Good morning! It's busy for results statements today, and next week looks extremely busy too, so let's crack on.

Majestic Wine (LON:MJW)

At £331m market cap (506p per share) it's not really a small cap, but I suspect that valuation may drop today. This wine emporium usually puts out decent trading statements, but not today. In this morning's update the company says that trading conditions in calendar 2014 to date have been challenging.

It has a 31 March 2014 year-end, so with two weeks to go, LFL sales and profits are now expected to be flat against last year. The last update on 8 Jan 2014 indicated that LFL sales were up 0.8% for the first 40 weeks of the year, so it's not a disaster, but by my rough calculations, I reckon that probably means Jan-Mar this year is likely to have been negative by say 3-4% on a LFL (like-for-like basis). LFL strips out the impact of new shop openings, and closures, thereby being the best measure of underlying sales performance.

It looks to be an undershoot of about 10% on profit expectations, which is surprising coming so late in the year, and I think could knock the shares by 10-20% today, at a guess.

So that means EPS has been flat at about 26p for three years. It's difficult to see why the PER should be much more than about 10-12, if this is now going to struggle to make any headway, which would imply a share price around 260-310p. Therefore it hardly looks a bargain even at this morning's current price (at 08:08) of 425p. I'm not tempted to catch this falling knife, although have added it to my watchlist.

Increased costs are expected in 2014/15 for various reasons, and the outlook sounds hesitant;

...the Board now anticipates a flatter profit growth profile in the 2015 financial year.

Maybe the supermarkets are squeezing Majestic? Although I note they claim to have maintained market share.

WANdisco (LON:WAND)

This seems to be a fashionable technology share, where usual conventions on performance and valuation don't seem to apply. The company cheerfully reports what they describe as a "highly successful year for WANdisco". However the financials look utterly appalling to me.

Turnover was up 33% to $8m, but the operating loss mushroomed from $8.5m to $19.3m! How on earth can any business lose so much on such small turnover? The market cap is about £300m, so clearly the company must have sold investors a fantastic story about future potential. There's no sign of it in these figures though. So it's a bargepole job for me, indeed it's on my list as a potential short for when the market turns nasty at some point.

Robinson (LON:RBN)

This is a small packaging company, with surplus property assets in Chesterfield. I last reported on it here on 17 Feb 2014, giving a thumbs up to their plans to acquire a Polish packaging company called Madrox, in what looks like a transformative deal (Madrox made £2m profit in 2012).

Robinson announces its own results for calendar 2013 today. These figures are before the Madrox deal, which has been announced but not yet completed. Results look to be in line with expectations, with a pre-exceptional profit of £2.3m (slightly down on the £2.4m reported in in 2012). Pre-exceptional EPS has come in at 12.2p on a fully diluted basis. So at 200p the shares might look expensive on a PER basis, but that ignores the expected benefit of the Madrox deal, which should roughly double profits.

I can't find any broker forecasts including the impending acquistition, so will ignore the existing forecasts.

Similarly the strong Balance Sheet is set to see all the surplus cash deployed on the Madrox acquisition, and there will be some debt after that deal. The narrative has a rather flat feel to it, and they talk of subdued market conditions in 2013, so it's difficult to see anything in the short term to drive the price any higher. It depends on how well the Madrox acquisition goes, but note also this comment in today's results;

The Group also has a substantial property portfolio with development potential.

So it looks to me as if this share is likely to remain a good long term investment, assuming the acquistion proceeds as planned, and performs well. The PER post-acquisition might be around 10 perhaps, which together with surplus property assets, means the shares are probably quite good value at the moment, despite their strong performance in the last couple of years;

ShareSoc Brighton Investor Evening

I hope Stockopedia won't mind me promoting my own event, but it's a not-for-profit thing, which I hope will be of interest to investors.

I'm setting up an investor evening in Brighton on Tue 8th April. It's the same format as David Stredder's highly successful "Mello" evenings in Beckenham. So I've booked a nice brasserie near Brighton station (fast trains to multiple London stations), and an excellent speaker (an AIM growth company CEO), who is coming along to not only talk about his company, but also to give some insights on his experiences of being an AIM CEO.

So we'll start at 6pm with drinks, then the speaker, then a 3-course meal from 8pm. It should be a thoroughly jolly evening, with an emphasis on it being informal & friendly. All are welcome. I'm doing it on a not-for-profit basis, so there's no money involved in any direction, other than guests paying £25 for their own meal, and extra for any drinks.

To book your place for this much anticipated event, we've set up an online booking facility which requires a non-refundable £10 deposit (to ensure people are financially committed on a small scale, hence turn up on the day!). So please book early to avoid disappointment, as places are fairly limited by the relatively small size of the brasserie.

