Good morning!

Flybe (LON:FLYB)

Share price: 60p

No. shares: 223.1m

Market Cap: £133.9m

Sunday Times article - I note that there was a very unbalanced article in the Sunday Times yesterday about Flybe (LON:FLYB) which suggested that things were going terribly wrong there. I've noticed that where an individual or company refuses an invitation to be interviewed (which the CEO of Flybe apparently did in this case), then the journalist concerned seems to regard it as open season to do a hatchet job! (possibly aided & abetted by "helpful" PR people from competitors?!)

Having gone carefully through the facts myself, the S.Times article seemed to greatly exaggerate the problems the company has - which are mainly due to 9 surplus aircraft (pending disposal, but accruing considerable costs of c.£26m p.a. while they are grounded), and stiffer competition than expected on some routes. A fuel hedging policy has back-fired, since it has inadvertently locked in high priced fuel for the next year or so.

Given Flybe's strong balance sheet, none of these things look likely to affect the company's solvency, in my opinion. It has net tangible assets of £167.5m, at the last balance sheet date of 30 Sep 2014. An additional provision may well be needed against the surplus aircraft though, although I am told they are modern planes, so it's only a matter of time before they are disposed of.

As you can see from the trading update from 26 Jan 2015 (below), the company's underlying trading is around breakeven, after one-offs of around £16m relating to an EU compensation ruling, and the sale of their loss-making Finnish operation. So in other words, the underlying business is at a run rate of about £16m p.a. profit, with the temporary issue of 9 surplus planes being an additional cost of £26m p.a.. So even if they cannot dispose of the surplus planes, then the run rate is currently a loss of about £10m p.a. - which is a very different picture to the one painted in the S.Times yesterday, where the journalist included very little in the way of figures, but speculated that the company might struggle to raise fresh cash (not seeming to realise that it doesn't need to).

My opinion - Flybe is in a 3-year turnaround, and so far a lot of positive things have been done, including drastically reducing overheads. However, it's fair to say that the upside hasn't come through as anticipated - in particular the new routes, e.g. from London City Airport, seem to have been something of a damp squib.

On the other hand, the shares are now half the price they were, so valuation has already adjusted to take into account slower than hoped-for progress in turning it around.

In my view the disposal of the 9 surplus aircraft is the big issue. It's known about, and has been factored into the valuation of the shares. So I see this as now being an opportunity - since the market could take it as a catalyst for the shares to recover, once a deal is announced to dispose of surplus aircraft. In the meantime, the company can buy extra cheap fuel, and run those planes on temporary routes, to generate some cashflow, which is exactly what they are doing with some extra summer routes.

I'm not particularly keen on these shares now, given that the company has disappointed recently. Although the savage markdown in share price now looks overdone to me, so I've been averaging down at 60p. I often hear people saying that averaging down is a terrible strategy, but actually it can work very well, but only if you do it at companies with a sound balance sheet, and where problems are temporary. Obviously it's a disastrous strategy when problems reported are just the tip of the iceberg.

A recent case where being patient, and averaging down proved successful, was Spaceandpeople (LON:SAL) - where the company's problems were of a temporary nature, and were fixable. The shares have since bounced about 50% from their lows on a recent in line trading update. I see it as a potential opportunity where people sell at any price on bad news. Flybe is looking a potentially interesting situation along those lines, at 60p, in my opinion, but as always please DYOR. I'm sure we will have a lively debate in the comments below, as I know there are plenty of readers who are bearish in Flybe, so please feel welcome to post a more sceptical view if you wish.

Looking at revised broker forecasts, the turnaround has basically been pushed out by about one year. If the company does achieve lowered earnings estimates, then it could look a bargain this time next year. With a track record of missing estimates though, some caution is probably wise.

Amino Technologies (LON:AMO)

Share price: 126p

No. shares: 53.7m

Market Cap: £67.7m

Preliminary results - for the year to 30 Nov 2014 have been published today, and look to be in line with forecasts.

Turnover rose a smidge to £36.2m, but profit showed a useful increase, from £3.3m to £4.1m, using the most relevant profit measure, of operating profit before exceptional items.

Balance sheet - this remains fabulous, with the net cash pile having increased further to £20.8m. This is very much material, so needs to be factored into the valuation.

Valuation - net cash is the equivalent of 38.7p per share. Deduct that from the share price of 126p, and you're really only paying 87.3p per share for the business. Although net cash is only worth something if management are going to do something useful with it, like paying divis or making a decent acquisition.

Dividends - in this case management are paying generous divis, and are committed to increasing the divi further, by 10% in each of this year & next year. So that should mean the divi rising from 5p, to c.5.5p, and then just over 6.0p next year.

