Good morning! The panic market sell-off seems to have abated. Thinking back to the sequence of events over the last three weeks, it seems to me that the following were the main causes: sharp fall in the price of oil, pulling down oil-related stocks. More negative economic data. Nervousness about Ebola impacted transport stocks such as airlines, cruise ships, etc. The Shire deal falling through apparently triggered big margin calls with merger arbitrage hedge funds, which clearly snowballed into a bigger sell-off as leveraged positions were shaken out of the market. Confidence then returned as buyers decided the worst was over. That all relates mainly to the US market, which always seems to drive what happens here too.

As for small caps, it was just a worsening of a bear market that we've been suffering from since about Mar 2014. To my mind, we must be getting near to the stage where anyone who was likely to sell their small caps, would have done so by now, surely? That combined with some decent value that is starting to appear, makes me feel considerably more optimistic than I was before this sell-off. The market was overheated, and needed to correct, and it has done.

The other thing is that markets are meant to go up & down, especially in small caps. Illiquidity in many small caps means that we have to endure stomach-churning volatility sometimes - that's just the price we have to pay for being in the asset class that usually performs best in the long run. Gearing is the killer. Providing you don't have any gearing, then you can ride out any market volatility. Good stocks with sound finances will always come back up again eventually, and if they pay a good divi too, then waiting is no hardship.

McBride (LON:MCB)

Share price: 83.6p

No. shares: 182.2m

Market Cap: £152.3m

Trading update - when this maker of household & personal care products puts out an update, it's usually a profit warning. However, today the company sounds more upbeat, saying;

The trading performance of the Group has been in line with the Board's expectations. The Group has made a solid start to the year, with Group revenue at constant currency returning to modest growth.

Cost-cutting seems to be underway, which makes sense given that its margins are being squeezed by customers;

The UK business restructuring project, announced in June 2014, is fully on track to generate planned savings of £12 million by 30 June 2016, of which £3 million will benefit the year ended 30 June 2015.

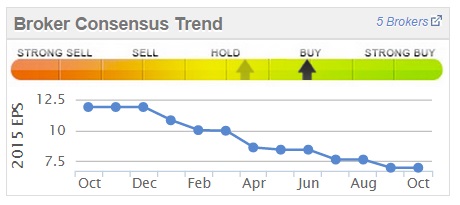

Although as the Stockopedia graphic below shows, broker estimates for earnings have come down a lot in the last year, so arguably the company is up against soft targets now;

My opinion - I've been negative on this company for a while, mainly because it has too much debt, a pension deficit, and operates in a low margin sector against lots of competition. However, now that the company's performance seems to be stabilising, and the share price has come down a fair bit, then it might be worth a fresh look perhaps? The divi yield is high, but looks like it's stretched - i.e. not well covered by earnings. Overall, I think there are probably better bargains out there, but maybe the bad news is now flushed out?

GB (LON:GBG)

Share price: 145p

No. shares: 120.2m

Market Cap: £174.3m

Trading update - this sounds positive;

The Board is pleased to report that GBGroup has achieved a strong set of results in its half year to 30 September 2014 with growth coming from both its organic activities and acquired businesses. The Group expects to show an adjusted operating profit1 of not less than £3.7 million (2013: £2.6 million), an increase of over 40%...

...we expect our strong performance to continue through the second half of the year.

There's no mention of performance versus market expectations, so I assume they must be trading in line.

Valuation - broker consensus is for 5.95p EPS this year, so that puts the shares on a racy valuation of 24.4 times. It's the growth that drives a higher valuation, although I wonder how much growth is organic versus acquisitions? The company seems to increase its number of shares in issue each year, and EPS has been fairly flat around 5-6p for the last few years. So I am questioning whether such a high rating is justified if the growth is mainly coming from acquisitions?

Quadrise Fuels International (LON:QFI)

Share price: 32p

No. shares: 807.2m

Market Cap: £258.3m

Final results - for the year ended 30 Jun 2014 are out today, and show that this is still really a concept stock - i.e. it hasn't started commercial sales yet of its new type of oil for ships. The loss of £6.0m for the year was mainly non-cash items, so that cashflow statement doesn't look too bad, with cash burn of about £2.3m before the issue of £10.1m in new shares in Mar 2014. So the company looks reasonably well funded, with net cash of £11.1m at the year end.

