Good morning!

It's just me (Paul) reporting today, as Graham is busy with other stuff. There's lots to cover, so I'll be taking my time & updating this article throughout the afternoon.

Time permitting, I hope to cover the following companies today;

ST Ives (LON:SIV) - shares down 40% on another profit warning.

Revolution Bars (LON:RBG) - in line trading update, and solid Xmas trading.

FreeAgent Holdings (LON:FREE) - interesting deal with a major bank.

Portmeirion (LON:PMP) - slightly ahead of expectations for 2016

Mission Marketing (LON:TMMG) - good trading in 2016, so management have decided it's time to help themselves to some upside with a "growth shares" scheme. I'm selling my shares, in protest.

ST Ives (LON:SIV)

Share price: 84p (down 33.6% today)

No. shares: 142.8m

Market cap: £120.0m

Trading statement (profit warning) - it's deja vu time. This marketing group warned on profits in Apr 2016, and the shares dropped 45%. I reported on that here. The same sort of thing has happened today. Today's RNS covers H2, being the half year to 27 Jan 2017.

Problems mentioned today are;

- Project deferrals & cancellations

- Delays in generating replacement work - full benefit of which won't happen until Q4

- "Very challenging" conditions in its marketing activation division - which relies heavily on clients in the grocery market.

- New business won, but on lower margins.

- Cost-cutting has been done, but again the benefit won't be felt until Q4.

This naturally all feeds through to reduced profits.

Outlook - not good;

As a result of the above, the Board now anticipates that the out-turn for the full financial year will be materially below its previous expectations with the majority of the shortfall due to the pressures within the Marketing Activation segment.

The Board remains confident in the long term strategy currently being pursued, and in the growth opportunities open to the Group. The balance sheet remains sound and we have the necessary cash flow capabilities to support our investment priorities and to further reduce debt.

"Material" in the context of profits means 10% or more. I hate it when companies use a phrase like this, as it leaves us completely in the dark. It could be a 10% shortfall, or a 20% shortfall, who knows? They should give figures, not words. So in this case, the company should clearly state that they expect profits to be, say 10-20% below market expectations.

I have to plough through thousands of trading updates every year, and it really bugs me that so many are badly written, and fail to give readers the accurate information we actually need. Instead we now have to struggle to get hold of the latest broker updates. Brokers will of course have been given a steer by the company. So the market is left in the dark, whilst brokers are given the information that everyone should be given. What a daft system.

Broker downgrade - I've managed to track down one broker note this morning, which has reduced its profit forecast for this year by almost 22%, to £25m. The broker reckons generous divis will be maintained. It also believes that there are no issues with banking covenants.

This is all vital information that we all need to be told by the company, yet none of these points were included in the profit warning RNS. It's just not good enough, and means that private investors are left in the dark, whilst the city receives privileged information. That's clearly not right.

Balance sheet - when a company says that its balance sheet is sound, more often than not it's a red flag (because if a Bal Sht really is strong, then they don't need to tell anyone - it's obvious!).

Sure enough, in this case the group actually has a weak balance sheet, laden with £189m of intangibles. Write those off, and you get to a negative NTAV position of -£55m. There is a lot of bank debt, and also a (last reported) pension deficit of £26.4m.

Therefore, far from being "sound", the balance sheet is actually weak, and the group is heavily reliant on its bank remaining supportive. That's fine if it remains decently profitable, which it still is. However, what happens when the next recession kicks in, and profits collapse? (which always happens at marketing companies, as clients slash discretionary spending as recession bites).

I've checked the last annual report, and it does have freehold & investment property in the books at around £20m. Although that's only around a quarter of the last reported net debt of about £81m.

Note from the Stock Report how net debt has been steadily increasing - from a £16.3m net cash position in 2011, to £80.8m net debt in 2016. That's a huge change (deterioration) in the group's financial position. So it's essentially been growing through acquisitions, fuelled by ever-increasing debt. Sounds horrible to me.

