Good morning!

Avation (LON:AVAP)

Share price: 126.5p (down 9% today)

No. shares: 55.2m

Market Cap: £69.8m

Interim results - for the six months to 31 Dec 2014 are out today. This is an aircraft leasing business, based in the Far East. The market has reacted negatively to its interim results today, with the shares down 9%. Some of us have met with the company, as they were active on the investor circuit last year, appearing at a number of investor shows, and other investor events (including one of my Brighton investor evenings).

It's a straightforward business model, with experienced management, who know the pitfalls. So they buy aircraft, lease them out, and borrow at fixed rates and periods which match the leases. So in theory it should all be pretty simple, with Avation making a profit on the leasing charges exceeding the interest they have to pay on debt. Bad debts shouldn't be a problem, as aircraft are repossessed if necessary, and the client's security deposit forfeited.

From the research I've done, problems with leasing businesses usually arise when there's a recession, and the residual values on the assets end up being way below book value, leaving a hole in the balance sheet, which usually coincides with a withdrawal of borrowing facilities. Hopefully Avation should steer clear of these issues by carefully matching its borrowings to the leases of particular aircraft.

Profits - the interim figures appear to be quite a big miss vs forecast. Basic EPS is reported at $0.1139, so converting that into sterling at £1=$1.544 gives us 7.4p EPS for H1. I can't see why there would be any seasonal bias in a leasing business, so annualise that and it gets to 14.8p EPS (or $0.228) for the year.

The trouble is, broker consensus is for $0.33 this year, so that looks like a 31% shortfall against forecasts.

Adjustments? - this could be a presentational issue, as Avation has not published any adjusted figures today, and has not explained in the narrative anything about why some costs appear to have risen by a greater percentage than turnover.

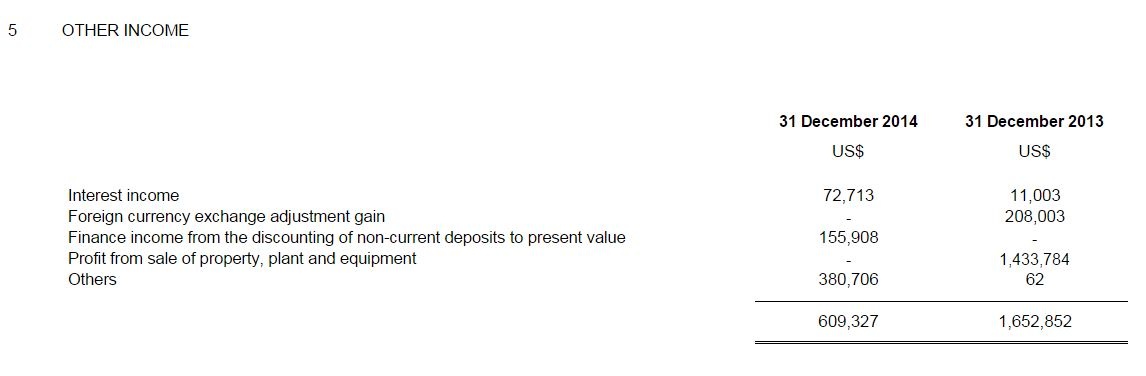

I note in particular that other income of $609k is significantly down on last year's H1 of $1,653k. Checking note 5, these look like one-offs, e.g. forex gains, profit from disposal, etc:

Why didn't the company present underlying, or adjusted figures in the headlines, so that investors can see the underlying trading picture more clearly?

Why also didn't they explain the big movements in overheads?

It's all rather unsatisfactory - results statements need to give a clear narrative explaining the main features of the results. There isn't really any proper analysis of the results in today's statement, so I think the company needs to go back to the drawing board on how it presents results. Investors need more info than this to make an informed judgment, especially where the reported figures appear to be well short of forecast.

I suppose we'll have to wait for an updated broker note to properly understand the figures.

Profit before taxation fell from $7.9m to $7.0m, but that is accounted for by the reduction in other income. So adjusting for that, then underlying profit is slightly up. Surely the company should have flagged this clearly in the headlines?

Cost of debt - a key figure, the average has improved to only 4.6%, which looks encouragingly low, compared with the gross rental yield of 13% (measured against NBV of the aircraft).

Taxation - note that a new, lower rate of tax has now kicked in, thereby boosting earnings. I seem to remember this was planned, and might be due to the company being domiciled in Singapore, but best check that, as my memory is imperfect.

Outlook - rapid growth is in the pipeline, with 13+ new aircraft due to join the existing fleet of 29, by the end of 2016.

Valuation - I remember thinking that valuing this company on a PER basis may not be appropriate, in a low interest rate environment, as that could mean that earnings are unusually high at the moment, possibly?

So I've been waiting for a time when the market cap matched the tangible net asset value, and we're pretty much there now, after recent share price falls. I note that NTAV is $117.1m (excl. minority interests) or £75.8m. The market cap is £69.8m, actually a 8% discount to NTAV.

My opinion - although there is uncertainty over earnings vs forecasts, and today's results appear to be an earnings miss, in my view once the shares are below NTAV then they are good value. Accordingly I bought a few more personally today at 130p.

This won't ever be a big holding for me, as I don't like leasing businesses. In this case though, I think management are experienced, so know how to avoid the main pitfalls. Being able to buy the shares at 8% below NTAV seems a reasonable buying opportunity to me. As always, this is just my personal opinion, it's not any kind of recommendation.

I note that Stockopedia is fairly neutral on this share, with a StockRank of 58, which is trending down. Worth a look though, and am interested in reader opinions, so please add a comment below if you have looked at this company, it would be good to compare notes.

