Good morning!

NB. There won't be a SCVR tomorrow I'm afraid, as I will be attending the London Value Investing Conference. I will however report back (at a later date) on the LVIC, with one or two articles here on the talks which I find most interesting.

I've been glued to my screen this morning again, watching all the excitement going on with Plus500 (LON:PLUS) following their regulatory problems (inadequate client identity checks, it seems). I seem to have confused some of the gentlefolk on bulletin boards, by writing a blog here yesterday afternoon saying that I didn't like PLUS, never had done, and wouldn't go near it, but then posting on Twitter about half an hour later that I'd gone long!

The explanation is very simple - this blog is me with my sensible hat on. So this is about value investing, and longer term views of companies. However, I also like to do a bit of short term punting on the markets too - partly for fun (it's exciting), but also overall I make money at it too. The two things are very distinct activities. A lot of people do the same thing - shorter term trading gives us something to do, whilst we wait for our long term positions to either succeed or go wrong.

As this is a value-orientated report, I don't tend to mention my short term trades here, as that's not what these reports are about, although I will always disclose whether I hold a particular share or not, when mentioning it.

There are loads of results I want to cover today, so will probably spend all afternoon writing this article. I have a call with CEO/FD of Zytronic shortly, then a Synety AGM to "attend" by webinar. So busy, busy!

Zytronic (LON:ZYT)

Share price: 287p

No. shares: 15.3m

Market Cap: £43.9m

(at the time of writing, I hold a long position in this share)

Interim results - this is one of my favourite companies. Zytronic manufactures bespoke touch-screen displays, with superior performance characteristics, in N.E. England, primarily for export.

Interim results to 31 Mar 2015 are out today, and look good in my view. The share price dipped early on, as I think some people failed to notice that a £0.4m forex cost is buried in admin costs, so the underlying result is better than it at first appears.

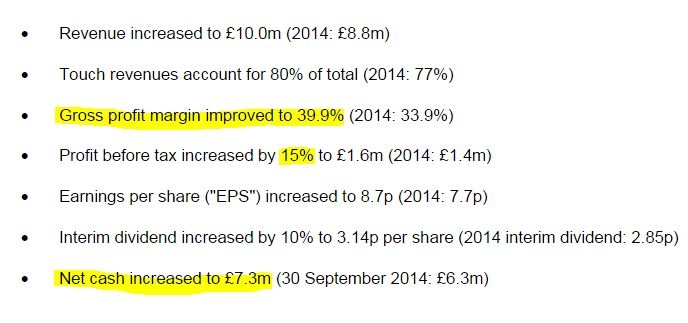

Key numbers (remember these are only a half year, and H1 looks to be seasonally softer than H2);

I've highlighted the items which particularly interest me. The big rise in gross margin is a very good sign - this is due to a higher proportion of larger displays being sold. Note that the gross margin was 26% in 2013, 34% in 2014, and nearly 40% this year. So a terrific progression there, in the last three years.

The obvious question is why did profit before tax only rise by £0.2m to £1.6m, when gross profit was up £1.0m to £4.0m? The answer is mainly that admin costs rose by £0.7m, as follows;

Operating costs were up £0.3m, including £0.2m for salary increases, and share-based payments. Note that Zytronic doesn't try to strip out share-based payments as many companies do, it properly recognises them as remuneration - conservative & truthful accounting, which I very much like, and wish we saw more of it with other companies!

FX charges of £0.4m, being a £0.2m tranlational loss (vs £0.1m gain in H1 last year), and a £0.2m cost of marking to market forward exchange contracts.

I'm happy to regard the FX stuff as non-underlying, and there is no mention of forex in the interims from last year, therefore to my mind the underlying profit before tax really rose from £1.4m in H1 last year, to £2.0m this year (i.e. adjusting out the forex cost this year). Or if you reverse out last year's £0.1m favourable move, then the underlying profit growth is greater still, at £1.3m to £2.0m this year. A healthy underlying picture therefore.

Dividends - are generous, and sustainable (they didn't cut the divi when trading was tough a couple of years ago). The H1 divi has risen by a slightly larger percentage than usual, and is up 10% to 3.14p. The final divi should be about 7.86p, to give 11p for the full year. That's a healthy 3.8% yield, and looks set to continue growing.

Balance Sheet - bulletproof. It sails through my tests, and note that net cash is £7.3m, or nearly 48p per share! That's a material factor when valuing the company, at 16.7% of the share price. It's genuine surplus cash too, in my view. There are no hidden nasties, indeed trade payables are only £1.7m, suggesting that Zytronic uses its financial strength to pay suppliers promptly & hence get discounts and better service, I imagine.

