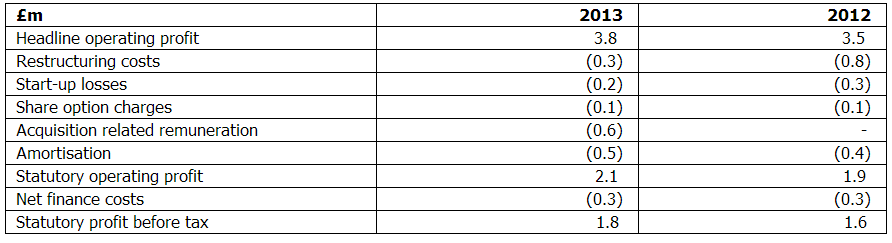

The valuation might stack up on adjusted profits figures, but I'm recoiling at just how many adjustments they are making to profit to arrive at "headline" operating profit. These are still all costs, and I'm leaning more towards the £1.8m statutory profit, than the £3.8m headline figure, as something I am comfortable relying on:

It's getting a bit ridiculous how companies are finding more & more things to adjust out of profit, to turn a lacklustre performance into something more sparkly. We're surely getting near the time when the accountancy bodies will need to act, and publish some new accounting standard to ensure comparability of adjusted profits, and what is & isn't acceptable.

In particular, I'm noticing that restructuring costs now seem to crop up as exceptional pretty much every year with many companies. Adjusting your payroll & office space is arguably just a normal part of running a business, so it's difficult to see why such costs should be excluded from underlying performance measures.

Also, I'm not keen on Cello's Balance Sheet. Strip out the intangibles, and their net assets are negative, to the tune of £6.9m. So they are paying a dividend whilst relying on fairly significant bank debt, on a weak Bal Sheet, which I think is unwise, and it kicks away the support for the share price from the dividend, given that they probably shouldn't be paying a generous divi, if at all, if they were being properly prudent with their finances. Just in my opinion, others may not see it that way.

So overall, it's not for me.

That's me done for today!

See you tomorrow at the same time.

Cheers, Paul.

(of the companies mentioned today, Paul has long positions in NXR and FWEB.

A Small caps Fund to which Paul provides research services also has long positions in NXR and FWEB)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.