Good morning! It's been another remarkable V-shaped rebound by the US markets in the last few days. This pattern just keeps recurring - i.e. a market sell-off, then an immediate and strong rebound all the way back up again. Although I'm wondering what will happen eventually when this pattern stops working? Maybe a more serious sell-off? Although with the US economy now being heavily boosted by the lower oil price, it's difficult to see why US equities would sell off in the face of a recovering economy. Who knows? I can't help feeling that this bull market is looking stretched though.

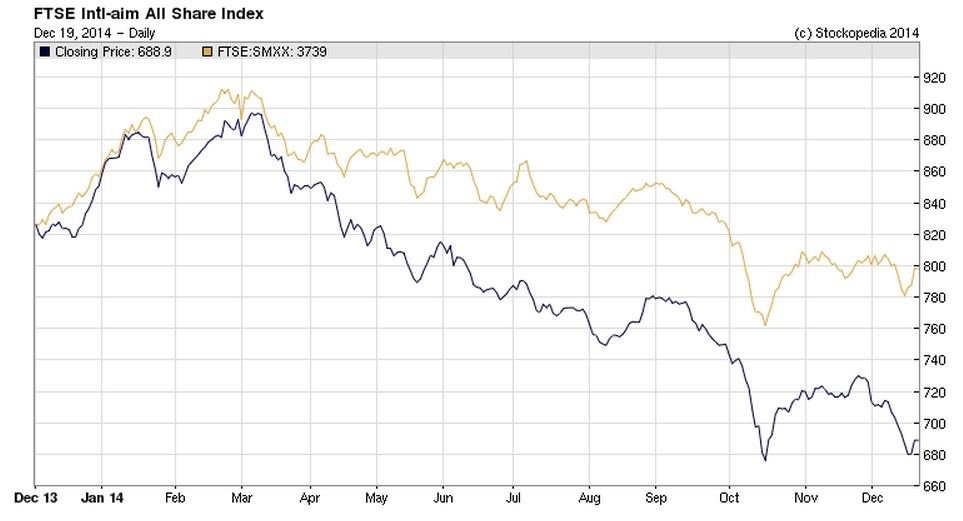

The US markets might be powering along, but there's no sign of a bull market in my neck of the woods, in UK small caps. We're still firmly in the doldrums, with AIM teetering only a few points above its lows for the year, and FTSE Small Caps also looking soft, here's the latest chart of both;

So if you only invest in small caps, then you've probably had a fairly rough year.

NATURE (LON:NGR)

Share price: 10.5p

No. shares: 79.3m

Market Cap: £8.3m

This company is an absolute disaster area, in my opinion.

Profit warning - yet again it has disappointed. It's got to the point where I don't think you can value the company on future expectations at all, as nobody (least of all management) seem to have any idea what trading is going to be like.

On the positive side, there is a £1.1m (initial revenue, so presumably with scope for more?) contract win in Norway announced today, for Nature's water & sludge treatment units.

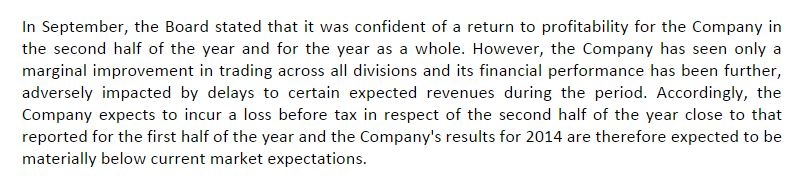

Everything else is negative, the key paragraph saying;

That's bad. "...materially below current market expectations" is nearly always enough to trigger a 30%+ fall in share price, and sure enough these are down about 35% today.

My opinion - with its operations mainly linked to the oil industry, it's bound to see continued difficult trading. The loss in H1 was about £1.0m, so a similar loss in H2 means that the full year results are going to look awful.

There was about £2.4m in bank debt on the Balance Sheet when last reported on 30 Jun 2014, although at that time it was more than offset by £3.0m in cash. My worry is that if the cash is now depleting, then will the bank remain supportive, given deteriorating trading losses? They might do, I don't know, but it's worth asking the question.

I note from the 2013 Annual Report that fixed assets includes £4.6m described as "vessels", so presumably they would be regarded as reasonable security by the bank, which should help.

Overall, I think these shares can really only be viewed as a complete punt. If the company can get things back on track, then there might be decent upside - after all, buying when sentiment is on the floor can sometimes be very profitable. Although I don't see any visibility of earnings here, and management have completely blown their credibility in my view, so it's not for me.

OpSec Security (LON:OSG)

Share price: 32p

No. shares: 101.2m

Market Cap: £32.4m

This seems to be a USA based group, listed on AIM (why?!) which I last reviewed about 18 months ago, here. I wasn't interested in it then, at 40p per share, and I'm not interested in it today either, at 32p per share. The company sells products related to security & anti-counterfeiting, eg. product security labels, security devices for passports, ID cards, etc.

Interim results for the six months to 30 Sep 2014 are published today. The headline figures look alright - adjusted operating profit for H1 is reported at £1.6m, double the £0.8m in the equivalent period last year.

