Good morning! I'm on a bit of a go-slow this week, so these reports seem to be evolving from about 10am.

Although this Thursday's report will be early, because I'm off into London for the London Value Investor Conference - this is the Rolls Royce of value investing conferences, so I'm excited about attending - the speakers were literally world-class last year, and I'm sure they will be this year too. It's like having your value batteries charged up again once a year, and although it's expensive, is worth every penny in my view.

I shall be doing a couple of write-ups here about the most interesting talks, probably this coming weekend. For anyone interested, here is Part 1 of my 3 part series of articles from last year's conference.

Bloomsbury Publishing (LON:BMY)

I've been hovering around this share for at least a year now, with it never quite being cheap enough for me to hit the buy button, but coming very close several times. What put me off was a TV documentary I saw recently about how Amazon is not only dominating the retail of books & ebooks, but is now also beginning to dominate publishing too. Apparently people are often self-publishing through Amazon, hence it's difficult to see why traditional publishers are still needed.

The company put out a positive-sounding trading statement on 16 Jan 2014, and I recall almost buying some shares then, but a rather negative broker note issued at the same time put me off.

As a reader commented here recently, publishers might still be needed as aggregators of content, but having seen how cheap old economy stocks can get, such as Trinity Mirror (LON:TNI) hitting a PER of one in 2012, I'm reluctant to get involved again in any sector that apears to be in structural decline, as the market can be brutal in its valuation. It always pays to remember that market valuations do not have to be rational - they are just the balance of sentiment between buyers & sellers at any particular point in time. So valuations can & do become wildly irrational at times.

Anyway, BMY has today published its unaudited results for the year ended 28 Feb 2014. These do not seem to have impressed Mr Market, as the shares are currently down 4% to 158p. However, bear in mind that the market has been distorted by a recent Simon Thompson tip in Investors Chronicle, which has given them the usual short term 10-30% spike, which tends to last about a fortnight if you're lucky, before the stampeding crowd get bored & move on to the next thing.

I've already found three references in the results narrative to their adult division having a "spectacular year". That makes me uneasy, as it's rather over the top language, but also suggests that such performance may not be repeated perhaps?

At 157p the market cap is about £116m.

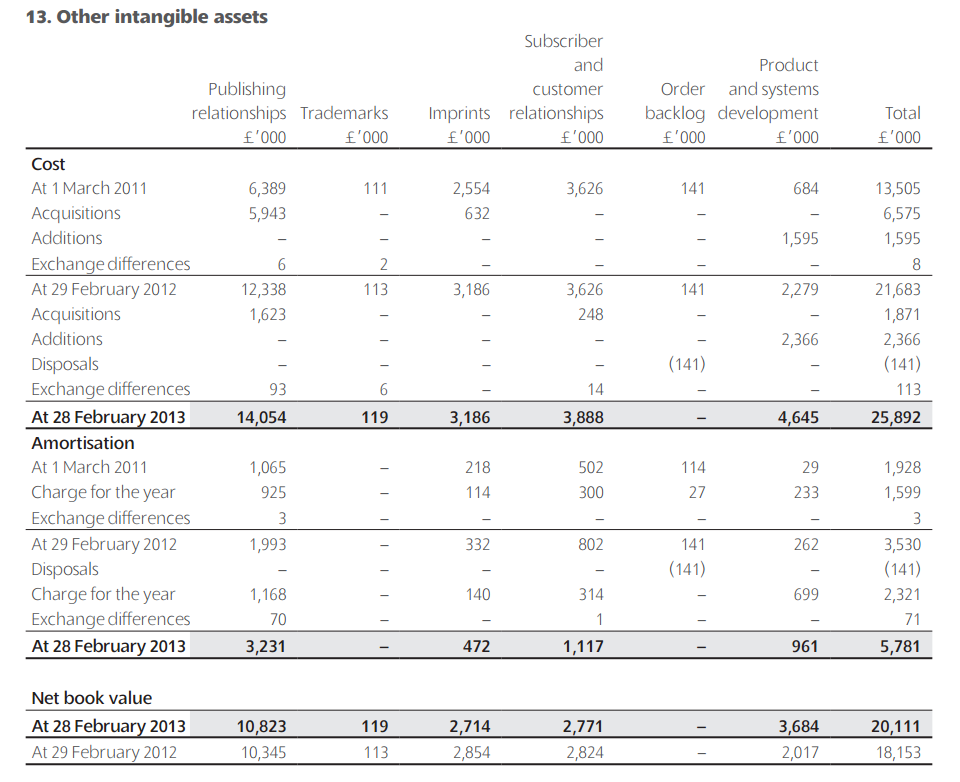

The results look pretty solid - turnover is up 11% to £109.5m, so the PSR is just over 1. Profit before tax is up 4% to £13.0m, so a decent profit margin there. Although note that the £13m profit figure is stated before £3.5m of costs which they describe as "highlighted items", the bulk of which (£2.8m) is amortisation of intangibles. What's that then? Checking the 2013 Annual Report for more detail, it appears that they do not amortise goodwill, so it's not that. Here is note 13 to last year's Annual Report, detailing all the different costs that were capitalised into intangible assets:

