Good morning!

I am sorry to read the news that investing legend Jim Slater has died, aged 86. His book, The Zulu Principle was one of the first investment books that I read, and it was instrumental in my decision to focus almost entirely on UK small caps. Rummaging through my bookshelf, I can't find it, so will have to buy another copy, as it's probably about time to refresh my memory.

I hadn't realised that he had such a dramatic, and at times controversial business career, as that was mostly before my time - there is an interesting obituary in today's Telegraph. Certainly he was a major figure in the investing world, and of course is followed by his son, Mark Slater, a highly respected fund manager and commentator in his own right. Mark's insights are always worth listening to - my condolences to him.

Several people have asked me to comment on price movements of individual stocks. I don't usually do that, as these reports are focussed on flagging up, and commenting on trading updates and results statements from interesting smaller companies.

However, I have noticed that this week in particular, there have been some unusual wobbles in quite a lot of small companies, so it looks as if a bit of profit-taking is going on. My observation is that, when you see similar wobbles going on at lots of companies, especially ones which had previously been quite buoyant (e.g. Trakm8 Holdings (LON:TRAK) or Somero Enterprises (LON:SOM) ), then that can be a good time to top up, if you like the company. (disclosure: I hold a long position in SOM).

If an individual share is dropping for no apparent reason, whilst everything else is strong, then that's more of a concern, as it could indicate that an insider is selling ahead of bad news. However, when lots of things are all going wobbly simultaneously, then there is less likely to be anything stock-specific going wrong, so that scenario gives me more confidence to buy the dips on individual stocks.

That said, I do think that the valuations of a lot of fashionable growth stocks, are now getting into fairly bonkers territory (or have been for a while). If you have to assume that a company will execute to perfection for the next 2-3 years, to even begin to justify the current valuation, then you're really not getting good risk:reward - if something goes wrong, the market is brutal, and you can see the price smashed as everyone rushes for the exit simultaneously. How many smaller companies do actually execute to perfection, over several years? Not many!

Lots of market participants seem to be using trend-following, i.e. momentum-based strategies. That's fine whilst it works, and it can work very well indeed, but it can also lead to valuations detaching from reality, and you're then sitting on a time-bomb. So caution is needed on valuations, in my view.

Bear in mind also, that many companies distort reported earnings by making all sorts of adjustments to the figures. Listed companies tend to push the envelope, trying to maximise reported profits, in order to maximise the share price. Compare that with private companies, which tend to minimise profits, in order to minimise their tax charge. This is another factor which is tending to make investors over-pay for companies which sometimes are barely profitable at all, once you include all costs, and reverse accounting shenanigans like capitalising part of the payroll costs into intangibles. I don't care what the accounting standards say, development spending is nearly always just an ongoing payroll cost, so it should be expensed, not capitalised.

So caveat emptor - there are lots of significantly over-priced shares out there, in my view.

Ideagen (LON:IDEA)

Share price: 49.5p

No. shares: 178.9m

Market cap: £88.6m

Trading update - covering the 6 months to 31 Oct 2015, this update was put out yesterday. The company confirms it's trading in line with expectations;

Trading in the first half of the year remained strong. Revenues and adjusted EBITDA are expected to be significantly ahead of the same period last year and in line with market expectations.

Being significantly ahead of last year is good, but that was expected already, so the key message is always how any company is trading versus market expectations (i.e. broker forecasts).

Growth is flattered by acquisitions having been made, but it still reports 6% organic growth - reasonable, but not terribly exciting.

Contract win - this caught my eye, and looks very interesting;

The Board is pleased to announce that the Group has just received an Award Decision Notice for its SaaS-based GRC platform, Enlighten. The Award Decision Notice is from a public sector organisation and is expected to be worth £4.9 million over 5 years. The process is now subject to a short mandatory standstill period, following which the Group expects to sign a definitive contract.

Not quite in the bag, but once signed off, this is a hefty contract for a small group like this. Also note the tantalising comments by the CEO on this contract win, and the potential for more;

"We are also delighted to have received a major Award Decision Notice post period end for our recently launched SaaS-based platform, Enlighten, which is testament to the great development work that has gone into the product and represents only the start of what we believe will be strong market adoption. The Board remains confident in the Group's growth prospect."

If he's right about that, and assuming that the contracts are high margin (I don't know what costs are associated with the contracts, e.g. support staff, implementation, training, hosting, etc), then there could be interesting potential for profits to zoom up.

Cash - is £5.4m, with no debt, so that's positive.

