Good morning! Interim results from Plastics Capital (LON:PLA) look OK. Turnover is up 4.1% to £16.4m for the six months to 30 Sep 2013, and adjusted profit before tax is down 4.9% to £1.7m. That strips out £559k goodwill amortisation (which is fine, goodwill & the related amortisation should be completely ignored in my opinion). So in this case I can go along with their adjusted EPS figure, which is 5.4p (versus 5.5p prior year H1). There are various other costs which are adjusted out, including foreign exchange translation, derivative gains/losses, and exceptional items. These are non-trading items, so I accept that the adjusted profit figure gives an accurate view of the underlying performance of the business.

Net debt is a little higher than ideal, but it has reduced a little to £8.1m (down from £8.6m a year previously). The company comments that a decision was made to make £1m in capex to increase capacity, which seems a sensible move at this stage in the economic cycle - i.e. to gear up for recovery.

A recent acquisition in China was funded through a small Placing, and this has not yet impacted results, but the narrative sounds positive about their Chinese operations, where surprisingly they state that this now makes them the no.1 maker of creasing matrix, and gives them a management infrastructure in China.

The all important comment about the whole year's outlook says;

The Board expects the Group to trade in line with expectations for the rest of the year.

Stockopedia is showing 11.4p normalised EPS as broker consensus for the current year, so that puts them on a fairly modest PER of 10 times (with the share price at 113p). That's a reasonable price, but remember that net debt is nearly 27p per share, so on a crude basis (i.e. without adjusting earnings for interest cost) that would take the PER up to about 12.3 on a cash/debt neutral basis - still actually quite reasonable, so I could see some further upside on the current share price - it's not difficult to imagine that these shares might rise to say 130-150p in the next year, if progress continues. That's probably not exciting enough upside to entice me in, but in a generally expensive market these shares look reasonable value.

Note that the dividend is rising strongly (up 52% to 1.0p for the interim), and a full year payout of 3.2% is forecast, so that's attractive given that it's also rising.

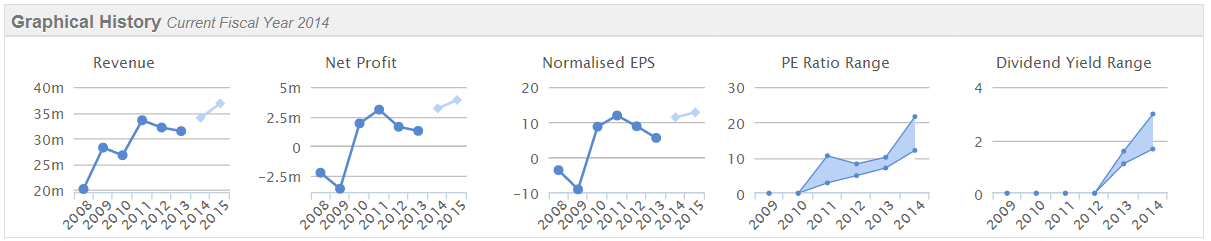

Note from the Stockopedia historic performance charts below, that profits have been pretty reliable through a period of a weak economy in the last 5 years, which is the sign of a resilient business;

There is a trading statement from Clean Air Power (LON:CAP), the maker of innovative systems that convert diesel-engined HGVs into hybrids which can run on both diesel and natural gas - a fuel which is becoming increasingly available, cheaply, in some countries, crucially the USA and Russia.

It's a bit of a mixed bag. The product is already selling, and sales + orders (they are reported combined) have risen to "over 400 units" this year to date, up on last year's 300 for the whole year, although this is "marginally behind current market expectations for the year". I was hoping for rather more rapid growth than that, so it's not really taking off as yet. Although they then go on to say that due to a different sales mix, the loss for 2013 will be "marginally smaller than market forecasts".

Demand is expected to continue growing in 2014.

However, the crucial USA launch has not happened yet, and looks to have slipped slightly from Q1 to Q2 of 2014, which does not concern me particulalrly - there are always delays in the launch of new products and markets, and a couple more months is immaterial.

They describe 2014 as "opportunity rich", so I'm happy to sit back & wait to see what transpires. With this type of share the price tends to spike up on newsflow, then drift back as people get bored and sell in order to chase other opportunities. So I have tended to top-slice my holding on the spikes up, and top up on the occasional spike down.

There are 231m shares in issue, so at about 10p the market cap is about £23m, which is probably enough for the time being. The shares have been marked down pre-emptively this morning by the Market Makers, and I would expect it to be a tug of war between people who don't see enough positives to keep them excited in this announcement, and the next wave of PR from the company bringing in fresh buyers - we are in a bull market after all.

I think the jam tomorrow stories at Torotrak (LON:TRK) are getting very stale these days - the company has been on the verge of great things for pretty much my entire investing career. Also, they've diversified into other new products, which as a general point in my view is usually a tacit admission that the prospects for the original project are not very good.

Their interim results for the six months to 30 Sep 2013 are not good at all. Turnover is only £1.7m, and a loss after tax credits of £1.5m. Note that the cash pile is depleting, being £6.7m at 30 Sep 2013, down from £8.9m six months ago, and £10.7m another six months before that, so they are burning an average of £4m p.a., which gives them about 18 months left on the remaining cash, if burn continues at that rate. Not good.