Portmeirion (LON:PMP)

Regulars might recall that this high end ceramics group is one of my favourite long term holdings, on a buy & forget basis. I like the strong Balance Sheet, the good track record in growing earnings and dividends, the decent operating profit margin, and the recurring nature of revenues - although not contractual recurring, there is strong repeat buying of key product lines, on a very predictable basis.

Preliminary results for calendar 2013 are published today, and contain no surprises. Basic EPS rose 12.6% to 53.3p (slightly ahead of broker consensus forecast of 50.1p), and the dividend has been hiked 10.1% to a full year payout of 24p. Therefore at a share price currently of 758p the PER is 14.2, and the dividend yield is 3.2%.

I think that valuation is probably about right in the short term. The attraction for me is the steady growth, which I think could generate say 10-20% capital gain each year, plus the dividend, so that should (barring any upsets) generate a very decent overall return. It's not exciting, but it's pretty low risk, and beats money in the bank or in Bonds in my opinion.

Net cash of £6.2m was held at the year end, despite £3.9m having been spent during the year to buy the freehold of their HQ.

In terms of outlook & strategy, the key sentences are;

We are very well positioned for a recovery in the North American market.

Trading in the first two months of the current year is ahead of the comparative period in 2013, however sales in these months are low in comparison to the rest of the year and the second half in particular...

We continue to seek out and consider acquisition opportunities against our demanding standards.

The pension deficit has come down nicely, from £5m to £2.4m, which is not terribly material given the level of profit and asset-backing.

So all looks fine. I will just tuck away and forget these for another six months.

James Latham (LON:LTHM)

There is a refreshingly brief, and positive update today from this timber products company. It looks a mature business, that makes about £7m profit each year, looking at the historical P&L summary on Stockopedia, so it's not likely to attract a high rating.

Revenue for the year ending 31 March 2014 is expected to be broadly in line with market expectations and profit before tax is likely to be higher than expected.

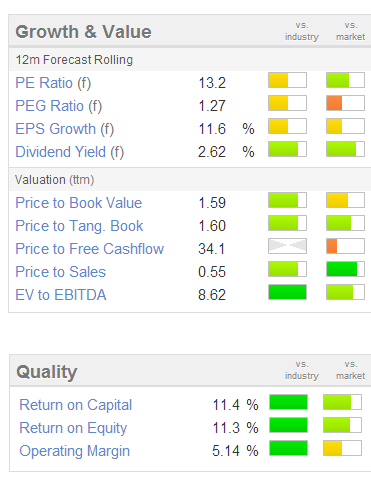

As you can see from the Stockopedia valuation graphics on the right, its forward PER is 13.2, and a 2.6% dividend yield look about right for this type of business.

As you can see from the Stockopedia valuation graphics on the right, its forward PER is 13.2, and a 2.6% dividend yield look about right for this type of business.

There should be some upside on earnings from economic recovery, and the improving housing market. The shares are up about 50% in the last year though, so I wonder if the re-rating has already happened?

Checking back on my previous notes, there is a pension deficit here, which was last reported on the Balance Sheet at £13.7m, with a 10-year recovery plan agreed with the Trustees. In all other respects their Balance Sheet is strong, so no concerns here at all about solvency.

It's a very nice, steady business in my opinion. I'm not a buyer at this price, but is certainly something that I'd consider if the PER dropped back to about 10, which is not likely unless we get into a really crazy technology bull market, where people sell off value shares in order to chase story stocks to mad valuations, which is what happened in 1999. There's not any sign of that happening now anyway, but I'm keeping my eyes peeled for a repetition of that phenomenon.

FW Thorpe (LON:TFW)

This is another really nice, solid company that I also like. It reports interim figures to 31 Dec 2013 today.

They look reasonably good. Turnover up 12% to £30.4m, operating profit up 70% to £5.1m, which is a strong 16.8% operating profit margin - a good sign of a quality business with pricing power.

It's good to see the company getting back on track, as they had a bit of a downturn in 2012/13. I can't see any comments about the full year outlook for this year, so assume they are in line. Although having said that I can't find any broker forecasts for this year. There is an H2 weighting to profits, so back of the envelope it looks to me as if they could pencil in approaching 9p EPS this year. At 134p I would say the shares are quite good value. That's a PER of nearly 15, but once you adjust for the ridiculously strong Balance Sheet with about £35m of surplus cash, which is about 20% of the market cap, then the underlying PER is about 12. That's good value in my opinion, for a quality business. I don't own any, but probably should, as it's very much my type of company.

That's as much as I can manage for today! Sorry for missing a few other companies of interest, but my brain reaches overload by lunchtime! Same time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in PMP, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.