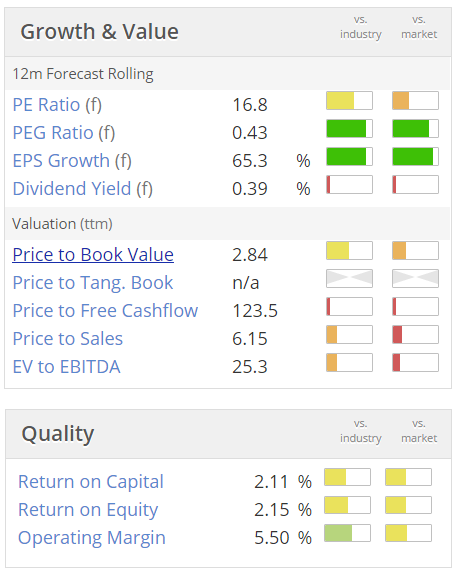

My opinion - I don't know the company well enough to form a strong view either way. The market cap looks extremely high based on the historic figures, but looks fairly reasonable against broker forecasts, see the usual Stockopedia graphics below;

I like software companies, as they often have reliable, contracted recurring revenues, and largely fixed cost bases. So the operational gearing from winning new clients can be enormous, if they develop a really great product.

However, now that so much software is moving to the cloud, it means that small companies don't really need to have their own IT departments any more, it can be outsourced. Computer systems can now talk to each other much more easily, e.g. using APIs, so it's getting much easier for organisations to switch software providers - but that depends on how deeply embedded in the company the existing software provider has become.

All in all, an interesting area. Note that there tends to be a lot of inertia in public sector organisations, so once a software package has been sold and installed, it will probably generate a lovely income stream for the software provider for many years to come - hence a high lifetime value for new clients that are signed up.

All in all then, the valuation scares me, but there are interesting signs of potentially good things happening at this company, so it's worth a closer look I think.

T Clarke (LON:CTO)

Share price: 88p

No. shares: 41.8m

Market cap: £36.8m

(at the time of writing, I hold a long position in this share)

EDIT: I am interviewing the CEO of T Clarke shortly. If you wish to submit a question, please use the form on this page. Please don't submit questions any other way, as the form will collate them all in one place for me, thus saving lots of time/hassle. Deadline for questions, midnight, 24 Nov 2015

Trading update - covering the period 1 Jul 2015 to date (yesterday). The key message is that they're trading in line with expectations;

Reflecting the steady improvement in our core markets, the underlying performance of the Group for the year continues to be in line with the Board's expectations.

We have to just assume that the Board's expectations are the same as market expectations, although this seemingly interchangeable terminology is rather annoying. Why can't they just say trading is consistent with full year market expectations?

Net debt has come down, from £8.7m at end Jun 2015, to £6m at end Oct 2015, clearly a good thing.

Order book - maintained at £320m (the same as when last reported), but that's up 15% against this time last year.

Margins - this stock is all about rising margins. So this section of the update is particularly encouraging, as what I hoped would happen, is happening. Higher margins lead to a big increase in profit, due to the operational gearing;

More pleasingly, we can see a significant improvement in the quality of our order book as we work through the majority of contracts awarded during the down-cycle. We are increasingly confident that this will be reflected in a material increase in our operating margin during 2016 and 2017. The improving quality of our order book is a function of our strategies of focusing on those business units and regions with the greatest potential to impact our future performance, especially London; aligning ourselves with high quality contractors; and bidding only on those contracts that offer appropriate returns.

It's a very cyclical business, but T Clarke has a strategy of maintaining its employee & hence skill base during downturns, and taking on low margin work to just keep the lights on (geddit?!). When the upturn comes (which lags the building cycle somewhat, since this company fits out largely completed buildings) they are then in pole position to take on work, at higher margins. This is skilled work, so it takes time for competitors to recruit and train the right people.

Forecasts - the house broker yesterday upgraded their 2016 EPS forecast by about 8%, to 7.2p, and 8.5p for 2017. Given that 2015 is forecasted at 6.0p, then I very much hope that the 2016 and 2017 forecasts are too conservative. Personally I'm looking for considerably more, due to business now feeding in which is at higher margins.

My opinion - with any luck, this should be a share which is steadily upgraded in the coming years. My recent interview with the CEO of Waterman was quite revealing, in that he was extremely upbeat about the prospects for UK commercial property building, and infrastructure. Waterman is earlier in the cycle than T Clarke, so if Waterman see years of growth in the pipeline, then that suggests T Clarke could have even more years of good growth ahead of it. Hence why I hold both stocks personally. The divi at CTO is worth having, at 3.5%.

