Good morning!

Markets have been all over the place again since the UK closed yesterday afternoon. The US plunged again, but not quite as badly as a week ago - somehow a 470 point drop in the Dow last night doesn't seem such a big deal these days!

The Futures are showing that the US is expected to recover about a third of that when it opens today. The price of oil is lurching all over the place too, with a big percentage rally, now apparently fizzling out. So nobody really knows if we've just had a dead cat bounce, and are on our way to further falls, or if we're just re-testing the lows for another buy the dip opportunity?

At the moment I'm feeling reasonably relaxed about my long term portfolio of UK small caps - the recent sell-off showed most of them to be resilient, and the ones that did fall, quickly recovered. Also, the sharp falls showed which shares were the strongest, with several in my portfolio not dropping at all - so if buyers were absorbing all the sells during a market sell-off, then the future looks bright for those particular stocks.

As always, I think it's all about holding decent companies, at reasonable valuations, then providing the fundamentals of the company remain strong, the share price should look after itself in the long run.

Halfords (LON:HFD)

Trading update - it's not a small cap, with a £1.02bn mkt cap last night, but the shares are down 9.5% today to 462p. This news looks topical, and might have read-across for other retailers possibly, so I'll mention it.

Halfords has a 3 April year-end, so its Q1 figures (Apr-Jun) were reported on 15 Jul, and looked good, with group Like-for-like (LFL) sales up 3.5%.

Today however, the figures for Q2 to date (Jul-Aug) are reported, and they show a marked deterioration - LFL sales are down 1.3%, with cycling being the problem category, reporting -11.0% LFL sales (compared with +2.0% in Q1). That's some drop in demand for cycling. Reasons given are: more discounting (i.e. competitive pressures), and poor weather.

I've been wondering how long it would be before retailers started blaming the weather for disappointing sales! I suspect clothing retailers will probably be OK, as they hold summer clearance sales in July (when the weather was alright in the UK), and so August is when the Autumn/Winter ranges are introduced. Poor weather in August might have actually helped some retailers, as it makes people more inclined to shop, if they can't go to the beach.

Outlook - a "broadly in line" full year comment is given today, i.e. they're a bit below forecast.

My opinion - Halfords is a stock I definitely would not want to hold. The reason being that they over-charge. The prices are way too high on some items, and this alienates customers. I certainly won't be going back, after they tried to charge me nearly £5 for a tiny packet of generic washers, that probably cost about 5p or less to make in China.

If you treat your customers with contempt, you won't be around for long. Ask Gerald Ratner about that.

The other problem with the recent surge in interest in cycling, is that once people have bought a bike, they don't need another one for quite a number of years. Parts and accessories can easily be bought on the internet, at prices much lower than Halfords charge.

So I suspect Halfords might really struggle over the coming years.

Spaceandpeople (LON:SAL)

Share price: 86.5p (up 12.3% today)

No. shares: 19.5m

Market cap: £16.9m

(at the time of writing, I hold a long position in this company)

Network Rail contract signed - from reading chatter on the web, I see that some shareholders were getting jittery about the delay in finalising this contract. So it's good news to see the announcement today confirming it has been signed. No financial details are given, as that is commercially sensitive information.

This should be a material contract for the company, hence why I'm reporting it. I put in a call to the company this morning, to get a better handle on the Network Rail contract. As it says in today's RNS, the annual footfall of these sites is 1 billion people, and rising (there has been a very big increase in UK rail travel in recent years).