Dividends - during this time the company has also been paying generous dividends, which really doesn't make sense when bank debt is increasing dramatically, as it has since 2011.

In my view the company has been reckless in paying big dividends, fuelled by debt effectively. I wouldn't rely on the dividend yield remaining at this level. The 7.8p forecast divis this year are now about 9.3% yield. When yields go much above 6-7%, the market is telling you that the payout probably won't be sustainable. That's what the weak balance sheet is telling me too.

My opinion - I've never liked this share. A weak balance sheet, combined with what seems like limited visibility of earnings, and big exposure to a problem sector (grocery), plus possible macroeconomic headwinds, all adds up to a situation that is best avoided, in my view.

I think this is a good example of a value trap - where the apparently bargain low PER & great divi yield have turned out to be not such a bargain after all. That happens a lot. So it's not for me, and I definitely won't be bottom fishing here.

Ed has taught us that buying after profit warnings is usually a mistake. I'm trying very hard to teach myself to stop catching falling knives - which is one of the 2 big leaks in my performance (the other being selling good companies too early).

Revolution Bars (LON:RBG)

Share price: 215.75p

No. shares: 50.0m

Market cap: £107.9m

(at the time of writing, I hold a long position in this share)

Trading update - covering H1, being the 26 weeks to 31 Dec 2016.

I'm perplexed as to why the share price has reacted negatively to a solid, in line trading update. Still, people can have all sorts of reasons for wanting to sell, and it's an illiquid share, which moves a lot on not much volume. So I tend not to worry about short term price fluctuations.

The main bit says;

Trading results are expected to be in line with the Board's expectations, reflecting a further period of growth in the number of sites, revenue and profit.

Like-for-like sales* rose by 2.0% for H1 FY17. Overall sales, including the contributions from new bars, were £66.6m for the same period (2015: £59.1m), +12.7%.

LFL sales growth of 2% should be enough to deal with cost inflation. Especially given that RBG's gross margin is very high.

Director comments confirm that the 4 new sites opened in time for Xmas all delivered encouraging initial trading.

My opinion - I'm as bullish as ever on this high quality retail roll-out. The key figure for any roll out is what return on capital is achieved on new site openings. In this case, it's excellent, at about 35-40%. That gives a payback period on new sites of less than 3 years, which given the capex is typically £1m per site, means each new site bolts on several hundred £k extra profit.

Rents are cheap, because the High Street is thinning out, as conventional retailers go to the wall. The new Reading site I visited in Dec 2016 for example, used to be an HMV. RBG has done a wonderful refit on it, and it's now very much an aspirational place where people go to eat & drink all day - not just in the evenings.

Best of all, RBG has no debt. So the valuation simply doesn't make sense to me. I think the PER should be 15-20, not around 12-13. Moreover, with patience, the roll-out could accelerate. The new Revolucion de Cuba format is working very well, and I don't think the market has woken up to the excellent performance of this newer branding, and different format from the traditional Revolution Vodka bars.

Patience is likely to be rewarded here, in my view. In the meantime we're being paid a 2.6% divi yield for now. I've stress-tested the figures, and because it has no debt, RBG could survive even a severe recession - it only reduces to about cashflow breakeven if you model a c.20% drop in sales, which was what killed highly indebted Luminar a few years ago.

FreeAgent Holdings (LON:FREE)

Share price: 107p (up 6.5% today)

No. shares: 40.6m

Market cap: £43.4m

(at the time of writing, I hold a long position in this share)

Contract with RBS - I only comment on contract wins that appear to be significant, in terms of being likely to trigger broker upgrades, and subsequently improved profits. Although the Directorspeak says that it's too soon to expect any material benefit to revenues in the current financial year (ending 31 Mar 2017).