Downsides risks shouldn't be ignored though. The balance sheet at CTO isn't great, and as with all low margin contracting businesses, things can go wrong, leading to unexpected losses to rectify problems on large contracts. So I fully understand why some investors won't be interested in buying shares in a low margin contracting business.

For me, it's a cyclical play, and this looks to be the right point in the cycle when earnings should begin to power ahead, which in my view is not fully reflected in forecasts. So it's a share that might have a couple of years' good returns, providing nothing serious goes wrong, and then of course everyone thinks they will be able to sell right at the top, before the cycle turns down!

Halosource Inc (LON:HAL)

Share price: 25p (down 22% today)

No. shares: 220.3m

Market cap: £55.1m

Profit warning - the company blames delays to customer roll-outs, and operational challenges, for the following warning;

...total consolidated revenues for the year ending 31 December 2015 will be materially lower than market expectations and, consequently, the net loss for the full year will be higher than market expectations.

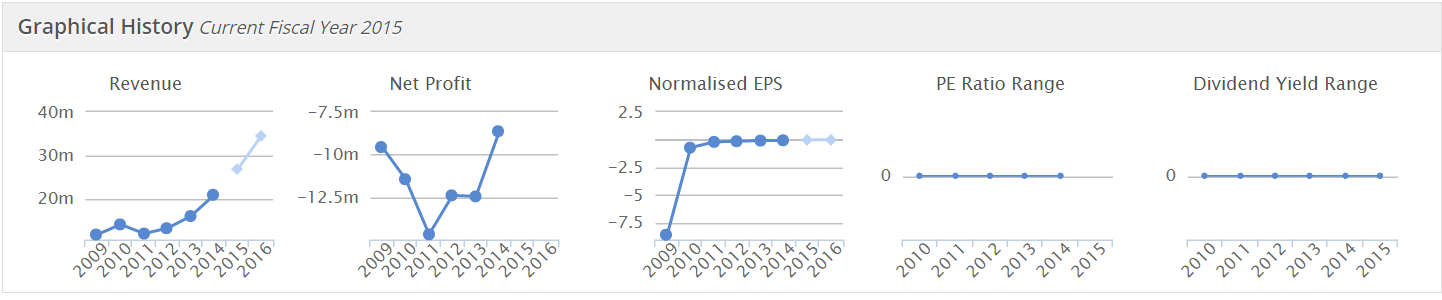

Looking back at the historic figures, I'm amazed that this company has managed to find funding to generate these multi-year losses;

Looking at the rate of cash burn, and the last set of accounts, it looks to me as if the cash position will be getting tight by now, so another fundraising looks inevitable.

So, it's a heavily cash-burning company, there's a profit warning today due to under-performance, and it's likely to need another fundraising quite soon - so a toxic mixture. Therefore this one's gone on the Bargepole List, as being too high risk.

Cambridge Cognition Holdings (LON:COG)

Share price: 87p (up 5.5% today)

No. shares: 16.6m

Market cap: £14.4m

Trading update - it's seems odd that this update is entitled "year end update", given that the company's year end is 31 Dec 2015. Anyway, the update today sounds encouraging;

Cambridge Cognition Holdings plc, (AIM: COG), a specialist in the development and marketing of computerised tests for detection and monitoring of neuropsychological disorders, is pleased to announce that it has made significant progress with its commercial operations and expects to end the year with three new major pharmaceutical clinical trial contracts totalling US$4.5m including upfront payments and revenues to be recognized in the current year and through to 2017.

The potential for these contracts was highlighted in the interim results and they ensure that, despite increasing investment in both healthcare technology development and commercial infrastructure in the USA, the outturn for this year should be similar to 2014 and provide a strong contracted revenue base for the next fiscal year. Accordingly 2016 is expected to be a year of material growth as the Company continues to make significant commercial and technological advances.

My opinion - I like this company, although it's not one I currently hold. The shares are likely to be a slow burner, but the company does appear to be making progress. It's still rather dependent on lumpy contract revenues.

Hopefully the up-front payments mentioned should mean that the need for a fundraising has abated, as the cash position was looking a little tight.

Quite an interesting company though, with intriguing long-term potential, in my view.

Right, I have to dash, as an old friend is coming to visit me for lunch.

Have an enjoyable weekend!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SOM, CTO, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are purely personal opinion, which are subject to change without notice. This is NOT financial advice, or recommendations. DYOR is what it's all about on this site!)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.