Outlook - here is an excerpt from today's results;

Given the considerable project progress made over the last year, supported by a strengthened treasury at the year end, the Group is forecast to move towards commercial revenues in 2015. Whilst these may be modest initially, the commercial endorsement of MSAR® emulsion fuel by leading players in the marine, refining and power generation industries should provide a solid platform for rapid growth in demand over time. The market for heavy fuel oil is already well established, with over 500 million tons consumed per annum. As already demonstrated, our fuel provides a lower cost alternative to end-users, with greater environmental benefits. We do not, therefore, envisage any practical difficulty in increasing the demand for the fuel once its commercial and environmental credentials are well understood and appreciated by the market.

My opinion - I don't know anything about the company, but that £258.3m market cap would scare me witless if I were a shareholder, since it's entirely based on expectations of future commercial success. If anything goes wrong, then it's a long way down.

There are nearly always delays, or complete failure, with this type of concept stock, so I hope holders know what they're doing here.

Servoca (LON:SVCA)

Share price: 14p

No. shares: 125.4m

Market Cap: £17.6m

Trading update - this reads very well, saying;

The Company is pleased to report that results for the year ended 30 September 2014 will be significantly ahead of market expectations and the Board is encouraged by the excellent performance of the Group.

The September period, which is important for the Group's Education recruitment businesses, was very positive and showed another marked improvement on the prior year. Trading in the second half also saw a substantial improvement in the performance and profitability of the Company's Healthcare businesses.

The performance for the year and the platform established give the Board confidence for continuing growth in 2015.

Can't argue with any of that!

Valuation - being this small, broker coverage is limited, but forecast EPS seems to be for 0.8p for the year just finished. What is "significantly ahead" of that? I'm guessing they must be talking about 1p+ of EPS? So at 14p the shares don't look cheap, unless the company is way ahead of forecasts.

My opinion - Small recruitment companies should be cheap, and particularly in this case as it doesn't pay a divi, and has a bit of debt. So I shall wait to see what the results are like, when published on 4 Dec 2014, but at the moment the share price seems to be valuing the company on a rather aggressive basis perhaps? Although that depends to what extent the company has beaten forecasts.

Avation (LON:AVAP)

There are two announcements today from this aircraft leasing company.

Change in depreciation policy - this is positive in that the company is being more conservative, but it also highlights that arguably previous reported profits could be seen as overstated. I was discussing aircraft leasing with a retired broker, and he said to me that the depreciation policy is where they always come unstuck, so that's the key area for investors to focus on.

I read somewhere that some airlines are now leasing brand new aircraft, using them for about 12 years, then just parking them up in the desert - i.e. they have little residual value apparently. So there could be an argument for the depreciation policy being tightened from 30 years to 25 years by Avation still being too loose perhaps?

Sale & leaseback deal - with Thomas Cook has also been announced today.

which brings me on nicely to;

Brighton Investor Evening

The FD of Avation is our speaker at the next Brighton investor evening that myself and an investor friend are organising. The date is 28 Oct 2014 - yikes I've just realised that's a week tomorrow!! So if you can join us for a relaxed evening eating, drinking & chatting about shares, then do please book up using this link. It's a fun evening, and I organise them entirely for social reasons, so do come along if you can.

Mello Beckenham

Another reminder that it's the Mello Beckenham investor evening tonight. I understand that David Cicurel of Judges Scientific (LON:JDG) is one of the speakers, which should be interesting given the reduced broker forecasts & sharply reduced share price there.

Shareholder rights petition

Changes are on the distant horizon to improve shareholder rights regarding shares held in nominee accounts. However, the process is very slow, and I feel we should get behind ShareSoc's campaign to push this up the agenda. Therefore, if you agree that we should all have automatic rights to attend and vote at company meetings, even if our shares are held via a nominee account, then please consider signing this online petition.

A report on the recent seminar held by ShareSoc can be found here.

I can't find anything else of interest today, so shall sign off. See you tomorrow as usual!

Regards, Paul.

(of the companies mentioned today, Paul holds no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.