Good morning. Quite a busy morning with several profit warnings, so here goes.

Cupid (LON:CUP)

I won't beat about the bush, I don't like this company one bit. It operates a number of dating websites, and was embroiled in scandals last year over allegations (on TV & in the press) about customers being ripped off in various ways. The company's explanation that this was due to mysterious third parties trying to scam their users simply does not pass my common sense testing, since the sole beneficiary of trying to draw users deeper into a dating website, is the dating website itself (from increased monthly subscriptions).

The controversial casual dating websites were disposed of, for deferred consideration. The business that is left behind and still Listed has released its final results for calendar 2013 today, and they look very poor to me, especially the worsening profitability trend in H2.

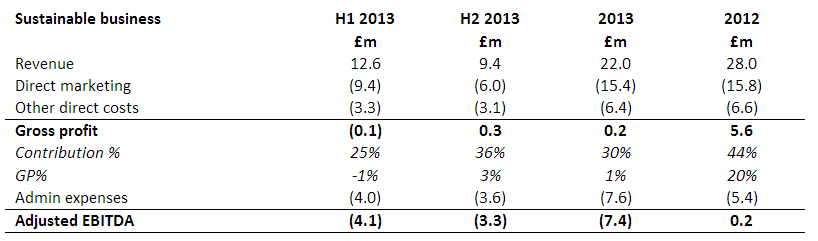

Turnover from continuing operations was flat at £26.6m. What they describe as "sustainable business" (i.e. excluding the effect of cross-marketing from the now disposed of websites) looks very grim indeed, as the table below from these results demonstrates - it's barely eking out any gross profit at all, and generated a £7.4m adjusted EBITDA loss (which as we know is the most flattering measure of profitability);

This is not a viable business, based on those figures.

The outlook statement details the efforts being made to turn around the business, but warns on profit for H1 of 2014, which will be below 2013. The outlook beyond that is described like this;

As marketing spend is increased we expect subscriber numbers and then revenue to grow. As part of our three-year strategy, we will also bring on stream our data proposition in the second half of the year and begin to grow our non-subscription revenue. We expect to be cash generative in the second half of the year and our profitability to be at a positive run rate as we enter 2015. This is all part of the evolution to provide the platform upon which to grow in 2015 and beyond.

So it's a potential turnaround perhaps, but from a pretty bad starting point, based on these dreadful 2013 figures.

Cupid shares are down 9% to 63.5p at the time of writing (08:45). That values the company at £45.2m. At first that seems a lot, considering it is heavily loss-making. However the company is paying out decent divis, making good use of its cash, and also did a share buyback in 2013. Note the very high Debtors, both in current assets and in non-current assets, which is the receivables from the sale of their casual dating sites. So far the instalments have been received on this, so the company's valuation hinges heavily on continuing to receive the agreed instalments, as Debtors in total are £24.2m, or 54% of the entire market cap.

There is £12.6m in cash on the Balance Sheet, so it is financially strong, providing they can stem the losses going forwards.

A 3p dividend has been declared, but the commentary hints that the dividend could be cut in future;

The level of dividend is intended to deliver a yield the directors believe is appropriate for a company of this size and nature, as well as demonstrating the optimism for our business model going forward. The Board intends to continue with a progressive dividend policy based on the Group's retained annual earnings. The level of distributions will, however, be subject to the Group's working capital requirements and the ongoing needs of the business.

Since it is currently loss-making, then this surely suggests that future dividends are not safe?

It looks a messy situation to me, so I'm steering well clear of this. This company probably never should have Listed on the Stock Market in the first place. Listed companies are subjected to far more rigorous scrutiny than privately-owned companies, so this was not the right place for a company that operates in a grubby sector, where unethical behaviour is rife.

You can see from the two year chart the point where negative allegations about Cupid began, in early 2013. However, since then the company's profitability has totally collapsed too, so the shares would have come down anyway.

It's interesting to note that the Directors sold huge amounts of stock in 2011-12, over £30m worth! So a pretty glaring sell signal was being telegraphed by them to the market, well in advance of problems emerging. A £1m purchase of shares by a Director in Mar 2013 failed to steady the ship at 114p, as the market correctly saw it for what it was.