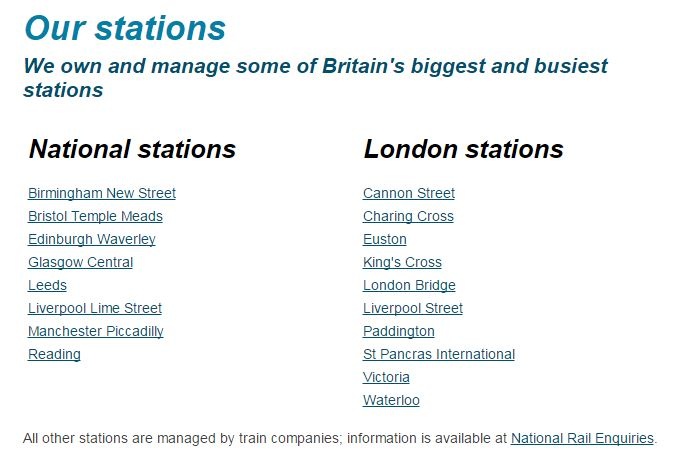

I wrongly assumed that this contract was for all railway stations in the UK, but it turns out that Network Rail manage the top 20 stations, which are the ones SAL wants the most, so are contracting to manage the mall space for exhibitions, marketing & kiosks. So it's the big London stations, plus key mainline stations such as Bristol, Cardiff, etc. Here is the list from Network Rail's website:

The company says that these stations are the ones where there is massive footfall, and so the biggest opportunities. This contract was previously managed by JC Decaux apparently. SAL are not disclosing the financial terms, as it's commercially sensitive, although I am sure we will get some indication of potential business with the next broker updates.

The company confirmed to me that they are sticking with their more conservative approach to forecasting, one of the lessons learned from the problems in 2014. So forecasts now don't include any new business, they are based purely on existing contracts. Now Network Rail is signed though, it will feed into the forecasts, which should go up, although bear in mind also there will be some up-front costs, although I get the impression we're not talking big bucks particularly on set-up costs.

The company is upbeat about this contract, as you would expect. They used phrases like "very optimistic", "excellent springboard", and said that this is a "really important contract" because it further establishes SAL as the market leader in experiential marketing.

The sales pipeline is already building up, and has been for a couple of months, with the contract due to go live on 1 Oct 2015. So it won't have a material impact on 2015 figures, but should start to make a difference from 2016.

My opinion - everyone hated this stock this time last year, but actually that would have been a cracking time to buy, as the shares have now doubled since the lows then. Management had a credible plan to turn the company around, after disappointments last year, and they seem to be doing a good job implementing it.

This company has entrepreneurial management, with plenty of skin in the game, and they dominate a unique niche. There are also some international operations (mainly Germany, but also a toe in the water in India), and today's announcement dangles the possibility of more rail work overseas perhaps in future?

"This is a significant win for SpaceandPeople and it complements the existing successful shopping centre business that we have built over the years. The Network Rail portfolio offers an extremely large footfall across the UK, which provides us with a unique opportunity to build a bigger network of transport hubs in the UK and Europe."

I feel that investors sometimes become too emotional after bad news. It's important to put aside those emotions, and think calmly and rationally about what has gone wrong, and what they are doing to fix it. Although as we saw with SAL, the bad news doesn't usually come out in one go, it can often come in several waves.

However, at some point, there can often be a wonderful buying opportunity, when sentiment is on the floor. Providing of course that the balance sheet is sound, and the problems are fixable within a reasonable timescale, and cost.

If the problems are the thin end of the wedge, and the financial position is weak, then buying after bad news can be a disaster, so it's an area that needs a lot of thought & research. Generally speaking, if in doubt, then it's best to play it safe and avoid falling knives. However, in some cases, there can be rich pickings, when the market over-reacts on the downside for a business that is fundamentally sound, but has just run into some short term difficulties, as happened at SAL last year.

Johnson Service (LON:JSG)

Share price: 92.3p (up 0.8% today)

No. shares: 330.5m

Market cap: £305.1m

Interim results to 30 Jun 2015 - this dry cleaning & related activities group has had a strong turnaround in recent years, and is now also growing through acquisitions. I reported on their most recent buy, London Linen Supply, here on 1 May 2015. A small Placing was done at 73p per share, but the bulk of the acquisition was financed through increased debt facilities, which struck me as becoming a tad on the high side. The price paid appears quite high relative to profitability.

More recently, I reported here on 2 Jul 2015 on the group's "slightly ahead of expectations" trading update for H1.

Looking at today's figures, I've been wrong to think of this as a dry cleaning business, as that is now only 22% of turnover (£23.5m for H1), and makes negligible (£0.5m) adjusted, pre-exceptional operating profit. It was heavily loss-making after restructuring costs of £6.2m.

The group is mainly now a textile rental business, as that was £85.7m out of £109.2m total turnover in H1, and generated £12.4m operating profit.

