Good morning!

I was amused this morning to see on an American website, they were asking New Yorkers for their views on Brexit. One confused respondent asked, "Is it something to do with breakfast?"

Is it affecting the markets much? Things feel a little more nervous this week. Looking at the small & mid cap indices for the last year, it all looks fairly stable to me, apart from a nasty spike down in Jan-Feb:

The SMXX is down about 4% in the last 12 months, and MCX is down just over 6% over the same period. So not a very good market. A lot of people I talk to are saying that their portfolio is flat, or slightly up or down so far this year. By the way, the blue links on SMXX & MCX are worth clicking on, as that takes you to the Stockopedia page which shows all the constituents of each index. It's interesting to have a rummage, sort them by various criteria, etc.

Personally, my long-term portfolio is about flat this year-to-date, but my geared trading account is up strongly - due to catching the HOME takeover bid, and being heavily overweight (and geared) in BOO. Although one needs a few big winners to mop up all the mistakes. I've not done my stats yet for this year, but last year my win:lose ratio was 60:40, which gave a satisfactory overall result. We shouldn't beat ourselves up over getting some investments or trades wrong - it's perfectly normal. As long as there are more (and bigger) winners than losers, then everything should be fine.

I'm padding this out a bit, because there are only 2 companies in my universe which are reporting today, and only one of them is any good.

Porvair (LON:PRV)

Share price: 330p

No. shares: 45.1m

Market cap: £148.8m

Trading update - for the 6 months to 31 May 2016.

I've re-formatted the trading update into bullet points, and bolded the most important points:

- Constant currency revenue growth of around 10%

- Most markets experiencing good demand.

- Interim profits are in line with management expectations and will be ahead of those reported in 2015.

- Order books for the second half are healthy.

- During the period the Group acquired TEM, which is performing well.

- Investments were made in expanding manufacturing facilities in both the US and UK.

- Net cash at 31st May 2016 was £7.0m

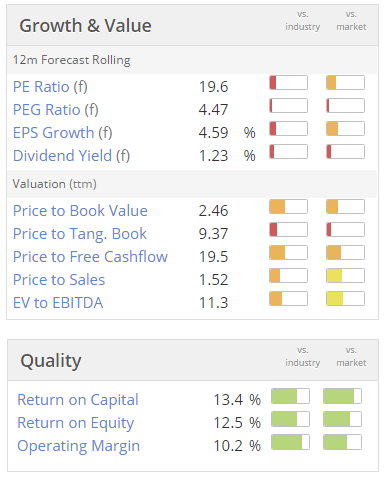

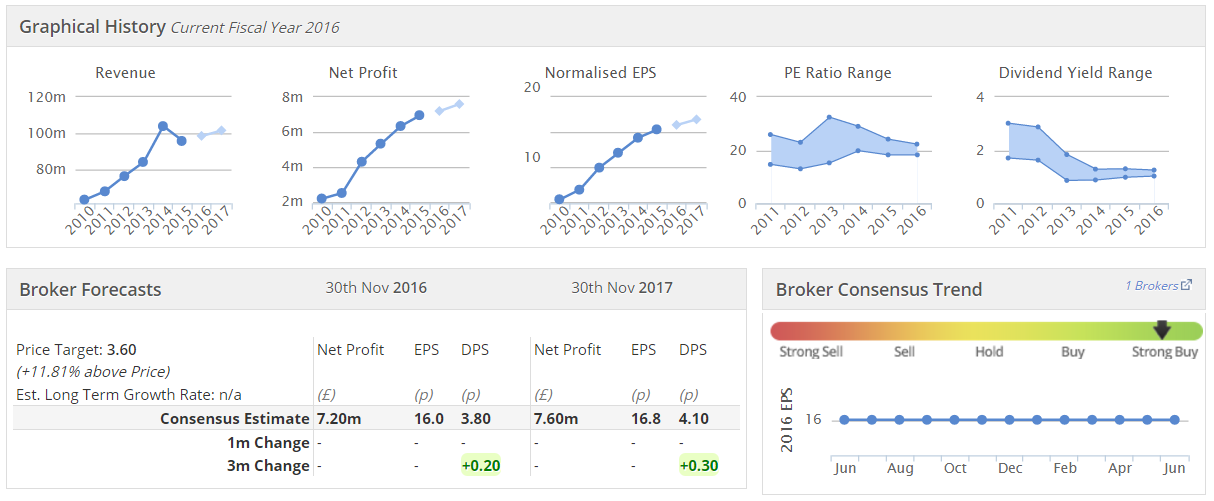

Valuation - broker consensus is 16.0p EPS for the current year (11/2016). Therefore the PER is 20.6. A growth company rating. The trouble is, there's not actually that much growth happening. As you can see from the Stockopedia graphics below, this stock is looking expensive on all measures:

In particular, note that forecast EPS growth this year is only 4.59% - very modest. So why is it on a PER of over 20? (which implies much higher growth). Maybe investors think that earnings will rise more rapidly in future?