The deal is that Royal Bank of Scotland is planning to give FreeAgent software (which usually costs about £25 per month, with first 6 months half price) to its small business customers, as part of a package. We're not told what bulk discount (if any) RBS has negotiated. Also we're not told what the package is - so I can't yet assess whether it's likely to be something that many customers will take up, or not. It sounds promising though.

I've not mentioned this company before in my reports here (although several of us were discussing it on Twitter a few weeks ago. It's a cloud-based accounting software company, targeting UK micro businesses (from 1 to 10 employees). The product can be seen on their website here.

I try to keep on top of new issues, and this share was listed on AIM in Nov 2016. The Admission Document sounded interesting, so I decided that the best research to do next was to actually try out the product. There's a free trial on the company's website, which is very easy to set up, as it's a cloud-based programme. So it's up & running all the time, from any computer, with no downloads, or security issues for end users to worry about.

To cut a long story short, I liked the software so much, that I moved one of my own little companies onto it, and became a fully paid-up subscriber. That reminds me of the old Remington shaver adverts - "I liked it so much, I bought the company!"

Valuation - this is where things don't look quite so rosey, I'm afraid. As with lots of up & coming growth companies, the valuation looks rich at the moment.

The company is still loss-making, although it is demonstrating a steadily rising stream of high quality recurring revenues. Customers are sticky, because the product is so good. A lot of micro businesses go bust, but more often than not the same person/people will resume trading through a new company. So FreeAgent would continue having that client.

FreeAgent is forecast to reach breakeven in 2018. Thereafter, it should become profitable.

Competition - there are other cloud-based accounting packages available Xero is possibly the best known. I am told that QuickBooks and Sage are also now selling cloud-based small company products too, and there must be lots of others too. However, FreeAgent seems to be the only decent package that is specifically designed for micro businesses. Xero is very good, I've used that too, but it's not as user-friendly as FreeAgent, for micro businesses anyway.

My opinion - this share ticks the right boxes for me, as a growth investment. Valuation is high at the moment, for sure. I imagine that most readers won't want to pay up-front for growth, so this share may not appeal.

However, the best long-term growth companies are never cheap, even when they're small. Overall though, I like it, and could see the RBS deal accelerating growth. So, taking a long term view, this could be an interesting growth share, providing nothing goes wrong.

I am nervous about competitive pressures, and the cost of acquiring new customers. However, the secret weapon of FreeAgent may be firms of accountants. I've checked with several, and they all said that FreeAgent is the best software for their smallest clients, and it's the one they recommend.

I've just done a whole year's business accounts on FreeAgent. Instead of a whole weekend typing into spreadsheets, it took me only a couple of hours to download all the bank transactions, then go through them on my smartphone, telling FreeAgent what they are. Then it learns, and automatically classifies them in future (in theory, but it didn't prove terribly good at that bit). Bank transactions will now sweep in overnight automatically, so no keying in at all! I can raise invoices (even automatic monthly ones), take a photo with my iPhone of receipts & attach them to my expenses claims for each client - all done on my phone. It's an absolutely outstanding product - try it!

I then emailed my tax accountant a login, and he reviewed everything, and even put through all the year end journals relating to tax. FreeAgent reminds me when to pay, etc. It's really good.

The shares are more speculative, and are a bet on it reaching & exceeding breakeven in the next 2 years. There are no guarantees that will happen of course.

Portmeirion (LON:PMP)

Share price: 977p (up 30p today)

No. shares: 11.0m

Market cap: £107.5m

Trading update - this update is for the year ended 31 Dec 2016. The most important bit says;

Portmeirion, the manufacturer and worldwide distributor of high quality homewares under the Portmeirion, Spode, Royal Worcester and Wax Lyrical brands is pleased to confirm that it expects profit before taxation for the year to 31 December 2016 to be slightly ahead of market expectations.

Slightly ahead is clearly positive. Although note that expectations were sharply lowered in Jul 2016 (from 70p to 56.5p), following a profit warning.