Adjusted operating profit for the whole group was £10.1m in H1, up an impressive 20.2%, although the acquisitions of Bourne and London Linen (only 2 months in H1) have boosted the figures. Bear in mind that London Linen will contribute a full 6 months to the H2 figures, so that should help further boost profits.

Outlook comments sound upbeat, and another small upwards revision to expectations is flagged - clearly good news for shareholders;

We expect further progress in the second half and the result for the full year to be slightly ahead of current market expectations."

This is how it should be done - keep market expectations grounded at the start of the year, then out-perform as the year progresses, edging up forecasts as you go along. Why can't more companies get this process right?! Mind you, demand is probably fairly easy to forecast at JSG, as it's providing a recurring service to lots of customers, so good predictability.

Valuation - broker consensus is currently 5.9p for 2015, so we can probably guess that 6.0p or more is in the bag. Then earnings should rise further in 2016 as the acquisitions contribute a full year, so 6.3p EPS is the current forecast - that might rise to maybe 6.5p to 7.0p perhaps?

Given the company's decent track record since 2012, and positive macro backdrop for restaurants in London, I'd be happy to value the business on a forecast above current market expectations, at 7.0p. That puts it on a 2016 PER of 13.2, which would look reasonable if the company was cash/debt neutral, but it's not.

Balance sheet - I think they've taken on a bit too much debt to fund the acquisitions. Net debt is reported today at £72.4m, which is about 3.5 times next year's forecast profit before tax. After tax, that rises to nearer 4.5 times earnings, which I think is too high, but others might be more comfortable with it, that's up to you.

The net debt is nearly 24% of the market cap, so fairly significant, and that needs to be taken into account when valuing it.

The current ratio is poor, at 0.63, and long-term creditors are also high, mainly the bank debt, but also note the existence of a pension deficit of £15.4m.

Net assets of £100.5m includes £91.1m goodwill, and £36.5m of other intangibles. Strip those out, and you have negative net assets of -£27.1m. I usually try to avoid companies with negative net tangible assets, although if they are decently profitable and cash generative, then it's not necessarily a huge problem.

My opinion - as I've mentioned before, the Balance Sheet is starting to look a bit stretched here. That may not matter whilst the sun is shining, but it can be a serious problem when a recession really bites, and business starts evaporating as customers go bust owing you money.

So it depends what your investing time horizons are, and what your appetite for risk is? Some people might argue that companies gearing up their balance sheets a bit for sensible acquisitions makes sense in the good times. Trouble is, bank loans can be withdrawn when things go wrong, and personally I've been scarred by experiences of this for businesses that I was running about 15-20 years ago.

Highly geared companies generally can't pay big divis either, as they need the cashflow for repaying debt. The yield here is not great at 2.2%.

Overall, I think this company has done well, it's delivering ahead of expectations, and the shares have had a good run in the last year, but the net debt is starting to worry me, and the valuation looks pretty much up with events. Maybe the shares could keep rising to 100p, but that might act as a short term limit for the time being possibly?

Severfield (LON:SFR)

Share price: 67.6p (up 1.3% today)

No. shares: 297.5m

Market cap: £201.1m

Trading update - things seem to be progressing well at this structural steel manufacturer;

The Group's trading performance and financial position is in line with management expectations.

I'm having a quick flick through the 2014/15 Annual Report on their website, and it's obviously a cyclical business, and quite low margin - achieving £9.0m, 4.5% underlying operating margin on turnover of £201.5m last year. It's almost entirely a UK business, with that making up nearly 97% of turnover last year.

Order book - this sounds encouraging, in particular re margins improving;

The UK order book of £188m remains strong with the London Commercial markets and Large Industrial Distribution Centres in particular continuing to provide opportunities, which supports revenue growth in the current financial year. Operating margins are continuing to improve as benefits from the ongoing operational improvement programme continue to be realised.

Balance sheet - looks alright. The company was refinanced with a Rights Issue in Apr 2013, so there are no solvency issues that I can see.

Outlook - again, this sounds positive (India doesn't look significant financially);

The UK business continues to progress well in a steadily improving environment with both revenue growth and margin improvement in evidence. The Indian business remains steady and is generating good opportunities in what remains a slow market. Overall the Group is on track to progress as expected over the remainder of the financial year.