The dividend yield is poor, at 1.23%.

My opinion - this is undoubtedly a high quality company, with a very charismatic CEO. However, I wonder if investors have got used to the stock being highly rated, without noticing that earnings growth has slowed down to a crawl now?

As you can see from the Stockopedia graphics below, the company has performed very well for the last 6 years, but the growth rate is now apparently slowing. That's assuming market expectations are correct of course. The company could prove doubters like me wrong, by thrashing forecasts for the full year, perhaps? There's no indication that's on the cards in today's update though.

So overall, I'd say - nice company, but the price looks considerably over-valued right now.

Fastjet (LON:FJET)

Share price: 27.1p (down 4.0% today)

No. shares: 66.4m

Market cap: £18.0m

Results y/e 31 Dec 2015 - it beggars belief that any company would be reporting 2015 numbers, here we are in Jun 2016. So that's a very bad sign to start with.

The operating loss on continuing operations was a staggering $37.9m, on turnover of $65.1m. The rather obvious comment on those numbers, is that this clearly is not a viable business.

So how much cash is left before it goes bust? At 31 Dec 2015 it had $28.9m in cash. This had fallen to $13.7m by 30 Apr 2016. If the same cash burn rate continues, then the company will be out of cash before the end of Aug 2016.

The company seems to be trying to cut costs, and 2 aircraft leases expire in 2016. Although it's rather late in the day to be restructuring. I doubt whether investors are likely to inject any more funds. Amazingly, Fastjet managed to raise $75m in Apr 2015.

On funding, it today says:

Based on current forecasts, the Company has sufficient funds to meets its operational requirements for the foreseeable future. However, these forecasts are sensitive inter alia to changes in passenger numbers, yields and foreign exchange rates. Accordingly, the Board is considering a range of funding strategies in the short term, including asset sales, and expects to raise further funds in the near future to provide additional headroom and to ensure the Company has the resources to fund future growth as markets improve.

The company's forecasts have, in the past, been completely delusional. So I wouldn't place any reliance at all on any reassurances from the company.

There's a lengthy going concern note in today's accounts. Shareholders should read this very carefully - it's basically telling you that there's a high risk of insolvency. Note this bit:

The Directors are confident that, with a new CEO and a revised business plan, additional funding will be available. However, as at the date of approval of these financial statements, no commitment has been made or received for any future financing and there can be no certainty that additional funding will ultimately be raised.

I'd be amazed if investors are willing to pour more money into this black hole, with or without a new CEO.

Looking at the balance sheet, I think there is one owned aircraft within fixed assets. So it's look very likely that will need to be sold, giving a last ditch cash injection.

My opinion - this concept just hasn't worked. I think it's inevitable this company will go bust, probably before the year is out. My local share club owned £120 of shares in it, and I urged them to sell. It took a couple of months to convince them, but as I pointed out, if there were 6x £20 notes lying on the floor, we wouldn't leave them there for the cleaner!

When something has comprehensively failed, I think it's best to sell up, even if only a small amount remains. It gives a psychological boost too, to clear a losing trade off your portfolio. It's important to learn the lessons. What went wrong? Could it have been anticipated? In this case, it was blindingly obvious that there was never a viable business. However, as is so often the case, people bought into a story of future glory. Story stocks hardly ever work out, so why do we keep being taken in by them?

PurpleBricks (PURP)

Just a quick comment on this one. I see that shares in this disruptive online estate agents are slipping. I've looked at lots of online businesses over the last few years, and the common factor is that to succeed, they have to spend vast amounts on marketing.

Very few manage to reach profitability. Once they do, they have to continue spending heavily on marketing, in order to drive further growth. Take Boohoo.Com (LON:BOO) for example (in which I hold a long position) - it spends about 10% of turnover on marketing. So that's about £20m p.a. Previously, it was spending even more in percentage terms on marketing - 13 to 17% about a year ago. Start-ups just can't compete with that - where would a start-up get £20m p.a. from, to spend on marketing?

Koovs (LON:KOOV) is an earlier-stage company which is burning cash like there's no tomorrow, a lot of it on marketing, for very little actual result. Sure the growth rates look high, but that's because it's from a tiny starting position. This one, in my view, looks highly dubious - it has a mountain to climb, to get anywhere near breakeven.

Hostelworld (LON:HSW) (in which I hold a long position) is spending a staggering 45-50% of turnover on marketing, to protect its market leadership.

So going back to PURP, I don't think it has anywhere near enough cash to fund itself through to profitability. The trouble is, doing estate agency work is not repeat business mostly. People usually only move house occasionally. So PURP will need to keep spending huge amounts on TV ads, etc, to prompt potential customers to check them out.

Plus there are competitors. Existing estate agents aren't going down without a fight. I've seen TV ads for other online, or hybrid estate agents. The market cap of about £310m for PURP (at 128p) looks totally bonkers. Why are investors happy to pay up-front, assuming a start-up will be successful, before it has got anywhere near to commercial success??

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.