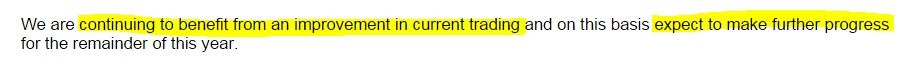

Outlook - as ever, this is the all-important bit. Historic performance is of passing interest, but as investors we're really interested in what the future holds. Management here are not given to hyperbole, and given the limited visibility of their order book, it makes sense to be prudent.

They sound confident about the outlook today;

Valuation - whilst not specifically mentioned, the company sounds by default, to be in line with expectations (they would have to say so otherwise), which is for 20.9p EPS this year, and 23.8p next year. So the PER is 13.7 times this year's forecast. Take off the 48p per share net cash though, and you get an EV of 239p, therefore a cash neutral PER of just 11.4 times this year's forecast earnings. That looks really good value to me.

My opinion - I'm about to have a chat with management, so will publish this for the time being, then update this article this afternoon with my feedback from the call.

Update: Have just had a good call with management. Nothing much to report really, it was all just me asking questions on the detail of the numbers, and asking them about the general outlook, competitive landscape, etc.

As things stand now, management sound optimistic, as stated in the RNS today. The £0.4m currency hit in H1 was a bit of a one-off, and might even reverse a bit in H2. Their Taiwan office is now open, so sales into China are easier. Competition is mainly for smaller screens, but Zytronic are making progress with larger screens, where there is little competition, so good pricing power. Demand is good. Curved screens - are starting to sell (e.g. for gaming machines). Some additional capex is needed, to replace ageing machinery, but should be similar to depreciation charge, so nothing to worry about. Mortgage is a fixed term, so will be paid off from cash reserves in 2017, saving a bit of interest. They hedge currencies about 12 months ahead, so have certainty of margins on sales.

The Achilles Heel of this (and many smaller, manufacturing companies) is that whilst they have a good sales pipeline, order visibility will always be a problem - it's typically 4-8 weeks. So gaps can open up in the order book, and hence there will always be the risk of a profit warning. There's nothing they can do about this, they've tried everything, but it's just the nature of the business, and shareholders need to understand & accept that (my words, not theirs, I hasten to add).

Overall, I'm very happy to tuck away & forget my Zytronic shares for another six months! I think the company is a quality outfit, and the shares are good value, but as always that is just my personal opinion, and not any kind of recommendation.

The two year chart below still just shows the profit warning this time two years ago. Buying 6-8 weeks after the profit warning would have been a very good entry point. This reinforces my view that fundamentally sound companies should generally not be sold after profit warnings, providing the profit warning is something temporary, and fixable. That's not always easy to determine of course, so there is an equally sensible argument to sell out (if you can), and sit on the sidelines until the dust settles.

accesso Technology (LON:ACSO)

Share price: 585p

No. shares: 21.9m

Market Cap: £128.1m

AGM trading update - today's update is dripping with positive comments, here is part of it, to give a flavour;

It continues in the same vein for several more paragraphs.

There's no mention of performance against market expectations though, so I presume that they must be trading in line.

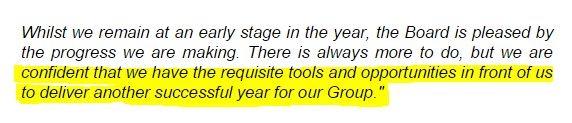

Outlook - this is beautifully crafted to not really say anything specific!

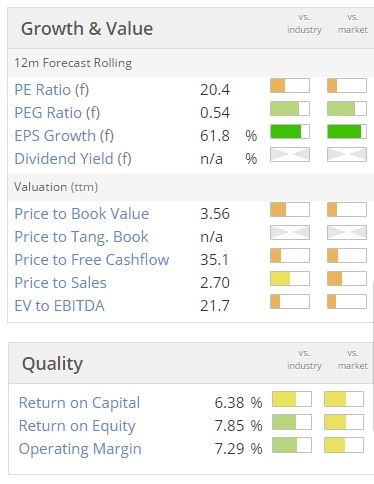

Valuation - this share has often look significantly over-valued in the last few years, but it looks more sensible these days, with the forward PER having come down to a still fairly ambitious 20.4

As you would expect for a growth company, it doesn't pay divis. Note that the quality scores are not especially exciting.

