Good morning!

Tracsis (LON:TRCS)

Results are out this Weds, for this interesting group of companies with niche products/services targeting the rail industry. I interviewed the CEO just after results a year ago, and have set up another interview this Thu morning.

My interviews are interactive, so the idea is that readers can submit questions in advance. I can't promise to ask all of them, but will select the best questions, and bunch together similar questions into one. The deadline for submitting questions is midnight on results day, so that gives you time to digest the figures first.

To submit a question, please either message me via Stockopedia, or add a reply to this article.

Waterman (LON:WTM)

(at the time of writing, I hold a long position in this share)

CEO interview - just to flag up that I published an interview with Waterman's CEO yesterday. A transcript is also available for the hard of hearing, or those who just prefer to read, rather than listen to the audio.

He sounded upbeat, and the UK commercial property sector appears to be buoyant right now, so there should be good read-across for other companies active in the same area.

I should add that a major shareholder, Ruffer, appears to be drip-feeding stock into the market.

Zotefoams (LON:ZTF)

Share price: 355p (up 0.7% today)

No. shares: 43.8m

Market cap: £155.5m

Q3 trading update - there's a fair bit of detail, but no specific comment on performance against market expectations. The final paragraph reassures that they're probably in line, but if so, why didn't they actually say so?

The business is trading well and we have strong order books in all three of our business units for the final quarter of this year. Whilst being mindful of the potential impact of economic conditions the Company continues to expect 2015 to be another year of progress and remains confident about the long-term prospects for the business.

Reading between the lines, it sounds like they're not terribly confident about the medium term, but are confident about the long-term. So I feel the above comments are hinting at potential problems, or at least covering themselves in case problems do emerge.

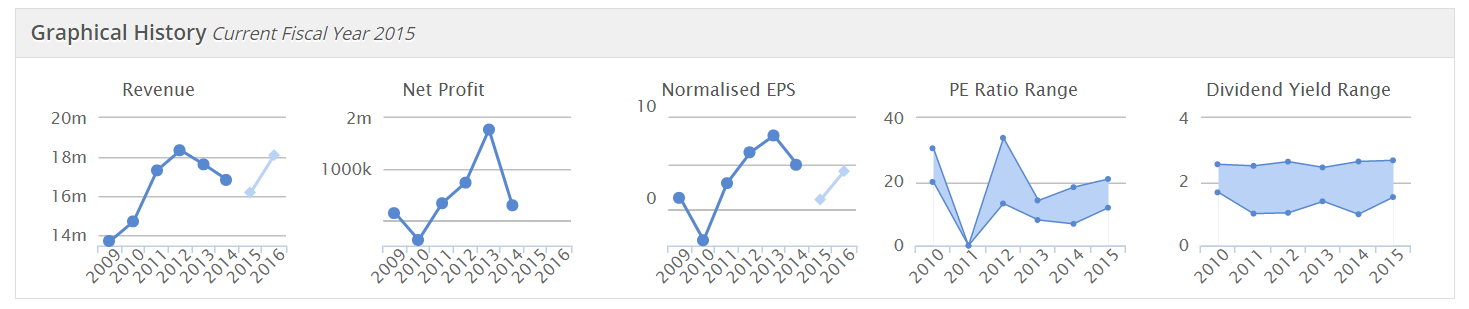

Increased capacity - note that the "major investment" in more production capacity at their Kentucky plant, is expected to start production in Q3, 2016. So it would be worth doing some digging to find out what size uplift in sales is achievable from the new capacity. Existing sales are at good margins - the operating margin has been in the range 8.8% to 13.7% since 2009, so clearly scaling up production will be very positive for profits, if similar margins can be achieved on the extra production.