In terms of lessons learned from this one, my view is that it's best to avoid shares that operate in a grubby area. There's nothing grubby about online dating as such, but a lot of companies in this area behave unethically, e.g. creating fake user profiles, generating fake messages to falsely convince subscribers that the site has users who are interested in dating them - which is a ruse to persuade the subsriber to keep paying monthly subscriptions.

Also I would say, follow the big Director sells! They know the business better than anyone else, so if they are banking huge profits, I wouldn't want to be buying.

Furthermore, I think it's best to sell at the first sign of serious trouble. Investor psychology is such that many people agonise over selling a share that they are emotionally attached to. So the first sellers will probably get the best price, whilst others hang on, trying to convince themselves that everything is fine, when it isn't. We've all done it! Personally I now find it very quick & easy to change my mind on stocks. If the facts change for the worse, then I have absolutely no problem hitting the sell button. My performance has improved a lot since I learned that skill.

Sweett (LON:CSG)

Talking of hitting the sell button, that's exactly what I did first thing with this company, which is a firm of Quantity Surveyors. A statement issued today says that allegations of wrongdoing by former employees has now escalated, with the Serious Fraud Office (SFO) in the UK, and the Department of Justice (DOJ) in the USA involved;

...The Group is cooperating with both bodies and no proceedings have so far been issued by either of them. The Group has commissioned a further independent investigation which is being undertaken on its behalf by Mayer Brown LLP.

Whilst this investigation is at an early stage and is ongoing, to date still no conclusive evidence to support the original allegation has been found. However, evidence has come to light that suggests that material instances of deception may have been perpetrated by a former employee or employees of the Group during the period 2009 - 2011. These findings are being investigated further.

As far as I'm concerned, this now makes CSG shares uninvestable, as the risks are too high. Remember this is not a big company, it's only a market cap of £28.2m at the current share price of 41p. So imagine what the potential fines, and legal costs could be, if charges are brought against the company?

I've had reservations about this company before, and this is the one where I was castigated last year by some readers here for over-reacting to some confusing & arguably flattering presentation of the results. Funny how things turn out.

Anyway, in my view the company is now a bargepole job. Things might turn out fine, but equally they could turn very ugly and even bring down the company, if it is prosecuted for what now appears to be (by their own admission) material instances of deception by their former employee(s). I take the view that this is not a time to worry about what price to get out at, it's just important to preserve one's money, and get out. If other people are happy to take on the risk of holding the shares, then fine.

What lessons can be learned from this one? It's too soon to say, as we don't know the outcome. However, I suppose it's a reminder that allegations over wrongdoing can appear to have been dealt with (as I thought they were, by the company's case closed announcement of 8 Jan 2014), yet can subsequently resurface, and escalate into something far worse.

Also in general terms, I think the old adage "no smoke without fire" is always worth bearing in mind. If any company has a bad smell about it, that's probably because there is something rotten somewhere.

Rare Earths Global (LON:REG)

Today's biggest faller is this company, whose shares are down 68% to 22p, on the announcement that they intend to de-List their shares from AIM. It is a mining services company with operations in China. So two negatives in one sentence there.

With 67.6m shares in issue, the market cap has fallen from about £47m last night, to just £14.9m today. Their plant has basically been shut down by a change in Chinese regulations, as they wish to restrict supply by squeezing out smaller operators, of which this company is one.

A wonderful example of why I do not touch any Chinese companies.

I draw readers attention to the following comments from the company's de-Listing announcement today, as these clearly have far wider implications for all Chinese & Indian companies Listed on AIM, and indeed many other lowly rated overseas companies. I think they will probably all de-List in time, and since that results in a collapse in share price, I maintain my bargepole rating on ALL Chinese and Indian companies Listed on AIM. In fact I probably wouldn't touch any overseas company Listed on AIM, unless it has a good track record of genuine profits & cashflow, and pays a reliable dividend every year.

...that admission to AIM no longer serves a useful function for the Company in terms of providing access to capital or enabling the Company's Ordinary Shares to be used to effect acquisitions, although the Directors acknowledge the benefit to Shareholders of having a public market in the ordinary shares;

-- the lack of liquidity in trading of the Company's Ordinary Shares;-- the Company has been unable to attract any significant investor interest and support in the UK, making a listing on AIM of limited value to the Company; and...