The company raised £7m in a Placing & Open Offer in Apr 2014, but despite that the Balance Sheet still looks a bit stretched to me. The current ratio is alright, at 1.39 but there is an additional £13.9m in long term creditors which bothers me, especially the £11.5m borrowings. That looks too much debt for a company that is not very profitable. Sure you could net off the £5.9m in cash, but that's just a snapshot on the year end date - and most companies chase up customers to pay early for the year end date, so it's not normally a typical cash balance throughout the rest of the year. If it were, then the company would pay off some of the bank debt with that surplus cash!

My opinion - it's got too much debt, doesn't pay any divis, and hasn't got a good track record - i.e. it has not established that it can be consistently profitable. So there would have to be some special reason to make me want to invest here - e.g. a blockbuster new product, etc. Based on the historic figures, there is no reason to invest here in my view.

Judging from the volume bars on the chart below, it looks illiquid too - another negative.

Promethean World (LON:PRW)

Share price: 21.2p

No. shares: 203.2m

Market Cap: £43.1m

This company sells audio-visual equipment for schools, including electronic whiteboards. Looking at the historic figures, its glory days appear to be behind it. The company made big profits from 2008-11, but has been loss-making since.

Profit warning - the old chestnut of contract slipping from Q4 into next year is trotted out today;

My opinion - I like the way the company has quantified what turnover will be. It's not a disastrous miss - Stockopedia shows broker forecast turnover at £126.5m for calendar 2014. So they look to have fallen short by about 7% at turnover, although no doubt with operational gearing that will be a bigger miss at the profit level.

The interims were lousy, with a £3.7m "pro forma net loss", on turnover of £57.7m. So with H2 turnover looking to have only come in slightly higher, it looks like the business will possibly make a full year loss of perhaps £6-7m at a guess?

It looks to me as if a fairly serious restructuring is going to be needed here, to cut costs, and get the business back into the black. Until then it's very difficult to see any appeal of these shares.

Ideagen (LON:IDEA)

Share price: 37.5p

No. shares: 122.9m (pre Placing)

Market Cap: £46.1m

I meant to look at this one yesterday, but ran out of time, so am circling back to it now.

Acquisition & Placing - this is a very material acquisition, as Ideagen is raising £17.5m by issuing 51.5m new shares at 34p. Note that is a 41.9% increase in the number of shares in issue, and remarkably, the new shares are being issued at no discount to the market price at the time the deal was being arranged. It was over-subscribed too, further reinforcing that there is clearly considerable Institutional interest in this small cap software group.

The company being acquired is called Gael, which operates in the same area as Ideagen - i.e. risk, and regulatory compliance management software. I don't know enough about it to say whether or not it's a good acquisition, time will tell, but clearly Institutions were convinced that it was a good deal, as they were keen to finance it.

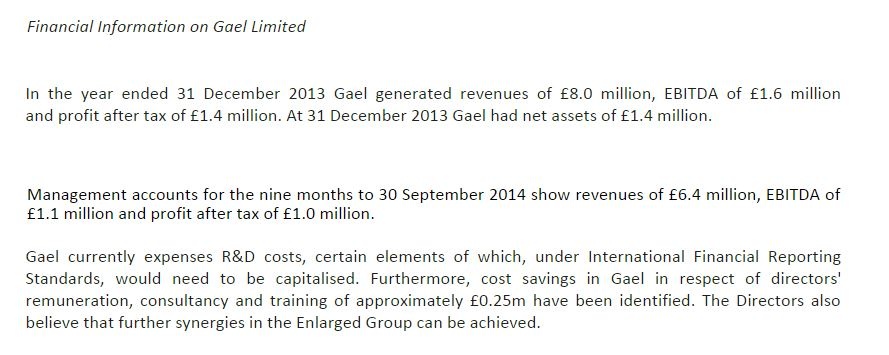

There is some financial info given on Gael, as follows;

It's good that Gael is profitable, and the price paid seems alright.

It looks as if Gael's profits are going to be massaged up now it's part of Ideagen, by starting to capitalise some development spend! That's quite revealing.

My opinion - I can see why people like Ideagen. There's a lot to be said for providing software into large organisations, such as the NHS, as once you're in, it's likely to be lucrative for years to come. This share has somehow never really appealed to me though - it's a tiny company still, although Gael will give it scale!

It's interesting that the shares jumped to a premium of the Placing price, so altogether a very well executed deal by FinnCap.

Real Good Food (LON:RGD)

Share price: 30p

No. shares: 69.6m

Market Cap: £20.9m

I've never liked these shares - the company has almost everything wrong with it that you can think of - a weak Balance Sheet, too much debt, it's capital-intensive, it doesn't make any profit, it's got a pension deficit, a legal dispute with a major supplier, selling to supermarkets (so being squeezed on price no doubt), the list just goes on & on!

Interim results - to 30 Sep 2014 are out, and they look pretty awful. Turnover is down slightly to £128.7m, but the loss before tax "and significant items" was £5.2m. Ouch. Net borrowings were a whopping £36.3m.

The management commentary sounds more upbeat though, so perhaps the company is now over the worst?

My opinion - it's much too high risk to be considered a sensible investment in my opinion.

Although in the past the shares have multi-bagged when it recovered from previous close-shaves with insolvency, so who knows, maybe it's one where the bold (or reckless!) punter might make a nice profit? It's not worth the risk of a 100% loss in my view.

All done for today & the week. Have a great weekend!

I'll try to record an audiocast this weekend, so will Tweet (@paulypilot) when that's published.

Also, the videos for Mello Derby 2014 are now available for viewing online (for a modest fee, to cover the cost of production) - here.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.