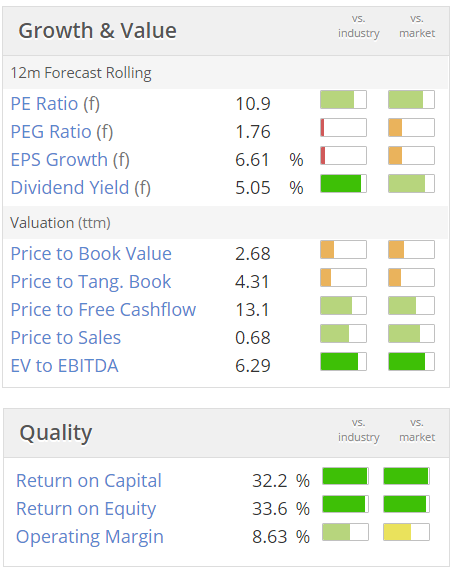

Valuation - these shares look very expensive, based on current broker forecasts. So if I held this share, I would need to be very confident that the company will smash forecasts, and/or that the 2017 figures (with new capacity online by then) will be significantly higher than the 2016 numbers.

My opinion - I've not looked into the company in enough detail to determine what its future prospects are like. Based on the existing forecasts, it looks expensive. That seems to be because investors are anticipating higher future production & profitability.

The StockRank is reasonable, at 70.

There might be a better opportunity to buy in on bad news in the future. New production plants are often delayed, or have teething problems, which can cause a spike down, so I might watch out for that in late 2016.

Note that the shares have doubled in the last two years, so I wonder how much more upside is likely for now?

Flybe (LON:FLYB)

Share price: 87p (up 1.5% today)

No. shares: 216.7m

Market cap: £188.5m

(at the time of writing, I hold a long position in this share)

Completion of Project Blackbird - this is the name given to FlyBe's efforts to dispose of (originally) 14 Embraer E195 jet aircraft, which were unsuitable for the routes it wants to fly.

As I reported here on 8 Oct 2015, there were only 6 problem planes remaining. Today we are updated that all remaining surplus planes have been sorted out - rather than disposing of them, Flybe has found new routes for them to fly. This probably explains the rather muted share price reaction today - the market would probably have preferred for these jets to have been disposed of altogether, rather than flying routes which presumably may not be profitable, but will probably incur smaller losses than having the planes grounded.

The solution found has mitigated about half the potential £80m worst-case scenario costs;

Completion of Project Blackbird delivers a £40m mitigation versus Flybe's previously indicated obligation of £80m over the remaining term of the aircraft leases. We currently anticipate that the financial cost of resolving the remaining E195s will be £20m this year, reducing to around £10m next year, and then to £6m the year after and £4m in the following year.

My opinion - this is a positive step, and will allow analysts to forecast with more clarity, and provides increasing cost savings in future years - therefore earnings should rise.

Flybe is a good example of a turnaround situation where the strong balance sheet has given them time to fix all the many legacy issues. I think a reasonably good business could emerge here over the next couple of years, with management now free to focus on operational stuff, rather than fixing big problems.

As a reader pointed out recently, in a very good point, the additional routes being added by Flybe will use fuel that they can buy at current market price (i.e. cheap), whereas existing flights will be using more expensive, hedged fuel. It will be interesting to see how the new routes pan out. They sound sensible - adding capacity to existing, popular routes.

I imagine this share could continue its recovery, assuming there's no fresh bad news. It's a lot of company for the money, especially if they can really improve profitability as the expensive fuel hedges gradually expire.

The market should also now factor in the improved cost situation re the formerly surplus planes, so broker forecasts could increase from here perhaps?

Quindell (LON:QPP)

Share price: 99.5p (down 2.7% today)

No. shares: 445.0m

Market cap: £442.8m

Capital return update - the company says it will seek Court approval to make a capital repayment to shareholders of 90p in Dec 2015, so that's about 90% of the current share price.

The intention is to pay a further 10p per share to shareholders at the end of 2016, funded by the escrow funds connected with the disposal of its main business to Australian firm Slater & Gordon.

A "tax efficient" method is being sought (but not specified today) to return these funds to shareholders. Further possible distributions are flagged, based on a "prudent estimate" of the contingent consideration (I think this relates to the NIHL claims?) of £39.6m.

So there could be an interesting special situation here. If you buy shares now, then you should get 90% of your money back quite quickly, in Dec 2015, leaving a rump shareholding on which there might possibly be some good upside, who knows?

There's also the remaining, but I believe loss-making telematics business. Some people think that is interesting, others have said it's worth very little. So who knows?