There was a fair bit there of costs that were capitalised in both 2012 and 2013, and looking at the 2013/14 figures issued this morning, the cashflow statement shows that £1.7m of costs were capitalised into intangibles. So I am leaning towards rejecting the company's definition of adjusted profit. You cannot capitalise a load of costs, and then ignore the amortisation charge. So to my mind, the correct figure to focus on is the £9.5m profit before taxation. After tax of £1.8m that becomes earnings (which are always post tax remember) of £7.7m. That is equivalent to 10.57p basic EPS, or 10.43p diluted EPS, indicating few share options exist.

Therefore on valuation, the stock at 158p is on a PER of 15.1 times. That doesn't strike me as a bargain. I'd be interested if the PER was sub-12, maybe even sub-10, to reflect the structural challenges to their business model from Amazon.

However, the Balance Sheet here is excellent. It has £55.2m in net tangible assets. Working capital is very strong, with current assets of a remarkable £92m, representing 243% of the £37.8m current liabilities - which is just bulletproof. So there is at least £20-30m excess working capital on this Balance Sheet, which gives an excellent buffer against anything going wrong, and is attractive to a bidder, so the chances of a takeover bid here are probably better than average. After all, if you can part-fund a deal using the acquired company's own working capital, then it gives plenty of scope to do things.

Total divis for the year are 5.82p, giving a yield of 3.7%, which is fairly good.

The outlook statement seems to be general waffle, so it's not clear how the business is currently trading.

Overall, I like the Balance Sheet here, but the PER isn't cheap, which given the uncertain future of publishing is suprising. Hence I'm not tempted to buy these, and am taking them off the watch list, unless they get much cheaper.

Renew Holdings (LON:RNWH)

Time to batten down the hatches, as a lot of friends hold this stock, so I always get tetchy messages from them whenever I point out what a weak Balance Sheet this company has. That heightens risk, so it has to be considered.

The financial highlights look good - with revenue up 48% to £225.8m, and adjusted profit before tax up 65% to £7.6m. Although note the low margins. I would say that low margins are not always a problem, but when combined with potentially problematic large contracts, certainly increase risk. This company seems to be doing well at the moment, but it wouldn't take a lot for things to go badly wrong. So I would treat this as a high risk share.

For the time being though, it all looks good. The order book is up 18% to £427m. The outlook statement confirms expectations for the full year (ending 30 Sep 2014). So it seems to be on a forward PER of about 12, which looks about right - or at least it would do if the Balance Sheet was solid.

Trouble is, it's weak. Net tangible assets are negative, to the tune of £22.5m! Working capital is also negative, with current assets of £106.4m being just 78% of current liabilities of £136.8m. That's really not a good position at all. So personally I wouldn't consider investing here unless that £30m deficit on working capital was corrected.

The business appears to be financed through up-front cash received from customers. The last Annual Report shows that of the £112.3m trade creditors, £67.3m was "accruals & deferred income", which means that customers have given them cash up-front for goods/services not yet provided. This is not dissimilar to how the travel sector operates - airlines, and holiday companies do the same thing - i.e. receiving cash up-front from customers, and using that to fund the business. It's fine as long as you can guarantee that the same payment profile will continue forever. However, if that changes, then there is potentially a disastrous problem, as the Balance Sheet has a £30m hole in it.

So overall then, the company seems to be trading well, but it has a weak Balance Sheet, so should be seen as high risk in my opinion.

As you can see, the shares have had a terrific run in the last year. Personally I'd be banking the profit, but each to their own.

William Sinclair Holdings (LON:SNCL)

These shares are down 36% to 71p today, so there must have been a profit warning.

Here it is - and it's a nasty one;

Whilst order intake and sales early in the season were encouraging, the extent of the growth in revenues compared to the prior year that had been anticipated to result from a return of more normal weather patterns did not fully meet expectations. Sales to both retail and professional customers have disappointed, as have to a lesser degree margins. As a result, whilst it expects broadly to break-even at the underlying EBITDA level, the Group will report a significant underlying net loss for the year

Checking the archive here, I last looked at this company (it sells bags of compost) on 29 Jul 2013, after a previous profit warning, and concluded that at 127p the shares were best avoided, due to the company being too accident prone, and having a weak Balance Sheet.

Today's statement contains the dreaded phrase;

The Group continues to enjoy the support of its lenders.

It all sounds very messy, and hence I think is too high risk for me to assess any further. Two other issues mentioned in the update today are that the interim dividend has been passed, a large cash inflow is expected from a claim against Natural England but not until the end of the year, and that the new Ellesmere Port factory is due to start up in 12 weeks.

It's impossible to value at the moment, so I shall wait to see what the next set of figures (for year ending 30 Sep 2014) look like in due course.

Nothing else to report today, so I'll sign off. See you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.