My opinion - the smart money was made on this share when it was a major multibagger from the Lo-Q days, a few years ago. The valuation got well ahead of reality a while back, but management have played a blinder - using the toppy valuation to go on an acquisition spree, thus creating growth which has now arguably justified the high valuation.

I think it would be interesting to analyse how much growth is organic, and how much has been bolted on through acquisitions - there seems to be some bank debt involved now, which needs watching.

The outlook comments today sound very good indeed, so it would be surprising if the company did not at least meet, and maybe beat expectations for this year. As such, I think it's looking potentially interesting, for the first time in a while. The quality of earnings should be pretty good, as there seems little competition, and once water parks & the like are signed up, that should then be long-term recurring revenue.

So worthy of a closer look, in my view.

Somero Enterprises Inc (LON:SOM)

(at the time of writing, I hold a long position in this share)

A very useful AGM report has been posted here on Stockopedia by "VegPatch" - he attended Somero's AGM today, and in particular has clarified the issue of slowing growth in China. It sounds a lot better than I feared from the RNS yesterday. In particular VegPatch says;

My opinion - I'm glad this point has been clarified, as I was worried about the apparent loss of sales momentum in China, and the apparently contradictory RNS yesterday. Things sound much better than I feared, so that is a relief.

Furthermore, I see Simon Thomson of Investors Chronicle has today written a bullish piece about Somero, which he sees as attractively priced. He's right too, it is attractively priced!

Idox (LON:IDOX)

Trading update - shares in this software company, specialising in the public sector, fell 7% today to 37.5p, so clearly this update was not well received.

The update today covers the six months to 30 Apr 2015. The summary says;

Sales to the public sector (75% of group revenues) are up 14%, but the balance (called the EMI division) are down 28%, with the blended result flat against H1 last year.

Net debt has reduced from £15.8m to £9.7m in the last six months, although it's worth checking the seasonality of that (i.e. what was the equivalent figure 12 months ago).

Costs have been cut promptly in the EMI division, hence why the group is still in line with market expectations.

My opinion - this doesn't sound too bad to me. The shares are now valued on about 11-12 times forecast earnings, and pay a 2% divi. The Balance Sheet isn't great, but has improved in recent years. Overall, I wouldn't rule it out, and it might be worth a deeper look, because margins look to have improved considerably recently.

Set against that, I imagine the stock is on a modest rating because investors might be worried about continued constraints on public spending budgets. The stock looks to find good support from investors around 30-35p, so I might put this one on the watch list, with a view to buying any further dips, possibly. On the other hand, it wouldn't be a conviction buy, so maybe not.

Tangent Communications (LON:TNG)

Results for the year ended 28 Feb 2015 look poor to me. This is an online printing business, e.g. printed.com and goodprint. I might have ordered some business cards online from them a while ago?

Whilst turnover is only slightly down, at £26.25m (£26.5m last year), underlying profits have tanked, down 53% to £1.2m.

The business does have an ungeared Balance Sheet though.

The outlook comments don't sound great.

Overall, I'm struggling to see anything of interest here, and it's not even particularly cheap at 3.5p per share, for a £9.7m market cap, so I'm dropping coverage of this company, unless performance improves significantly. There are lots of these companies around, with nothing much to distinguish them, so it's just a race to the bottom on prices, and hence profits permanently under pressure.

I think to be attractive investments, companies have to do something different - and hence have pricing power. Or, they have to just execute so well, that they destroy the competition. Does this company do either? Doesn't look like it. With performance deteriorating, and the market cap low, I'd also be worried about it possibly de-listing at some point, which is an instant 50% loss on announcement. Shares in companies this size are also illiquid, and have a wide spread, so why bother?

Bloomsbury Publishing (LON:BMY)

Preliminary results - for y/e 28 Feb 2015. Just a very quick comment or two.

Revenue was up 1.5% against the prior year, to £111.1m.

Profit was up a whisker, at £12.1m (before highlighted items) and £9.6m profit before tax.

Diluted EPS before highlighted items was 14.73p (or 11.9p unadjusted), so at 179p per share the PER is either 12.2 or 15.0 times.

The balance sheet looks strong, but note that debtors is very high. This is due to a substantial amount of prepayments, and accrued income. I'm not madly keen on that, as big debtors means a lot of capital is tied up, and things can get buried in there that should be written off, in my experience.

Outlook - the company says it has started the new year well.

My opinion - I don't want to invest in any book publisher, unless they are really dirt cheap (i.e. PER of 6 or below), due to the uncertainty over what will happen to the industry longer term. So it's not of any interest to me at the current valuation.