Since earnings of 7.68p last year more than covers the divi, then the cash pile should actually keep rising modestly, so there remains a very good safety margin here, in terms of balance sheet strength.

Outlook - today's announcement contains quite a lot of positive Directorspeak, e.g.;

My opinion - this looks a good share, in my opinion. I like the very strong balance sheet with lots of cash, the good & growing dividend yield, and the positive outlook comments. The shares look as if they could have a bit more upside, if solid trading continues. Although I would say that not knowing what the company is going to do with all its surplus cash, is a hindrance. Nobody wins prizes for just sitting on a pile of cash that is generating no return! Shareholder value could be enhanced here by them doing something clever with the cash - so my message to management here is - either make a good acquisition with that cash, or give it back to shareholders.

This can be a nice share to buy on the dips. There was a wonderful buying opportunity in Oct 2014, on a spike down, which looked like clumsy selling by an Institutional holder, Miton, I seem to recall, judging from a reduced holding in company RNS that was issued by them at the time.

The shares have had a good re-rating lately, so maybe the positives are largely priced-in now? It's probably not one that I would chase any higher at the moment, without understanding something about the dynamics of their sector - who they are selling to, the size & lumpiness of orders, the competition, and what advantages Amino's products have.

A separate announcement today from Amino says that the company is set to receive a further £700k cash rebate on overpaid duties, from a tax tribunal, although HMRC might appeal. This follows a £1.65m rebate that was treated as exceptional income in last year's accounts. Rather nice for shareholders, and helps keep the company's cash pile topped up!

Energy Technique (LON:ETQ)

Share price: 417p

No. shares: 2.4m

Market Cap: £10.0m

Trading update - for the nine months to 31 Dec 2014, which reads positively. Checking our archive here, I don't seem to have mentioned this company before, probably because its market cap was too small (I tend not to mention many companies under £10m market cap, because they are too illiquid for readers to trade easily).

Looking at the historical numbers, this company seemed to bump along generating £5-7m p.a. turnover, and somewhat randomly moving from small profits to small losses. However, something seems to have changed in the last couple of years, and the company now seems to be performing better.

Sales are up 16% to £8.1m for the nine months to 31 Dec 2014, and profit has risen by almost 41% to £582k. Reading the commentary today, the sales seem to be mainly coming from "fan coils". Having googled this term, it seems to be a generic term for heating or cooling units which blow air over a heating or cooling coil - so relatively simple units which don't require air ducting. The contract wins mentioned below sound good as reference sites, but I wonder whether this is resulting in a one-off boost to the company's current performance?

Net cash - has improved to £752k, and increased further in Jan 2015, so the company now no longer needs to use its invoice discounting facility, which will reduce finance costs, which sounds positive.

Outlook - note that there's a potential risk of order deferment in here;

My opinion - there don't seem to be any broker forecasts on this company, but it would be fairly easy to work out your own figures from today's trading update. It looks as if earnings (i.e. post-tax profits) might be c. £600-700k for the year ending 31 Mar 2015.

That would put the shares on a valuation of £10m, on a PER of about 14-17. That looks a pretty aggressive valuation for such a small company in my opinion, so I'd say the share price looks fully up with events, and is already anticipating further increases in profits. Little companies like this really should be priced on a single-digit PER, to reflect the higher risk, so at the current level this share doesn't appeal to me.

ISG (LON:ISG)

Share price: 262p (down 27% today)

No. shares: 39.2m

Market Cap: £102.7m

Profit warning - low margin building project companies nearly always end up disappointing sooner or later, when a big contract or two goes wrong, and provisions have to be made for heavy losses, etc. That's fine if you make big margins on other work, but where the profit margin is wafer thin to start with, then there's no fat to absorb mistakes. That's why I generally avoid this type of company.

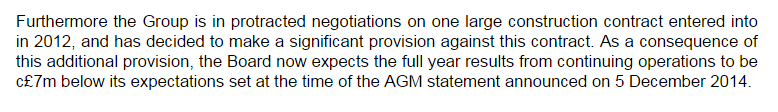

A contract has gone wrong, and requires a £7m provision, which seems to be just over half the forecast profit for the year ended 30 Jun 2015, so this is a big profit miss:

However, there is more bad news about exceptional costs on discontinued activities;

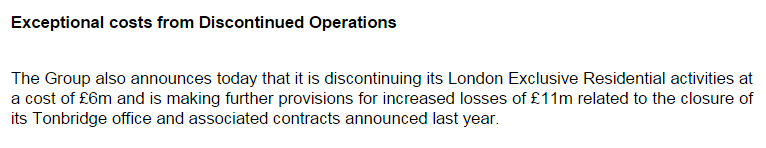

Outlook & financial position - in the interest of balance, the company does reassure on its finances, and order book. However, I think banking covenants would need to be looked into carefully, to be sure that the bank facilities will remain available to the company.