The shares have come off quite a bit recently, but still look significantly over-valued to me. With the share price down 7.5% to 21p this morning, that still equates to a market cap of £38m. Pretty racy, considering there's no sign of any commercial viability here.

It's important not to get too wedded to blue sky stories. If they are not delivering on the potential, then in my view it's best to just cut the cord, and move on. Too often people fall in love with the story, get too close to management, and feel they would lose face by selling up and moving on. Again, all classic investing mistakes, which I've made in the past too. So these days I try to keep rational & dispassionate - is it delivering on the potential? Yes or no. If it's no, then I sell up and move on. Better to take a moderate loss now, than see it drift down & down as other people also realise the game is up. That's a general point, not specific to Torotrak.

Behavioural finance suggests that investors refuse to accept bad news, hence there can often be a slow reaction to even very obvious signs that a company is not executing well. Hence the shrewd investor is the one who can react quickly, without emotion, and cut the losers quickly, before everyone else.

Remember also that some Fund Managers arguably keep refinancing losing companies in order to protect their own careers. So just because failing companies get refinanced doesn't mean everything is going to work out alright in the long run.

There's a strange announcement from Albemarle & Bond Holdings (LON:ABM) this morning - that 4 Non Executive Directors have all resigned, with no explanation given. That can't be good - it sounds to me like the company might be about to go under? On top of all the other bad news from this company, I think this is a potentially very worrying sign, and it's not a share I would now want to hold at any price, due to the high risk of insolvency.

Today's FT makes a good point, that two of the former Non-Execs at ABM were representatives of the 30% shareholder, EZCorp. So their resignation frees up EZCorp to negotiate on refinancing (or sell down its stake) without its appointees on the board of ABM having a conflict of interest.

It still seems strange that the other 2 Non-Execs also resigned at the same time, thought to be for personal reasons according to the FT - yeah, right!! A more credible reason to my mind is probably that they don't want to remain caught up in a situation that looks like it's getting messy, one way or another.

Shares in Innovation (LON:TIG) have done well this year, up to 35.25p which values the company at £345m.

Their results for the year ended 30 Sep 2013 published this morning look good - with adjusted EPS up 15% (or 22% at constant currency) to 1.44p. So that puts the shares on a PER of 24.5! Yikes, that's very warm. They try to steer investors towards EBITDA, which I am ignoring because they are capitalising costs into intangibles, so it's an artificially inflated figure for that reason.

They don't have the ballooning Debtors issue that Quindell Portfolio (LON:QPP) has, hence probably why these shares are on a much higher rating. Although personally I wouldn't go near TIG at this type of valuation. There are no dividends, and the Balance Sheet is not great. Horrible sector as well. So it just looks considerably over-priced to me. Drop the price by three quarters, and I might start to get interested!

In a similar vein to Torotrak, Corac (LON:CRA) is another jam tomorrow company that always seems on the cusp of great things, but has diversified into other areas, just in case. Anyway, they've come back for more money, this time raising up to £13.1m, the bulk of which (£11m) is through a Placing at 10p. Other shareholders can apply for Open Offer shares on the basis of 1 new share for each 15 existing shares held.

Post new money, the valuation will be over £40m, which looks very rich to me, considering they've not achieved any commercial success to date with the core product, and that in all likelihood the fresh cash will be burned up over the next two years.

Buying these shares would just be a complete punt, unless you've really dug down into the product & the likelihood of it succeeding, and have the expertise to judge it well. I don't, so this share doesn't appeal to me.

I'm pleased to see that a little speculative froth seems to be coming off some stocks today. I see that as a good thing. Far too many investors are losing touch with sensible valuations, and chasing up stocks on momentum & jam tomorrow stories. This can be very dangerous, because there are two simultaneous risks - firstly that even a small disappointment could pole-axe the share price. Secondly, that the market as a whole could turn from very optimistic to much more cautious. That could happen virtually overnight, and will hit the valuations hard on the most speculative stocks, and that then could trigger waves of forced selling from margin traders. You have been warned!

However for Value/GARP investors such as myself, a market correction is something to be welcomed, as that will give me the chance to deploy my reserves, and even gear up a little too, if the right stocks are offered to me at the right price!

I feel that the IPO market is starting to overheat now too. Virtually all IPOs seem to be going to a premium, so I suspect that some people are now buying into IPOs in the expectation of such a premium. However, when you look at something like recent IPO Bonmarche Holdings (LON:BON), it really wasn't worth the asking price, let alone a premium. So I think some of these recent IPOs are potential accidents waiting to happen further down the road.

There's lots of money to be made speculatively in bull markets, but it's very important to not get too carried away in my view, as many of us did in 1998-2000 - because it all ended spectacularly badly that time, so the novice investors like me at the time who bought into the hype stocks, were left holding the baby. Thankfully I realised it was all going horribly wrong, and completely changed my strategy in 2001 to Value/GARP, and never looked back - well apart from a pretty major cock-up in 2007-8 by being geared up in illiquid stocks that I couldn't get out of, but we've already covered that saga a few times here before.

That will do for today. Thank you for reading, and commenting below - remember that you can sign up for free just to comment (see the small link on the plans page), although obviously we much prefer paying subscribers!

See you tomorrow as usual.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in CAP, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.