Revenue for 2016 is up 11% to "over £76m", but this is flattered by the acquisition of Wax Lyrical, and the benefit of weaker sterling vs the US dollar. This papered over the cracks - sharply worse trading in the key S.Korea market, and India;

"As we advised in the summer, our Indian and South Korean markets have been challenging in 2016; total revenues from these two markets were over £7 million below the reported revenue for these markets in 2015.

Nevertheless, as a Group we have again produced record revenues, a result which shows how resilient the Group is to such external shocks. We look forward with confidence."

That's a big fall in sales from those 2 markets. I don't think the company has adequately explained what actually went wrong. Why did customers in those countries suddenly reduce their purchasing so much?

My opinion - I liked this company in the past, due to its steady, reliable profit growth. Profit is down in 2016 vs 2015, despite having the benefit of 8 months trading from a sizeable acquisition benefiting 2016 results vs 2015.

So this means that the core business went backwards a lot in 2016, vs 2015. For that reason, I am a lot less keen on this business than in the past. I think management need to properly fess up about what went wrong, and what they're doing to fix it.

For the time being therefore, I'm happy to sit on the sidelines, in case there might be more problems.

Mission Marketing (LON:TMMG)

Share price: 43.25p (down 3.9% today)

No. shares: 84.1m

Market cap: £36.4m

Trading update & growth shares - this is a group of marketing/PR companies. It's looked cheap for a long time, on a low PER. Today the company says that 2016 ended well;

We are pleased to report that the missiontm has again experienced a strong second half, and accordingly the Company expects 2016 to be a year of further growth, both in terms of operating income ("revenue") and profitability. Headline profit before tax for the year to 31 December is expected to be 8% higher, at £7.0m.

The trouble is, this RNS omits the most important information I need to judge its performance - namely whether results are in line with market expectations or not. Stockopedia shows a forecast increase of 17.6% in revenues to £155.5m, and a 44.6% increase in net profit. However, the forecast shown of £5.8m net profit may not be calculated on a comparable basis to the £7.0m mentioned above. So I'm a little confused as to whether this is above, in line, or below market expectations.

Luckily, I've just subscribed for Research Tree today, as it suddenly dawned on me that I'm risking thousands of pounds with every trade, but am too tight to pay out £22.50 per month for ready access to some useful broker notes! I think that's called penny wise, pound stupid. I do get access to broker notes via my stockbroker, but there's a delay, and it's a pain having to request them by email individually.

Research Tree shows 3 broker notes today on TMMG, from Edison, Hybridan, and FinnCap.

Edison says that headline profit will come in £0.2m below broker forecast! So TMMG has been using spin in its RNS, to deceive us into thinking that they were trading better than expected, when they actually were not. Dear oh dear. You have to be so careful with PR companies, as they just can't help going into spin mode, with their own results.

FinnCap says that 2016 has come in "broadly in line" with its forecasts, i.e. slightly below.

The Hybridan note is just a short summary of the RNS, so not much use to me.

Balance sheet - my warning klaxon has just gone off, as TMMG claims to have a strong balance sheet in today's update - usually a good indicator that the balance sheet is actually ropey.

I've checked back to the latest published balance sheet, with the interims, as at 30 Jun 2016, and sure enough, it's a weak balance sheet. Specifically;

NAV of £75.1m is dominated with intangibles, so NTAV is poor at minus £6.9m! Strong balance sheet? I don't think so.

The current ratio is a little low, at 1.08.

However, there's also a big lump of longer term liabilities - totalling £14.8m, being mostly bank loans of £11.2m, and acquisition payments of £2.9m.

Although it sounds as if things are weak, but not problematic;

The Company's balance sheet remains strong and, despite settling over £3m of acquisition obligations during the year, gearing and debt leverage ratios are expected to be lower than those of 2015 and comfortably within the Board's target.

Growth share scheme - no details are given, but this sounds like one of those awful value creation plans:

The Board remains committed to increasing shareholder value and intends to launch a growth share scheme later this quarter to incentivise board and operational management.