My opinion - this looks a can of worms, and it's going on my bargepole list. The company's balance sheet is weak, with negative net tangible assets, so combined with contract problems announced today, I see this as too high risk to be investable.

Low margins, complicated and large contracts, and a weak balance sheet - when these three factors combine, then it's usually only a matter of time before something disastrous goes wrong, so this type of investment is usually best avoided altogether.

Murgitroyd (LON:MUR)

Share price: 480p

No. shares: 8.9m

Market Cap: £42.7m

Interim results to 30 Nov 2014 are out today. I've just written up a whole section about them, then my little finger caught a random key on my keyboard by accident, and the whole section vanished! Don't you just hate it when that happens.

Anyway, I concluded that whilst today's results are described as in line with expectations, they seem lacklustre to me, with profit down from £2.3m to £2.0m for the six months.

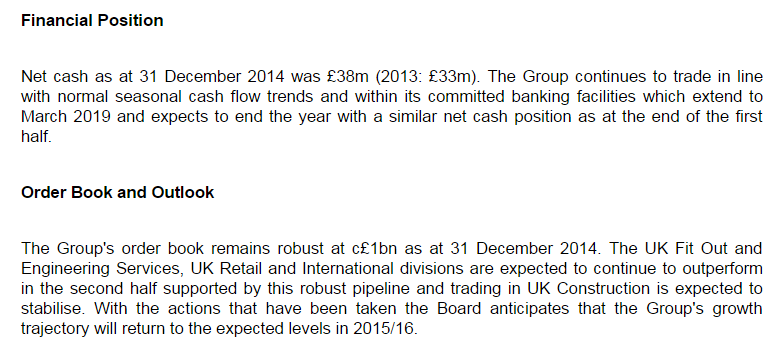

Valuation looks average;

The company talks about good growth in the USA, but that must be offset by contraction elsewhere, as the overall results are not showing growth.

My opinion - I can't see anything to get excited about here. It has sound finances though. People businesses like this don't usually get to high valuations, because the key people can be poached by competitors, or set up on their own. Although it is positive that the founder still has a 27% shareholding, which is enough to mean his interests are well aligned with other shareholders.

Quarto Inc (LON:QRT)

Share price: 155p

No. shares: 19.7m

Market Cap: £30.5m

Trading update - for the year ended 31 Dec 2014 is published today, and reads positively. The key part says;

Net debt is reported as $66.0m at 31 Dec 2014, and various other details are given about broadening the product range to include stationery and gifts. Note that net debt of $66.0m translates to £44.0m in sterling, and looks far too high to me - at one and a half times the market cap! So the apparently low PER of just 4.3 doesn't look half so cheap if you take into account the debt mountain.

Intra-year debt is higher still (it was $81.5m at the half year), so I suspect the year end figure might be a favourably low figure after busy Xmas sales perhaps? There seems to be an H2-weighting to trading in the P&L, which would tie in with that supposition on my part.

Balance Sheet - as mentioned above, there is very high net debt. There is also another figure that jumps out of the page at me, and looks worryingly large and inappropriate. That is the $63.8m included within current assets, called "Intangible assets: pre-publication costs". So it looks as if the company capitalises the costs of creating a book, and then expenses it gradually after publication. It's a type of work-in-progress balance.

My concern is that, if you write off this large figure, as I always do with intangible assets, then the balance sheet looks very weak indeed - the current ratio (excluding intangible assets) drops to an alarmingly low 0.59.

Therefore, this business is totally reliant on its debt facilities, and would not be able to continue trading if they were withdrawn for any reason, in my opinion. The 2013 Annual Report says bank facilities are due to expire in April 2015. I've checked through some RNSs over the last year, and can't see anything about renewal of bank facilities, so this is something would need to be carefully checked before the shares could be considered investable.

My opinion - I see this as a very stretched balance sheet, and for that reason I consider this share uninvestable. The divi was cut in 2012, and with a balance sheet this stretched, I don't think it should be paying divis at all - the cashflow should be used entirely to reduce debt, in my view.

It can be argued that the book titles at Quarto, once published, create an annuity stream. That's fine for the time being, but is book publishing really such a great area to be investing in long-term? I don't think so, and personally I'm avoiding all companies involved in conventional publishing, as I think they're wasting assets effectively. Tablets, and the next new thing - maybe headsets or holograms that project images in front of us electronically, are likely to leave books withering away as a means of conveying information or pictures. Sad, but things move on.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FLYB, and no short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.