UPDATE - I've just had a call from Richard Wolanski, Avation's FD. He's read my article, and wanted to respond to the points I raised, so I'm happy to relay the gist of the conversation here.

I asked how he felt about my criticism, and he said that he totally "takes it on the chin", and takes responsibility for today's announcement not adequately explaining the numbers. They will try harder next time. Although as I pointed out, it's the job of their broker & PR people to ensure the results are presented well, so they should share the blame.

- 5 new planes were delivered near the end of H1, so the H1 P&L did not see much benefit from that. However, H2 will benefit, thus we should see a stronger H2 than H1. Annualised turnover is currently running at about $60m p.a. - i.e. H2 should see turnover of about $30m, with a corresponding benefit to profitability vs H1.

- admin costs rose faster than turnover - overheads tend to be increased in steps (e.g. additional staff), which happened this H1.

- the reduction in average cost of borrowing to 4.6% is a big benefit that he didn't adequately emphasise in the results. On $350m debt, just a 1% saving is $3.5m p.a. over several years - so very significant.

- depreciating the aircraft faster from 1 Jul 2014.

- a further 40% growth in the fleet is planned in the next 12 months, so a similar impact will happen, with the P&L benefit flowing through in the first full half year that the new planes are leased out.

My (revised!) opinion - I'm a lot happier that this doesn't appear to be a big profit miss after all, although I'll be interested to see what the house broker's next set of figures look like. It wouldn't surprise me if they are trimmed back a little, but that's just my hunch.

I took a bit of a flyer (geddit?!) this morning buying some shares at 130p, but am more relaxed now that this was probably a sound decision.

Majestic Wine (LON:MJW)

CEO stepping down - with immediate effect, which strikes me as rather odd. The FD is becoming Interim CEO until a permanent replacement has been found.

Both sides give each other glowing tributes in the RNS today, make of that what you will. I am not familiar with the situation, but it does rather look as the CEO was pushed. Why else would it be immediate, with the FD taking over in the interim?

Nothing is said about current trading in today's statement. I wonder if trading is still lacklustre? After all, companies don't usually push out their CEO if things are going terrifically well, do they?

The valuation metrics here are beginning to look interesting, but my caution over this company has served me well in the past, so I'll keep watching from a distance methinks.

I used to drink industrial quantities of wine, but hardly touch the stuff now - too acidic. However, I have never stepped foot in a Majestic Wine. There's no need to, when there is such a variety available, and constant promos, from the supermarket chains.

EPS has been flat-lining here at about 26p, so given that there's little sign of earnings growth, why would you rate the shares above a PER of 10? That suggests a share price of 260p, versus the current price of 341p. So I'll steer clear. Nice 5% divi though.

Inland Homes (LON:INL)

Share price: 56.5p

No. shares: 202.8m

Market Cap: £114.6m

Trading update - this reads positively, with the company mentioning a "very strong performance" in H1 (the 6m to 31 Dec 2014).

Inland was originally a land regeneration specialist, getting planning permission on brownfield sites, then selling them on. However, it has more recently, and sensibly I think, been changing into a housebuilder itself. Therefore they now make the developer's margin too, as well as the margin from turning wasteland into housebuilding plots.

The land bank is becoming substantial, and is now 4,000 plots (which includes owned sites, as well as those under option, or pending).

Outlook - "well placed to deliver strong growth during the remainder of this financial year".

Broker view - WH Ireland today reiterated their 100p+ sum of the parts valuation, and 80p price target.

My opinion - I like this one. Indeed, I'm positive on housebuilders generally at the moment, especially ones in the South East. Whilst mortgage availability may be getting tighter, there are also signs of institutional money coming into buy to let in a way that we haven't really seen much of in the UK. It's strange, because in other developed countries it's quite normal for institutions to own a large percentage of the private rental housing stock, but that is conspicuously low in the UK. I think we might be at the start of a big shift on that front. If I'm right, then housebuilders could continue to prosper for years to come, even if owner occupiers find it difficult to purchase houses, because new house buyers might be institutional, buying whole estates in one go, rather than individual house buyers.

Promethean World (LON:PRW)

Share price: 23.15p

No. shares: 203.2m

Market Cap: £47.0m

Preliminary results - for the year ended 31 Dec 2014. These figures look bad to me, so I've added this share to my Bargepole List, of shares that are too high risk for me to invest in (it's certainly not a comprehensive list, in fact it's just the tip of the iceberg).

In a nutshell, what I don't like is that turnover is down heavily, down 16.3% to £118.2m, and the company is now significantly loss-making. It made a £7.9m operating loss. They refer to adjusted EBITDA being positive at £0.8m, but his ignores £9.8m of development spending which was capitalised into intangible assets!

So in reality the business is leaking cash badly. Net cash fell from £17.6m at the end of 2013, to £4.7m at the end of 2014. The company says in today's announcement that it will use a bank facility when the cash runs out. That doesn't exactly fill me with joy.

Balance sheet - this has deteriorated noticeably in the year, and is flashing me amber warning signals. The current ratio was 1.7 at end 2013, but had fallen to 1.28 by end 2014. If that trend continues, then I wouldn't be surprised to see a Placing being required to prop up the finances. Banks don't like funding losses, so I'd be very surprised if the bank are happy to just let them run up an overdraft.

My opinion - these shares are a punt on the company improving its trading. If that doesn't happen, then the future looks bleak. It's not something I would want to take a risk on. That said, the company does refer to potential improved sales from the replacement cycle kicking in, and new software it has developed.

That's enough for today. Back in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in AVAP and INL, and no short positions. A fund management company with which Paul is associated may hold positions in companies referred to)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.