This type of scheme is basically an elaborate form of theft, and like many other private investors, I deplore such schemes. Anyway, I will await details.

My opinion - I don't trust any management who introduce elaborate schemes to line their own pockets at the expense of shareholders. Schemes which use a new type of share capital in an intermediate holding company are particularly loathsome.

Anyway, I wasn't particularly keen on keeping these shares, so the news of their "growth share scheme" tipped the balance for me, and I've ditched my holding as a result. I can cope with a modest share options scheme, to lock in key management, and better align their interests with shareholders. However, VCPs or growth share schemes are a step to far. They're just brazen theft of part of the company from its rightful owners. Management are already incentivised - by being paid generously.

Page 32 of the 2015 Annual Report details a whole page of various nil-cost options - which itself is a terrible idea. Share options should be priced at the share price prevailing when they are issued. The upside should only come from share price appreciation.

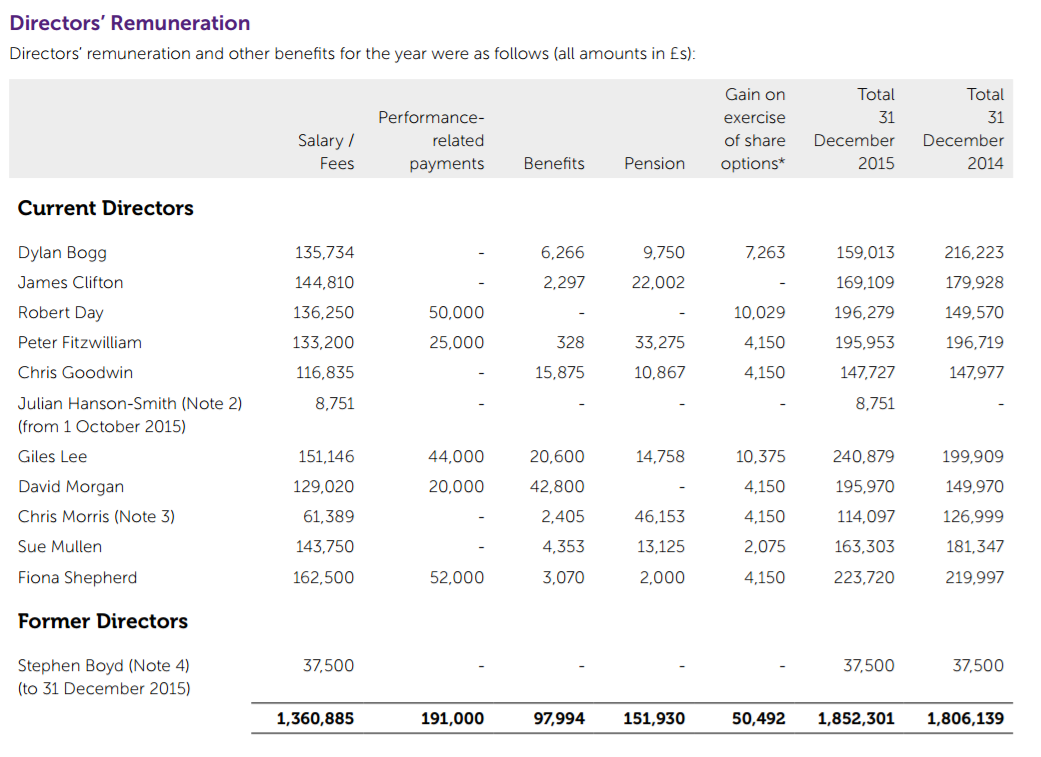

Mind you, to be fair, I've looked at Director remuneration for 2015, in the Annual Report, page 50, and it's not excessive (mind you, remember these are not London rates, its offices are outside London).

That's all from me. I'm having a day off tomorrow, so Graham will be reporting. I'll email Graham some comments if anything relevant to me crops up on the RNS.

Best wishes, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.