Good morning! Let's start with two companies that have dropped this morning on disappointing announcements.

Seaenergy (LON:SEA)

Share price: 15.4p

No. shares: 56.4m

Market Cap: £8.7m

Trading update - this is a rather odd collection of small, sub-scale businesses. However, one particular subsidiary, called R2S did look interesting - it provides software which integrates detailed 3D photography of client premises (e.g. oil rigs, large ships, factories) into the client's database of service & repairs. So it's a visual interface for maintenance records. Growth had looked quite exciting, but since their main market is oil rigs, it's not surprising that the company today reports that business has become more difficult.

Overall, they say that 2015 will produce a "broadly comparable performance to 2014". So a bit below then.

The ship management subsidiary always looked a non-starter, and the penny seems to have dropped with management at long last, and they today say that it is non-core, and "management are reviewing exit strategies".

If I held shares here still, I'd want to see management reviewing their own exit strategies, as they've made a hash of things here, to be blunt.

Outlook - some hope for the future on international expansion;

(had to remove this picture, as it corrupted the text)

My opinion - the group strategy here didn't make sense from the start - a tiny group, trying to do lots of different activities, and ending up doing none of them well enough.

I think there's a strong argument for jettisoning everything apart from R2S, kicking out all the plc Directors, who have turned out to be a large overhead with questionable benefit (in my opinion), and instead focus the stock market listing on the most promising subsidiary company alone, with leaner overheads, R2S - as that's where the growth is likely to come from.

Intercede (LON:IGP)

Share price: 94.5p (down 11% today)

No. shares: 48.4m

Market Cap: £45.7m

Final results for y/e 31 Mar 2015 - we saw yesterday how GB Group (GBG) is rated very highly, as it operates in a sexy growth sector, namely online identity verification.

Intercede seems to be more about online security. This is part of the section on how they describe themselves;

The figures reported today look poor. The company complains about lumpiness of orders, and reports turnover down nearly 10% to £8.8m, and it has moved from a modest profit before tax of £395k last year, to a comparable loss of £1,672k this year.

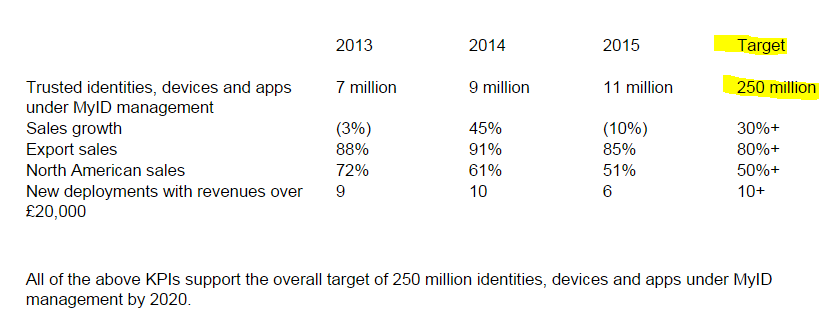

So why on earth is this company valued at £45.7m, when its performance is going backwards? In two words - jam tomorrow. This table from the results today is interesting, as it dangles the prospect of the business growing over 20-fold by 2020. However, how credible is that, given that turnover fell 10% in 2014/15?

Cash position - is it going to run out of cash? That is always the first question to ask yourself when a company starts reporting losses. In this case the company looks fine for the time being, with £5.9m in net cash on the balance sheet - although note that there is a corresponding creditor of £2.0m for deferred income, which tells you how much of the cash pile relates to up-front payments from customers. This is not necessarily a problem, but is something one should always keep in mind, as in my experience the year end date is usually chosen to correspond with the most favourable point in the year for cash balances!

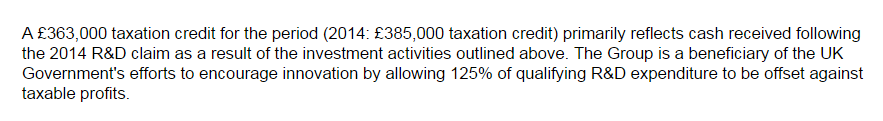

Taxation - note that the company benefits from the UK Govt's policies on encouraging R&D spending. Whilst helpful to the company for now, tax policy frequently changes, so with this type of company there is an argument for valuing the element of earnings relating to tax credits at a lower multiple than genuine earnings.

