Good afternoon,

Myself and Paul got our wires crossed today. So that makes for an extra-late report. Apologies!

There were plenty of requests at the bottom of yesterday's article. I'll try to cover a few of them today as well.

Cheers,

Graham

Photo-Me International (LON:PHTM)

- Share price: 169.75p (+2%)

- No. of shares: 376.5 million

- Market cap: 639 million

A thread has already been created covering today's update at this link.

This photo-booth/laundry business confirms that the year ended in April was an excellent one for the group.

This follows on from very strong interim results which I covered in the SCVR of December 9th. (It's true that this isn't really a small-cap, but it's a high-quality and widely-followed mid-cap, so I'm happy too make an exception).

Performance is in line with expectations:

The Board expects the financial year ended 30 April 2017 will be in line with market expectations, with significant revenue growth and record progress in profit before tax (+c.20% compared with 2016), supporting the Group's stated commitment to increase the total ordinary dividend by 20% year on year.

So PBT should be in the region of £48.1 million.

There is also good news in the photo-booth business.

Back in January, there were concerns that more relaxed rules from the Home Office meant that demand for photo-booth passport photos would be seriously undermined.

Checking the currently official rules for passport photos, it looks to me as if most people would continue to use a photo-booth in the UK, for convenience, rather than try to print a professional photo themselves.

Outside the UK, government relationships appear to be improving as Photo-Me has partnered with the Agence Nationale des Titres Sécurisés (ANTS) in France, so that photos and data can be uploaded directly to the driving license government database. A similar move is underway in Ireland. And the roll-out of the laundry business is going well too.

All in all, a great little update which confirms that Photo-Me is doing fine.

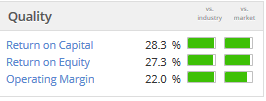

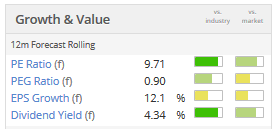

I wouldn't expect fast returns here since the valuation is already full enough (17x PE) but for a long-term buy-and-hold with a quality outfit, I'd say you could do worse.

Revolution Bars (LON:RBG)

- Share price: 126p (-1%)

- No. of shares: 50 million

- Market cap: £63 million

Appointment of Chief Financial Officer

This much-discussed group of bars announces that its interim Finance Director has become the Chief Financial Officer with immediate effect. He is said to have strong prior experience in accounting/CFO roles in various retail and leisure businesses, particularly with pubs and bars.

The prior CFO resigned in February for family reasons, having joined in August 2016.

Shareholders should now reasonably expect that financial performance will improve. To make a footballing analogy, if I was a shareholder, I would now be hoping for stability at the top, and for the new manager to stay for a reasonably long period of time, to implement his strategy! Though of course the influence of the CEO and Chairman shouldn't be underestimated either.

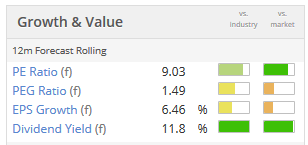

To be blunt, this is not an industry which I find attractive at all. That said, I could probably be tempted to invest if the rating was so low and the FCF high enough that it could be treated as a high-yield dividend cash cow. The metrics aren't a million miles away from that level now.

Laura Ashley Holdings (LON:ALY)

- Share price: 12p (-4%)

- No. of shares: 728 million

- Market Cap: £87 million

A reader has asked my opinion of Laura Ashley, the home furnishing and womenswear group.

This is a share which I traded in and out of in 2014-2015, being very fortunate to make about 4-5p in profit per share before I got cold feet.

I was lucky enough to sell out a few months before it was announced that the Malaysian management team (the CEO and the largest shareholder are both Malaysian) had organised the £31 million purchase of an office building in Singapore.

That purchase, for many investors, raised fundamental concerns about whose interests management were acting in.

While an 8-storey office block in Singapore is a fantastic asset, it didn't appear to make a lot of sense for Laura Ashley to own such a thing. Why not rent instead, and generate higher returns through reinvigorating the brand and expanding the franchise model? If Laura Ashley investors were interested in the more modest returns of property ownership, there were plenty of other investment vehicles through which they could do so.

Fast forward to the present, and the interim results to December 2016 showed LfL sales down 3.5% and PBT down 30% (covered by Paul in a February SCVR). The dividend was cut at last.

High historic dividends have been presented as good evidence that the majority shareholder is aligned with other shareholders, and I think that's a good argument, but it's also possibly indicative of management who don't have very strong ideas about how the brand could be refreshed and modernised for a fresh audience and especially for more recent generations of women. The dividend has consumed the vast majority of the company's EPS since about 2007.

Without wishing to sound alarmist, I might also point out another factor which might have dampened demand for the company's shares recently. In late April, it announced that it was changing auditors to the same firm which also audited a variety of suspicious Chinese companies (Naibu, Camkids and China Chaintek, all of which have been suspended and which wiped out British investors).

For all I know, they may be highly reputable accountants. But for investors who are increasingly nervous about losing their capital due to foreign shenanigans, maybe the optics of this overall situation are just too uncomfortable. The Malaysian links may also be troubling in the context of the recent Fusionex debacle.

Needless to say, the shares are on sale for the brave. Stockopedia algorithms have classified it as a Value Trap.

That's it for today. See you next week!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.