Good morning! I'm running slightly late this morning, due to over-indulging in canapes at some friends' launch party for their insured crowdfunding venture, called Archover, at the IoD last night. Things are really starting to change, with the traditional banks being increasingly being by-passed through new portals which connect savers and borrowers.

Norcros (LON:NXR)

Results for the year ended 31 Mar 2014 have been issued by this bathroom fittings company which I've written about extensively before. It's probably the nearest thing to a value share out there, with a particularly low PER. Most other businesses of this size and type are on a PER in the mid to high teens, whereas this is about 9. That's a clear pricing anomaly in my view.

I'm just going through the figures now, so will update this article over the next couple of hours, therefore please refresh this page later today.

Somewhat belatedly I got round to looking at the figures from Norcros, and have to say I'm very pleased to continue holding the shares. These are not the easiest accounts to interpret, as there are a number of distorting factors, namely;

- Sharp depreciation of South African currency (39% of group turnover was from S.Africa last year)

- Acquisition of another UK business, Vado.

- Legacy property issues (empty warehouses & surplus land)

- An unusually high finance charge of £7m, although £4.6m of this was foreign exchange contract movements.

- IAS19 adjustments to the pension fund accounting.

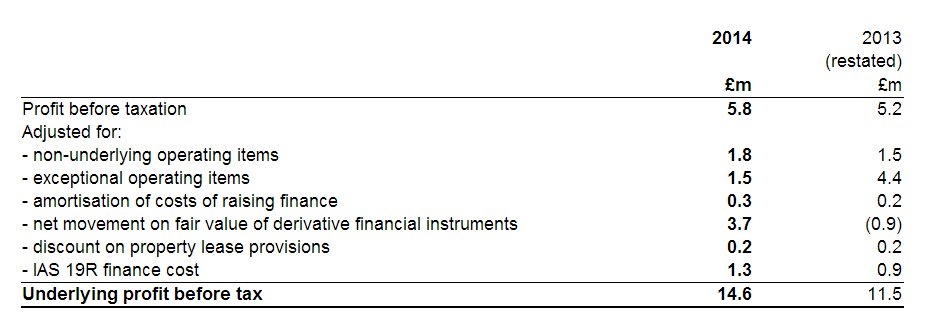

However, the company has helpfully included a table showing how they arrive at £14.6m underlying profit, and personally I am happy that these are bona fide adjustments to strip out unusual items that are not part of the underlying performance of the business:

Rather than ploughing through all the detail, I am prepared to accept the underlying diluted EPS figure of 2.1p. In valuation terms then, that means that at 19p Norcros shares are only on a PER of 9. In my opinion that is a bargain, although as always please DYOR.

There is a humungous pension fund at Norcros, although it's reasonably well funded, and the deficit shown on the Balance Sheet has shrunk from £30m to £21.8m. As interest rates begin to rise, the deficit should reduce or melt away altogether. Overpayments are just over £2m at the moment, which is 10% of underlying cashflow. So it's not a huge issue in my view. The only other thing to consider is that the pension scheme probably makes it very unlikely that Norcros will be taken over any time soon. So you could argue that the share price includes a discount for that factor.

Net debt looks fine to me, at £26.9m, which the company reports is only 1.2 times EBITDA, which is well within the boundaries of what most banks consider reasonable.

The company's strategy is to double in size, to revenue of £420m by 2018, through organic growth, and further acquisitions. I think management have demonstrated with Vado that they are capable of making the right type of acquisitions, and Vado looks like the jewel in the crown now, with strong reported figures for 2013/14.

Hopefully the replacement cycle of c.7 years for electric showers should begin to improve things at Triton too. The core businesses seem to be performing OK, in competitive markets.

Overall, I like it. This is a nice value share in my view, and it also comes with a 3.2% dividend yield - hence I'm happy to hold for maybe several more years, and I think at some point the shares are likely to decently re-rate. After solid results, this looks a good point both on the chart, and on valuation to be buying, in my opinion only - as always this is never a recommendation, just my personal opinion.

The sell off from 25p down to 19p seems to have been caused by general market background noise, rather than any specific to Norcros.

My apologies for the tardiness in publishing this update.

As always, comments in the comments below please!

Regards, Paul.

(Paul has a long position in Norcros)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.