So I strongly suspect that a big investing theme for 2014 and 2015 is likely to be de-Listing of overseas companies on AIM, along with (continued) heavy losses for investors who bought those shares.

Today's announcements are a reminder that it's an absolute minefield out there in the investing world. So people who are cheerfully paying up top whack valuations for often quite speculative shares, are really setting themselves up for a fall when this bull run ends, or when any company-specific bad news comes out. What happened to requiring a margin of safety? A lot of investors seem to have forgotten about that at the moment!

Seaenergy (LON:SEA)

This is a company I like, and hold in my long term portfolio. Its shares are down 7% to 36.75p this morning on publication of results for calendar 2013.

My initial reaction on reading the results was that the announcement lacks sparkle. There is a lot of investor interest in one subsidiary company called R2S, and I've been to a couple of company presentations, where the potential for the technology is obvious. It is growing fast too. The problem is that the success of the R2S subsidiary is currently being obscured by the other, less exciting ventures that the group has undertaken.

My feeling is that more shareholder value would be created by hiving off all the other bits, and just having R2S as a standalone company, which would then have clean, profitable figures, and would be put on a growth multiple by the market.

Bundling it together with some other rather unconvincing projects, which are currently loss-making, seems to me a negative.

Note that the cash pile of £4.7m is ear-marked for paying the remaining earn-out to the vendors of R2S, of £4.6m, so it will really be cash/debt neutral. There is also a nagging doubt that those vendors are motivated to have a spectacularly good year this year, to earn the maximum, but perhaps not so highly motivated thereafter?

I have a nagging doubt about future dilution too. The legacy asset of 21.5% stake in Lansdowne Oil & Gas (LON:LOGP) has been steadily declining in value too. These shares received a big boost from an excellent article in the Investors' Chronicle a few weeks ago, which propelled them from around 30p to over 40p. I think I'll wait for that froth to disappear before considering a top-up here. However, I very much like what I see as the core business, R2S. It takes detailed 3D photography of assets such as oil rigs & ships, then integrates those images with the maintenance records. This has many benefits for the operator of the asset, and seems to be a niche they have to themselves.

So overall, I like it, but am not in any hurry to increase my position here.

Note the IC spike in mid-Feb 2014 on the chart below;

Anpario (LON:ANP)

This natural animal feed additives company announces results today for calendar 2013. These show a 12% rise in sales to £26.3m, and diluted EPS has risen from 11.1p to 13.0p. So at 271p the shares are on a lofty rating of 20.8 times 2013 earnings. That's not the sort of multiple that I would pay, unless I'd done a lot of research and was convinced that profits are certain to continue rising, and by a considerable amount.

Several friends like this stock, and have looked into it in far greater depth than myself, so if you understand the sector they operate in, and are prepared to pay up for a growth company rating, then it might be worth a deeper look. Not my type of thing though., as I have no way of judging what the company's future prospects are like. A PER of around 12 might tempt me on a speculative basis, but not a PER of over 20.

Software Radio Technology (LON:SRT)

Just a quick mention of a trading update here, which as I expected has failed to deliver on the buoyant H2 that was mooted a while ago. So poor results for the year ended 31 Mar 2014 are flagged in today's trading update. Only £6m turnover, and a loss of £1.5m.

However, there is also a further announcement today of a $6.75m "frame order" over 12 months, of which $450k has been shipped so far. That seems to have satisfied the market, and absorbed the disappointment of poor 2013/14 results.

It seems to me that there is something worthwhile at this company, but its performance is just so erratic that it's impossible to value. I couldn't sleep at night if I owned any of these shares, as there have been so many profit warnings from missed targets. The market cap of £24m (at 19.75p per share) seems too high to me, given the track record to date, and the impossibility of forecasting future performance within even an extremely wide range.

I hope it comes off, as a lot of my friends own this stock, but it's not the type of thing that interests me.

That's it for today, as I have to head into London for more company meetings.

See you tomorrow morning.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SEA, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.