Good morning!

There's just one report today, from me. Graham is busy travelling back from Asia to Ireland, so he's got today & tomorrow off, and possibly Weds if he's jet-lagged!

Everything is winding down for Christmas now, so there shouldn't be a great deal of newsflow. Although I enjoy this time of year, as with many market participants off work, or too hungover to function normally, there can be nice little trading opportunities in small caps. Illiquid markets can often cause bizarre price movements - providing good buying & selling opportunities.

There's also a heightened risk of profit warnings occurring at this time of year, as some companies fail to close deals that they need, in order to hit full year forecasts. So I keep a close eye on the list of top fallers for the day - and hoping that none of those will be things in my portfolio!

Just Eat (LON:JE.)

Not a small cap, I know, but an interesting & topical share. I'm very interested in internet disrupters at the moment, as discussed last week. I came very close indeed to buying some JustEat shares last week, because it seems to be dominating its niche. Although I'd be surprised if the regulators let it go ahead with its proposed purchase of major competitor Hungry House.

However, something happened over the weekend which made me realise that JustEat has a fundamental flaw in its business model. In my London household we use JE probably twice a week, and have been trying out different local takeaways. Anyway, we've now found a curry place which is our favourite, by far.

Last night, the delivery man from our favourite curry house looked much older than the usual ones, so the penny dropped that this was probably the proprietor. As he handed me our meal, he thrust a few menus into my hand, saying - please order direct with us in future, and we'll either give you a bit of discount, or some free extras. So that's what we're going to do from now on - cutting out JE altogether from our future transactions.

Bottom line, I think by charging (apparently) 14%, JustEat are being too greedy, and thereby sowing the seeds of their own decline. Some business is likely to leak away, as takeaways connect with their regular customers, and persuade them to order direct, by telephone, instead of via the JustEat platform.

For that reason, there's no way I'll pay a forward PER of 34 times, to buy shares in a company that in time, is likely to see business leaking away to a certain extent. For customers, JustEat is a great way to sample different local takeaways, but once you've found your favourite, the owner may well induce you to bypass JustEat's platform in future.

I see the Chairman of JE has just sold 235,000 shares at 571.89p, banking over £1.3m.

CloudTag Inc (LON:CTAG)

There's an increasingly bitter Twitter battle raging between bulls & bears here. I'm watching from a distance, more for entertainment than anything.

The more disciplined I become in keeping away from blue sky stuff, the better my performance gets. They nearly all fail, so why bother trying to find the needle in the haystack?

EDIT: although I would add that shorting micro caps is extremely dangerous, and not something I would risk doing. What happens if the share price 10-bags on some amazing announcement? It's happened before.

I remember a while back, a company called CPP was shorted down to a few pence, but then it spiked up to 31p. That move absolutely killed some people who had shorted it & were convinced it was going bust. Very dangerous stuff, shorting small companies, best avoided I think, unless you have very deep pockets & properly understand the risks.

Windar Photonics (LON:WPHO)

Share price: 92p (down 3.2% today)

No. shares: 39.8m

Market cap: £36.6m

Trading update (profit warning) - there's a very muted market reaction to this profit warning. The company says that project delays has caused 2016 revenue to fall short;

While the Company has continued to experience an increased interest in its product offerings and particularly interest from major OEMs and large IPPs for participating in the Company's recently launched Wake optimization project, due to timing, logistics and in some cases the need for customization of deliveries, actual delivery of some of these projects is now expected to be pushed into 2017.

As such, the Board now expects annual revenue for 2016 to be in the range of €1.5 million to €2.0 million, which is slightly below market expectations but still represents revenue growth of between 60% and 100% compared to 2015.

The forecast data on Stockopedia says E2.57m revenues, and a E2.31m loss for 2016. So the actual result looks quite a bit below that actually, not "slightly" as the company says.

The outlook comments for 2017 sound upbeat though.

Subscription - a very small fundraising of £491k at 94p per share is also announced today. This strikes me as a bit odd. Why raise such a small amount of cash? The company was almost out of cash at the last set of interims.

The company makes a sensor for wind turbines, which they claim increases output by 1-4%, and potentially increases the life of the turbines.

My opinion - it's almost impossible to value this share, as it's dependent on future orders. Forecasts showing a leap in turnover to E17.8m, and a E5.2m profit in 2017 look a tall order.

I don't invest in this type of jam tomorrow stuff any more. Too risky.

Collagen Solutions (LON:COS)

I've had a quick look at interim results out today. Revenue is up 30% to £1.9m, but the trouble is that losses have worsened, to £983k, or a £418k loss at the adjusted level.

Cash has dropped from £2.5m to £1.7m in just 6 months, so it looks as if a fundraising is likely to be on the cards.

Shares are down 11% today, so the market cap has dropped slightly below £10m.

I wouldn't pay anything near that for it, as it's not yet clear that this is a viable business.

NWF (LON:NWF)

Share price: 173.5p (down 2.3% today)

No. shares: 48.6m

Market cap: £84.3m

Trading update - for H1, the 6 months to 30 Nov 2016.

More detail is given, by division, but the overall conclusion is this;

The Group reports that trading for the half year ended 30 November 2016 was lower than the prior year as a result of a weaker first quarter. Trading has been better in recent months and the Board maintains its full year expectations in terms of performance and net debt levels.

That sounds OK. However, I've found that the share price can often lurch down again when interim results are published, even if the company has forewarned that they're not going to be very good. A recent example of that was Trakm8 Holdings (LON:TRAK) .

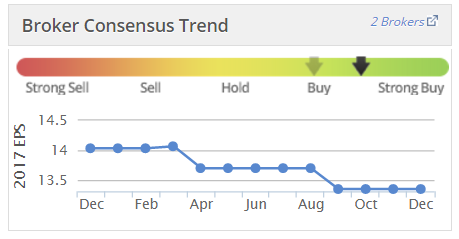

Also, a weak H1, combined with maintaining full year expectations, can increase the risk that there might be a profit warning in H2. The margin of safety may have gone, as regards forecasts. Although I note that broker consensus has dropped in the last year;

My opinion - it's difficult to find anything much of interest with this share.

It looks ex-growth, and on a PER of about 13, which doesn't interest me.

That's it for today, as there's nothing else of interest in my universe of small cap stocks.

See you tomorrow!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.