Synectics (LON:SNX)

AGM statement - trading for the five months to 30 Apr 2015 (not a typo, it has a 30 Nov year end) has been "in line with the Board's expectations".

When companies say the Board's expectations (and not market expectations), I am told it is because there are no current broker forecasts, or there is uncertainty over the broker forecasts. I wonder if any city people who read this could clarify if that's correct or not, in the comments section below?

So I would be a little wary about the forecasts showing on Stockopedia, as these may be out of date. Anyway, the company says;

Sounds as if things are improving a little anyway. This CCTV company has been particularly hard hit by the downturn in the oil & gas sector, I believe, where they were very active previously.

My opinion - I spotted a very high debtors figure here a while back, and flagged it as a warning sign, well before the big profit warning hit in Oct 2014 - see my report from then. I'm wary about this issue - big debtors are often a sign of problems building up - so I want to see the next set of accounts, rather than relying on this trading update.

Although it sounds as if things might be stabilising, if today's update is taken at face value.

Portmeirion (LON:PMP)

AGM statement - an in line statement today from the British pottery maker;

Mostly reassuring, although the South Korea comment is worth noting, as that is one of the company's three biggest markets (the others being UK & USA).

Also, note that the 10% growth is at constant currency, so the reported figure will presumably be lower than that.

Outlook - comments above sound solid.

Balance Sheet - here is lovely, really strong. They own the freehold of their HQ now too.

My opinion - I'm currently sitting this one out, which might be a mistake. Funds were needed for other stocks with potentially more immediate upside, and I wanted to cut back my overall market exposure a bit, so decided to bank my profits recently on PMP, perhaps temporarily - am tempted to buy back in, but I'd prefer a PER of 12-13, rather than 15, to trigger a buy.

This remains one of my favourite companies, so it will be good to get back on board as a shareholder again at some point.

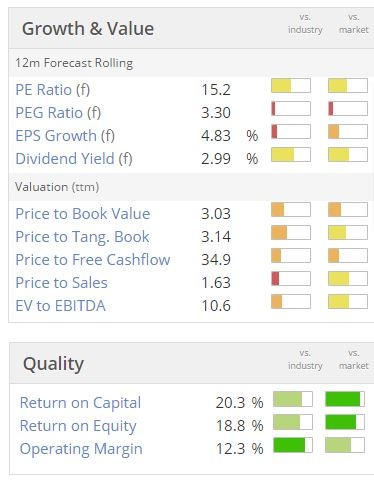

The valuation doesn't look particularly compelling any more - note that, due to the share price rises this year, many of the Stockopedia valuation bars have turned amber rather than green. Although the quality scores are still high.

Note that the StockRank is a very impressive 94. I do find it very reassuring when my favourite companies score highly on StockRank.

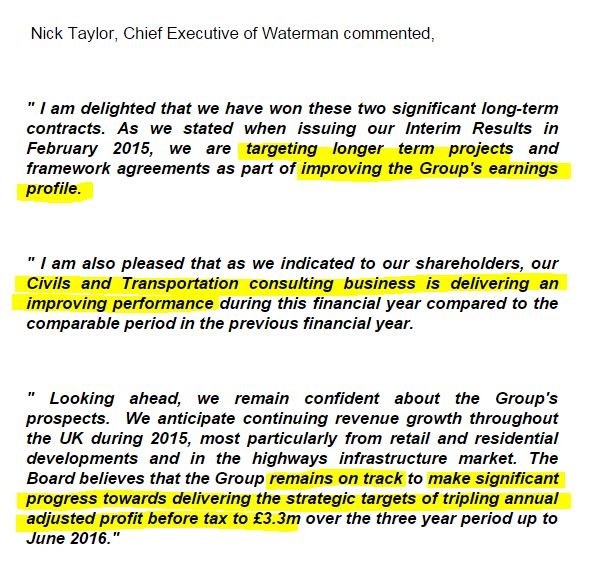

Waterman (LON:WTM)

(at the time of writing, I have a long position in this share)

Trading update - a very quick comment. Two long-term contract wins are announced today, along with a reassuring trading update:

My opinion - I like this stock. It's turning around a problem division, which is means that overall results are improving. There's a growing divi, and the StockRank is high, at 95.

On the downside, the shares can be illiquid, and the business is highly cyclical.

Phew, I'm exhausted! Sorry I didn't get round to looking at results from TET, RNWH, or CMH.

There's no report tomorrow, as I'm in a conference all day.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in ZYT, SOM and WTM, and has no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.