Good morning!

I was burning the midnight oil last night, updating yesterday's report, so for readers who only saw the original report, there are now new sections added on;

Johnson Service (LON:JSG)

MySale (LON:MYSL)

STM (LON:STM)

Hydro International (LON:HYD)

A couple of those look quite interesting actually, so yesterday's full report is worth another look - here is the link.

There's not much news today, so my plan is to write today's report, then also write a catch up report for Monday, to bring us up to date. I don't like gaps in the sequence, but sometimes it's unavoidable if I'm under the weather.

I liked the results from Somero Enterprises Inc (LON:SOM) yesterday, which seemed remarkably strong in its main market, the USA, considering that there have been worries of the USA going into recession.

So it was interesting to see that economic data released last night seemed to allay those fears, with both manufacturing and construction data from the US coming in above expectations. I think this is what's driving the current rally in US stocks - i.e. that the economic outlook is now probably better than investors feared in January. It's important to keep an eye on stuff like this, as it provides the context for our investing.

Seeing Machines (LON:SEE)

Share price: 4.25p (down 6.0% today)

No. shares: 943.9m

Market cap: £40.1m

CFO Resignation - today's announcement says that the CFO has tendered his resignation, to take up a non-competing CEO role. CFOs are usually career-minded, and hence them moving on to pastures new for a promotion, is not necessarily a red flag. However, I am wary when CFOs at jam tomorrow companies move on - as it sends me a signal that they don't see the future as very exciting in their existing job (otherwise they would have stayed).

SEE remains significantly loss-making, and by my calculations, it could well need another cash call in the not-too-distant future. Perhaps the CFO didn't fancy doing the rounds, and talking to the same investors again, to explain why the original business plan has not succeeded as yet?

The other big problem with SEE is that its core sector for existing sales is mining, which as we all know is not doing too well right now.

My opinion - I no longer hold this share, because I'm trying to weed out the jam tomorrow companies, since they nearly all disappoint in the end. To my mind, it has taken too long, and burned too much cash to be worth £40m as things stand right now. There's no sign of a major commercial breakthrough as yet.

I think shares should be easy to value. So as little guesswork as possible is what I'm looking for these days. Rather than latching onto an innovative product, and then hoping that it will sell.

The CFO leaving isn't great news, and suggests to me that a major breakthrough is probably not imminent.

Empresaria (LON:EMR)

Share price: 88.15p (up 2.5% today)

No. shares: 49.0m

Market cap: £43.2m

Results y/e 31 Dec 2015 - these figures look very good to me.

I'm not entirely clear how the group has managed to achieve a significant increase in profitability, but haven't read all the narrative yet - it seems to be more about margin growth, than top line growth. Some growth has come from acquisitions, and hoovering up minority stakes in existing non-100% owned subsidiaries.

Adjusted EPS is up a very impressive 24% to 9.9p. So the shares look good value at 88p, a PER of about 8.9 - hardly demanding. Although this needs to be seen in the context of the staffing sector having sold off a lot recently, so there are plenty of cheap, smaller recruitment companies to choose from. Although there's an obvious attraction to picking one like this, that is performing well.

Balance sheet - my concerns are easing on this front. With profitability up, and net debt down from £9.8m last time, to £7.3m at 31 Dec 2015, that doesn't look particularly stretched. Although I would need to drill down into the detail more, as in the past the disclosed net debt position was arguably somewhat massaged down, although that may not be the case now.

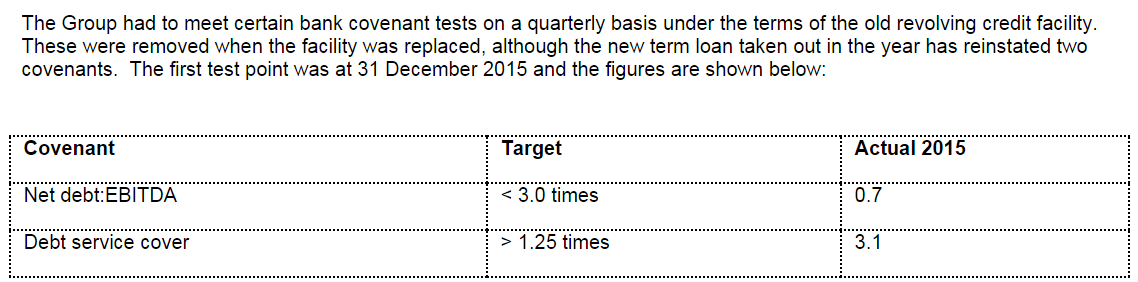

Bank covenants - top marks to Empresaria for publishing a simple table today stating clearly what its bank covenants are, and what the current reading is. This is very transparent, and as you can see below, the company seems to have decent headroom;

Outlook - this sounds positive, and note that Pharmaceutical Strategies was a fairly material acquisition, costing £7.9m, and was acquired on 19 Oct 2015, therefore only contributed to group profits for just over 2 months in 2015. This will contribute a full year in 2016, thus boosting the overall figures. Although note that c.4.5m new shares were issued to part-fund the acquisition, increasing the share count by about 10%, which will correspondingly dilute EPS in 2016.