Personally I wouldn't want to risk my funds, just in case the 90p distribution cannot be done tax efficiently. A mess up there would ruin the potential returns. Also, the balance then has to be left for at least a year, and the risk is that legal cases could spring up, and together with costs, consume a lot of the remaining cash. After all, this company's former management are being investigated by the Serious Fraud Office, and there's no doubt that the previous accounts were indeed misstated - the company has admitted as much.

Weighing up risk:reward, the current price looks about right, so therefore it's not of any interest to me. We all know the history, so I won't bother going over all that again.

LPA (LON:LPA)

Share price: 86.5p (up 29.1% today)

No. shares: 11.8m

Market cap: £10.2m

Trading update - this is manufacturer of LED lighting, and similar systems for the transport sector (especially trains, by the sound of it).

After a challenging first half, the factory load, particularly in the LED-based lighting activity, has significantly improved, delivering a much stronger performance in the second half and the previously reported problems with the integration of the fabrication capability into the electro-mechanical facility have been largely overcome. As a result, the Board expects that results for the year will be ahead of market expectations.

That's encouraging, but I note that Stockopedia shows analysts forecasting a poor year, at only 1.1p EPS This year. So to beat that isn't necessarily a great result.

There is more detail on orders won, but these all sound like one-off projects, so I'm not sure it appeals to me, since there doesn't seem to be any recurring revenue - do correct me if I'm wrong on that.

My opinion - the company seems to be in a good patch, but will that continue? Its track record is erratic, with no obvious trend, as you would expect from a manufacturer winning unpredictable, large one-off orders;

Note that it has been a consistent dividend payer though, although the forecast yield is unexciting at 2.4%.

To make this share attractive, I think investors would need to properly research its products, and the markets it serves, competition, etc, and only consider this share if it becomes clear that this company has some competitive advantage over the many other companies there must be serving these markets.

It's not for me.

Vislink (LON:VLK)

Share price: 34.25p (down 11.6% today)

No. shares: 122.6m

Market cap: £42.0m

Share price movement - there's no announcement from the company, but at this rate I think they will have to explain what's going on with a trading update.

Looking at the chart, the ill-conceived VCP (Value Creation Plan) whereby Directors have created a new intermediate class of share capital, to line their own pockets basically, has massively backfired. All the shareholders I've spoken to absolutely hate it, and consider this one of the worst cases of executive greed that we've witnessed at a small cap in a long time. Given that the Exec Chairman here is already paid a king's ransom, he wants more - at no personal risk.

It seems clear now, that one of the main reasons for moving from the main list to AIM, was so that a scheme of this kind could be pushed through, without even requiring shareholder approval!

I can see why Non-Execs are called "Noddies", because they've been useless at this company, allowing the Execs to push through a plan which is tantamount to them helping themselves to 15% of the company, above a certain threshhold.

I think a lot of shareholders just dumped their shares in disgust - I did too.

The other event which seems to have accelerated the spiral down is the last set of interim results.

It seems to me that management are doing a pretty good job of value destruction here! Time to kick them out, and bring in some real talent prepared to work hard for a reasonable (rather than excessive) remuneration package?

My opinion - The chart seems to be signalling to us that something serious is going wrong - profit warning coming? However, if you like the company, and think that everything is fine, then this could be a good time to buy, who knows?

Personally, I don't trust the management here, so will not be revisiting this share until the Chairman has departed.

Epwin (LON:EPWN)

Share price: 123.5p (down 5.0% today)

No. shares: 135.0m

Market cap: £166.7m

Trading update / acquisition - an in line with expectations update;

The Board announces that despite challenging market conditions, the Company's profits for the year ended 31 December 2015 are anticipated to be in line with market expectations.

The market conditions comment is probably the reason for the 5% share price fall today. The valuation looks about right to me for this type of company;

This company is the sister company of Entu (UK) (LON:ENTU) which floated at the same time. Entu is effectively the sales & marketing operation, and Epwin is the manufacturer. Therefore there must be concern that either Entu is too cheap, or Epwin is too expensive, given the big divergence in share price after Entu's profit warning (I am currently long of Entu, and have no position in Epwin).

A relatively small acquisition is also announced, with a £5.2m initial consideration, and up to £3.3m in earn-outs.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in WTM, FLYB, and ENTU, and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are personal opinions only, NOT advice or recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.