Outlook - there doesn't seem to be an outlook section, although the Chairman/CEO comments are as follows;

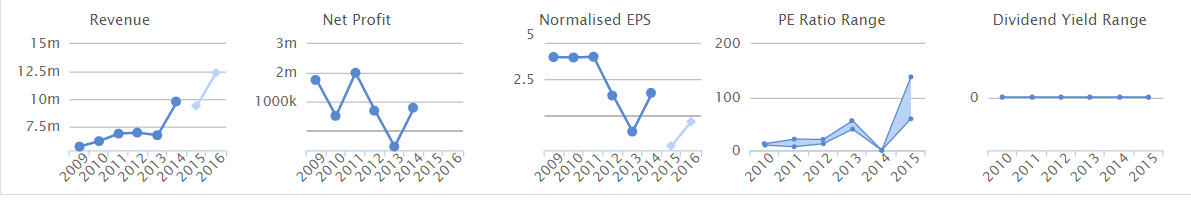

My opinion - I have absolutely no idea how to value this company, since it's now loss-making, although historically it has tended to be profitable:

So it's not a blue sky thing - there is a proper business here, but given that it has struggled to maintain profits, and has today reported a significant loss, on 10% lower turnover, then I think the valuation of £45.7m has to be challenged hard.

Technology in this space moves so fast, that things which were new and exciting a couple of years ago can rapidly be displaced and obsolete soon after. Therefore, rather than applying racy valuations to this type of company, there's a strong argument for applying a deep discount, since most will fall by the wayside. Therefore it's not for me - trying to pick the winners in tech shares is like trying to find the proverbial needle in a haystack. Also, as Neil Woodford said at the recent London Value Investor Conference, hardly any UK tech companies ever make it to any sort of scale. The only one he could think of was ARM.

Anyway, good luck to Intercede, let's hope they are successful. But at this valuation, the shares have no appeal to me.

Driver (LON:DRV)

Share price: 55p (down 2.6%)

No. shares: 31.0m

Market Cap: £17.1m

Interim results to 31 Mar 2015 - these figures look a bit of a mess, and I'm surprised the shares haven't fallen more today actually.

Unpicking the figures & the not too clear narrative, the problem seems to be that expansion in the group's Africa, Asia & M.East region has gone wrong, and they've had to kick out the management. As a result that region moved from a profit of £1.3m in H1 of last year, to a loss of £0.5m this year. However, they seem to be over the worst, as overheads have been cut back, so performance should improve in the future.

Share based payments, and exceptional items, take the reported operating loss for H1 to £-2.0m, versus a profit of £1.3m in the previous year's H1. So a pretty serious bump in the road, so much so that the group CEO has relocated to the area to oversee the recovery. Actually, it's worse than a bump in the road, it's more like a wheel has come off & they've ended up in a ditch!

Dividends - The interim divi of 0.6p has been maintained, as a sign of confidence in the actions taken to recover.

Balance sheet - this is fine, and passes my usual tests. So there are no solvency issues here to worry about, in my view. That's always vital in turnaround situations - you need a strong balance sheet to ride out a downturn, without having to go cap in hand to shareholders after things have gone wrong.

Outlook - I was starting to get interested in Driver as a turnaround investment, as the broker forecast for next year puts it on a PER of only 4.98, which could give about 100% upside on the current share price, if that level of earnings is indeed achieved.

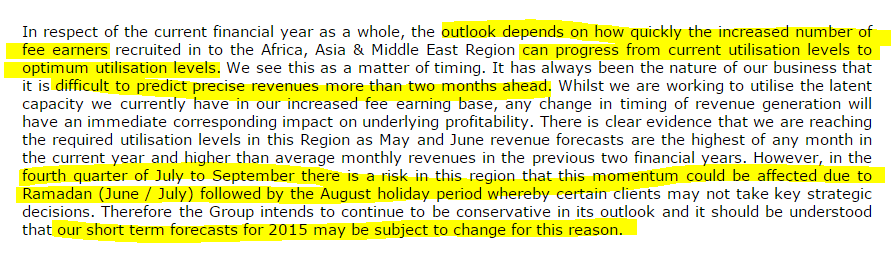

However, what has changed my mind is what sounds like another profit warning in the pipeline with this comment;

The final sentence in particular is as clear as can be, that there's a good chance the company might have to warn on profits in the next few months, due to known factors that sound likely to suppress activity levels in the problem region.

I also note that Driver's M.East division targets the oil & gas industry, which really isn't a good place to be right now with low oil prices prevailing.

My opinion - it sounds to me as if the company could be a good medium term recovery story, but that there's a high chance of another profit warning in the next few months. For that reason, I'll put it on my watchlist rather than buying. I've had more profit warnings in the last year than I can remember at any time in my career, so the merest hint of potential trouble ahead in an outlook statement, is enough to frighten me off.

That said, as you can see from the two year chart below, there's a lot of bad news already in the price, so at some point this could make a nice recovery stock, as the problems sound fixable, and its finances are fairly solid.

There are a number of other companies I want to mention, including some shorts, but editorial rules mean I cannot mention them here, and it takes too long to type up everything.

So on my YouTube channel there should be a 10-minute update from me, hope to be live by about 14:00 - I will Tweet out a link when it's working.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.