The Group has delivered another period of strong profit and earnings per share growth, driven by our focused growth strategy. We are confident that 2016 will be another year of growth with the Group benefiting from both the investments made in its existing brands and the purchase of Pharmaceutical Strategies.

Despite wider market uncertainties at the start of the year we see exciting opportunities to develop our network. We are committed to growing the business to drive increased profits and enhanced shareholder value. We look forward to the year ahead with confidence.

My opinion - I like it. I met management last year, and they seem competent managers, growing the group by sensible acquisitions. Also note that they seem to make a multi-territory, multi-brand strategy work well, which is quite unusual for a relatively small group - and again indicates to me strong management & financial controls must be in place.

So whilst it's not a share I currently hold, it's certainly going onto the watch list again after publishing what seem impressive results (I've previously held, so know the company reasonably well).

Another factor to bear in mind is that the group faced currency headwinds in 2015 from sterling being strong. That should reverse this year, giving them a nice tailwind if sterling's steep recent fall remains in place. A weak pound means that EMR's overseas revenues & profits would translate into a higher sterling amount - a positive thing for the share price.

Driver (LON:DRV)

Share price: 61.5p (down 16.3% today)

No. shares: 31.1m

Market cap: £19.1m

Background - I last looked at this group of specialist consultants (e.g. for dispute resoution) to the construction sector here on 2 Jun 2015, when the shares were 55p, and whilst acknowledging the turnaround potential, concluded that there was a "high chance of another profit warning in the next few months". This view was based on the wording of a rather wobbly outlook statement at the time, and serious problems with losses at the Africa, Asia & M.East region.

Things seemed to settle down a bit in H2 of 2015/16 (year ended 30 Sep 2015), I'm just reviewing the figures now, which I didn't report on at the time they were published. Again though, the outlook statement at the time (published on 8 Dec 2015) doesn't inspire much confidence, due to lack of forward visibility;

We had a relatively strong second half to the year and Q1 of 2015-16 looks to be continuing in this vein. There are opportunities for growth across the three operating areas of the Group and we are well positioned to capitalise on these. However, the Group will continue to be cautious in its forecasting due to the inherent short term visibility of secured work in our core disputes business.

AGM statement - today's update flags contract delays in the M.East;

...However, in the period mid-December to mid-February the Middle East business was affected by a number of dispute commissions being delayed and suspended which had the effect of eroding the good start we had to the year. We have subsequently secured some significant appointments and a number of the delayed or suspended commissions have commenced meaning that over the coming months management anticipate recovering much if not all of this shortfall. We do, however, continue to cast a watchful eye on Qatar where workload and pressure on fees continues to be an issue.

There has also been a profit shortfall in the UK;

The UK disputes business despite having a strong second half to 2014-15 had a slow first quarter in 2015-16 due to the mix of commissions containing a lower number of large team assignments than is usual which has impacted on our utilisation levels. The UK project services business had a slow start due to oil and gas related clients scaling back their requirements. From January the mix of commissions has been more favourable and our project services business is securing higher work volumes meaning that a return to expected performance was achieved in January. However, we do not currently expect to recover the first quarter shortfall.

There's a dreaded back-end loaded comment about the current year, which is very often a deferred profit warning;

Overall we continue to progress well against our Strategic Plan and the delivery of expected revenue levels for the year. However, as was the case last year, these will be materially back end loaded given the reduced revenue levels in the periods previously mentioned which have also used a significant amount of our contingencies.

The CEO is stepping down into a Non-Exec role, which is encouraging in a way, in that at least it suggests there is nothing untoward surrounding his stepping down (which is often the case when CEOs leave altogether, at short notice).

Valuation - this is tricky because, whilst today's update is informative in terms of reasons for under-performance, it doesn't quantify what the under-performance is likely to be! It sounds as if the company doesn't really know, due to the poor visibility which it has, in fairness, mentioned before, and is just the nature of the business it seems.

Unfortunately, I don't have any updated broker notes as yet, so cannot comment on how profits might be affected by the above. However, clearly it makes sense to apply a significant discount to existing earnings estimates, or ignore them altogether.

Existing EPS fc for this year is 8.7p, so if we say halve that, to 4.3p, then the PER would be 14.3, hardly a bargain. This is very imprecise though, as the level of earnings is really currently unknown. Therefore I can only conclude that, for now, it's not really possible to value this share, unless you make broad assumptions about how it might perform in future.

Balance sheet - checking back, the last reported balance sheet at 30 Sep 2015 looks reasonable overall.

Although I do flag up the high level of debtors, which is 34.5% of annual turnover. As a very rough check, personally I prefer to see debtors less than 25% of annual turnover. Any amount above that is increasing the risk that there might be disputed invoices, or work booked to revenue, but perhaps not collectable. The prior year ratio was 32.6%.

My opinion - there are too many uncertainties here in my view. As I mentioned at the start of this report, companies should be easy to value. This one isn't. The more uncertainty there is, then the greater the risk of you valuing it incorrectly, and losing money.

Looking at the upside case, if you trust management to turn things around, and performance begins to fire on all cylinders again, then there could be nice turnaround potential here.

Where there is uncertainty, and disappointing performance, I like there to be deep value, which is not apparent here. So it's not for me at the moment.

(work-in-progress. please update this page later)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.