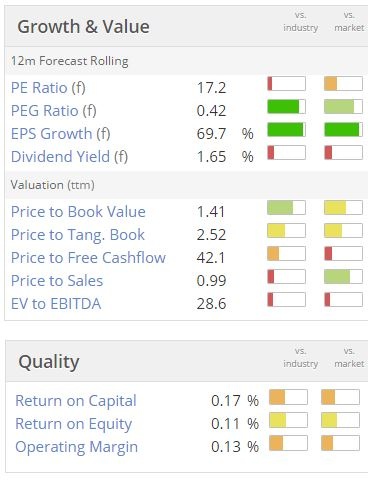

Valuation - so, everything's going pretty well, the only question really is how do we value it? Here are the usual Stockopedia valuation graphics;

The quality scores look very low, but that's probably because they are backward-looking, whereas the company is now clearly in a positive stage of the business cycle, with improving margins.

The dividend yield is unexciting - I would have expected more generous divis when business is improving, in something of a commercial building boom, especially in London.

My opinion - how you value it depends entirely on where you think we are in the economic cycle, as it's a cyclical business that does well in economic booms, and craps out in recessions.

Looking at the long term share price chart, it had a fantastic run from 2003 to 2007, the collapsed. So who knows what might happen next? I don't really have any idea, but now that the company is delivering improved results, the shares could maybe have further to run upwards?

Bear in mind though that the number of shares in issue went up by 72% in 2013, so for that reason the shares are not likely to get back to anything like the highs of 2007.

Concurrent Technologies (LON:CNC)

Share price: 61.5p (down 3.1% today)

No. shares: 72.6m

Market cap: £44.6m

Interims to 30 Jun 2015 - these interim figures look great at first sight, but the outlook comments neutralise the good figures, as it doesn't look as if the increase in profit is sustainable.

Revenue is up 72% to £9.6m in H1, and profit before tax shot up 4-fold from £0.4m in H1 last year, to £1.6m in H1 this year. That's terrific, but;

Outlook - indicates that profit growth in H1 was perhaps a one-off;

"Our order book is robust, our cash position remains strong and, while our second half performance is not expected to match the first half, we look forward to a satisfactory outcome for the remainder of this year. Continued investment in the Group's diverse and expanding product range and customer base should continue to deliver solid results in the future."

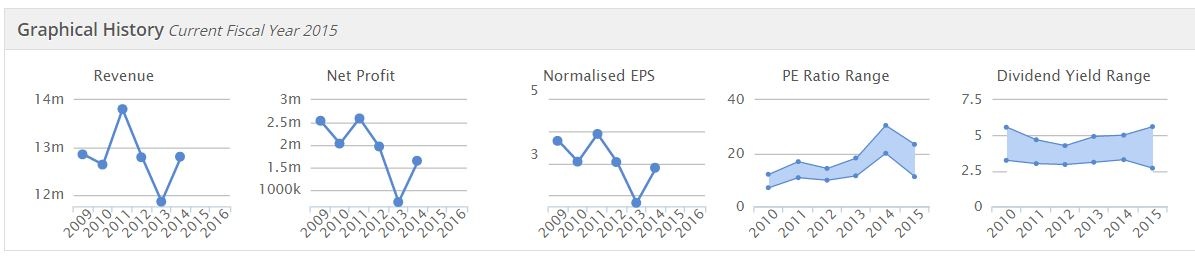

Looking at the Stockopedia graphical history, it seems a steadily profitable business, but I would say that it looks set to produce another year in 2015 similar to 2009-12, i.e. around £2m to £2.5m profit for the year. Is that enough to justify the premium market cap? I can't see any evidence of sustainable growth here.

Balance sheet - this looks fantastic, with a current ratio of 3.7, including net cash of £5.7m. Inventories seem a little high, so that's worth checking out.

Cashflow - note that the company is capitalising a lot of development spend, thus flattering profits. In H1 it capitalised £1.15m into intangibles, but only amortised £638k through the P&L, so a net benefit to profit of £0.5m. So almost a third of H1 profit is not profit on a cash basis.

Dividends - the company has a good track record of paying gradually rising dividends.

All done, see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SAL and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are just Paul's personal opinions, not recommendations or advice, so please DYOR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.